- Home

- »

- Clothing, Footwear & Accessories

- »

-

Loafers Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Loafers Market Size, Share & Trends Report]()

Loafers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Leather, Fabric), By End Use, By Distribution Channel (Specialty Footwear Retailers, Supermarket, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-519-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Loafers Market Size & Trends

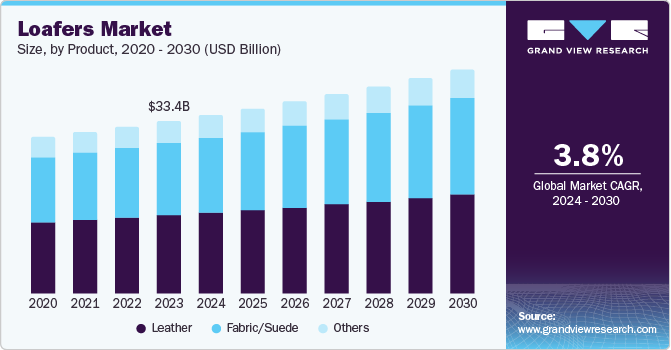

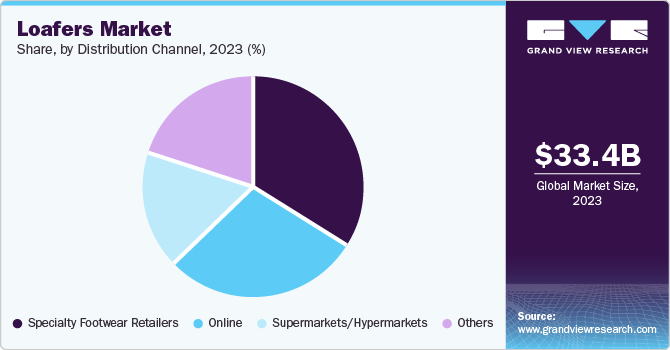

The global loafers market size was valued at USD 33.4 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The market surge can be credited to broader trends in fashion and consumer behavior. Rising requirements for stylish and comfortable footwear among the middle-aged working population have promoted the increased utility of loafers. Loafers are considered to be convenient and comfortable footwear among different age groups with features including not overly fitted in the heel and slip-on design. The millennial population and Generation X have increasingly preferred to purchase trendy, comfortable, and fancy shoes. Leather loafer shoes are extensively taken into consideration as premium products, and they occupy a major proportion of the market.

With the rise of remote work and more relaxed dress codes, there has been a major shift from traditional formal shoes towards more comfortable yet stylish options including loafers. This trend is particularly evident in urban areas where the blending of casual and professional attire is more accepted. The convenience of loafers, which can be easily worn without the need for laces or buckles, adds to their appeal in a fast-paced lifestyle.

In addition, technological advancements in footwear manufacturing have also played a crucial role. Innovations in materials and production techniques have led to the creation of loafers that are stylish, durable, and comfortable. For instance, the use of high-quality leather, breathable fabrics, and cushioned insoles enhances the overall wearing experience. In addition, sustainable practices in manufacturing, such as the use of eco-friendly materials and ethical production processes, have become more prevalent. These trends align with the growing consumer demand for environmentally responsible products.

Moreover, the market has observed that men are the major customers of loafers. They wear this product as an alternative to formal shoes, along with a stylish component. Key market participants have invested in branding and promotional activities to increase their customer reach. They have focused more on investing in fashion shows and uploading product videos on a social media page to attract more consumers.

Over the past few years, a growing working-class population, coupled with increasing spending on personal attire including footwear products in developing economies including China and India, is expected to promote the market size. Companies including Woodland and Hush Puppies have also expanded their product portfolio to attract consumers to spend more on the footwear segment. Some of the popular loafer footwear types available in the market are tassel, footbed slip, black calf, suede leather, velvet slippers, no lace casual, and folded leather.

Product Insights

Leather loafers held the dominant market share of 45.3% in 2023attributed to leather’s premium quality and durability making it a most preferred consumer choice. A large number of consumers prefer to purchase these premium, high-quality products due to their long shelf life. These loafers come with features including breathability, water resistance, better fit, and easy-to-clean characteristics. They are considered to be luxury goods as the raw material is sleek and shiny. In addition, technological advancements in leather processing and manufacturing have also played a crucial role. Innovations such as improved tanning processes and the development of eco-friendly leather alternatives have enhanced the quality and sustainability of leather products.

The fabric/suede segment is expected to register the fastest CAGR during the forecast period. Fabric and suede loafers offer a perfect blend of style, versatility, and comfort. These are primarily made from hemp or cotton, which makes the footwear breathable enough to offer extra comfort to consumers at different temperatures. Consumers have increasingly purchased these fabric loafers due to their lightweight features. Furthermore, these products are hypoallergenic, which attracts consumers with sensitive skin to purchase fabric-made loafers. The availability of varieties of colors and designs of fabric and suede loafers is driving the consumer demand.

End Use Insights

Men have secured the largest market revenue share in 2023 owing to the rising shift in workplace attire. The increased remote work culture coupled with relaxed dress codes, have led men to increasingly opt for comfortable yet stylish footwear. They have increasingly favored loafers for their versatile design that are suitable for both professional and casual settings. This trend has been particularly evident in urban areas where the blending of casual and professional attire is more accepted.

Women are expected to emerge as the fastest-growing segment at a CAGR of 4.2% over the forecast period owing to the increased demand for versatile and stylish footwear. Women have increasingly sought shoes including loafers that can be seamlessly transitioned from casual to formal settings. Their blend of comfort and elegance makes them suitable for various occasions including office wear and social gatherings as a stylish, comfortable alternative to high heels. In addition, economic factors such as rising disposable incomes, particularly in emerging markets, have encouraged more women to in a variety of footwear options, including loafers. Moreover, the expansion of e-commerce platforms has made it easier for consumers to access a wide range of products, compare prices, and make informed purchasing decisions. This accessibility has fueled the growth of the women’s loafers market.

Distribution Channel Insights

The specialty footwear retailers have held the propellant market share in 2023 with easy convenience and availability of different types of products. Consumers have increasingly preferred the personalized shopping experience that these retailers offer. Unlike general retail stores, specialty footwear retailers provide a curated selection of loafers, catering to specific consumer preferences and needs. This focus on niche markets allows them to offer expert advice, customized fittings, and a higher level of customer service, which enhances the overall shopping experience. In addition, specialty footwear retailers have increasingly adopted advanced technologies such as augmented reality (AR) and virtual reality to provide immersive shopping experiences. These technologies allow customers to virtually try on loafers, explore different styles, and make informed purchasing decisions without physically visiting the store. Furthermore, the integration of data analytics helps retailers understand consumer behavior and preferences, enabling them to stock the most sought-after products.

Online distribution channels are projected to grow at the fastest CAGR of 4.4% over the forecast period. The booming e-commerce sector worldwide has progressively influenced consumers with easy accessibility of products without geographical barriers. Consumers have increasingly favored easy product selection and doorstep product delivery services. Ease of product selection and availability of customer reviews are expected to increase the penetration of this segment in developed economies including the U.S., Germany, the U.K., and France

Regional Insights

The loafers market in Asia Pacific dominated the market with a 39.8% share in 2023. The rising investment in comfortable and stylish apparel and footwear products across developing countries including China, India, Bangladesh, and South Korea has been the primary driving factor. China is the largest footwear manufacturer, and it exports its products to countries including the U.S., Canada, the U.K., and Germany. Furthermore, the growing penetration of e-commerce companies including Flipkart, Alibaba, and Amazon in economies such as China and India is expected to remain a favorable factor for industry growth over the next few years.

Europe Loafers Market Trends

The Europe loafers market held 26.5% of the global revenue share in 2023. The increasing importance of stylish footwear among the consumers of developed economies including Germany and the U.K. is a major trend observed in this region. Furthermore, the increasing awareness regarding personal grooming among European consumers has driven per capita spending on apparel and footwear, thereby generating the demand for convenient footwear, including loafers. Furthermore, consumer shift towards premium products in countries including Germany, France, Italy, and the U.K. is expected to continue to generate the demand for loafers in the upcoming years.

North America Loafers Market Trends

The loafers market in North America held 24.0% of the global revenue share in 2023 owing to the evolving consumer preferences with a growing emphasis on comfort and functionality. Modern consumers have increasingly looked out for footwear that offers both style and comfort. For instance, the use of high-quality leather, breathable fabrics, and cushioned insoles enhances the overall wearing experience. In addition, sustainable practices in manufacturing, such as the use of eco-friendly materials and ethical production processes, have become more prevalent, aligning with the growing consumer demand for environmentally responsible products.

U.S. Loafers Market Trends

The U.S. loafer market was primarily driven by the rise of e-commerce. Online retail platforms provide consumers with a wide range of options, allowing them to compare styles, brands, and prices conveniently. The ease of online shopping, coupled with detailed product descriptions and customer reviews, has made it easier for consumers to make informed purchasing decisions. In addition, the rising disposable incomes have encouraged consumers to invest in premium footwear options.

Key Loafers Company Insights

The global loafers market is intensely competitive. Some of the key companies include Cole Haan, Tod’s, Salvatore Ferragamo, Allen Edmonds, and more. These organizations have increasingly focused on increasing customer base to gain a competitive edge in the industry. Key market participants have undertaken several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies. In addition, new product launches in terms of canvas loafers in developing economies including China and India, targeting the growing millennial population, is expected to open new avenues over the next few years.

-

Cole Haan offers a wide range of footwear for men women and kids, including loafers, casual shoes, sneakers, and formal shoes. The company is known for offering unique combination of traditional shoes with modern technology to enhance comfort and style.

-

Salvatore Ferragamo is an Italian luxury brand known for its high-end shoes, leather goods, and fashionable trending accessories. Their primary focus is on comfort-enhanced footwear including casual shoes, formal shoes, sandals, and loafers. They have collaborations with artists and designers to develop unique limited edition collections.

Key Loafers Companies:

The following are the leading companies in the loafers market. These companies collectively hold the largest market share and dictate industry trends.

- Cole Haan

- Tod's

- Salvatore Ferragamo S.P.A.

- Church & Co Ltd.

- Gucci

- Allen Edmonds Corporation.

- CLARKS RELIANCE FOOTWEAR PRIVATE LIMITED

- ABC Rockport LLC.

- Sebago.com

- Johnston & Murphy

Recent Development

-

In March 2021, Clarks developed GORE-TEX, a product that is layered with a gortex membrane. These footwears have pores that allow water vapor to pass through simultaneously they are small enough to prevent water drops from coming inside the shoes.

Loafers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.6 billion

Revenue forecast in 2030

USD 43.3 billion

Growth Rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, Brazil, Saudi Arabia, South Africa

Key companies profiled

Cole Haan; Tod's; Salvatore Ferragamo S.P.A.; Church & Co Ltd.; Gucci; Allen Edmonds Corporation.; CLARKS RELIANCE FOOTWEAR PRIVATE LIMITED; ABC Rockport LLC.; Sebago.com; Johnston & Murphy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Loafers Market Report Segmentation

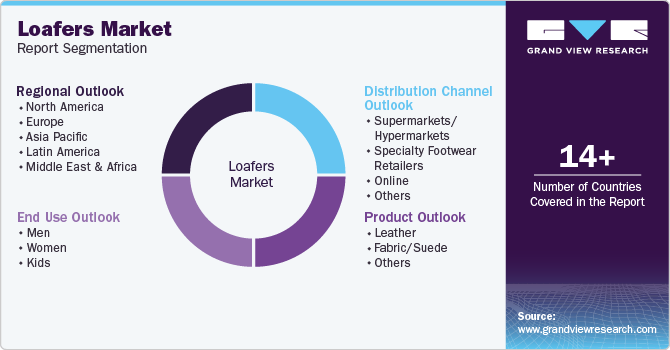

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global loafer market report based on product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Leather

-

Fabric/Suede

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Footwear Retailers

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.