Lithium-ion Battery Recycling Market Size, Share & Trends Analysis Report By Application (Transportation, Consumer Electronics), By Region (North America, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-315-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Lithium-ion Battery Recycling Market Trends

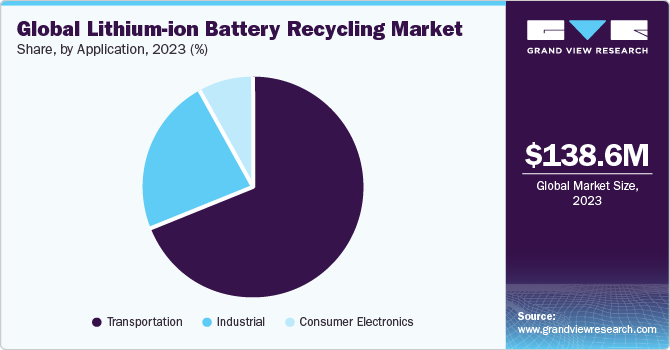

The global lithium-ion battery recycling market size was estimated at USD 138.62 million in 2023 and is projected to grow at a CAGR of 44.8% from 2024 to 2030. The market for recycled lithium-ion batteries is expanding rapidly due to the popularity of electric cars and consumer gadgets. According to the International Energy Agency (IEA), electric car sales surpassed 2.3 million, up 25% from the previous year. Projections suggested 14 million electric cars would be sold by the end of 2023, with a 35% annual increase driven by heightened purchases in the latter half of 2023.

The lithium-ion battery recycling sector has emerged as a crucial element in facilitating the transition towards a sustainability-driven paradigm that actively promotes renewable energy sources. The demand for lithium-ion batteries has increased due to the quick spread of consumer electronics, renewable energy storage solutions, and electric vehicles (EVs), which cause a rise in battery waste. According to the Commonwealth Scientific and Industrial Research Organization (CSIRO), Australia’s lithium-ion battery waste is growing by 20% per year, and only 10% of the country’s battery waste was recycled in 2021. The market offers a great deal of opportunity for players to profit from environmentally friendly battery solutions in the face of the global environmental movement.

The market for recycling lithium-ion batteries is expanding due to several factors, such as rising battery waste production, government recycling incentives, and rising consumer environmental concerns. For instance, in February 2022, Glencore and Britishvolt formed a joint venture to establish an ecosystem for battery recycling in the UK. However, shifting to a circular economy offers industry participants several chances to get creative and take advantage of the rising demand for environmentally friendly battery solutions. An intense competition among the players encourages creativity and teamwork. As the shift towards a circular economy progresses, there are plenty of opportunities, such as expensive capital expenditure and regulatory concerns.

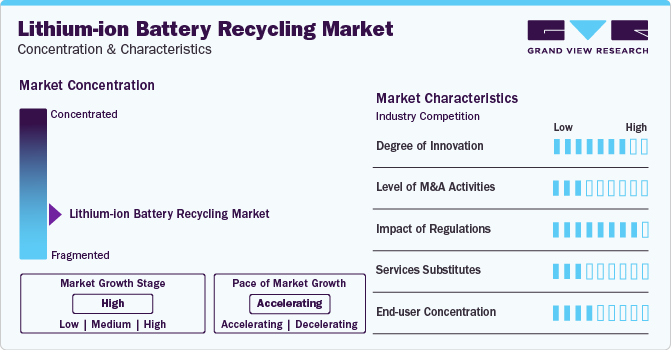

Market Concentration & Characteristics

The industry growth stage is high and the pace of industry growth is accelerating. The growing demand for electronic devices and electric vehicles drives growth in the global lithium-ion battery recycling industry. For instance, electric car sales increased by 80% in 2022 as vehicle battery demand grew in China. Regional differences exist in industry concentration, with certain corporations controlling niche industries.

The lithium-ion battery recycling market globally exhibits a high degree of innovation. Growing investment and research are being done to create more eco-friendly and effective recycling processes due to the growing demand for sustainable practices and stringent environmental restrictions. For instance, Umicore has created a patented method for recycling batteries that is more efficient, scalable, sustainable, and effective than existing methods and procedures. Umicore is going for a remarkable expansion in European recycling batteries to meet the demand for increasing production capacity.

The lithium-ion battery recycling industry has a smaller number of mergers & acquisitions compared to the other sectors at the global level. For instance, in 2021, Retriev Technologies, a battery recycling company, acquired battery solutions to develop North America's most prominent extensive battery management solution.

Regulations have a significant impact on the global industry for lithium-ion battery recycling. Governments and regulatory agencies are progressively enforcing stronger laws to address environmental concerns and encourage the recycling of lithium-ion batteries. For instance, in June 2023, the Biden-Harris administration announced USD 192 million to advance the battery recycling technology market.

The global lithium-ion battery recycling industry offers few alternatives to the services provided. While there are other ways to handle and get rid of lithium-ion batteries, such as burning or landfilling, recycling is more sustainable and environmentally beneficial.

The concentration of end users in the recycling battery market is low. This is due to the wide range of businesses and sectors that need lithium-ion battery recycling services, such as consumer electronics, automotive, energy storage, and aerospace. For instance, in July 2021, lithium-ion battery maker Lohum Cleantech, which also offers recycling solutions, announced ambitions to double output and recycling capacity.

Application Insights

Transportation dominated the market and accounted for a revenue share of 68.8% in 2023. Several vital advantages make lithium-ion batteries one of the most preferred transport uses, such as discharge tolerance, improved energy density, cycle life, and recharge times with a low memory effect. Recycled batteries can be used for stationary energy storage systems in the automotive industry, offering a long-term solution for grid stabilization and integrating renewable energy sources. Comparably, the electronic sector can reuse the used batteries to create new items such as wearables, computers, and smartphones, which lessens the need for virgin resources.

The transportation segment is anticipated to grow at the fastest CAGR over the forecast period. Various factors drive the growth in the transportation segment, such as increasing awareness of the sustainable environment, demand for electric vehicles, and many others. The industrial segment is also anticipated to witness a substantial upsurge in manufacturing and recycling batteries owing to the increased demand for electronic gadgets, renewable energy storage, aerospace, and medical devices. Industries value lithium-ion batteries for their high energy density, long lifespan, and rechargeable nature.

Regional Insights

The North American market is expected to grow at a significant CAGR over the forecast period. The demand for cleaner power sources drives the market growth in the region.

U.S. Lithium-ion Battery Recycling Market Trends

The U.S. is the leading market due to increased industry investments in recycling plants and the development of new recycling infrastructure. For instance, in July 2023, Stellantis and Samsung SDI announced their collaborative efforts to build a second Star Plus Energy Gigafactory in the U.S., with plans for the battery plant to commence production in early 2027.

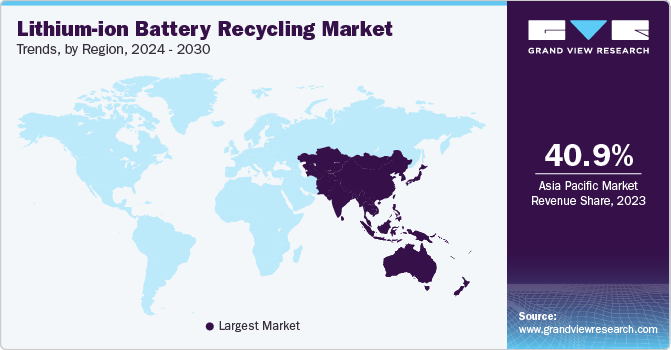

Asia Pacific Lithium-ion Battery Recycling Market Trends

The Asia Pacific dominated the global market in 2023. The factors driving the market growth include low-cost batteries, rapid adoption of EVs due to increased awareness of sustainable mobility, and increased sales of consumer electronics. The increasing population in regions such as China and India also drives the Asia Pacific market.

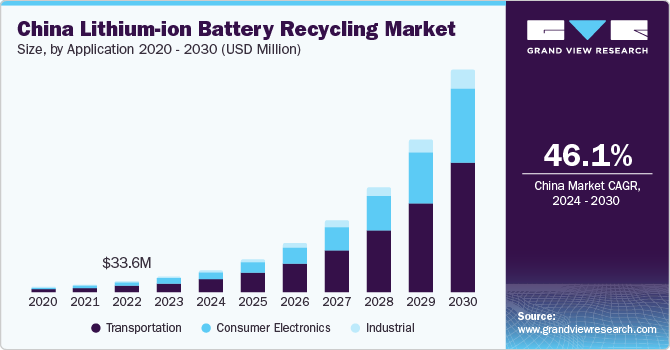

The China lithium-ion battery recycling market is witnessing significant demand growth. Growing environmental concerns, innovations in technology, and government assistance are significant trends in China. Focus has also been placed on creating novel procedures to recover valuable materials from wasted batteries and increasing recycling efficiency.

Europe Lithium-ion Battery Recycling Market Trends

The European market is identified as a lucrative region for the lithium-ion battery recycling industry. The European Union (EU) is determined to reduce greenhouse gas emissions and boost renewable energy sources.

The lithium-ion battery recycling market in Germany is the leading market in Europe due to various governments offering subsidies for rechargeable batteries, increasing the demand for EVs. For instance, in September 2022, Fortum, a prominent European energy firm renowned for its battery recycling technology advancements, established the Fortum Batterie recycling plant in Germany to offer secure and sustainable EV battery recycling services across central Europe.

Key Lithium-ion Battery Recycling Company Insights

Some of the key companies operating in the market include Contemporary Amperex Technology Co., Limited, LG Energy Solution, Panasonic Corporation, and SAMSUNG SDI CO., LTD.

-

Contemporary Amperex Technology Co., Limited is known for its ceaseless innovation in battery technology. They are the explorers in cobalt-free Lithium Ferro Phosphate (LFP) batteries, which offer enhanced safety and environmental benefits.

-

LG Energy Solution designs and manufactures lithium-ion batteries for EVs, IT, energy storage systems, and mobility. It is contributing to a sustainable future of clean energy.

Key Lithium-ion Battery Recycling Companies:

The following are the leading companies in the lithium-ion battery recycling market. These companies collectively hold the largest market share and dictate industry trends.

- Contemporary Amperex Technology Co., Limited

- LG Energy Solution

- Panasonic Corporation

- SAMSUNG SDI CO., LTD.

- BYD

- SVOLT Energy

- Tesla

- Shenzhen Manly Battery Co.

- TOSHIBA CORPORATION

- SK on Co., Ltd

- CALB

- Gotion, Inc.

- Sunwoda Electronic Co., Ltd

- Li-Cycle Corp.

- Helbiz

Recent Developments

- In October 2023, Toyota Kirloskar Motor made an investment of nearly USD 8 billion in a North Carolina battery plant to strengthen the company’s commitment to sustainability and being the key player in EV supply chain.

- In February 2023, GEM Co., Contemporary Amperex Technology Co., Limited, and Mercedes Benz signed a Memorandum of Understanding (MoU) for the recycling project, including lithium metals, cobalt, nickel, and manganese taken from Mercedes Benz used batteries.

- In July 2021, Li-Cycle Corp.and Helbiz partnered to advance battery recycling in micro-mobility is a significant step towards sustainability in the transportation sector. Li-Cycle Corp.specializes in lithium-ion battery recycling, which is crucial for reducing environmental impact and conserving resources.

Lithium-ion Battery Recycling Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 198.37 million |

|

Revenue forecast in 2030 |

USD 1.83 billion |

|

Growth Rate |

CAGR of 44.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; CSA; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Poland; Netherlands; China; Japan; South Korea; Taiwan; India; Indonesia; Malaysia; Thailand; Vietnam; Australia; Brazil; Argentina; Chile; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Contemporary Amperex Technology Co. Limited; LG Energy Solution; Panasonic Corporation; SAMSUNG SDI CO., LTD; BYD; SVOLT Energy; Tesla; Shenzhen MANLY Battery Co.; TOSHIBA CORPORATION; SK on Co., Ltd; CALB; Gotion; Inc.; Sunwoda Electronic Co., Li-Cycle Corp.; Helbiz |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lithium-ion Battery Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium-ion battery recycling market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Consumer Electronics

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Taiwan

-

Indonesia

-

Malaysia

-

Thailand

-

Vietnam

-

-

Central South America (CSA)

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lithium-ion battery recycling market size was valued at USD 138.62 million in 2023 and is expected to reach USD 198.37 million in 2024.

b. The global lithium-ion battery recycling market is projected to grow at a compound annual growth rate (CAGR) of 44.8% from 2024 to 2030 to reach USD 1.83 billion by 2030.

b. Transportation dominated the market and accounted for a revenue share of 68.84% in 2023. Several vital advantages make lithium-ion batteries one of the most preferred transport uses, such as discharge tolerance, improved energy density, cycle life, and recharge times with a low memory effect.

b. Some of the key companies operating in the lithium-ion battery recycling market include Contemporary Amperex Technology Co., Limited, LG Energy Solution, Panasonic Corporation, and SAMSUNG SDI CO., LTD.

b. The market for recycled lithium-ion batteries is expanding rapidly due to the popularity of electric cars and consumer gadgets. According to the International Energy Agency (IEA), electric car sales surpassed 2.3 million, up 25% from the previous year, 2022.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."