- Home

- »

- Automotive & Transportation

- »

-

Loader Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Loader Market Size, Share & Trends Report]()

Loader Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Backhoe Loader, Skid Steer Loader, Crawler Loader, Wheeled Loader), By Engine, By Fuel (Electric, ICE), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-678-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Loader Market Summary

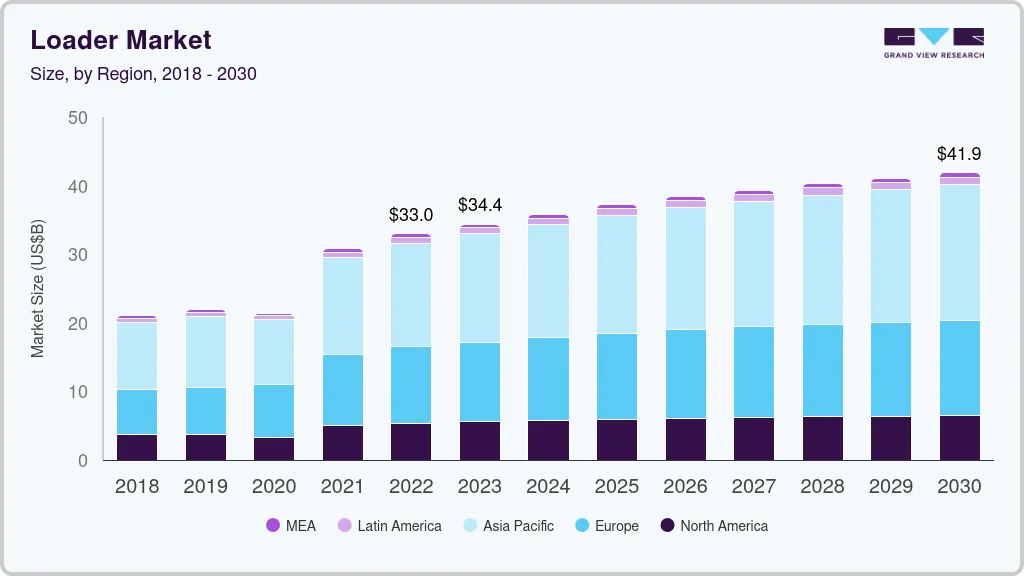

The global loader market size was estimated at USD 32.37 billion in 2023 and projected to reach USD 51.64 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030. The increasing pace of infrastructure initiatives and the rising number of construction projects worldwide, especially in developing and emerging economies are major factors driving market growth.

Key Market Trends & Insights

- Asia Pacific loader market accounted for the largest revenue share of 45.6% in 2023 in the global market.

- China loader market accounted for a significant regional market share in 2023.

- Based on type, the wheeled loader segment accounted for a leading revenue share of 34.0% in the global market in 2023.

- Based on engine, the engine capacity of up to 250 HP accounted for a leading revenue share in 2023.

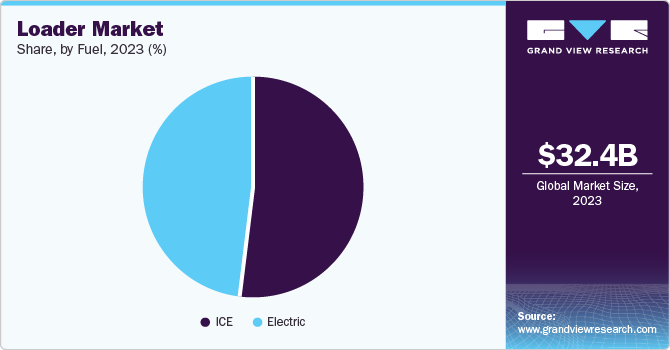

- Based on fuel, the internal combustion engine (ICE) segment accounted for the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.37 Billion

- 2030 Projected Market Size: USD 51.64 Billion

- CAGR (2024-2030): 6.7%

- Asia Pacific: Largest Market in 2023

Increasing rates of public-private partnerships for infrastructure projects and frequent residential, commercial, and industrial developments are anticipated to drive the demand for equipment such as loaders in the coming years. Other major sectors, such as consumer goods, logistics, and agriculture, contribute substantially to the loader market’s growth. For instance, in the logistics space, packers facilitate the efficient movement of goods between warehouses and delivery points by using loaders, improving the efficiency of the supply chain. Meanwhile, in agriculture, they are utilized in activities such as loading/unloading crops, clearing different areas, and moving materials such as gravel, soil, and rocks. Thus, the versatility offered by loaders has made them an important machinery across various industries.

Companies involved in the development and manufacturing of loaders are investing heavily in launching products with advanced features that can increase the efficiency and convenience of operators. For instance, in August 2024, Caterpillar announced a range of updates to improve the performance of its next-generation Cat 950 to 982 medium-wheel loaders, thus improving productivity and ease of operations. The introduction of loader models with high payload capacities is driving market expansion. At the same time, the growing impact of automation is also expected to propel the launch of innovative loader models during the forecast period. Integration of technologies such as Global Positioning System (GPS), intelligent assistance systems, and telematics is also expected to enhance usage experience substantially. Furthermore, there has been a rapidly expanding market for electric loaders that offer more efficient operations, create minimum noise, and help operators and construction companies adhere to various environmental and sustainability standards.

Type Insights

The wheeled loader segment accounted for a leading revenue share of 34.0% in the global market in 2023. These loaders are extensively utilized in infrastructure and construction projects due to their versatile nature and high mobility. A rapidly expanding need for effective material handling solutions from the logistics and agriculture sectors further enables segment demand. Additionally, an increasing focus on technological innovations to elevate operator comfort has provided new opportunities for these products to meet the changing requirements in the industry. Moreover, the shift towards sustainability has propelled the incorporation of environment-friendly technologies in these loaders, aiding segment expansion. For instance, in September 2024, Volvo CE inaugurated new facilities at its Arvika plant in Sweden to increase the production of electric wheel loaders. This strategic move is part of the company’s objective to attain fossil-free status by 2040 and ensure a 35% contribution to electric machine sales by 2030.

The backhoe loaders segment is anticipated to witness the fastest CAGR during the forecast period. These extremely versatile loaders can be used in several major industries, such as construction, mining, utilities, agriculture, and forestry. In addition, design advances in loader components such as boom, front loader, and bucket are constantly making it easier to load and transport construction materials. For instance, Case Construction Equipment launched the 580SV Construction King backhoe at the CONEXPO trade show in March 2023. It features a front end styled as a tool carrier that is ideal for businesses using the backhoe’s loader end for material handling purposes. Manufacturers are also developing models that provide a range of control modes and precise responses. For instance, the 320 P backhoe loader by John Deere provides a ‘Lift Mode’ to boost craning capacity by 15% and a ‘Precision Mode’ that provides a reduction of 55% inflow to offer more precise control without sacrificing performance. Such developments have ensured the steady growth of this segment.

Engine Insights

Engine capacity of up to 250 HP accounted for a leading revenue share in 2023. Loaders with this capacity offer an optimal balance between power and versatility, making them suitable for a wide range of applications. They are capable of handling heavy-duty tasks while also proving to be manageable for operators in challenging areas such as construction and mining. In addition, these loaders incorporate the latest technological upgrades, including advanced controls, safety features, and automation, to maintain their efficiency; these factors drive segment growth. Companies have increased the pace of development of compact loaders and mini loaders as they ensure better fuel efficiency, lower ground damage, high maneuverability, and reduced maintenance costs in the long run. Doosan Bobcat, in November 2023, announced that it would be making an investment of USD 300 million to build a manufacturing facility in Mexico’s Monterrey. The plant would produce the company’s M-Series of compact loaders for the North American region. Thus, higher demand for these loaders is anticipated to drive segment expansion.

The demand for loaders with more than 500 HP engines is anticipated to witness significant growth over the forecast period. There are several large-scale development projects being undertaken across fast-growing economies such as India, China, and Brazil, which has created a significant need for heavy machinery, leading to this segment’s expansion. A high engine capacity leads to efficient handling of substantial loads while also easing the loader’s operability in challenging terrains. The emergence of electric models in this segment has also contributed to their rising popularity among project developers, as such loaders can help carry out intensive material handling and digging functions while ensuring minimum noise levels and meeting sustainability objectives.

Fuel Insights

The internal combustion engine (ICE) segment accounted for the highest revenue share in 2023. Good fuel efficiency, widespread availability of gasoline and diesel due to a well-established fuel infrastructure globally, and affordability have helped maintain a strong demand for ICE-powered loaders. Most infrastructural projects are currently focused in Southeast Asia, Africa, and Latin America, where most economies still prefer using conventional construction equipment for such activities. Additionally, these loaders do not present any issues concerning refueling, while their durability further makes them an appealing option for heavy machinery operators.

The electric segment is anticipated to expand at a substantial growth rate from 2024 to 2030. With an increasing focus on sustainability and environmental conservation, the demand for conventional gas-powered equipment in the construction sector is expected to decrease steadily, with governments focusing on the growing use of their electric counterparts. Moreover, battery systems have undergone several technological advancements over the years, leading to improved loader performance and reliability. Loader manufacturers have also pivoted towards developing a portfolio of electric solutions while offering battery replacement and maintenance services. According to a report titled ‘The Global Electric Construction Equipment Industry’ published by Off-Highway Research, around 7,300 electric construction equipment were sold globally in 2023, significantly higher than the preceding year’s sales of around 3,800. Such demand signifies a greater awareness among companies regarding their performance and environmental benefits.

Regional Insights

Asia Pacific loader market accounted for the largest revenue share of 45.6% in 2023 in the global market. This region includes rapidly expanding economies such as China, India, Thailand, and South Korea, where urbanization and infrastructural developments have created a strong demand for construction equipment, including loaders and excavators. Governments and private organizations have launched various ambitious projects and initiatives to strengthen transportation networks across economies and launch public amenities. For instance, in India, the development of the Navi Mumbai International Airport is expected to greatly lessen the load on the existing international airport in Mumbai. The airport is expected to become operational in the last quarter of 2024, with its first phase expected to serve 12 million passengers. Large-scale projects have ensured a steady demand for heavy construction equipment such as loaders.

China loader market accounted for a significant regional market share in 2023. The country has constantly witnessed the development of several megaprojects aimed at the modernization of transportation infrastructure and improvements in public amenities. The Belt and Road Initiative (BRI) adopted by the Chinese government seeks to improve the economy's connectivity with neighboring countries and strengthen trade and economic relations. A report by Daxue Consulting published in August 2023 stated that over 10,000 construction projects had been launched in China in the first quarter of 2023, highlighting a constant requirement for construction equipment. China is also spearheading a range of sustainability and eco-friendly initiatives to lower its contribution to carbon emissions, boosting the demand for electric loaders and excavators.

Europe Loader Market Trends

Europe loader market accounted for a significant revenue share in the global loader industry in 2023. The regional market growth can be attributed to a rising emphasis on urban development and redevelopment projects. Several European governments are investing aggressively in enhancing the city infrastructure and rolling out public amenities, focusing on expanding transportation networks and developing new residential areas. Continued urbanization and the subsequent infrastructure development have increased the demand for loaders, owing to their versatility to undertake various tasks such as earthmoving, loading & unloading, and pallet handling. Additionally, several notable companies such as Caterpillar, Komatsu, and Mitsubishi Heavy Industries have a strong base in this region, ensuring constant developments in the market.

Germany loader market accounted for a significant regional market share in 2023 owing to factors such as the constant focus on infrastructural development activities and initiatives to launch environment-friendly products in the country's construction sector. Manufacturers are focusing on accelerating the launch of electric loaders to adhere to the European Commission's emission reduction targets, aimed at lowering the carbon footprint from this sector to 35% by 2030 in the region. Global loader manufacturers are focused on expanding their operations across Europe, which has led to positive developments in the German market. Additionally, the country hosts several events and trade fairs focusing on heavy machinery and construction equipment, driving awareness about technological innovations among German customers. For instance, at the Agritechnica show held in November 2023 in Germany, Bobcat launched the L95 compact wheel loader indicated for various agricultural applications.

North America Loader Market Trends

North America loader market is anticipated to witness substantial growth in the global market during the forecast period. Rising focus on technology integration and automation, particularly in the construction and industrial sectors, is a major driver of the regional market. Manufacturers adapt to this trend by incorporating advanced features such as telematics systems and digital controls. Additionally, integrating GPS technology in loaders allows operators and other users to monitor machine performance and enhance construction project productivity precisely. In September 2024, Bobcat introduced the B760 backhoe loader in the region, which offers the highest digging depth in its size category and is highly versatile in its operations. Similar developments by competitors at a frequent pace are expected to drive steady regional growth in this market.

U.S. Loader Market Trends

The U.S. loader market accounted for the largest revenue share in the North American loader market in 2023. The federal government's increasing focus on developing new infrastructure, such as roads, tunnels, and bridges in the country, along with the growing popularity of single-family home development projects, are factors expected to drive market expansion. The U.S. Census Bureau published a report in January 2024, which valued the construction expenditure at approximately USD 2.1 trillion. Additionally, modernization and upgrading of transport infrastructure, particularly in major states such as California, Texas, Florida, and New York, are projected to shape market growth positively in the coming years.

Key Loader Company Insights

Key companies involved in the loader marketinclude Caterpillar, CNH Industrial N.V., Doosan Bobcat, and Hitachi Construction Machinery, among others.

-

Caterpillar is a global provider of construction and mining equipment, offering a wide range of excavators, bulldozers, and loaders, as well as engines and generators. In addition to developing construction equipment and machinery, the company also manufactures parts and accessories to ensure their productivity and reliability. Caterpillar provides compact wheel loaders, small wheel loaders, medium wheel loaders, and large wheel loaders for efficient material handling on job sites. In March 2024, the company launched the Cat 973 Track Loader with better fuel efficiency and higher productivity than its predecessors, as well as cab improvements to enhance operator convenience.

-

Doosan Bobcat, a subsidiary of Doosan, is a South Korean company that specializes in the development and manufacturing of heavy machinery and construction equipment. The company offers a range of construction-focused products, including excavators, wheel loaders, and industrial engines. In the loaders segment, the company is known for its skid-steer loaders, mini-track loaders, backhoe loaders, and compact wheel loaders, among other equipment. Doosan serves several major industries, including construction, mining, and manufacturing.

Key Loader Companies:

The following are the leading companies in the loader market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- CNH Industrial N.V.

- Doosan Bobcat

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- AB Volvo

- Kobelco Construction Machinery Co., Ltd.

- Komatsu

- Liebherr

Recent Developments

-

In July 2024, Liebherr-Werk Bischofshofen GmbH announced plans to expand its production capacity significantly through an additional manufacturing facility in Styria, Austria, focusing on small wheel loaders. This development is expected to address the steadily rising global demand for compact wheel loaders, with the completion of this plant expected to be in 2029. The site’s present capacity can produce 7,000 such loaders annually, with the imminent expansion expected to boost this production to 10,000 units. The new facility would be involved in manufacturing the L 504 to L 518 loader models, along with models for the company’s OEM partners, Claas and John Deere.

-

In June 2024, Doosan Bobcat announced that it was setting up a new facility dedicated to compact loader production in Salinas, Victoria, Mexico. Operations in this plant are expected to start in 2026, with this development marking the company’s first-ever production facility in the country. Doosan Bobcat’s production capacity for loaders in North America is projected to grow by around 20% once the facility begins operations. The Mexican plant adds to the company’s existing manufacturing hubs in South Korea, India, China, Germany, France, Czech Republic, and the U.S., signifying its growing global footprint.

Loader Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.91 billion

Revenue forecast in 2030

USD 51.64 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, engine, fuel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Caterpillar; CNH Industrial N.V.; Doosan Bobcat; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; AB Volvo; Kobelco Construction Machinery Co., Ltd.; Komatsu; Liebherr

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Loader Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the loader market report based on type, engine, fuel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Backhoe Loader

-

Skid Steer Loader

-

Crawler Loader

-

Wheeled Loader

-

-

Engine Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Fuel Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

ICE

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.