- Home

- »

- Power Generation & Storage

- »

-

Lithium-Sulfur Battery Market Size And Share Report, 2030GVR Report cover

![Lithium-Sulfur Battery Market Size, Share & Trends Report]()

Lithium-Sulfur Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Low Energy Density, High Energy Density), By Battery Capacity (Below 500 mAh, 500-1000 mAh), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-377-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium-Sulfur Battery Market Summary

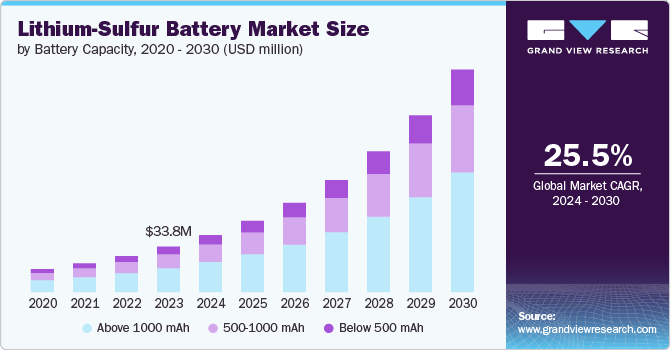

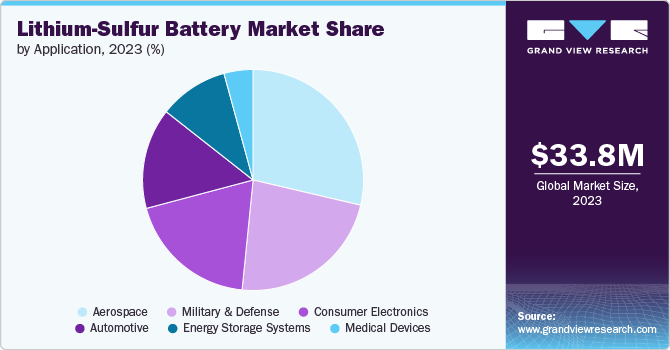

The global lithium-sulfur battery market size was estimated at USD 33.80 million in 2023 and is projected to reach USD 165.40 million by 2030, growing at a CAGR of 25.5% from 2024 to 2030. The lithium-sulfur (Li-S) battery market is primarily driven by the increasing demand for high-energy-density storage solutions in various sectors, particularly in electric vehicles (EVs) and portable electronics.

Key Market Trends & Insights

- Asia Pacific dominated the global lithium-sulfur battery market with the largest revenue share of 48.0% in 2023.

- By battery capacity, the above 1000 mAh battery capacity segment accounted for the largest revenue share of over 53.0% in 2023.

- By type, the high energy density type segment accounted for the largest revenue share of over 67.0% in 2023.

- By application, the aerospace segment held the dominant position in the market and accounted for the leading revenue share of 28.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 33.80 Million

- 2030 Projected Market Size: USD 165.40 Million

- CAGR (2024-2030): 25.5%

- Asia Pacific: Largest market in 2023

Li-S batteries offer theoretical energy densities up to five times higher than traditional lithium-ion batteries, making them a promising technology for extending the range of EVs and improving the battery life of mobile devices. For example, companies such as Oxis Energy and Sion Power have been developing Li-S batteries specifically for the automotive and aerospace industries, aiming to provide longer-lasting and lighter-weight power sources.

Another significant driving factor is the potential cost-effectiveness of Li-S batteries. Sulfur, the primary cathode material, is abundantly available and inexpensive compared to the cobalt and nickel used in conventional lithium-ion batteries. This cost advantage could lead to more affordable energy storage solutions, particularly for large-scale applications such as grid storage. Additionally, the environmental benefits of using sulfur, a byproduct of petroleum refining, align with the growing focus on sustainable and eco-friendly technologies.

However, the Li-S battery market also faces challenges that are influencing its development. The main technical hurdles include the shuttle effect, where polysulfides dissolve and migrate between electrodes, causing capacity loss. Also, the expansion of the sulfur cathode during cycling, which can lead to structural degradation. Researchers and companies are actively working on addressing these issues through advanced materials and cell designs. For instance, Stanford University scientists developed a novel coating that helps prevent the shuttle effect, potentially increasing the lifespan of Li-S batteries.

Battery Capacity Insights

Based on the battery capacity, the lithium-sulfur battery market is segmented into below 500 mAh, 500-1000 mAh, and above 1000 mAh. Above 1000 mAh battery capacity segment registered largest revenue market share of over 53.0% in 2023. Lithium-sulfur batteries are being developed primarily for electric vehicles, aerospace applications, and grid energy storage systems. Their potential for high energy density makes them attractive for long-range electric vehicles and aircraft.

Lithium-sulfur batteries with a capacity below 500 mAh are typically designed for small, portable electronic devices that require lightweight power sources. These batteries are ideal for applications such as wearable technology, medical devices, and IoT sensors. Despite their lower capacity, they offer advantages in terms of energy density and potential for cost reduction compared to traditional lithium-ion batteries. This segment is particularly attractive for manufacturers looking to develop compact, energy-efficient products.

The 500-1000 mAh segment of lithium-sulfur batteries represents a middle ground in terms of capacity and applications. These batteries are suitable for a wider range of consumer electronics, including smartphones, tablets, and small drones. They offer a balance between size and power output, making them versatile for various portable devices. This capacity range batteries are used in electric vehicles, particularly for auxiliary power systems or range extenders.

Type Insights

Based on the type, the lithium-sulfur battery market is segmented into low energy density and high energy density. High energy density type segment accounted for the highest revenue market share of over 67.0% in 2023. High energy density lithium-sulfur batteries utilize higher sulfur content and more advanced cathode designs to maximize energy storage capacity. While they offer significantly higher energy density compared to conventional lithium-ion batteries, high energy density lithium-sulfur batteries often face challenges with cycle life and sulfur dissolution.

Low energy density lithium-sulfur batteries are characterized by their lower sulfur content and simpler cathode structures. These batteries offer improved stability and cycle life compared to high energy density variants.

Application Insights

Based on the application, the lithium-sulfur battery market is segmented into automotive, aerospace, consumer electronics, energy storage systems, medical devices, and military and defense. Aerospace application segment of the lithium-sulfur battery market registered highest revenue share of over 28.0% in 2023. The aerospace industry uses lithium-sulfur batteries for their high specific energy, which could result in lighter and more efficient power sources for aircraft and satellites. These batteries potentially extend flight times for electric aircraft or provide more power for satellite systems while reducing overall weight.

Lithium-sulfur batteries are gaining attention in the automotive sector due to their potential for higher energy density compared to traditional lithium-ion batteries. This could lead to electric vehicles with longer driving ranges and potentially lower costs.

Moreover, lithium-sulfur batteries offer devices with longer battery life and potentially faster charging times in the consumer electronics sector. This technology is extensively beneficial for smartphones, laptops, and wearable devices where energy density and lightweight designs are crucial.

Regional Insights

North America has a strong industrial base and a growing focus on electric vehicles (EVs) and renewable energy storage. Major automakers such as Tesla, General Motors, and Ford are investing heavily in advanced battery technologies, including lithium-sulfur. Tesla, for instance, has shown interest in lithium-sulfur batteries for their potential to offer higher energy density than current lithium-ion batteries. This industrial push is complemented by supportive government policies, such as the Biden administration's goal to make 50% of new vehicle sales electric by 2030, which is driving demand for high-performance, low-cost battery technologies.

Asia Pacific Lithium-Sulfur Battery Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 48.0% in 2023. The region consists of major battery manufacturers and technology innovators, particularly in countries such as China, Japan, and South Korea. These nations have been at the forefront of battery technology development for years, with companies such as CATL, Panasonic, and Samsung SDI investing heavily in research and development of next-generation battery technologies, including lithium-sulfur. This concentration of expertise and manufacturing capabilities gives the Asia Pacific region a significant advantage in scaling up production and commercializing lithium-sulfur batteries.

Japan lithium-sulfur battery market has a long-standing reputation for excellence in battery technology. Companies such as Toyota, Sony, and Panasonic have been at the forefront of battery innovation for decades. These firms have leveraged their expertise in lithium-ion batteries to make significant strides in Li-S technology. For instance, Toyota has been working on Li-S batteries for electric vehicles, aiming to achieve higher energy density and longer driving ranges. Their research has shown promising results, with prototypes demonstrating energy densities up to five times higher than conventional lithium-ion batteries.

Europe Lithium-Sulfur Battery Market Trends

Europe boasts a robust automotive industry that is rapidly transitioning towards electrification. Major European automakers such as Volkswagen, BMW, and Daimler are investing heavily in electric vehicle (EV) technology. Li-S batteries, with their potential for longer driving ranges and lower costs, are seen as a promising alternative to current EV batteries. For example, the UK-based company OXIS Energy has been developing Li-S batteries specifically for aviation and automotive applications, showcasing the region's focus on innovation in this field.

Key Lithium-Sulfur Battery Company Insights

The lithium-sulfur battery market is characterized by intense competition and rapid technological advancements. Major players include established battery manufacturers, automotive companies, and emerging startups, all vying for market share in this promising sector. Key factors influencing market share include research and development capabilities, partnerships with automotive or electronics manufacturers, and the ability to scale production efficiently.

Key Lithium-sulfur Battery Companies:

The following are the leading companies in the lithium-sulfur battery market. These companies collectively hold the largest market share and dictate industry trends.

- PolyPlus Battery Company

- NexTech Batteries Inc.

- Li-S Energy Limited

- Zeta Energy LLC

- GS Yuasa Corporation

- LG Energy Solutions Ltd.

- Saft Groupe SA

- Gelion PLC

- Sion Power Corporation

- Johnson Matthey

- Giner, Inc.

- Lynntech, Inc.

- Ilika Technologies

- Williams Advanced Engineering

- Guang Dong Xiaowei New Energy Technology Co., Ltd.

Recent Developments

-

In May 2024, Lyten, Inc. announced that it had shipped samples of its 6.5 Ah lithium-sulfur pouch cells to some of the leading European and U.S.-based automotive original equipment manufacturers for customer evaluation. The company has already shipped samples to major consumer electronics players in the U.S. and plans to deliver lithium-sulfur pouch cells to the Department of Defense in the same month and expects to target delivery of samples to more than 20 potential customers for commercial evaluation in the second and third quarter of 2024.

-

In May 2024, Li-S Energy announced that its GEN3 semi-solid-state lithium-sulfur (Li-S) battery cells have successfully passed the nail penetration test requirements of the United States Military Performance specifications MIL-PRF-32383/4X and civilian UL2580 and UL2271 standards. In the nail penetration tests, the battery cell is penetrated with a steel nail in a blast-proof chamber and under precise conditions. The successful results of these tests can help the company promote its products for use in drones and electric aircraft.

Lithium-Sulfur Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.31 million

Revenue forecast in 2030

USD 165.40 million

Growth rate

CAGR of 25.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Battery Capacity, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

PolyPlus Battery Company; NexTech Batteries Inc.; Li-S Energy Limited; Zeta Energy LLC; GS Yuasa Corporation; LG Energy Solutions Ltd.; Saft Groupe SA; Gelion PLC; Sion Power Corporation; Johnson Matthey; Giner, Inc.; Lynntech, Inc.; Ilika Technologies; Williams Advanced Engineering; uang Dong Xiaowei New Energy Technology Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium-Sulfur Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the lithium-sulfur battery market report based on battery capacity, type, application, and region:

-

Battery Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 500 mAh

-

500-1000 mAh

-

Above 1000 mAh

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Energy Density

-

High Energy Density

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Consumer Electronics

-

Energy Storage Systems

-

Medical Devices

-

Military and Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global lithium-sulfur battery market was estimated at around USD 33.80 million in 2023 and is expected to reach around USD 42.31 million in 2024.

b. The global lithium-sulfur battery market is expected to grow at a compound annual growth rate of 25.5% from 2024 to 2030, reaching around USD 165.40 million by 2030.

b. The high energy density type segment had the highest revenue market share, over 67.0%, in 2023. High energy-density lithium-sulfur batteries utilize higher sulfur content and more advanced cathode designs to maximize energy storage capacity.

b. Key players in the market include PolyPlus Battery Company, NexTech Batteries Inc., Li-S Energy Limited, Zeta Energy LLC, GS Yuasa Corporation, LG Energy Solutions Ltd., Saft Groupe SA, Gelion PLC, Sion Power Corporation, Johnson Matthey, Giner, Inc., Lynntech, Inc., Ilika Technologies, Williams Advanced Engineering, and Dong Xiaowei New Energy Technology Co., Ltd.

b. The global lithium-sulfur battery market is primarily driven by the increasing demand for high-energy-density storage solutions in various sectors, particularly in electric vehicles (EVs) and portable electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.