Load Break Switch Market Size, Share & Trends Analysis Report By Type (Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed), By Voltage (Below 11 KV, 11-33 KV), By Installation (Outdoor, Indoor), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-397-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Load Break Switch Market Size & Trends

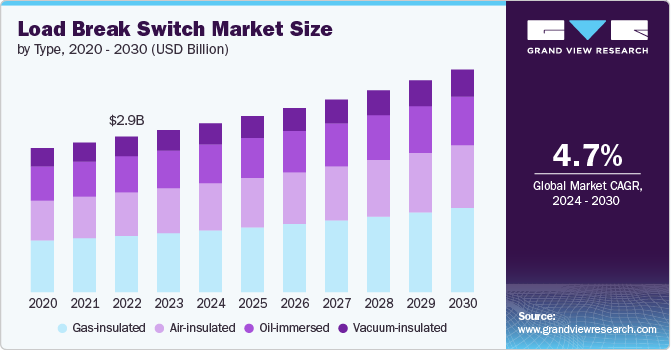

The global load break switch market size was estimated at USD 2.98 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. Rapid urbanization and ongoing infrastructure development across the globe significantly drive the demand for load break switches. As cities expand and new infrastructure projects emerge, the need for reliable and efficient power distribution systems becomes more critical. This growing demand for electricity necessitates advanced components such as load break switches to ensure safe and effective power distribution.

The construction of residential, commercial, and industrial buildings directly contributes to the rising need for load break switches. This trend is expected to continue as urbanization accelerates and electricity consumption increases.

The evolution of smart grid technology is another key factor fueling the growth of the market. Smart grids require advanced components to manage and control electricity distribution effectively, and load break switches play a crucial role in these systems. The growing demand for electricity, combined with the need for efficient grid management, drives the adoption of smart grids and the integration of load break switches. As smart grid technology continues to evolve, it will further boost market growth by enhancing the efficiency and reliability of power distribution networks.

The shift towards renewable energy sources, such as solar and wind power, is driving the growth of the market. Renewable energy systems require robust and reliable components to manage power distribution effectively, particularly as the demand for electricity continues to rise. Load break switches are essential in integrating these renewable energy sources into the existing power grid, ensuring safe and efficient operation. The increasing adoption of renewable energy sources, driven by the need to meet growing electricity demands sustainably, is positively impacting the market for load break switches.

Governments worldwide are implementing stringent regulations and standards to promote energy efficiency and electrical safety, which impacts the load break switch industry. These regulations often mandate the use of high-quality load break switches to ensure safe and reliable power distribution. The increasing demand for electricity amplifies the need for effective and compliant power management solutions, driving the adoption of load break switches. Compliance with these regulations not only enhances safety but also improves the efficiency of electrical systems. As regulations become more stringent, the market for load break switches is expected to grow in response to the rising electricity demand.

Technological advancements and innovations in load break switch design and functionality contribute to the market's growth. As the demand for electricity grows, manufacturers are focusing on developing advanced switches with improved performance, durability, and features to meet the evolving needs of power distribution systems. Innovations such as remote operation capabilities, enhanced safety features, and integration with digital technologies are expanding the applications of load break switches. These advancements cater to the increasing demand for reliable and efficient power management solutions. The continuous development of new products and technologies will sustain the momentum of the market.

Type Insights

Based on type, the gas-insulated segment led the market and accounted for 36.4% of the global revenue in 2023, owing to its advanced features and superior performance they offer. The growing need for compact, efficient, and reliable power distribution solutions in urban and industrial settings where space is limited is also contributing to the growth of the segment. These switches are increasingly favored for their enhanced safety, minimal maintenance requirements, and their ability to operate effectively in high pollution or harsh environmental conditions. The demand for gas-insulated switches is also fueled by the rising focus on upgrading existing infrastructure to support modern, high-performance electrical systems.

The air-insulated segment is expected to register significant growth from 2024 to 2030. These switches are appreciated for their simplicity, cost-effectiveness, and ease of installation, making them suitable for applications where space constraints are less of an issue. Despite their advantages, air-insulated switches face competition from gas-insulated technology, which offers superior performance and reliability. The adoption of air-insulated switches can be attributed to the increasing preference for more advanced solutions that align with modern power distribution needs.

Voltage Insights

The 11-33 kV segment accounted for the largest market revenue share in 2023. The 11-33 kV load break switch segment is witnessing robust growth driven by several key trends. This voltage range is particularly suited for medium-voltage distribution networks commonly found in urban and suburban areas. The increasing urbanization and expansion of infrastructure projects necessitate reliable and efficient power distribution systems, propelling the demand for 11-33 kV load break switches. In addition, these switches are essential for maintaining grid stability and safety in regions experiencing rapid population growth and industrial development. The trend towards upgrading aging electrical infrastructure to enhance reliability and efficiency further fuels the demand for load break switches in this voltage range.

The 33-60 kV segment is expected to grow significantly from 2024 to 2030. The growing focus on renewable energy integration, where higher voltage levels are necessary to connect large-scale renewable energy plants to the grid, is a major factor contributing to the growth of the market. In addition, the need for robust and reliable components in transmission and distribution networks, especially in regions with expanding industrial activities, is boosting the demand for 33-60 kV load break switches. The increasing investment in grid modernization projects to support higher capacity and improved reliability also drives the growth of this segment. As industries continue to scale up their operations, the demand for high-voltage load break switches is expected to rise correspondingly.

Installation Insights

The outdoor segment held the largest market revenue share in 2023. The rising need for robust and reliable electrical infrastructure in challenging environmental conditions is a major factor contributing to the growth of the market. These switches are essential for power distribution networks in rural and suburban areas where exposure to weather elements requires durable and high-performance equipment. The increasing focus on renewable energy sources, such as solar and wind farms, often situated in outdoor environments, boosts the demand for outdoor load break switches. In addition, the expansion of smart grids and the modernization of existing outdoor electrical infrastructure to enhance efficiency and reliability contribute significantly to the growth of this segment.

The indoor segment is expected to grow significantly from 2024 to 2030. The indoor segment is experiencing growth driven by trends in urbanization and the construction of new commercial, residential, and industrial buildings. These switches are integral to maintaining safe and efficient power distribution within indoor environments, such as substations, factories, and large commercial complexes. The growing emphasis on energy efficiency and the need for reliable electrical infrastructure in densely populated areas drive the demand for indoor load break switches. Furthermore, advancements in building technologies and the increasing implementation of smart building systems necessitate the use of advanced load break switches to ensure seamless power management.

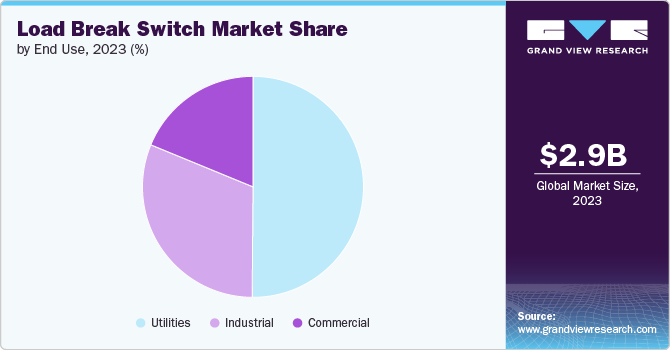

End Use Insights

The utilities segment accounted for the largest market revenue share in 2023. As the demand for electricity continues to rise, utilities are investing heavily in upgrading their infrastructure to enhance reliability, efficiency, and safety, thereby contributing to the growth of the market. The integration of renewable energy sources into the grid is another significant driver, as it requires advanced load break switches to manage power flows effectively and ensure grid stability. In addition, regulatory mandates and government initiatives aimed at improving energy efficiency and reducing carbon emissions further propel the adoption of load break switches in the utilities sector.

The industrial segment is expected to grow significantly from 2024 to 2030. Industries such as manufacturing, mining, and oil and gas require reliable and efficient power distribution systems to support their operations, driving the demand for load break switches. The trend towards Industry 4.0 and the adoption of smart manufacturing practices necessitate advanced electrical components that can ensure uninterrupted power supply and operational safety. Moreover, as industries expand and modernize their infrastructure to enhance productivity and reduce downtime, the need for robust load break switches becomes more important contributing to the growth of the segment.

Regional Insights

The North America load break switch market is anticipated to register significant growth from 2024 to 2030. The high rate of infrastructure development and the increasing focus on enhancing grid reliability and resilience are driving market growth. The U.S. and Canada are investing heavily in modernizing their electrical grids and integrating renewable energy sources, which require advanced load break switches for efficient power distribution. In addition, regulatory mandates for improved energy efficiency and safety standards further fuel the demand for these switches.

U.S. Load Break Switch Market Trends

The U.S. load break switch market is anticipated to register significant growth from 2024 to 2030. A strong focus on modernizing the national grid and integrating renewable energy sources drives this demand. The trend of upgrading aging infrastructure and implementing smart grid technologies is a major driver in the U.S. market.

Asia Pacific Load Break Switch Market Trends

The Asia Pacific load break switch market dominated the global market and accounted for 35.7% in 2023. The region's rapidly growing demand for electricity and the expansion of power distribution networks are major factors contributing to the market's growth. Countries such as China, Japan, and South Korea are leading the way with substantial investments in infrastructure development and renewable energy projects. The growing urbanization and industrialization in the region also contribute to the increasing need for reliable and efficient power distribution systems.

Europe Load Break Switch Market Trends

The European load break switch market is poised for significant growth from 2024 to 2030. The presence of established utility companies and stringent regulatory standards for energy efficiency and safety support regional growth. The trend toward smart grid implementation and the need to upgrade aging electrical infrastructure are key factors contributing to the rising demand for load break switches in Europe. As countries in the region continue to invest in sustainable energy solutions, the market is expected to see substantial expansion.

Key Load Break Switch Company Insights:

Key players operating in the market include Schneider Electric, ABB, Fuji Electric FA Components & Systems Co., Ltd., SOCOMEC, Rockwell Automation, ENSTO, Lucy Group Ltd., Safvolt., KATKO Oy, and Powell Industries. Leading companies such as ABB, Siemens AG, and Schneider Electric dominate the market with their innovative solutions and reliable products that cater to diverse applications in the utility and industrial sectors. These companies leverage advanced technologies and robust manufacturing processes to meet the growing demand for efficient and safe power distribution systems.

Companies across the globe are focusing on developing new load break switches to meet the growing demand for load break switches; for instance, Katko introduced an innovative VDE-qualified load break switch with an AC-23A 415 V rating up to 40 amps. This switch was initially available as 1, 2, 3, or 4-pole, and a 3-pole door mounting type. Change-over and 6- and 8-pole versions were planned to follow. Production of the switch started in June 2022 in Helsinki, Finland. The production process was fully automated, thereby increasing the capacity of KATKO’s Helsinki factory. The new production methods were key to meeting the growing demand for high-quality KATKO switches.

Key Load Break Switch Companies:

The following are the leading companies in the load break switch market. These companies collectively hold the largest market share and dictate industry trends.

- Schneider Electric

- ABB

- Fuji Electric FA Components & Systems Co., Ltd.

- SOCOMEC

- Rockwell Automation

- ENSTO

- Lucy Group Ltd.

- Safvolt

- KATKO Oy

- Powell Industries

Load Break Switch Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.11 billion |

|

Revenue forecast in 2030 |

USD 4.10 billion |

|

Growth rate |

CAGR of 4.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, voltage, installation, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Schneider Electric, ABB, Fuji Electric FA Components & Systems Co., Ltd., SOCOMEC, Rockwell Automation, ENSTO, Lucy Group Ltd., Safvolt., KATKO Oy, Powell Industries. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Load Break Switch Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global load break switch market report based on type, voltage, installation, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas-insulated

-

Vacuum-insulated

-

Air-insulated

-

Oil-immersed

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 11 kV

-

11-33 kV

-

33-60 kV

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Outdoor

-

Indoor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Utilities

-

Industrial

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global load break switch market size was estimated at USD 2.98 billion in 2023 and is expected to reach USD 3.11 billion in 2024.

b. The global load break switch market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 4.10 billion by 2030.

b. Asia Pacific dominated the load break switch market with a share of 35.7% in 2023. The region's rapidly growing demand for electricity and the expansion of power distribution networks is a major factor contributing to the growth of the market.

b. Some key players operating in the load break switch market include Schneider Electric, ABB, Fuji Electric FA Components & Systems Co., Ltd., SOCOMEC, Rockwell Automation, ENSTO, Lucy Group Ltd., Safvolt., KATKO Oy, and Powell Industries.

b. Key factors that are driving the market growth include rapid urbanization and ongoing infrastructure development across the globe and the evolution of smart grid technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."