Lithotripsy Devices Market Size, Share & Trends Analysis Report By Type (Extracorporeal Shock Wave, Intracorporeal), By Application (Kidney Stones, Pancreatic Stones), By End-use (Hospitals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-110-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global lithotripsy devices market size was valued at USD 1.20 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.40% from 2023 to 2030. An increase in the prevalence of kidney stones is augmenting the demand for lithotripsy devices. Additionally, advancements in lithotripsy technology have led to the development of more efficient and precise devices, making them a preferred treatment option. The trend towards minimally invasive procedures has also contributed to market growth, as patients and healthcare providers seek less invasive treatment options with faster recovery times.

Increasing awareness of kidney stone management options and improving healthcare infrastructure in developing regions are predicted to contribute to greater accessibility to lithotripsy procedures, further boosting the demand for lithotripsy devices. Favorable reimbursement policies and insurance coverage for lithotripsy procedures have encouraged more patients to opt for treatment, supporting market growth.

Ongoing research and development in the medical device industry are leading to technological advancements in lithotripsy devices, making them safer, more effective, and user-friendly. Healthcare providers are keen to adopt these advanced technologies, contributing to market growth. Furthermore, efforts to educate patients and physicians about kidney stones and available treatment options can have a positive impact on the demand for lithotripsy devices. Better awareness may lead to early diagnosis and more frequent use of lithotripsy as a preferred treatment option.

The trend towards ambulatory care and same-day procedures is growing due to cost-effectiveness and patient convenience. Since lithotripsy procedures can often be performed in an outpatient setting, the expansion of ambulatory surgical centers is estimated to fuel the adoption of lithotripsy devices over the forecast period. In addition, the incorporation of remote monitoring technologies and telemedicine can improve post-operative care for lithotripsy patients, potentially leading to better outcomes and greater acceptance of lithotripsy procedures.

Type Insights

The extracorporeal shockwave lithotripsy devices segment led the market and accounted for more than 51% of the revenue share in 2022. The main advantage of such devices is that the majority of patients can be treated for kidney stones without surgery. This subsequently reduces hospital stays, costs, and recovery time. Additionally, more than 70% of patients are observed to be free of stones within three months of treatments that use ESWT devices. Such a high success rate is predicted to enhance the segment growth.

The intracorporeal lithotripsy devices segment is expected to advance at a steady CAGR over the forecast period. The expansion of urological care services, along with the establishment of specialized urology clinics and centers, is likely to boost the adoption of intracorporeal lithotripsy devices as they become more accessible to patients. Additionally, intracorporeal lithotripsy devices are considered a preferred choice for their minimally invasive and efficient approach to breaking down kidney stones, making them increasingly popular among patients and healthcare providers.

Application Insights

The kidney stones segment accounted for the largest revenue share of 44.7% in 2022 and is expected to continue its dominance over the forecast period. With the rising number of people affected by kidney stones, there is a growing demand for effective and efficient treatment options. Lithotripsy devices are a primary treatment mode for kidney stones, making them indispensable in addressing the escalating number of cases.As the number of people affected by kidney stones continues to increase, there will be a larger patient pool preferring lithotripsy procedures in the coming years. The rise in patients seeking treatment will lead to higher adoption of lithotripsy devices in the coming years.

The pancreatic stones segment is anticipated to expand at 6.58% CAGR over the forecast period. As awareness of pancreatic stones and their associated complications rises, there may be an increased demand for effective treatment options. Lithotripsy devices could play a significant role in the treatment of pancreatic stones, offering a non-invasive or minimally invasive approach. The continuous development of advanced lithotripsy devices with improved capabilities, such as better imaging and precise targeting mechanisms, may render them more suitable for treating pancreatic stones effectively.

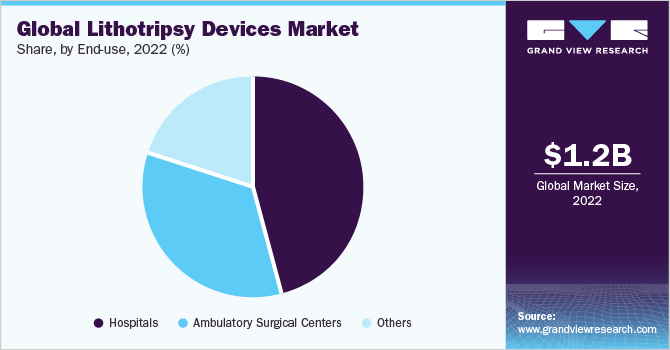

End-use Insights

The hospitals segment held the largest revenue share of 45.7% in 2022. Hospitals can raise awareness among both patients and referring physicians about the availability and benefits of lithotripsy procedures. Increased awareness can lead to more patients seeking lithotripsy treatment, contributing to the demand for lithotripsy devices. By investing in state-of-the-art lithotripsy devices, hospitals can draw patients seeking top-notch treatment options, thereby propelling the market demand for advanced lithotripsy technologies.

The ambulatory surgical centers segment is expected to expand at the fastest CAGR of 7.19% over the forecast period. ASCs offer lithotripsy procedures at more economical rates compared to traditional hospital settings. This cost-effectiveness of ASCs attracts more patients to opt for lithotripsy treatments, thereby boosting the growth of the lithotripsy devices market. Some ASCs focus on specific patient demographics or medical specialties. Those specializing in urology and kidney stone management are likely to generate higher demand for lithotripsy devices, particularly those designed for treating kidney stones.

Regional Insights

North America held the largest market share of 31.2% in 2022. The market for lithotripsy devices in North America is expected to expand owing to the rising prevalence of kidney stones, technological advancements, and the growing preference for minimally invasive treatments in the region. Moreover, a well-established healthcare infrastructure, increased healthcare expenditure, an aging population, reimbursement support, market competitiveness, and attractiveness to medical tourists are other factors contributing to the region’s growth. The competitive nature of the medical device industry in North America drives innovation, resulting in the introduction of new and advanced lithotripsy devices, offering healthcare providers with more choices and fueling market growth.

Asia Pacific is anticipated to expand at the fastest growth rate during the forecast period, owing to the large patient pool across several countries in Asia. The incidence of kidney stones is on the rise in Asia Pacific, leading to an increased demand for lithotripsy procedures and devices in the region. Improving healthcare infrastructure, including advanced healthcare facilities, hospitals, and specialized clinics, is enhancing access to lithotripsy treatments and driving the demand for lithotripsy devices. Certain countries in Asia Pacific have become popular medical tourism destinations due to their high-quality and cost-effective healthcare services, creating an opportunity for increased demand for lithotripsy devices.

Key Companies & Market Share Insights

Key market players are focusing on developing novel products to strengthen their portfolios. Companies are also taking strategic initiatives to increase their global reach, with key strategic initiatives including collaborations, partnerships, mergers and acquisitions, product approvals, and joint ventures. For instance, in January 2022, Applaud Medical received Breakthrough Device Designation from the FDA for its Acoustic Enhancer. This product is used in combination with laser lithotripsy and ureteroscopy for the breakdown of calcium-based kidney stones. Some of the prominent players in the global lithotripsy devices market include:

-

Zimmer MedizinSystems GmbH

-

Olympus Corporation

-

Richard Wolf GmbH

-

Boston Scientific Corporation

-

STORZ Medical AG

Lithotripsy Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 1.27 billion |

|

Revenue forecast in 2030 |

USD 1.96 billion |

|

Growth rate |

CAGR of 6.40% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historic data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion & CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Zimmer MedizinSystems GmbH; Olympus Corporation; Richard Wolf GmbH; Boston Scientific Corporation; STORZ Medical AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lithotripsy Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global lithotripsy devices market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Extracorporeal Shock Wave Lithotripsy Devices

-

Intracorporeal Lithotripsy Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Kidney Stones

-

Ureteral Stones

-

Pancreatic Stones

-

Bile Duct Stones

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lithotripsy devices market size was estimated at USD 1.20 billion in 2022 and is expected to reach USD 1.27 billion in 2023.

b. The global lithotripsy devices market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 1.96 billion by 2030.

b. North America dominated the lithotripsy devices market with a share of 31.2% in 2022. This is attributable to numerous collaborative efforts by key players to improve their R&D proficiencies and ensure high-quality standards.

b. Some key players operating in the lithotripsy devices market include STORZ MEDICAL AG, Zimmer MedizinSystems GmbH, Olympus Corporation, Richard Wolf GmbH, and Boston Scientific Corporation, Shenzhen Oceanus Medical Device CO., ltd., Medispec, BTL, MTS Medical, Shenzhen Huikang Medical Apparatus Co., ltd., Dornier MedTech.

b. Key factors that are driving the lithotripsy devices market growth include the increasing rise in surgical procedures, the increasing global geriatric population and technological advancements, the rising prevalence of kidney stones, and increased per capita healthcare expenditure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."