Lithium-ion Battery Binders Market Size, Share & Trends Analysis Report By Type (Cathode, Anode), By Application (Automotive, Energy Storage), By Material, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-414-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Lithium-ion Battery Binders Market Trends

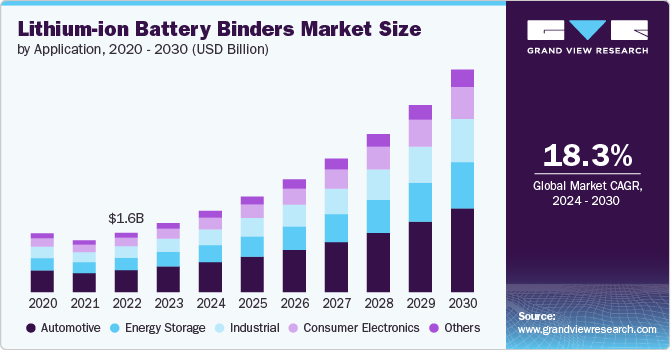

“2030 lithium-ion battery binders market value to reach USD 6.06 billion.”

The global lithium-ion battery binders market size was estimated at USD 1.88 billion in 2023 and is estimated to grow at a CAGR of 18.3% from 2024 to 2030. This surge is primarily driven by the increasing demand for electric vehicles (EVs), which has led to a heightened need for high-performance lithium-ion batteries.

Additionally, investments in renewable energy storage systems and consumer electronics are contributing to market expansion, driving the development of advanced binder materials aimed at enhancing battery performance and longevity. The adoption of binders that improve energy density and battery life is becoming increasingly critical, particularly in automotive and industrial applications where reliability and efficiency are essential.

Drivers, Opportunities & Restraints

The primary driver for the lithium-ion battery binders market is the escalating demand for electric vehicles (EVs), which requires high-performance batteries with enhanced energy density and longevity. The automotive industry's transition towards electrification is pushing manufacturers to develop advanced binders like polyvinylidene fluoride (PVDF) that improve battery efficiency and reliability. Additionally, the growing emphasis on renewable energy and energy storage systems is further fueling the need for high-quality binders that can support the expanding market for sustainable energy solutions.

One of the key restraints in the lithium-ion battery binders market is the performance limitations of traditional binder materials in extreme environmental conditions. For example, some ceramic binders face challenges in maintaining stability and reliability in polluted or harsh environments, which can hinder their adoption in critical applications. Moreover, the stringent regulatory landscape surrounding battery production and environmental impact is pushing the industry towards more innovative and durable solutions, creating pressure on manufacturers to continuously enhance the performance and sustainability of their binder offerings.

Significant opportunities lie in the innovation and development of eco-friendly binder materials that can cater to the rising demand for sustainable energy solutions. Companies are investing heavily in research and development to create binders that offer superior performance while being cost-effective and environmentally friendly. For instance, the increasing focus on using carboxymethyl cellulose (CMC) and styrene butadiene copolymer (SBR) in battery production presents an opportunity for market players to capture a larger share of the growing electric vehicle and energy storage markets, particularly in regions such as Asia-Pacific, where demand is surging.

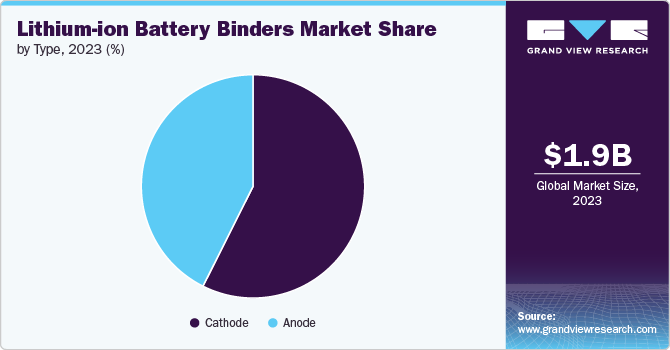

Type Insights

“Anode segment is anticipated to grow at fastest CAGR over the forecast period ranging from 2024 - 2030.”

The growing emphasis on electric mobility and renewable energy has significantly increased demand for anode binders like CMC and SBR, known for their cost-effectiveness and environmental benefits. BASF's recent investment in anode binder production highlights the industry's commitment to supporting the EV sector's growth.

Cathode binders, particularly those made from polyvinylidene fluoride (PVDF), are also gaining traction due to their superior chemical resistance and binding properties, making them indispensable in high-energy applications. The development of advanced PVDF binders by companies like Arkema is a testament to the ongoing innovations aimed at enhancing the efficiency and safety of lithium-ion batteries.

Material Insights

“Polyvinylidene fluoride held the largest revenue share of lithium-ion battery binders market in 2023.”

Material-wise, polyvinylidene fluoride (PVDF) continues to dominate due to its widespread application in both anode and cathode binders, particularly in high-performance settings like automotive and industrial sectors. Innovations such as Arkema’s development of cutting-edge PVDF binders are driving market growth by improving the efficiency and safety of lithium-ion batteries.

The styrene butadiene copolymer (SBR) segment is the fastest-growing material segment in the market, driven by their eco-friendly properties and cost-effectiveness. CMC, often used in combination with SBR, is gaining traction, particularly in the automotive and consumer electronics sectors, where the demand for sustainable and affordable battery solutions is rising.

Application Insights

“Automotive segment held the largest revenue share of lithium-ion battery binders market in 2023.”

The automotive sector holds the largest market share in the application segment, driven by advanced dry battery electrodes highlights the continuous innovation in this segment.

Moreover, the consumer electronics and energy storage sectors are also growing rapidly, fueled by the demand for longer-lasting batteries in devices like smartphones, laptops, and renewable energy systems. This diversification across multiple applications is expected to maintain the market's growth trajectory.

Regional Insights

“U.S. dominated the revenue share of the North America lithium-ion battery binders market.”

North America lithium-ion battery binders market is experiencing significant growth, driven by increasing investments in electric vehicle infrastructure and energy storage systems. Companies in the region are focusing on enhancing battery performance and longevity, with a strong emphasis on sustainability.

U.S. Lithium-ion Battery Binders Market Trends

The U.S. is witnessing substantial government and private sector investments in research and development, aimed at creating more efficient and environmentally friendly battery technologies. This trend is supported by initiatives like the U.S. Department of Energy’s funding for advanced battery materials, which is helping to drive innovation in binder technologies. The country’s growing emphasis on electric mobility, coupled with stringent environmental regulations, is pushing manufacturers to develop high-performance binders that can meet the demands of next-generation batteries.

Asia Pacific Lithium-ion Battery Binders Market Trends

Asia Pacific dominates the global lithium-ion battery binders market, with China and Japan leading the charge in production and technological innovation. China’s rapid expansion of its electric vehicle industry, supported by government incentives and a strong focus on renewable energy, has significantly boosted the demand for advanced battery binders. Japan leads in advanced battery technology, focusing on enhancing binder materials in the automotive industry. Companies in the region are significantly investing in research to stay ahead globally.

Europe Lithium-ion Battery Binders Market Trends

The European Union’s stringent environmental regulations and ambitious goals for reducing carbon emissions are propelling investments in advanced battery technologies, including high-performance binders. Germany and France are investing in R&D to create binders that not only improve battery performance but also align with the region’s sustainability objectives. This focus on green technology is positioning Europe as a leader in the global shift towards cleaner energy solutions.

Key Lithium-ion Battery Binders Company Insights

Some of the key players operating in the market include Arkema and BASF SE.

-

BASF SE, based in Germany, is a global leader in the production of advanced materials, including lithium-ion battery binders. The company is known for its innovative approach to binder technology, focusing on developing high-performance products that meet the rigorous demands of the automotive and energy storage sectors. Through substantial investments in R&D and strategic collaborations, BASF aims to enhance the efficiency and sustainability of lithium-ion batteries.

-

Arkema S.A., headquartered in France, is a prominent player in the lithium-ion battery binders market, specializing in the production of cutting-edge polymer binders like PVDF. Arkema’s extensive expertise in specialty chemicals and materials allows it to offer innovative solutions that enhance battery performance, safety, and longevity.

Key Lithium-ion Battery Binders Companies:

The following are the leading companies in the lithium-ion battery binders market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- Ashland

- BASF SE

- DAIKIN INDUSTRIES, Ltd.

- DuPont

- ENEOS Corporation

- KUREHA CORPORATION

- LG Chem

- Resonac Holdings Corporation

- Solvay

- SUMITOMO SEIKA CHEMICALS CO., LTD

- Synthomer PLC

- TORAY INDUSTRIES, INC

- Trinseo

- ZEON CORPORATION

Recent Developments

-

In May 2024, Arkema partnered with ProLogium, a leading South Korean manufacturer, to develop high-performance specialty materials for lithium-ion batteries. This collaboration focuses on enhancing the safety, efficiency, and lifespan of batteries, particularly for electric vehicles and energy storage systems, further strengthening Arkema's position in the growing battery materials market.

-

In April 2024, AM Batteries and Tokyo-based Zeon Corporation announced a partnership to develop a new dry battery electrode using innovative binders. This collaboration aims to enhance battery performance and sustainability by creating electrodes with improved energy density and reduced environmental impact. The novel binders are expected to advance the development of high-performance batteries, contributing to more efficient energy storage solutions and supporting the growth of the electric vehicle and renewable energy markets.

-

In May 2023, BASF SE announced a significant investment in new production assets for anode binders used in lithium-ion batteries. This investment is aimed at enhancing its capacity to produce high-performance binders that improve battery efficiency and longevity.

Lithium-ion Battery Binders Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.21 billion |

|

Revenue forecast in 2030 |

USD 6.06 billion |

|

Growth rate |

CAGR of 18.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, material, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Arkema; Trinseo; LG Chem; DAIKIN INDUSTRIES, Ltd.; Synthomer PLC; BASF SE; Resonac Holdings Corporation; SUMITOMO SEIKA CHEMICALS CO. LTD; DuPont; Solvay; ENEOS Corporation; ZEON CORPORATION; ENEOS Corporation; Ashland; KUREHA CORPORATION; TORAY INDUSTRIES, INC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lithium-ion Battery Binders Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium-ion battery binders market report based on type, material, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cathode

-

Anode

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polyvinylidene Fluoride

-

Carboxymethyl Cellulose

-

Polymethyl Methacrylate

-

Styrene Butadiene Copolymer

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy Storage

-

Automotive

-

Consumer Electronics

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lithium-ion battery binders market size was estimated at USD 1.88 billion in 2023 and is expected to reach USD 2.21 billion in 2024.

b. The global lithium-ion battery binders market is expected to grow at a compound annual growth rate of 18.3% from 2024 to 2030 to reach USD 6.06 billion by 2030.

b. By type, cathode dominated the market with a revenue share of over 55.0% in 2023.

b. Some of the key vendors in the global lithium-ion battery binders market are Arkema, Trinseo, LG Chem, DAIKIN INDUSTRIES, Ltd., Synthomer PLC, BASF SE, Resonac Holdings Corporation, SUMITOMO SEIKA CHEMICALS CO.,LTD, DuPont, Solvay, ZEON CORPORATION, ENEOS Corporation, among others.

b. The key factor driving the growth of the global lithium-ion battery binders market is attributed to the significant growth driven by the increasing demand for electric vehicles (EVs), which has led to a heightened need for high-performance lithium-ion batteries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."