- Home

- »

- Next Generation Technologies

- »

-

Livestock Grow Lights Market Size, Industry Report, 2030GVR Report cover

![Livestock Grow Lights Market Size, Share & Trends Report]()

Livestock Grow Lights Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Fluorescent, LED, Incandescent, High-Intensity Discharge), By Livestock (Cattle, Poultry, Swine), By Installation Type, By Light Color Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-086-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Livestock Grow Lights Market Size & Trends

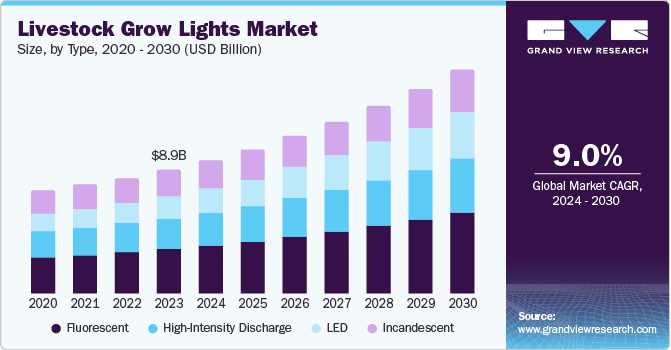

The global livestock grow lights market size was valued at USD 8.86 billion in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. An increase in the consumption of animal-based products is projected to grow over the forecast period. Moreover, rising focus on increase in domestic animals to increase livestock production is expected to drive the market growth for livestock grow lights. The adoption of smart livestock farming practices in developed countries such as Germany, U.K., and Uruguay, is also estimated to drive demand for grow lights in livestock barns.

Consumers are becoming more conscious about the quality and safety of their food, which has increased awareness of livestock natural farming practices. Grow lights play a crucial role in ensuring that livestock receive the optimal light conditions necessary for their growth and development. By improving the health and productivity of animals, these lights contribute to producing quality animal products and meeting consumer demand standards. Moreover, these lights aid in simulating natural daylight cycles, reducing stress and enhancing the well-being of the livestock. This improves animal welfare and leads to more consistent and higher yields, driving the demand for high-quality animal products.

Governments worldwide are implementing regulations and offering incentives to promote sustainable agricultural practices and improve animal welfare. These policies often include guidelines for proper lighting in livestock facilities and provide financial support for farmers to upgrade their lighting systems. Such regulatory frameworks and incentives encourage the adoption of advanced grow lights, driving market growth. For instance, the UK Government launched the Farming Equipment and Technology Fund (FETF) 2024 initiative to aid farmers in upgrading their agricultural practices with advanced technology. This includes investing in improvements to the health and welfare of their livestock by providing financial assistance.

Type Insights

The fluorescent segment accounted for the largest market revenue share of 35.9% in 2023. Proper lighting is essential for the health and well-being of livestock, and fluorescent lights provide the necessary illumination to support various aspects of animal welfare. Fluorescent lights emit a broad spectrum of light that closely mimics natural daylight, which benefits animals' physiological and psychological health. Adequate lighting aids regulate animals' circadian rhythms, improve feeding behaviors, and enhance reproductive performance. Fluorescent lighting enables farmers to maintain healthier and more productive animals, driving its demand in the market.

The LED segment is expected to register the fastest CAGR during the forecast period. LEDs consume less power, resulting in reduced electricity bills for farmers. This energy efficiency reduces operational costs, making LEDs a financially adaptive choice. Additionally, the long lifespan of LEDs reduces the frequency and expense associated with replacements and maintenance. The durability and longevity of LEDs ensure reliable performance, making them a cost-effective and low-maintenance solution for livestock farmers.

Livestock Insights

The cattle segment accounted for the largest market revenue share in 2023. By extending the daylight hours with artificial lighting, farmers increase their cows' milk yield. This boost in milk production translates to higher revenues for dairy farmers. Consistent light exposure reduces stress and improves the overall well-being of the animals. Healthier cattle are less prone to diseases and exhibit better growth rates, leading to higher meat and milk production. Moreover, the growing demand for dairy products such as milk, cheese, yogurt, and butter drive the demand for grow lights in cattle farms.

The poultry segment is anticipated to register a significant CAGR over the forecast period. The growing global population and rising demand for poultry-based products such as chicken and eggs drive the need for more efficient and productive poultry farming. Light exposure affects the hormonal regulation of laying cycles, and by optimizing light duration and intensity, farmers boost egg production rates. Additionally, specific light spectrums enhance eggshell quality and yolk color, which are suitable for human consumption. Consistent and appropriate lighting conditions aid in maintaining high levels of egg production throughout the year.

Installation Insights

Retrofit accounted for the largest market revenue share in 2023. Retrofit installations require minimal downtime, allowing farmers to maintain normal farming activities without significant interruptions. This is important in livestock farming, where continuous operation is critical for animal health and productivity. The ability to upgrade lighting systems without causing significant disruptions makes retrofit solutions suitable for farmers pursuing enhancing their operations efficiently and smoothly.

The new-installation segment is anticipated to register the fastest CAGR over the forecast period. New installations allow farmers to leverage advanced solutions such as LED lights, which offer superior energy efficiency and advanced control systems. These modern technologies significantly enhance the overall efficiency and effectiveness of the lighting system, leading to better performance and higher productivity in livestock farming operations. Additionally, new installations provide the flexibility to design and implement lighting systems personalized to the specific needs of different livestock and farming environments. This customization ensures that the lighting conditions are optimized for poultry, cattle, swine, or other livestock requirements, driving its demand in the market.

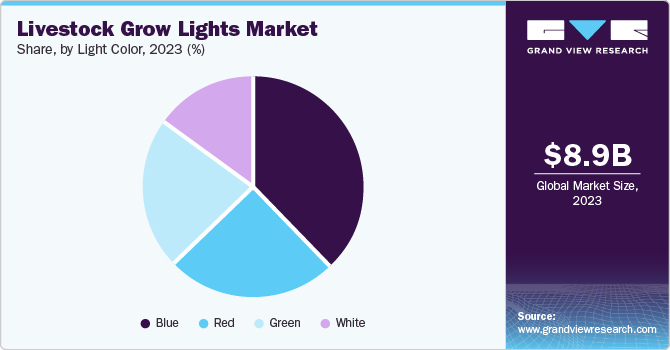

Light Color Type Insights

The blue color segment accounted for the largest market revenue share in 2023. Blue light supports better reproductive outcomes in livestock, such as cattle and swine, influencing hormonal cycles and enhancing productive performance. The positive effects of blue light on reproduction drive its adoption in livestock farming, particularly in operations focused on breeding and egg production. Blue light exposure during the daytime enhances the health and productivity of livestock.

The white segment is expected to register the fastest CAGR during the forecast period. White lights are highly energy-efficient, consuming less power while providing effective illumination. This leads to lower electricity bills and operational costs for farmers, making white light an economically convenient option. Additionally, it is suitable for different types of livestock, including poultry, cattle, swine, and more. The broad spectrum of white light makes it adaptable to different farming environments and specific needs.

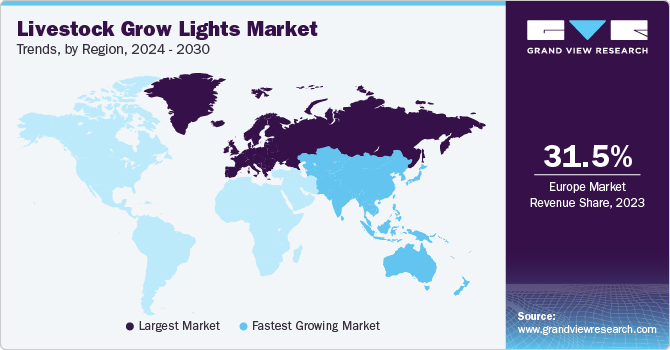

Regional Insights

The North America livestock grow lights market is expected to witness significant growth over the forecast period. Proper lighting is essential for creating a comfortable and healthy environment for animals. Adequate light exposure aids in regulating circadian rhythms reduces stress and promotes natural behaviors in livestock. Farmers in North America are adopting grow lights to ensure their animals receive the possible care, improving animal welfare, productivity, and product quality.

U.S. Livestock Grow Lights Market Trends

The U.S. livestock grow lights market accounted for the largest revenue share in North America market in 2023. Rising concerns regarding quality and safety are leading to a growing demand for products produced under optimal conditions. Proper light is essential for the health and productivity of livestock, which directly impacts the quality of animal products such as meat, milk, eggs, and others. By adopting advanced grow lights, farmers create ideal living conditions for their animals, resulting in higher quality and more nutritious products that meet consumer expectations.

Europe Livestock Grow Lights Market Trends

Europe livestock grow lights market accounted for the largest revenue share in 2023. European manufacturers are increasingly collaborating with agricultural technology firms and cooperatives to ensure that advanced lighting solutions are accessible to all farmers, regardless of location. Expanding the distribution network for livestock grow lights in Europe involves strategic initiatives such as developing new partnerships with local and regional distributors, enhancing logistics capabilities, and leveraging digital platforms for wider market reach. These factors support the overall growth and adoption of advanced European agricultural practices. For instance, in September, Greengage announced a distribution partnership with Rol-Tech-Mar. Rol-Tech-Mar joins the 15 distributors in the Greengage network, which is spread across five continents, seven countries, and four distributors in Europe.

The UK market is expected to witness significant growth over the forecast period. Companies in the UK are increasing manufacturing partnerships to enhance production capacity, drive innovation, and meet the growing demand for advanced lighting solutions. These partnerships often focus on joint research and development initiatives, creating advanced products that cater to the specific needs of different livestock operations. For instance, in May 2021, Greengage announced a strategic manufacturing partnership with Albacom. Albacom's reputation for engineering design and manufacture, customer support, and outstanding quality has led to the company becoming the manufacturing partner of Greengage's animal-centric ALIS brand of lighting products.

The France livestock grow lights market is expected to witness significant growth over the forecast period. Sustainability is a significant focus in France, with consumers and businesses prioritizing environmentally friendly practices. Energy-efficient lighting solutions, such as LEDs, consume less power and produce less heat, leading to substantial energy savings and a lower carbon footprint.

Asia Pacific Livestock Grow Lights Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period. Asian countries are witnessing significant shifts from traditional farming methods to modern, industrial-scale operations. This transformation is driven by the need to meet the food demands of growing populations and urbanization. Large-scale livestock farms require efficient and reliable lighting systems to ensure optimal animal growth and productivity.

China is expected to witness significant growth over the forecast period. As more people move to urban areas, the demand for animal products increases, necessitating the expansion and modernization of livestock farming. Additionally, increasing health concerns and changing dietary habits, including a higher consumption of meat and dairy products, require farmers to adopt efficient farming practices to meet the increased demand. Advanced grow lights aid farmers in enhancing their production capabilities, ensuring a steady supply of high-quality animal products to urban populations.

The India livestock grow lights market is expected to witness significant growth over the forecast period. As the consumer's living standards improve, health concerns rise, and disposable incomes continue to improve, there is a growing preference for premium-quality meat, milk, and eggs. Proper lighting conditions are essential for maintaining the health and productivity of livestock, which directly impacts the quality of animal products. By adopting advanced grow lights, farmers ensure their animals are raised in optimal conditions, leading to superior quality products that meet consumer expectations. This demand for high-quality animal products drives the adoption of livestock grow lights in India.

Key Livestock Grow Lights Company Insights

Some key companies in the bare metal cloud market include AGRILIGHT BV, Aruna lighting, Big Dutchman, Meyn Food Processing Technology B.V., Greengage Agritech Ltd., and Signify Holding

-

Greengage Agritech Ltd. is a UK-based company specializing in advanced lighting and sensor technologies for the agricultural sector. It develops integrated solutions to enhance animal welfare, productivity, and farm management efficiency. Its product offerings include LED lighting systems designed for poultry, swine, and dairy environments, featuring their patented ALIS (Agricultural Lighting Induction System) technology.

Key Livestock Grow Lights Companies:

The following are the leading companies in the livestock grow lights market. These companies collectively hold the largest market share and dictate industry trends.

- AGRILIGHT BV

- Aruna lighting

- Big Dutchman

- Meyn Food Processing Technology B.V.

- Greengage Agritech Ltd.

- Signify Holding

- OSRAM GmbH

- DeLaval

- Uni-lightled LED

- ONCE by Signify

- HATO

- CBM Lighting

- ENIM LIGHTING

Recent Developments

-

In July 2023, Fienhage International and LA Systems (Layers) Ltd announced their partnership for the UK market. LA Systems (Layers) Ltd represents Fienhage International, specifically focusing on poultry systems in the United Kingdom. In partnership, LA Systems (Layers) Ltd handles installation and after-sales support and provides customer guidance for Fienhage systems.

-

In March 2024, Signify, in collaboration with Tyson Foods developed Optient, a lighting solution focused on optimizing animal productivity and health.

Livestock Grow Lights Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.54 billion

Revenue forecast in 2030

USD 16.00 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, livestock, installation, light color type

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Brazil

Key companies profiled

AGRILIGHT BV; Aruna lighting; Big Dutchman; Meyn Food Processing Technology B.V.; Greengage Agritech Ltd.; Signify Holding; OSRAM GmbH; DeLaval; Uni-lightled LED; ONCE by Signify; HATO; CBM Lighting; ENIM LIGHTING

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Livestock Grow Lights Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the livestock growth lights market report based on type, livestock, installation, light color and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fluorescent

-

LED

-

Incandescent

-

High-Intensity Discharge

-

-

Livestock Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

Installation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retrofit

-

New-Installation

-

-

Light Colour (Revenue, USD Billion, 2018 - 2030)

-

Green

-

Red

-

White

-

Blue

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

- MEA

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.