- Home

- »

- Communications Infrastructure

- »

-

Lit Fiber Market Size & Share Growth Report, 2022 - 2030GVR Report cover

![Lit Fiber Market Size, Share & Trends Report]()

Lit Fiber Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Single-mode, Multi-mode), By Connectivity (On-net, Off-net), By Application (Networking, Industrial, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-946-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lit Fiber Market Summary

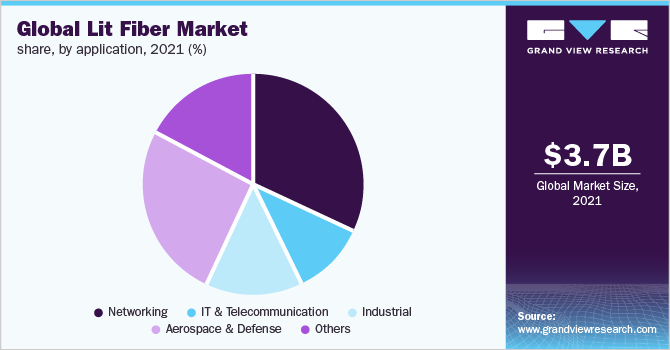

The global lit fiber market size was valued at USD 3.67 billion in 2021 and is projected to reach USD 14.24 billion by 2030, growing at a CAGR of 16.7% from 2022 to 2030. The rising demand for high bandwidth communication is propelling the growth of the market.

Key Market Trends & Insights

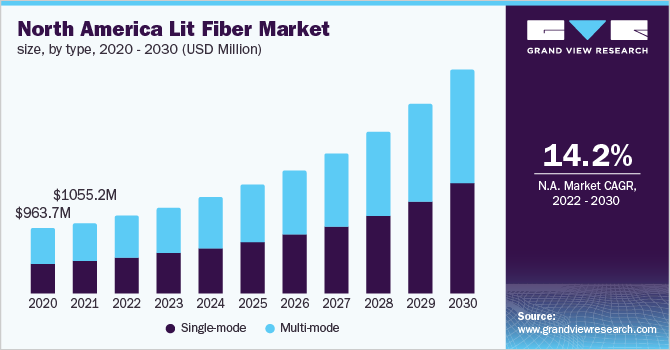

- North America held the largest revenue share of around 28% in 2021.

- Asia Pacific is likely to emerge as the second most promising region during the forecast period.

- By type, the multi-mode segment held the largest revenue share in 2021 and is expected to register a CAGR of around 16.3% from 2022 to 2030.

- By connectivity, the off-net segment is estimated to witness notable growth over the forecast period.

- By application, the networking segment held the largest revenue share of 31.7% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 3.67 Billion

- 2030 Projected Market Size: USD 14.24 Billion

- CAGR (2022-2030): 16.7%

- North America: Largest market in 2021

Lit fiber networks easily transmit data, including audio, video, and pictures, across a few meters to several kilometers. It is an active cable primarily deployed across the globe and is entirely established, managed, and maintained by service providers. Lit fiber allows enterprises to scale their business, allowing network engineers to maintain and troubleshoot the network, making it more reliable. The IT and Telecommunication sectors have witnessed some significant applications of lit fiber. Technological advancements in the telecom sector have also been attributed to the rise in the deployment of broadband network architecture.

Lit fiber can be configured as point-to-multipoint, with dedicated internet access and managed wave connections. Companies, including Amazon and Microsoft, offer their customers high-speed, low-latency connections and a secure network. It has enabled colleges and universities to stream their lectures in 4K video quality and present immersive learning experiences to students across the community.

Similarly, gaming companies have also been using these cables to offer gamers ultra-low latencies and gigabit speeds. Governments across the globe have leveraged this network to develop a platform for smart-city and public-safety applications and provide its residents with high-speed access to e-government services.

Type Insights

In terms of type, the lit fiber market is classified into single-mode and multi-mode. The multi-mode segment held the largest revenue share in 2021 and is expected to register a CAGR of around 16.3% from 2022 to 2030. Multi-mode fiber is used for connections over 400 meters. It has a larger core and is comparatively inexpensive than single-mode fiber, increasing its global adoption.

Multi-mode cables can easily transmit several light rays with higher attenuation and less brightness over multiple light modes. These consume less power than single-mode, making them ideal for use in a data center. Multi-mode cables can be installed and terminated quickly, allowing network engineers to upgrade a network across premises.

On the other hand, the single-mode segment is estimated to grow with a faster CAGR of 17.2%. Single-mode fiber comprises a smaller core than multi-mode fiber and is ideal for long-haul installations. It features a 9µm optical core, thus, allowing longer transmission distance and higher bandwidth applications.

It can be observed in several electronic devices that transmit up to 10 kilometers over a standard single-mode cable. Single-mode fiber has a smaller core when compared to multi-mode fiber, allowing the light to pass in one ray with minimum light reflection. Hence, these cables are ideal for long-distance connections and high bandwidth applications for telecommunication and CATV companies, universities, and colleges.

Connectivity Insights

The market is classified into on-net and off-net in terms of connectivity. The on-net segment dominated the market throughout the forecast period, growing at a higher CAGR of 17.0% over the forecast period. A carrier that owns the network facilities at a particular location offers on-net connectivity.

The carrier connects to the telecom service providers’ network using the equipment installed in a local BT exchange. This enables users to leverage an optimized network with technically advanced services. Any connection is considered on-net if the sender and receiver use the same network for communication. These connections are more cost-effective than off-net connections as the cables for the carrier network are physically present at the location.

The off-net segment is estimated to witness notable growth over the forecast period. It primarily comprises a solution provider that leases a connection at a local network facility through a supplier relationship. For instance, while on a roaming network, an individual uses a home network to connect to users subscribed to other network providers.

An off-net connection is established when a connection is made on a different network. Therefore, any off-net connection involves unknown and distant variables affecting the connectivity and service quality of the network. This results in complexities in upgrades and responses to out-of-service conditions.

Application Insights

The market is classified into networking, IT & telecommunication, industrial, aerospace & defense, and other segments in terms of application. The networking segment held the largest revenue share of 31.7% in 2021. Lit fiber connections carry data at faster speeds than copper cables. It enables organizations to leverage lit fiber for cloud-based applications, data-intensive applications, and high bandwidth infrastructure.

The telecommunication segment is anticipated to witness notable growth due to the rising adoption of technology in data transmission and communication services. Fiber optics allows users to leverage high-speed data transfer across small and long-range communications. Additionally, the increasing demand for cloud-based applications, video-on-demand services, and audio-video services is expected to propel the growth of the telecommunication segment.

The aerospace and defense segment is poised to witness the fastest growth over the forecast period, attributed to the increasing adoption of optic technology devices. Adopting lit fiber in defense organizations allows for enhanced sensing and surveillance, optical computing systems, tactical communication, weapon systems, and information transfer across guided vehicles. Lit fiber is more rugged than traditional copper wires; it is highly resistant to hazards and traffic present in military space. Thus, lit fiber is anticipated to become an integral part of aerospace and defense applications in the coming years.

Regional Insights

North America held the largest revenue share of around 28% in 2021 and is estimated to continue leading over the forecast period. Increasing penetration of internet service, demand for enhanced communication, mobile data, network management, and user inclination towards 5G network services are propelling the growth. The region has a well-developed infrastructure that eases the deployment of lit fiber connections across North America.

Asia Pacific is likely to emerge as the second most promising region during the forecast period. Rising technological advancements and large-scale adoption of technology in IT, telecommunication, and administrative sectors are the factors propelling growth in this region. Additionally, the high penetration of these cables in the industrial sector and aerospace and defense sectors across the Asia Pacific strengthens the regional market hold.

Governments across the U.S., the U.K., China, Japan, and Germany have invested heavily in improving national security infrastructure. It has allowed these countries to strengthen their grip on the global level. Such infrastructure requires the funding of technologies, mainly through fiber optic cables, which will improve the infrastructure of the telecommunications sector with better security measures.

Key Companies & Market Share Insights

The market is anticipated to witness increased competition due to several players' presence. Increasing spending on R&D activities by major players results in the development of new technologies, and improvements in fiber optic connectivity are expected to intensify the competition among the players in the ecosystem. Several global players offer lit fiber connectivity for networking, industrial, IT and telecommunication, and defense applications. The key players focus on intensifying their geographic reach by offering related services to untapped regions.

Major players in the market focus on R&D, strategic partnerships, and alliances with local and regional players to gain a significant market share. In August 2021, FiberLight, LLC, a fiber infrastructure provider, partnered with Coloblox Data Centers to offer lit and dark fiber services in Coloblox's ATL1 Atlanta data center. This partnership allows Coloblox customers to gain distinct connectivity options and other benefits as they continue transitioning to a hybrid work environment. Some prominent players in the global lit fiber market include:

-

AT&T

-

Altice USA

-

Comcast

-

Crown Castle Fiber

-

Frontier

-

GigabitNow

-

Lumen

-

Spectrum Enterprise

-

Verizon

-

Zayo

Lit Fiber Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.13 billion

Revenue forecast in 2030

USD 14.24 billion

Growth Rate

CAGR of 16.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, connectivity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; Japan; India; Brazil; Mexico

Key companies profiled

AT&T; Altice USA; Comcast; Crown Castle Fiber; Frontier; GigabitNow; Lumen; Spectrum Enterprise; Verizon; Zayo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global lit fiber market report based on type, connectivity, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Multi-mode

-

Single-mode

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

On-net

-

Off-net

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Networking

-

IT & Telecommunication

-

Industrial

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global lit fiber market size was estimated at USD 3.67 billion in 2021 and is expected to reach USD 4.13 billion in 2022.

b. The global lit fiber market is expected to grow at a compound annual growth rate of 16.7% from 2022 to 2030 to reach USD 14.24 billion by 2030.

b. North America dominated the lit fiber market with a share of 28.7% in 2021. This is attributable to the increasing penetration of internet service, demand for enhanced communication, mobile data, and network management, and user inclination towards 5G network services

b. Some key players operating in the lit fiber market include AT&T, Altice USA, Comcast, Crown Castle Fiber, Frontier, GigabitNow, Lumen, Spectrum Enterprise, Verizon, and Zayo.

b. Key factors that are driving the lit fiber market growth include continuously rising demand from bandwidth-intensive applications across the telecom and IT sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.