- Home

- »

- Distribution & Utilities

- »

-

LNG Storage Tank Market Size, Share & Growth Report 2030GVR Report cover

![LNG Storage Tank Market Size, Share & Trends Report]()

LNG Storage Tank Market Size, Share & Trends Analysis Report By Type (Self-Supporting, Non-Self Supporting), By Material (Steel, 9% Nickel Steel, Aluminum Alloy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-346-6

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

LNG Storage Tank Market Size & Trends

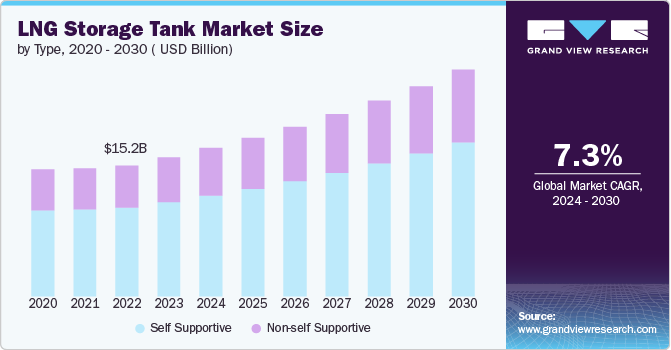

The global LNG storage tank market was estimated at USD 16.11 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. The increasing global demand for liquefied natural gas (LNG) as a cleaner energy source, particularly in power generation, transportation, and industrial applications, is a major driver. Expanding LNG production capacity, investments in liquefaction and regasification facilities, and growing LNG trade volumes are propelling the need for more storage infrastructure. Supportive government policies and regulations promoting the adoption of LNG to reduce carbon emissions are also propelling market growth.

Technological advancements in LNG storage tank design, materials, and construction techniques that enhance safety, efficiency, and reliability are further driving investments in new storage capacity. The rising focus on energy security and diversification of energy sources is another key factor underpinning the increasing demand for LNG storage tanks globally.

Drivers, Opportunities & Restraints

LNG is increasingly being used as a cleaner fuel alternative for power generation and transportation, replacing dirtier fuels like coal and oil. The growing use of LNG in these sectors is boosting demand for LNG storage capacity.Governments worldwide are implementing policies and regulations to promote the adoption of cleaner energy sources like LNG to reduce carbon emissions. These supportive regulatory environments are catalyzing investments in LNG infrastructure, including storage tanks.

The main restraint of the market is the high initial investment required for developing and constructing LNG storage infrastructure. Building LNG storage tanks, liquefaction plants, regasification terminals, and other supporting facilities involves significant upfront capital expenditures. The high costs associated with land acquisition, engineering, procurement, and construction of these specialized cryogenic storage tanks and facilities pose a major challenge, especially for smaller players looking to enter the market.

The increasing integration of LNG storage with renewable energy systems and hybrid energy solutions to enhance grid stability and promote sustainable energy systems is another key opportunity for market participants. Overall, the growing focus on energy security and diversification is expected to drive continued investments in expanding LNG storage capacity worldwide.

Type Insights

The self-supportive segment led the market and accounted for 67.79% of revenue share in 2023. The increasing demand for self-supporting LNG storage tanks is a key driver of the overall LNG storage tank market. Self-supporting tanks, which do not rely on the container structure for support, are preferred for their enhanced safety, reliability, and versatility. These tanks can withstand extreme temperatures and pressures required for LNG storage, making them suitable for a wide range of applications, including onshore, offshore, and marine environments.

The increasing demand for non-self-supporting LNG storage tanks is a key driver of the overall LNG storage tank market. Non-self-supporting tanks, which require external support structures to maintain their shape and integrity, are preferred for smaller-scale LNG storage applications, such as on-site storage for small-scale LNG users or temporary storage during LNG transportation.

Material Insights

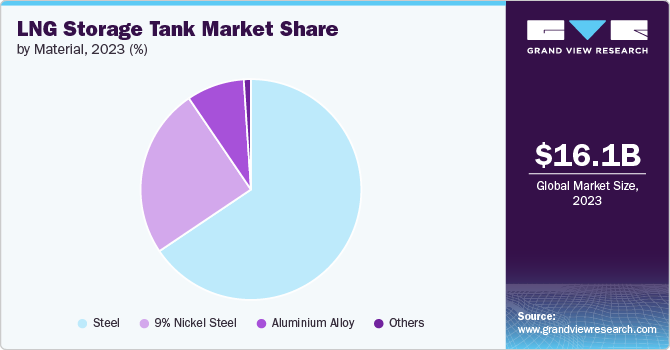

The steel segment led the market and accounted for 65.58% revenue share in 2023. A stationary. The increasing demand for steel is a key driver of the LNG storage tank market. Steel is a preferred material for constructing LNG storage tanks due to its durability, strength, and ability to withstand extreme temperatures and pressures required for storing liquefied natural gas. The global shift towards cleaner energy sources has propelled the demand for LNG, leading to a surge in the need for reliable and secure storage solutions made from materials like steel.

The increasing demand for aluminum alloy is a key driver of the LNG storage tank market. Aluminum alloy offers several advantages over traditional steel for LNG storage tank construction, including lightweight, corrosion resistance, and ease of fabrication. These properties make aluminum alloy an attractive option for mobile or modular LNG storage solutions, such as ISO containers or small-scale storage tanks used in remote locations or maritime applications.

Regional Insights

The LNG storage tank market of North America accounted for 25.39% market revenue share in 2023. The increasing global demand for liquefied natural gas (LNG) is a key driver of the North America LNG storage tanks market. The expansion of LNG production capacity, particularly in the United States, Canada, and Mexico, coupled with growing LNG trade volumes and investments in liquefaction and regasification facilities across the region, is fueling the need for more LNG storage infrastructure.

U.S. LNG Storage Tank Market Trends

The U.S. LNG storage tank market dominates the North America market and accounted for a share of over 78.36% in 2023. Supportive government policies, such as tax incentives and emission reduction targets, are also driving the growth of the U.S. LNG storage tanks market. These factors are expected to continue propelling the demand for reliable and efficient LNG storage solutions in the coming years.

The LNG storage tank market in Canada is expected to grow at a significant CAGR of 10.6%. The growing demand for liquefied natural gas (LNG) in Canada is a key driver of the market in the country. Canada has several proposed LNG export terminal projects, such as the Woodfibre LNG project in British Columbia, which is expected to drive investments in new LNG storage infrastructure.

Asia Pacific LNG Storage Tank Market Trends

The Asia Pacific LNG storage tank market is projected to grow at a significant rate. The increasing adoption of LNG as a cleaner energy source in power generation, transportation, and industrial applications is further driving the demand for reliable and efficient LNG storage solutions in Asia Pacific.

LNG storage tank market of China accounted for the largest share of over 49.7% in 2023 in Asia Pacific. The growing demand for liquefied natural gas (LNG) in China is a key driver of the market in the country. China has been expanding its LNG production capacity in liquefaction and regasification facilities, fueling the need for more storage infrastructure to support growing LNG trade volumes and the increasing adoption of LNG as a cleaner energy source in power generation, transportation, and industrial applications.

India LNG storage tank market is expected to progress with a CAGR of 8.2% over the forecast period. India is a major importer of LNG and has been inclined towards expansion of its LNG import and storage infrastructure to meet the rising energy demand, particularly in the power generation sector.

Europe LNG Storage Tank Market Trends

LNG storage tank market of Europe is witnessing heavy investments in expanding its LNG import and storage infrastructure to meet the rising energy demand, particularly in the power generation sector, and reduce carbon emissions by transitioning to cleaner energy sources like LNG.

Germany LNG storage tank market accounted for a market revenue share of 36.12% in 2023. A key driver for Germany's market is Europe's rising reliance on Liquefied Natural Gas (LNG) imports. This surge is fueled by factors like declining reliance on pipeline gas from Russia and growing LNG industry demands. As Germany builds new import terminals and upgrades existing facilities, the need for LNG storage tanks to accommodate this shift is expected to grow.

LNG storage tank market of Italy is expected to grow at a significant rate with a CAGR of 10.3%. Italy's market thrives on expanding LNG trade. This growth is driven by both a shift towards cleaner natural gas and rising investments in LNG infrastructure to handle the imported fuel.

Key LNG Storage Tank Company Insights

Mergers and acquisitions are on the rise to expand geographical reach and expertise. Companies are also focusing on developing innovative tank designs with improved insulation and safety features. Furthermore, the trend leans towards offering full-service solutions encompassing tank construction, maintenance, and even financing, catering to the diverse needs of LNG terminal operators and energy companies.

Key LNG Storage Tank Companies:

The following are the leading companies in the LNG storage tank market. These companies collectively hold the largest market share and dictate industry trends.

- Linde Plc

- McDermott International Inc.

- Wartsila

- IHI Corporation

- Chart Industries

- CIMC Enric

- Air Water Inc.

- Isisan A.S.

- Cryolor

- Sinopec

Recent Developments

-

In May 2024, CB&I secured a contract for the development of an LNG storage tank in Port of Sohar located in Oman. The project consists of EPC services for a 165,000 m3 full containment concrete LNG storage tank.

-

In November 2023, Sinopec announced the initiation of service for the world’s largest 270 000 m3 LNG storage tank. The tank will increase LNG storage capacity by 165 million m3 of Qingdao LNG Receiving Terminal located in China.

-

In July 2022, Bechtel announced a project for the construction of the largest LNG storage tank for the CPC Taichung Phase III LNG import terminal in Taichung, Taiwan. The project consists of two 180,000 m3 of full containment LNG tanks.

LNG Storage Tank Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.2 billion

Revenue forecast in 2030

USD 26.2 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; Australia; Germany; Russia; UK; Italy; Norway; France; Kuwait; Saudi Arabia; UAE; South Africa; Brazil; Argentina

Key companies profiled

Linde Plc; McDermott International Inc.; Wartsila; IHI Corporation; Chart Industries; CIMC Enric; Air Water Inc.; Isisan A.S.; Cryolor; Sinopec; Qatargas; ExxonMobil

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LNG Storage Tank Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global LNG storage tank market based on type, material, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Self-Supporting

-

Non-Self Supporting

-

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Steel

-

9% Nickel Steel

-

Aluminum Alloy

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Norway

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global LNG storage tank market size was estimated at USD 16.11 billion in 2023 and is expected to reach USD 17.20 billion in 2024.

b. The global LNG storage tank market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 26.2 billion by 2030.

b. Based on the Type, Self Supportive was the dominant segment in 2023, with a share of about 67.79% in 2023. The increasing demand for self-supporting LNG storage tanks is a key driver of the overall LNG storage tank market. Self-supporting tanks, which do not rely on the container structure for support, are preferred for their enhanced safety, reliability, and versatility.

b. Some of the key players operating in this industry include Linde Plc, McDermott International Inc., Wartsila, IHI Corporation, Chart Industries, CIMC Enric, Air Water Inc.

b. Key factors driving the market growth include the increasing global demand for liquefied natural gas (LNG) as a cleaner energy source, particularly in power generation, transportation, and industrial applications

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."