Lithium Cobalt Oxide Market Size, Share & Trends Analysis Report By Application (Electric Vehicles, Energy Storage), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-271-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Lithium Cobalt Oxide Market Size & Trends

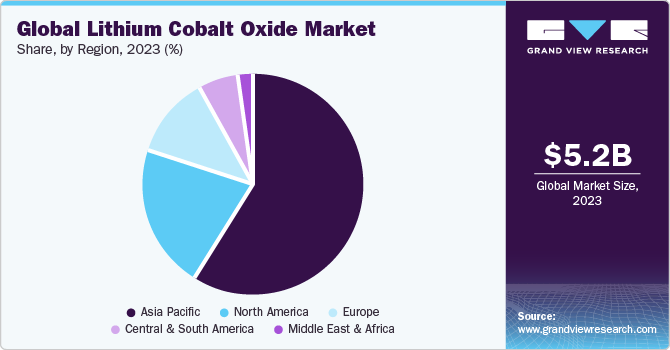

The global lithium cobalt oxide market size was estimated at USD 5.17 billion in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2030. The demand for lithium cobalt oxide (LCO) is primarily driven by the growing demand for lithium-ion batteries, particularly in the electric vehicle (EV) and consumer electronics sectors. In recent years, the adoption of EVs and the need for batteries with higher energy densities have further increased the demand for cobalt and lithium.

The lithium cobalt oxide market is driven by several factors, including technological advancements and regulatory support. The growing demand for lithium cobalt oxide products and services is fueled by factors such as population growth, urbanization, and changing consumer preferences. This demand is particularly evident in the portable electronics industry, where lithium cobalt oxide batteries are widely used due to their high energy density and long cycle life.

Technological advancements play a crucial role in the development of the market. Ongoing research and development efforts aim to enhance battery performance, increase energy density, and improve safety. For instance, the replacement of pure lithium cobalt oxide cathode material with mixed lithium cobalt/nickel oxide has improved the stability and performance of lithium cobalt oxide batteries. Additionally, the development of thin-film lithium cobalt oxide electrodes is important for the advancement of high-performance thin-film lithium batteries.

Market Concentration & Characteristics

The market is characterized as consolidated, with a few major players dominating the industry. The market is dominated by established companies that have a significant market share and strong manufacturing capabilities. These companies have extensive distribution networks and established relationships with customers in industries such as electric vehicles and consumer electronics.

The regulatory environment plays a role in shaping the market dynamics. Government policies and regulations related to the promotion of electric vehicles, renewable energy, and energy storage systems impact the demand for LCO. Furthermore, incentives and subsidies for electric vehicles drive the demand for LCO as a key component in lithium-ion batteries.

Technological innovation and advancements in battery technology influence the competitive landscape of the LCO market. Companies that invest in research and development to improve the performance and efficiency of LCO-based batteries are expected to gain a competitive edge.The supply chain dynamics in the LCO market also contribute to its consolidated nature. Major players in the market have established supply chain networks, including access to raw materials and production facilities, which can be challenging for new entrants to replicate.

The consolidated nature of the market allows major players to benefit from economies of scale. They can leverage their large-scale production capabilities to lower costs, which is expected to be a barrier for smaller players to compete. While the market is consolidated, it is important to note that factors such as government policies, technological advancements, and industry dynamics influence the competitive landscape over time. The market is forecasted to evolve at a lucrative pace as new players enter the industry and emerging technologies gain traction.

Application Insights

The electric vehicles segment dominated the market with a revenue share of 69.5% in 2023. The high share of this segment can be attributed to the market experiencing a surge in demand driven by the increasing popularity of electric vehicles. LCO is a crucial component in the lithium-ion batteries used in EVs due to its ability to provide high energy density and maintain the cathode's layered structure. The dominance of EVs as an application in the LCO market can be attributed to several factors. Firstly, the global shift towards sustainable transportation and the need to reduce carbon emissions has led to a significant increase in the demand for EVs.

The growing demand for EVs has contributed to the increasing need for energy storage solutions. EVs rely on lithium-ion batteries, which often utilize LCO as a cathode material. As the EV market expands, the demand for LCO-based batteries for electric vehicle energy storage increases.

The integration of intermittent renewable energy sources into the power grid requires energy storage systems to balance supply and demand. Energy storage technologies, including LCO-based batteries, can store excess energy during periods of high generation and release it during peak demand, thereby stabilizing the grid and ensuring a reliable power supply.

Regional Insights

Mining and production of cobalt in North America have increased dramatically in recent years, as the region capitalizes on the increased global demand and supply constraints in other cobalt-producing regions, such as Africa. This increase in domestic production is expected to further contribute to the rising demand for lithium cobalt oxide in North America.

U.S. Lithium Cobalt Oxide Market Trends

The U.S. imports many of the minerals used in EV batteries, including lithium and cobalt. While lithium imports primarily come from Argentina and Chile, cobalt supply is mainly a byproduct of copper, making investment decisions dependent on copper prices. The availability and cost of these minerals impact the demand for lithium cobalt oxide in the U.S.

The lithium Cobalt Oxide Market in Canada is poised to grow at a lucrative pace. Canada has significant lithium resources, estimated at 2.9 million tons, which account for 2.5% of the world's reserves as per the report of Natural Resources Canada. However, Canada's lithium reserves are relatively small compared to lithium powerhouses such as Argentina, Chile, and Australia. Despite this, Canada's potential in the lithium industry is supported by advancements in Direct Lithium Extraction (DLE) technology, which allows for faster and more environmentally friendly extraction of lithium from brine.

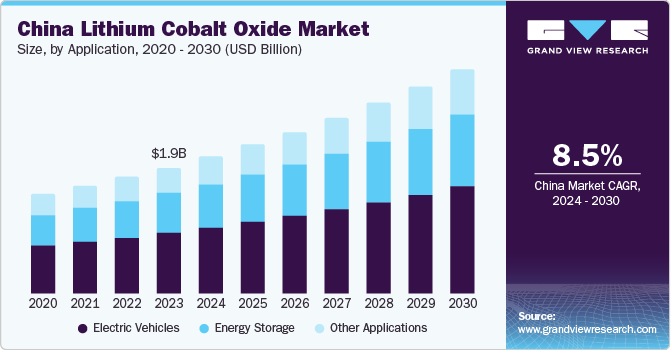

Asia Pacific Lithium Cobalt Oxide Market Trends

Asia Pacific held the largest revenue share of 59.5% in 2023. The dominance can be attributed to the rising demand for LCO in countries such as China, India, and Japan. The region is a prime manufacturer and consumer of lithium-ion batteries, with a significant demand coming from leading consumer electronics manufacturers in the region. Advancements in technology, particularly in wearable devices and consumer electronics, are fueling the growth of the market in the Asia Pacific region.

The India lithium cobalt oxide market is witnessing rapid growth consumer electronics market, which thereby boosts the demand for LCO. With a large population and increasing disposable income, the demand for smartphones, smartwatches, and other electronic devices is on the rise. LCO's high energy density makes it a preferred choice for batteries in these devices. As the consumer electronics market continues to expand, the demand for LCO, as a key component, in lithium-ion batteries is also projected to grow.

The lithium cobalt oxide market in Japan is experiencing a significant surge in the demand for LCO. The Government's strong emphasis on promoting EVs as a means to reduce greenhouse gas emissions has led to a rapid increase in EV sales. The government has also implemented subsidies and incentives to encourage EV adoption, further boosting the demand for LCO.

Europe Lithium Cobalt Oxide Market Trends

The demand for lithium cobalt oxide in Europe is witnessing substantial growth. One major driver is the increasing demand for EVs in the region. As the adoption of EVs continues to grow, the demand for lithium cobalt oxide is expected to increase significantly.

The Germany lithium cobalt oxide market has witnessed a strong increase in the battery market, fueled by the demand for lithium-ion batteries for electric cars. Germany is seeking to establish a more comprehensive production chain for lithium-ion batteries domestically, indicating a commitment to supporting the growth of the market within the country.

The lithium cobalt oxide market in UK is experiencing significant growth. The UK government has implemented initiatives such as the Plug-In Van Grant scheme to promote the adoption of EVs, which in turn fuels the demand for LCO.

Central & South America Lithium Cobalt Oxide Market Trends

Central & South America, in particular, plays a significant role in the lithium market. The region is known for its lithium fields. Lithium represents a route out of reliance on fossil fuel production and is widely used in electric devices, including electric vehicles.

The Brazil lithium cobalt oxide market is witnessing increased demand for LCO. Brazil's Government has taken initiatives to support the electric vehicle market, such as exempting annual car ownership tax and import tax on electric vehicles. This is expected to fuel the demand for lithium-ion batteries in the country, in the coming years.

Middle East & Africa Lithium Cobalt Oxide Market Trends

The market in Middle East and Africa is experiencing modest growth. The increasing demand for consumer goods and the need for battery recycling due to the rising adoption of lithium-ion batteries are driving the growth of the market in the Middle East and Africa region.

The lithium cobalt oxide market in Saudi Arabia is expected to gain traction in the upcoming years. Saudi Arabian Mining Company (Maaden), the state miner of Saudi Arabia, has announced plans for huge investments in exploring for lithium and nickel in the country over the next two decades. The aim is to tap into the growing demand for these critical battery metals, which are essential for the production of lithium-ion batteries used in EVs and other applications.

Key Lithium Cobalt Oxide Company Insights

Some of the key players operating in the market include NICHIA CORPORATION, Nippon Chemical Industrial, Ningbo Shanshan, Beijing Easpring Material, Elcan Industries Inc., and Xiamen YLX Battery among others.

-

Nichia Corporation is a Japanese company specializing in the manufacturing and distribution of advanced materials, including optical semiconductor materials, fine chemicals, vacuum deposition materials, battery materials, and magnetic materials. They also produce diode lights, laser diodes, and other related products.

-

Nippon Chemical Industrial Co., Ltd. is a Japanese company that specializes in the manufacturing and sale of chemical products. They have a long-standing history of over a hundred years, during which they have provided a wide range of high-quality inorganic chemical products such as chromium compounds, silicates, phosphorus compounds, and barium.

Targray, Cosmo Advanced Materials, GS Yuasa Corporation Ltd, Hitachi, Ltd, Stanford Advanced Materials, and Huayou Cobalt, among others, are some of the emerging market participants in the market.

-

Targray is a global company that specializes in the marketing and distribution of commodities and advanced materials for sustainable industries. Established in 1987 in Montreal, Canada, Targray has grown to become a leading international supplier of renewable fuels, electronic materials, agri-commodities, and environmental products

-

Cosmo Advanced Materials & Technology Co., Ltd. is a South Korea-based company that specializes in the manufacturing and supply of various materials for different industries. The company provides secondary battery cathode active materials, including lithium cobalt oxide, which are used in electric vehicles, energy storage systems, and secondary batteries for IT devices such as smartphones, tablet PCs, and laptops.

Key Lithium Cobalt Oxide Companies:

The following are the leading companies in the lithium cobalt oxide market. These companies collectively hold the largest market share and dictate industry trends.

- Targray

- Cosmo Advanced Materials

- GS Yuasa Corporation Ltd

- Hitachi, Ltd

- Huayou Cobalt

- Elcan Industries Inc.

- Stanford Advanced Materials

- NICHIA CORPORATION

- Nippon Chemical Industrial

- Ningbo Shanshan,

- Beijing Easpring Material

- Xiamen YLX Battery

Recent Developments

-

In November 2023, Toshiba Corporation made significant advancements in lithium-ion battery technology by developing a new battery with a cobalt-free 5V-class high-potential cathode material. This innovative cathode material suppresses the production of performance-degrading gases that can occur as side reactions during battery operation.

-

In June 2023, UC Irvine’s scientists announced the development of cobalt-free lithium-ion batteries. This discovery has the potential to address ethical concerns associated with cobalt mining, such as child labor, and reduce reliance on this mineral. Led by Professor Huolin Xin, the research team has devised a method that utilizes nickel as an alternative to cobalt in lithium-ion batteries.

Lithium Cobalt Oxide Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.56 billion |

|

Revenue forecast in 2030 |

USD 9.48 billion |

|

Growth rate |

CAGR of 9.3% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

NICHIA CORPORATION; Nippon Chemical Industrial; Ningbo Shanshan; Beijing Easpring Material; Elcan Industries Inc.; Xiamen YLX Battery; Targray; Cosmo Advanced Materials; GS Yuasa Corporation Ltd; Hitachi, Ltd; Stanford Advanced Materials; Huayou Cobalt |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lithium Cobalt Oxide Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium cobalt oxide market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electric Vehicles

-

Energy Storage

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lithium cobalt oxide market size was valued at USD 5.17 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030.

b. The global lithium cobalt oxide market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 9.48 billion by 2030.

b. Asia Pacific dominated the lithium cobalt oxide market with a share of 59.5% in 2023. This is attributable to the countries like China, Japan and India, is experiencing a rising demand for lithium cobalt oxide (LCO) due to several key factors.

b. Some of the key players operating in the market include NICHIA CORPORATION, Nippon Chemical Industrial, Ningbo Shanshan, Beijing Easpring Material, Elcan Industries Inc., Xiamen YLX Battery and among others.

b. The demand for lithium cobalt oxide (LCO) is primarily driven by the growing demand for lithium-ion batteries, particularly in the electric vehicle (EV) and consumer electronics sectors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."