- Home

- »

- Medical Devices

- »

-

Live Biotherapeutic Products And Microbiome CDMO Market ReportGVR Report cover

![Live Biotherapeutic Products And Microbiome CDMO Market Size, Share & Trends Report]()

Live Biotherapeutic Products And Microbiome CDMO Market Size, Share & Trends Analysis Report By Application (C.Difficle, Crohns Disease, IBS, Diabetes, Others), By Region (MEA, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-061-6

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

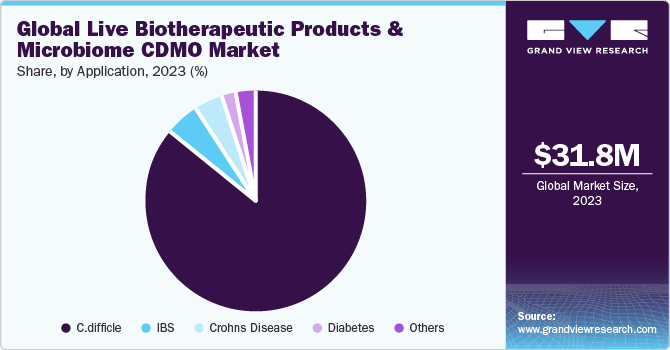

The global live biotherapeutic products and microbiome CDMO market size was estimated at USD 31.84 million in 2023 and is expected to grow at a CAGR of 37.77% from 2024 to 2030. The rising importance of the potential advantages of live biotherapeutic products and microbiome-based therapeutics in treating a variety of diseases, including inflammatory bowel disease, cancer, and neurological disorders, among patients and healthcare providers is the prime factor that propels market growth. Furthermore, the increasing prevalence of chronic diseases and the growing demand for personalized medicine also expand the live biotherapeutic products and microbiome-based therapeutics market.

CDMOs specializing in these fields have the expertise and infrastructure to support developing and manufacturing these complex therapies, which require specialized equipment and facilities. As a result, pharmaceutical and biotech companies can outsource their production to CDMOs, allowing them to focus on research and development.

Moreover, there is a growing interest in LBPs and the microbiome as potential therapeutic agents, leading to increased research and development activities in these areas. This has resulted in a greater demand for CDMOs with expertise in these fields. Advances in sequencing technologies and bioinformatics have allowed for a deeper understanding of the microbiome and its role in health and disease. This has enabled the development of more targeted and effective live biotherapeutic products and microbiome-based therapies.

Furthermore, regulatory bodies, such as the FDA, have recognized the potential of live biotherapeutic products and the microbiome and have guided the development and approval of these products. This has increased investor confidence and encouraged companies to invest in developing these products. Overall, the LBPs and microbiome CDMO market is expected to experience significant growth in the coming years due to these drivers and the increasing interest in these innovative therapies.

Market Concentration & Characteristics

Market growth stage is stable and is expected to accelerate over the estimated period. The live biotherapeutic products and microbiome CDMO industry is characterized by technologies, regulatory considerations, and globalization & outsourcing of product processes to influence advantages and specialized capabilities.

The live biotherapeutic products and microbiome CDMO innovations are continuously evolving to meet the industry’s demands due to the increased burden of infectious & rare diseases. Several advancements have shaped the live biotherapeutic products and microbiome CDMO market, enhancing drug development, manufacturing processes, and productivity.

Compliance with stringent regulatory requirements, particularly in the pharmaceutical industry, is critical. CDMOs in this market emphasize robust quality assurance practices and adherence to regulatory standards, thereby witnessing lucrative growth opportunities.

Live Biotherapeutic Products and Microbiome CDMO players in the market leverage strategies such as collaborations, partnerships, and acquisitions to promote the reach of their offerings and increase their product capabilities globally.

Increasing R&D activities, rising number of mergers & acquisitions, & growing disease burden can influence market dynamics positively. The local presence of several established pharmaceuticals, the rising burden of infectious & rare diseases, growing demand for CDMOs fuel market growth.

Application Insights

The C.difficle segment dominated the market with the largest revenue share of more than 85.0% in 2023. On the basis of application, the live biotherapeutic products and microbiome market is segmented into C.difficle, Crohn's disease, IBS, Diabetes, and Others. C. difficile is a bacterium found in the human gut microbiome and can cause severe diarrhea and colitis, particularly in people who have recently taken antibiotics.

In recent years, there has been growing interest in using live biotherapeutic products (LBPs) to treat various diseases, including those related to the gut microbiome. Live biotherapeutic products (LBPs) are living organisms, such as bacteria or viruses, used to prevent or treat diseases. C. difficile is one of the organisms that can be used as an LBP, and some research has been done into its potential use for treating C. difficile infections. As research into the human microbiome and the potential applications of LBPs continues to grow, it is likely that the market will show more interest in using C. difficile and other organisms for therapeutic purposes.

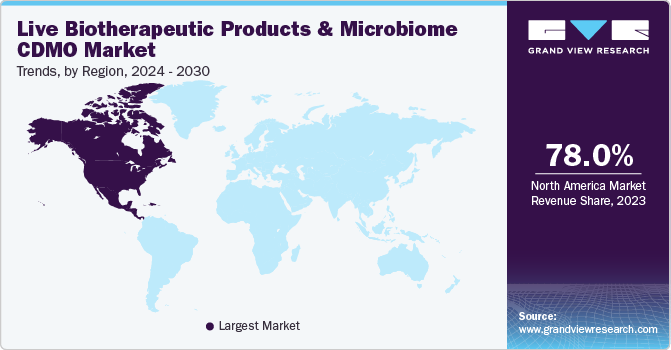

Regional Insights

In 2023, North America accounted for the largest share of 78.0% of the global live biotherapeutic products and microbiome CDMO market. The market is driven primarily due to the presence of key players and increasing investments in research and development activities in this region. The growing demand for effective treatments for various diseases, such as C.difficile, Crohn's disease, and IBS, has also contributed to the market growth in North America.

Moreover, the region has many established pharmaceutical and biotech companies with expertise in developing and commercializing biologic products, including live biotherapeutic products and microbiome-based therapies. Additionally, the region has a well-established regulatory framework for biopharmaceuticals, which provides a stable environment for companies to develop and manufacture these products. Adding to it, North America has a strong research infrastructure, including top universities and research institutions that drive innovation in the field. This has led to the development of cutting-edge technologies and techniques used in producing live biotherapeutic products and microbiome-based therapies.

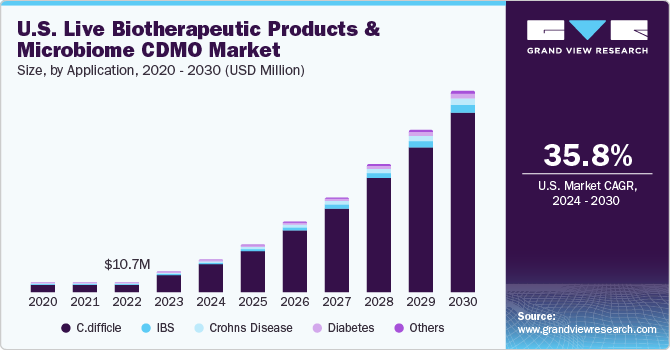

U.S. Live Biotherapeutic Products And Microbiome CDMO Market Trends

The Live Biotherapeutic Products And Microbiome CDMO market in the U.S. held the largest share in 2023, as many pharmaceutical and life sciences companies are in this country. Growing interest in clinical trials and the benefits of live biotherapeutics for rare diseases drive the development of new and novel drugs. Moreover, a well-established regulatory framework provides new opportunities for companies to develop and manufacture products with a wide range of applications and target populations with improved knowledge of the importance of microbiota in terms of health and disease.

Europe Live Biotherapeutic Products And Microbiome CDMO Market Trends

The Live Biotherapeutic Products And Microbiome CDMO market in Europe is expected to growsignificantly due to the high prevalence of CDI and the local presence of well-established market players, such as 4D Pharma, Microbiotica, EnteroBiotix, Prokarium, and Eagle Genomics. Moreover, increasing funding, acquisitions, and high R&D spending in European countries contribute to market growth. For instance, in April 2023, Seres Therapeutics, Inc. & Nestle Health Science announced the U.S. FDA approval for VOWST (fecal microbiota spores, live-brpk) known as SER-109.

Germany live biotherapeutic products and microbiome CDMO market held the largest share in 2023. The rapidly aging population, growing demand for biotherapeutics, and emerging chronic diseases have increased the pressure on pharmaceutical companies to innovate new drugs for patients. These factors have led pharmaceutical and biotechnology companies to shift their focus on R&D to produce niche live biotherapeutic products and microbiomes.

The Live Biotherapeutic Products And Microbiome CDMO market in the UK is anticipated to grow over the forecast period. The UK is one of the key countries in microbiome science and innovation in both public and private sectors. The country has growing IMT and IMMP opportunities with unique clinical research and genomic & digital capabilities. Moreover, it is the key destination for microbiome investment and innovation.

Asia Pacific Live Biotherapeutic Products And Microbiome CDMO Market Trends

The Live Biotherapeutic Products And Microbiome CDMO market in Asia Pacific is expected to grow at a CAGR of 44.23% during the forecast period. The live biotherapeutic products and microbiome CDMO market in Asia Pacific have witnessed significant growth and promising developments in recent years. Some key factors contributing to this growth are the prevalence of IBD and Crohn's disease and rising R&D investment and funding. Moreover, rising outsourcing and the increasing number of clinical trials are among the major factors responsible for the fastest market growth in Asia Pacific.

China Live Biotherapeutic Products And Microbiome CDMO market is expected to grow over the forecast period due to rising potential for growth and global leadership in the industry has led companies to innovate niche products such as live biotherapeutic products & microbiomes, with increasing collaboration, acquisition, funding, & FDA approvals.

The Live Biotherapeutic Products And Microbiome CDMO market in Japan held the largest share in 2023 due to a significant increase in the overall number of clinical trials on emerging live biotherapeutics and microbiomes as the government is undertaking steps to offer regulatory support & promote clinical trials in the country.

India The Live Biotherapeutic Products And Microbiome CDMO market is anticipated to grow at the fastest CAGR over the forecast period owing to rapidly increasing private healthcare services and academic research, which have led to growing interest and rising awareness of live biotherapeutics. Moreover, rising infectious diseases, hospital-acquired infections, and emerging IBD burden across the country are driving the market demand.

Key Live Biotherapeutic Products And Microbiome CDMO Market Company Insights

The major players operating across the market focus on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. The prominent strategies companies adopt are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players.

Key Live Biotherapeutic Products And Microbiome CDMO Companies:

The following are the leading companies in the live biotherapeutic products and microbiome CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Arrant Bio

- 4D Pharma

- Cerbios

- Biose Industrie

- Assembly Biosciences, Inc.

- Wacker Chemie AG

- Quay Pharmaceuticals

- NIZO

- Lonza

- Inpac Probiotics

Recent Developments

-

In March 2023, Cedars-Sinai established a new Human Microbiome Research Institute that will support investigators studying the microbiome, the diverse collection of fungi, bacteria, and viruses.

-

In December 2022, Biomica Ltd. announced an agreement for a USD 20 million financing round, which was led by Shanghai Healthcare Capital. The financing will enable the company to develop the microbiome-based therapeutics pipeline. Furthermore, the company completed its financing round in April 2023, with a USD 10 million investment from Shanghai Healthcare Capital, validating Biomica's long-term potential.

-

In November 2022, 4D Pharma plc company’s Blautix Phase II clinical trial results were published in the journal Alimentary Pharmacology and Therapeutics for the treatment of IBS.

Live Biotherapeutic Products And Microbiome CDMO Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.37 million

Revenue forecast in 2030

USD 358.07 million

Growth rate

CAGR of 37.77% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea;Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Arrant Bio; 4D Pharma; Cerbios; Biose Industrie; Assembly Bioscience Inc; Wacker Chemie AG; Quay Pharmaceuticals; NIZO; Lonza; Inpac Probiotics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Live Biotherapeutic Products And Microbiome CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global live biotherapeutic products and microbiome CDMO market report based on application, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

C.difficle

-

Crohns Disease

-

IBS

-

Diabetes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global live biotherapeutics products and microbiome CDMO market size was estimated at USD 31.84 million in 2023 and is expected to reach USD 52.37 million in 2024.

b. The global live biotherapeutics products and microbiome CDMO market is expected to grow at a compound annual growth rate of 37.77% from 2024 to 2030 to reach USD 358.07 million by 2030.

b. North America dominated the live biotherapeutics products and microbiome CDMO market with a share of 78.0% in 2023. This is attributable to the large presence of key players and increasing investments in research and development activities in this region.

b. Some key players operating in the live biotherapeutics products and microbiome CDMO market include Arrant Bio; 4D Pharma; Cerbios; Biose Industrie; Assembly Bioscience Inc.; Wacker Chemie AG; Quay Pharmaceuticals; NIZO; Lonza; Inpac Probiotics

b. The rising importance of the potential advantages of live biotherapeutic products and microbiome-based therapeutics in treating a variety of diseases, including inflammatory bowel disease, cancer, and neurological disorders, among patients and healthcare providers is the prime factor that propels market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."