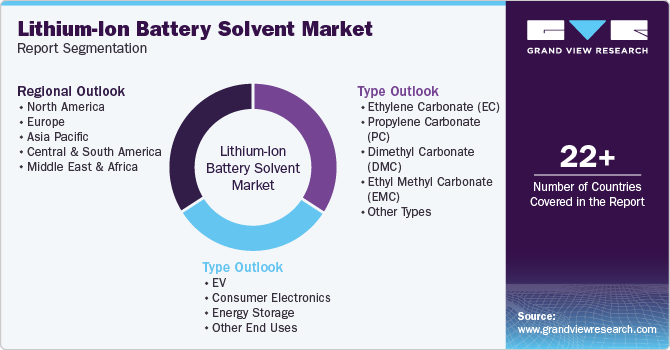

Lithium-Ion Battery Solvent Market Size, Share & Trends Analysis Report By Type (Ethylene Carbonate, Propylene Carbonate), By End Use (EV, Consumer Electronics, Energy Storage), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-386-6

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Lithium-Ion Battery Solvent Market Size

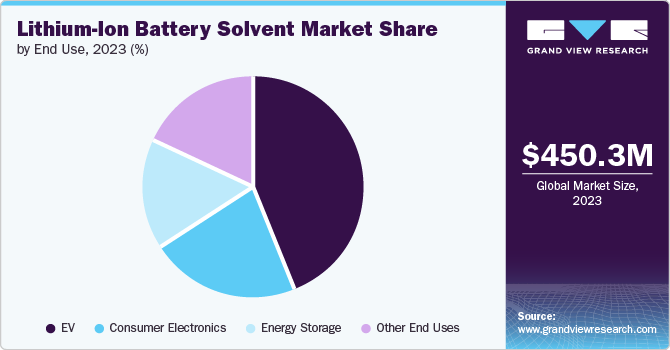

The global lithium-ion battery solvent market size was estimated at USD 450.32 million in 2023 and is projected to grow at a CAGR of 18.1% from 2024 to 2030. This growth is attributed to the rising need from electric vehicle (EV) producers and the growing interest from smartphone makers, which drive the demand for electrolyte solvents in lithium-ion batteries.

Lithium-ion battery solvents play a crucial role in the performance and safety of li-ion batteries. These solvents are typically part of electrolytes, which facilitate li-ions movement between the anode and cathode during the charging and discharging cycles. These solvents and salts work together to ensure efficient ion transport, stability, and safety in li-ion batteries, contributing to their widespread use in portable electronics, electric vehicles, and other applications.

Drivers, Opportunities & Restraints

The increasing demand for electric mobility and vehicles is primarily due to a growing awareness of environmental issues and the urgent need to reduce greenhouse gas emissions. Consumers are becoming more eco-conscious, accelerating towards more sustainable and lower-emission transportation options. In addition, advancements in battery technology have significantly lowered the cost and increased the range and efficiency of EVs, making them more accessible and appealing to a broader audience.

Using impure electrolyte solvents can lead to several significant risks and hazards. These impurities can cause chemical reactions that may degrade the performance of the electrolyte, leading to reduced efficiency and lifespan of the device it is used in. In addition, certain impurities could lead to unsafe conditions, such as generating toxic gases or increased flammability, posing severe health & safety risks.

Innovations in solvent compositions that enhance battery efficiency, safety, and longevity are promising. Moreover, environmental concerns and stringent regulations are pushing for the development of greener, more sustainable solvents, opening further avenues for growth in this sector.

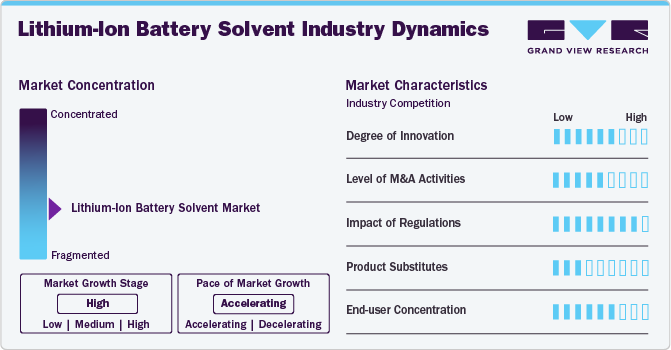

Market Concentration & Characteristics

The market is moderately fragmented, and some key companies account for its significant share. Emerging economies, such as India and China, are expected to provide growth opportunities to li-ion battery solvent manufacturers over the forecast period.

Raw materials account for a major portion of the cost of batteries. Volatility in the demand and supply of these raw materials may impact the battery market in the coming years. Manufacturers' capital investments vary according to the battery type. Lithium-ion batteries require significantly higher capital investments than other batteries.

Stringent specifications regarding the testing, storage, transportation, and labeling of this product before and after it is placed on the market may discourage new players from entering the market.

Type Insights & Trends

“Ethyl Methyl Carbonate EMC segment is expected to witness growth at 18.3% CAGR”

Dimethyl Carbonate (DMC) segment dominated the market with a market share of 33.2% in 2023. DMC has a significant role in the li-ion battery industry, particularly as a solvent in the manufacturing process. Its excellent properties, such as low toxicity, high dielectric constant, and good solvency, make it an ideal component for the electrolyte solution in li-ion batteries. DMC's effectiveness in dissolving electrolyte salts contributes to the efficient transport of li-ions between the anode and cathode, which is crucial for the battery's performance. In addition, its relatively low boiling point and stability enhance li-ion batteries' safety and energy density. As such, DMC is a valuable product in the solvent market for li-ion battery manufacturing, which helps improve the overall efficiency and quality of the batteries.

Ethyl Methyl Carbonate (EMC) is a significant component in the electrolyte solution for li-ion batteries. It is renowned for its high dielectric constant and good solvation capabilities, which enhance ionic conductivity and battery performance. As a part of a mixed solvent system, often combined with other carbonates, EMC helps optimize the electrolyte's viscosity and volatility to suit specific battery applications. Its stability and low toxicity make it a preferred choice in the li-ion battery solvent market, directly impacting the efficiency and safety of battery operation.

End Use Insights & Trends

“Energy Storage segment is expected to witness growth at 18.1% CAGR”

The EVs segment dominated the market with a share of 43.6% in 2023. EV represents a significant application within the market, primarily due to the core role of li-ion batteries in EV technology. As the demand for EVs continues to surge globally, driven by a collective push towards sustainable and eco-friendly transportation options, the need for high-performance li-ion batteries, and thus solvents, is rising. Solvents in these batteries are critical for the dissolution and conductivity of the electrolyte, which is essential for the battery's energy transmission capabilities. The evolution and expansion of the EV market directly influence the development, innovation, and scalability of li-ion battery solvents, underscoring their importance in achieving longer battery life, faster charging times, and overall improvements in battery efficiency and performance.

The consumer electronics segment accounts for a significant market share due to the widespread use of portable devices, such as smartphones, laptops, and tablets. These devices rely heavily on lithium-ion batteries for energy storage because of their high energy density, low weight, and long lifespan. The solvent in these batteries plays a crucial role in conducting li-ions between the cathode and anode, directly affecting the battery's performance, efficiency, and safety. As consumer electronics evolve and demand more power, developing and optimizing li-ion battery solvents becomes increasingly important to meet these energy requirements while ensuring device safety and durability.

Regional Insights

The North American market for li-ion battery solvent is expected to witness reasonable growth over the forecast period owing to increasing EVs and consumer electronics sales in countries including the U.S. and Mexico.

U.S. Lithium-Ion Battery Solvent Market Trends

Demand for li-ion battery solvents is anticipated to increase in the U.S. in the coming years due to rising sales of EVs in the country because of favorable federal legislation and the presence of market players in the country.

Asia Pacific Lithium-Ion Battery Solvent Market Trends

“China to witness market growth of CAGR 18.7%”

The Asia Pacific li-ion battery solvent market held the largest revenue share and is expected to remain dominant over the forecast period. This is due to significant demand for li-ion batteries, primarily from India, China, and Japan, primarily for applications in the automotive and electronics industries.

The Chinese market has been experiencing steady growth in recent years due to the adoption of EVs. According to the China Association of Automobile Manufacturers (AMMA), the country was the largest market for EVs in 2020 and is expected to remain the largest electric car market in the world in the coming years as well.

Europe Lithium-Ion Battery Solvent Market Trends

The European li-ion battery solvent market is expected to witness steady growth over the forecast period owing to the increasing use of li-ion batteries in various sectors including medical, aerospace & defense, automotive, energy storage, and data communication & telecom.

Germany's li-ion battery solvent market is expected to witness reasonable growth over the forecast period owing to the increasing use of li-ion batteries in energy storage systems, EVs, and consumer electronics.

Central & South America Lithium-Ion Battery Solvent Market Trends

Lithium-ion batteries are generally utilized battery types for Electrical Energy Storage due to applications including battery systems, stand-alone systems with PV, and emergency power supply systems for mitigation of output fluctuations from solar and wind power. This rising demand for li-ion batteries has resulted in increased demand for li-ion battery solvents.

The government of Brazil is taking different initiatives to boost the EV market by exempting import tax on EVs and annual car ownership tax. This is expected to fuel the demand for li-ion battery solvent over the coming years.

Middle East & Africa Lithium-Ion Battery Solvent Market Trends

MEA is expected to witness growth over the forecast period owing to the increasing demand for portable consumer electronics in countries including Saudi Arabia, South Africa, and Egypt. The growing middle-class population and rising disposable income levels are expected to fuel market growth. The growth in the consumer electronics market is also expected to drive the product demand.

South Africa Lithium-Ion Battery Solvent Market Trends

Automobile manufacturers are showing interest in setting up manufacturing plants in the country which are likely to fuel the demand for li-ion batteries over the upcoming years. R&D activities and adaptation engineering by multinational enterprises in the country have led to the design and development of new products using global platforms. These factors are anticipated to drive the product demand.

Key Lithium-Ion Battery Solvent Company Insights

Some of the key players operating in the market include UBE Corporation, OUCC, Dongwha Electrolyte, and Mitsubishi Chemical Corp., among others.

-

BASF SE is a chemical manufacturer that produces chemicals such as lithium-ion battery solvents. The company has a presence in Europe, North America, Asia Pacific, South America, Africa, and the Middle East. BASF SE comprises eleven operating divisions grouped into six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions. Polymers are produced under the chemical business segment of the company

-

Dow manufactures agrochemicals, rubber, specialty chemicals, and plastic materials. The company serves several industries, including agriculture, infrastructure, packaging, and consumer care, globally. Dow offers products, such as lithium-ion battery solvents, plastics, performance materials, coatings, silicones, and industrial intermediates. Dow operates in 31 countries with 104 manufacturing sites across Latin America, Asia Pacific, North America, Europe, the Middle East, and Africa

UBE Corporation, and Lotte Chemical Corporation, among others, are some of the emerging market participants in the li-ion battery solvent market.

-

UBE Corporation is a Japanese chemical company manufacturing chemicals, plastics, battery materials, pharmaceuticals, cement, construction materials, and machinery

-

Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd. was founded in 2002. It is one of the largest lithium battery electrolyte suppliers in the world and a domestic main silane coupling agent manufacturer. It has a capacity of 30,000 tons/year of lithium-ion battery

Key Lithium-ion Battery Solvent Companies:

The following are the leading companies in the lithium-ion battery solvent market. These companies collectively hold the largest market share and dictate industry trends.

- UBE Corporation

- OUCC

- Dongwha Electrolyte

- Shenzhen Capchem Technology Co., Ltd. (“Capchem”)

- BASF SE

- Mitsubishi Chemical Corporation

- Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd.

- Huntsman International LLC

- Shandong Lixing Advanced Material Co., Ltd.

- Lotte Chemical

Recent Developments

-

In March 2024, Dow announced plans to invest in ethylene derivatives capacity on the U.S. Gulf Coast, including producing carbonate solvents. These solvents are critical components in the supply chain of Li-ion batteries. This investment is intended to support the growth of the domestic EV and energy storage market. It also builds on Dow's successful track record of growth projects, such as the recent global alkoxylation capacity expansions expected to come online in the U.S. Gulf Coast and Europe in the next two years

-

In February 2022, Lotte Chemical announced a USD 502 million investment in its eco-friendly and specialty material business. The investment will be used to build a new plant producing high-purity organic solvents, including ethylene carbonate and dimethyl carbonate. These solvents are utilized in the production of li-ion battery electrolytes

Lithium-Ion Battery Solvent Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 489.34 million |

|

Revenue forecast in 2030 |

USD 1,326.64 million |

|

Growth rate |

CAGR of 18.1% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

UBE Corp.; OUCC; Dongwha Electrolyte; Shenzhen Capchem Technology Co., Ltd. (“Capchem”); BASF SE; Mitsubishi Chemical Corp.; Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd.; Huntsman International LLC; Shandong Lixing Advanced Material Co., Ltd.; Lotte Chemical |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lithium-Ion Battery Solvent Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the lithium-ion battery solvent market report based on type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene Carbonate (EC)

-

Propylene Carbonate (PC)

-

Dimethyl Carbonate (DMC)

-

Ethyl Methyl Carbonate (EMC)

-

Other Types

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

EV

-

Consumer Electronics

-

Energy Storage

-

Other End Uses

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lithium-ion battery solvent market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 1,326.64 million by 2030.

b. The global lithium-ion battery solvent market size was estimated at USD 450.32 million market size was estimated at USD 489.34 million in 2030.

b. Asia Pacific dominated the Asia Pacific market with a share of 47.67% in 2023. This is due to significant demand for li-ion batteries, primarily from India, China, and Japan, primarily for applications in the automotive and electronics industries.

b. Some key players operating in the lithium ion battery solvents market include BASF SE, HOPAX, Mitsubishi Chemical Corporation, Samsung SDI, Mexichem Fluor S.A. de C.V. (Koura), Daikin Industries, Ltd., Dongwha Group, Huntsman International LLC, Lotte Chemical, and Dow.

b. Key factors that are driving the market growth include rising need from electric vehicle producers and the growing interest from smartphone makers is expected to propel the demand for electrolyte solvents in lithium-ion batteries

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."