- Home

- »

- Petrochemicals

- »

-

Liquid Packaging Market Size & Share, Industry Report 2030GVR Report cover

![Liquid Packaging Market Size, Share & Trends Report]()

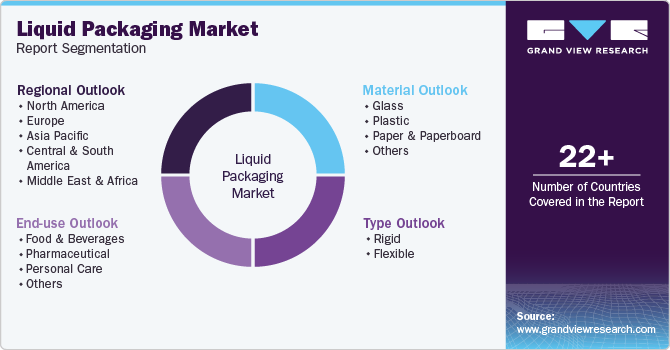

Liquid Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper & Paperboard), By Type (Rigid, Flexible), By End-use (Food and Beverages, Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-536-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Packaging Market Size & Trends

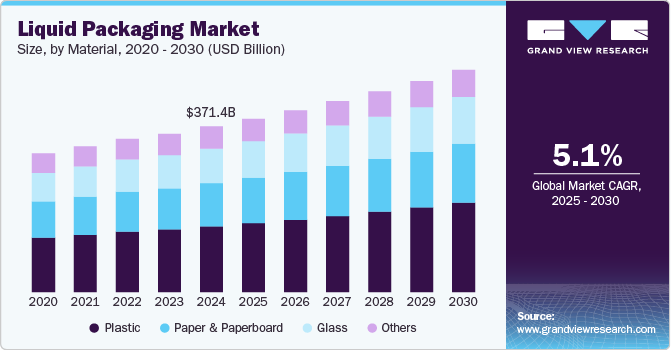

The global liquid packaging market size was estimated at USD 371.44 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. The liquid packaging market is driven by the rising demand for convenient, sustainable, and lightweight packaging solutions in the food & beverage, pharmaceutical, and personal care industries. Additionally, advancements in barrier technologies and increasing consumer preference for eco-friendly materials like paper-based and recyclable plastics further fuel market growth.

The rising demand for sustainable and eco-friendly packaging is a significant driver for the liquid packaging industry. Consumers and regulatory bodies are increasingly pushing for environmentally friendly solutions, leading to a shift toward recyclable and biodegradable materials. For example, companies such as Tetra Pak and SIG are investing in paper-based liquid cartons with minimal plastic and aluminum layers to improve recyclability. The demand for plant-based and biodegradable plastics, such as polylactic acid (PLA) and bio-PET, is also growing, especially in markets with stringent regulations such as the EU and North America. This trend aligns with global sustainability goals and circular economy initiatives, driving innovation in liquid packaging.

Additionally, an increasing consumption of packaged beverages and dairy products is driving market growth, particularly in emerging markets. Rapid urbanization, changing consumer lifestyles, and rising disposable incomes are fueling the demand for ready-to-drink (RTD) beverages, flavored milk, and plant-based alternatives such as almond and oat milk. For example, in India and China, the demand for aseptic liquid cartons for dairy and juice products is surging due to their longer shelf life and convenience. Additionally, the growth of energy drinks and functional beverages with added vitamins and minerals is driving innovation in packaging formats, including portion-controlled packs and resealable caps.

The growth of e-commerce and home delivery services has further propelled the liquid packaging industry. The shift toward online grocery shopping, accelerated by the COVID-19 pandemic, has increased the demand for sturdy, leak-proof, and tamper-evident liquid packaging solutions. Brands are focusing on lightweight and durable packaging that minimizes transportation costs while ensuring product safety. Flexible pouches with spouts, bag-in-box solutions, and PET bottles with improved barrier properties are becoming more popular for e-commerce distribution. For example, Coca-Cola and PepsiCo have introduced lightweight PET bottles with enhanced durability to cater to the booming direct-to-consumer (DTC) beverage segment.

Material Insights

The plastic material segment recorded the largest revenue share of over 39.0% in 2024 and is expected to grow at the fastest CAGR of 5.4% during the forecast period. This positive outlook is due to its lightweight nature, cost-effectiveness, and flexibility. It is widely used across various industries, including food and beverages, personal care, household cleaning, and pharmaceuticals. Different types of plastics, such as PET, HDPE, and LDPE, are commonly used for liquid packaging, providing durability and convenience. The rapid expansion of the e-commerce and food delivery industries has further fueled the need for lightweight, shatterproof, and cost-efficient packaging.

Paper & paperboard are increasingly used in the liquid packaging market, particularly in applications such as dairy products, juices, and plant-based beverages. Paper-based cartons provide a sustainable alternative to plastic packaging while maintaining the required barrier properties through additional coating or laminations. The primary driving factor for paper & paperboard packaging is the rising global emphasis on sustainability and reducing plastic waste.

Glass is a widely used material in the liquid packaging market due to its superior barrier properties, chemical resistance, and ability to preserve the taste and freshness of beverages and pharmaceuticals. It is extensively used in industries such as alcoholic and non-alcoholic beverages, pharmaceuticals, and perfumes. Additionally, glass is 100% recyclable without loss of quality, making it a preferred option for sustainable packaging solutions.

Type Insights

The rigid liquid packaging segment recorded the largest revenue share of over 58.0% in 2024. The rising preference for premium packaging in the food and beverage industry, especially for alcoholic and non-alcoholic beverages, is fueling the segment growth. Rigid liquid packaging includes containers made from materials such as plastic, glass, and metal. Common examples include bottles, cartons, cans, and jars, which provide durability and structural integrity to protect liquid contents.

The flexible liquid packaging segment is expected to grow at the fastest CAGR of 5.8% during the forecast period. It consists of pouches, sachets, bag-in-box, and other lightweight packaging products that offer convenience and cost-effectiveness. These packages are typically made from plastic films, foil, and paper-based laminates that provide barrier protection while reducing material usage. Flexible liquid packaging is gaining popularity in industries such as dairy, juices, sauces, and liquid detergents due to its ease of storage, lightweight nature, and extended shelf-life benefits.

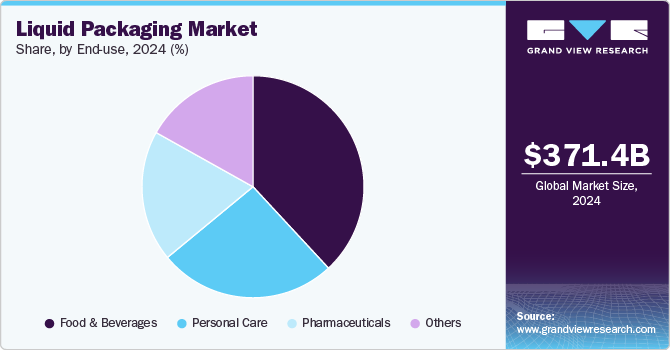

End Use Insights

The food & beverages end use segment recorded the largest revenue share of over 38.0% in 2024 and is projected to grow at the fastest CAGR of 5.5% during the forecast period. This positive outlook is due to the rising demand for dairy products, juices, soft drinks, and alcoholic beverages. Liquid packaging solutions such as cartons, pouches, bottles, and cans help in maintaining the freshness, safety, and shelf life of consumable liquids. The increasing focus on convenience, sustainability, and extended shelf-life packaging solutions is further fueling the demand for innovative liquid packaging in this sector.

The personal care industry includes liquid packaging for products such as shampoos, conditioners, lotions, liquid soaps, and perfumes. Aesthetic appeal, user convenience, and sustainability are key considerations in this segment. Packaging formats include flexible pouches, squeeze bottles, pumps, and spray containers, often with innovative dispensing solutions.

The pharmaceutical industry relies on liquid packaging for syrups, vaccines, intravenous fluids, and other medicinal formulations. Packaging in this segment is crucial for maintaining product integrity, sterility, and dosage accuracy. Glass and plastic bottles, ampoules, vials, and flexible pouches are commonly used in pharmaceutical liquid packaging, ensuring compliance with regulatory standards and patient safety.

Regional Insights

Asia Pacific liquid packaging market dominated the global market and accounted for the largest revenue share of over 42.0% in 2024 and is projected to grow at the fastest CAGR of 5.4% during the forecast period. The region’s dominance in the global liquid packaging market is due to its rapid economic development, increasing urbanization, and changing consumer lifestyles. Countries such as China, India, Japan, and South Korea are experiencing significant growth in packaged consumer goods, particularly in the food and beverage sector. This growth is supported by rising disposable incomes, which enables consumers to purchase more packaged products that offer convenience and longer shelf life.

China Liquid Packaging Market Trends

The liquid packaging market in Chinais primarily driven by its massive manufacturing capacity, rapidly growing consumer base, and government policies supporting sustainable packaging initiatives. As the world's most populous nation with a burgeoning middle class, China's demand for packaged beverages, dairy, and other liquid products has increased, necessitating innovative packaging solutions that meet both consumer preferences and regulatory requirements. Chinese companies such as Greatview Aseptic Packaging have emerged as formidable competitors to traditional Western packaging companies, offering cost-effective aseptic carton packaging for milk, juice, and other liquid products.

North America Liquid Packaging Market Trends

The food and beverage industry, particularly the ready-to-drink segment, drives substantial demand for advanced liquid packaging in the region. North America's busy lifestyle has accelerated the consumption of on-the-go beverages, functional drinks, and convenience foods, requiring specialized packaging solutions. The pharmaceutical and personal care industries also contribute significantly, with increasing demand for precise dosing mechanisms and tamper-evident packaging.

The liquid packaging market in the U.S. is primarily driven by its robust industrial infrastructure, technological innovation, and diverse consumer demands. Major manufacturers have invested heavily in advanced packaging technologies that extend shelf life while reducing environmental impact, allowing them to set industry standards worldwide. Companies such as Tetra Pak, Berry Global Inc., and Amcor plc have established significant operations in the U.S., leveraging the country's research capabilities to develop solutions such as aseptic packaging and innovative barrier materials.

Europe Liquid Packaging Market Trends

Europe liquid packaging market’s growth is primarily due to its robust regulatory framework and sustainability initiatives. The European Union's Circular Economy Action Plan and Single-Use Plastics Directive have pushed manufacturers to adopt eco-friendly packaging solutions ahead of other regions. This regulatory pressure has fostered innovation, with companies such as Tetra Pak pioneering recyclable cartons and Carlsberg developing the "Snap Pack," which reduces plastic usage by up to 76% compared to traditional six-pack rings.

Germany liquid packaging market is primarily driven by its robust manufacturing infrastructure, stringent environmental regulations, and innovative approach to packaging solutions. The country's robust circular economy approach has further strengthened its position. Germany's deposit return scheme for beverage containers achieves recycling rates above 90% for PET bottles, creating a reliable stream of high-quality recycled material. This has enabled companies such as ALPLA to develop recycled PET bottles for liquid packaging, meeting the growing consumer demand for sustainable options without compromising performance.

Key Liquid Packaging Company Insights

The global liquid packaging market is highly competitive and fragmented. Prominent players dominate the market through innovations in aseptic and eco-friendly packaging. Market share distribution is influenced by factors such as material advancements, regulatory compliance, and regional consumption trends. Emerging players compete by offering biodegradable and lightweight packaging, while established brands leverage economies of scale and strategic partnerships to maintain dominance.

Key Liquid Packaging Companies:

The following are the leading companies in the liquid packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sonoco Products Company

- Berry Global Inc

- Stora Enso

- Tetra Pak

- SIG

- DS Smith

- Mondi

- Ball Corporation

- ProAmpac

- Sealed Air

- Smurfit Kappa

- International Paper

- WestRock Company

- Greiner Packaging

- ALPLA

Recent Developments

-

In June 2024, AeroFlexx and Chemipack partnered to introduce sustainable liquid packaging solutions in Europe, addressing the growing demand for eco-friendly alternatives. AeroFlexx, known for its innovative liquid packaging technology, installed its proprietary filling machine at Chemipack’s production site in Poland. This collaboration leverages Chemipack’s expertise in blending and filling operations, with a production capacity exceeding 100 million liters annually, to expand AeroFlexx’s reach in the European market

-

In February 2024, Amcor plc, Stonyfield Organic, and Cheer Pack North America collaborated to launch the first all-polyethylene (PE) spouted pouch, marking a significant advancement in sustainable packaging. This innovative solution replaces Stonyfield Organic's previous multi-laminate packaging for its YoBaby refrigerated yogurt with a mono-material PE design that is recycle-ready and eco-friendly.

Liquid Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 389.3 billion

Revenue forecast in 2030

USD 499.2 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, end use, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Amcor plc; Sonoco Products Company; Berry Global Inc; Stora Enso; Tetra Pak; SIG; DS Smith; Mondi; Ball Corporation; ProAmpac; Sealed Air; Smurfit Kappa; International Paper; WestRock Company; Greiner Packaging; and ALPLA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Packaging Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid packaging market report based on material, type, end use, and region:

-

Material Outlook (Revenue, USD Million 2018 - 2030)

-

Glass

-

Plastic

-

Paper & Paperboard

-

Others

-

-

Type Outlook (Revenue, USD Million 2018 - 2030)

-

Rigid

-

Flexible

-

-

End Use Outlook (Revenue, USD Million 2018 - 2030)

-

Food & Beverages

-

Pharmaceutical

-

Personal Care

-

Others

-

-

Region Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global liquid packaging market was estimated at around USD 371.44 billion in the year 2024 and is expected to reach around USD 389.3 billion in 2025.

b. The global liquid packaging market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach around USD 499.2 billion by 2030.

b. Food & beverages emerged as the dominating end use segment in the liquid packaging market due to the rising demand for packaged beverages, dairy products, and functional drinks, along with the increasing adoption of sustainable and aseptic packaging solutions for extended shelf life.

b. The key players in the liquid packaging market include Amcor plc, Sonoco Products Company, Berry Global Inc, Stora Enso, Tetra Pak, SIG, DS Smith, Mondi, Ball Corporation, ProAmpac, Sealed Air, Smurfit Kappa, International Paper, WestRock Company, Greiner Packaging, and ALPLA.

b. The liquid packaging market is driven by rising demand for sustainable and eco-friendly packaging, increasing consumption of packaged beverages and dairy products, and the growth of e-commerce.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.