- Home

- »

- Beauty & Personal Care

- »

-

Liquid Makeup Market Size, Share & Trends Report, 2030GVR Report cover

![Liquid Makeup Market Size, Share & Trends Report]()

Liquid Makeup Market Size, Share & Trends Analysis Report, By Product (Foundation, Eye Products, Concealer, Lip Products, Others), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-950-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global liquid makeup market size was estimated at USD 7.7 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.4%from 2022 to 2030. The market's growth is reliant upon the global consumer trend toward well-being. Additionally, the global market is being driven by the changing consumer behavior patterns for beauty and personal care. The global liquid makeup supply chain and distribution channel were disrupted by the COVID-19, which resulted in the closure of salons and their services, worldwide. The pandemic caused a significant shift in consumer purchasing priorities. Personal health and sustainable development are now at the forefront of buyers' minds, especially when it comes to cosmetic purchases.

In addition, vegan cosmetics are more popular than ever, and demand for organic, convenient, and sustainably made products is rising. Consumers are making purchasing decisions, based on sustainability and are adopting products with organically sourced ingredients, which have caused a significant shift in consumer expectations.

The demand for liquid makeup products is increasing, due to the growing disposable income of the consumers. The liquid makeup market is dominated by the foundation segment, particularly among millennials (18 to 34 years old), a generation that is keenly conscious of environmental and social concerns.

Foundation witnesses high popularity among consumers, due to its benefits and easy adaptability with serums and toners. Thus, the market penetration of the foundation is higher than other types of liquid makeup. The advent of e-commerce channels has made liquid makeup accessible to consumers across several parts of the world.

As a result of increased internet usage and growing consumer preference for shopping apps, major market participants are rapidly building e-commerce websites in huge attractive areas. Along with discounts and unique deals, online brands provide benefits to those who join their online community. In 2020, Arianna Grande, an American Singer launched her new line of cosmetic brand R.E.M Beauty on Instagram- The product line includes, lip stain markers and liquid eye shadows.

Apart from women, male consumers worldwide are showing interest in beauty & cosmetics. Brands are acknowledging this trend and investing in efforts to increase inclusivity for this group. For instance, Perfect Diary, a popular C-beauty (China beauty) brand, launched its first male beauty products in July 2020 after announcing a collaboration with the National Gymnastics Team to produce a line of men's products.

This marks their first entry into the market for men's care products. While the growth and potential of the male beauty market in the UK are on the rise, China and Korea pioneered the beauty trend, which spread to the rest of the world. Korea has surpassed the U.S. as the world's "largest male spender" on skincare and other Korean beauty products. This is owing to the changing society, and an increasing number of people are embracing gender neutrality, feminine expressions, and new definitions of masculinity.

Product Insights

The foundation segment accounted for a 24.1% share of the global revenue in 2021. The rise in consumption of organic raw materials coupled with a growing number of manufacturers offering liquid-based makeup products is driving demand for the liquid foundation segment. The use of a liquid foundation provides the consumer with full coverage compared to a powder formulation. The base of a liquid foundation usually contains a mixture of water and silicone enabling the consumer to get an even application.

The eye product segment is expected to expand at a CAGR of 5.6% during the forecast period in terms of revenue. The liquid eye makeup constitutes products such as eye shadows, eyeliners, and mascara, among others. Factors such as the lesser amount of clumping, smooth application of the product, and high level of precision offered by liquid makeup products are driving the demand for the segment. In 2021, Bite Beauty, a Canadian-based beauty brand introduced a new range of clean cosmetics featuring mascara and eyeliner. The eyeliner is enriched with passionflower extract which allows the consumer to get a smoother application.

Distribution Channel Insights

The online segment dominated the market and accounted for 56.2% of the global revenue share in 2021. Consumer buying habits have been significantly altered by the online distribution channel, which offers benefits such as doorstep service, simple payment options, substantial savings, and the availability of a large choice of items on a single platform. Due to increased internet usage and customer preference for shopping apps, major market participants are rapidly building e-commerce websites.

The offline segment is expected to expand at a CAGR of 5.3% during the forecast period in terms of revenue. Offline channels include; supermarkets/hypermarkets, retail outlets, and specialty stores. The price of products in these stores varies according to the brand, and customers have the option of selecting from a variety of brands to fit their budget. Consumer demand for makeup products has increased in portfolio expansions at supermarkets and hypermarkets.

Regional Insights

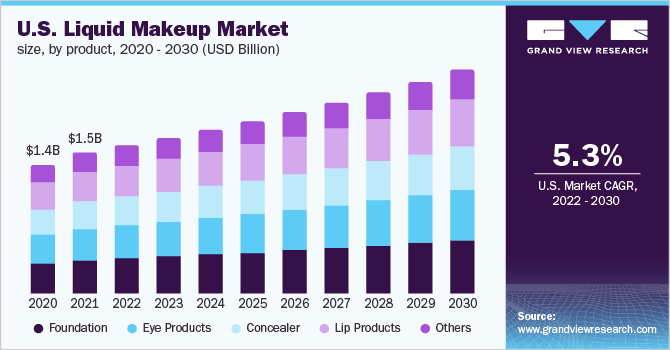

Asia-Pacific dominated the regional market and accounted for a 30.1% share of global revenue and North America accounted for 25.2% of the market share in 2021. The U.S. is the largest consumer of liquid makeup. Consumers are becoming aware of organic products and thus, consumption of chemical-free products is high in the U.S.as compared to other regions. Moreover, the growing influence of adopting a trending makeup look is expected to fuel the demand for liquid makeup in the region. Furthermore, factors such as easy product availability and pocket-friendly pricing are the factors expected to fuel the demand for liquid makeup during the coming years.

Europe is anticipated to expand at a CAGR of 5.2% during the forecast period in terms of revenue. Germany dominated the Europe liquid makeup market in 2021. Consumers in Europe are shifting from conventional products to organic products. The availability of a wide range of liquid make-up in terms of color, size, shape, pattern, and price is likely to create several opportunities for the liquid make-up market in the region.

Key Companies & Market Share Insights

The global liquid makeup market is characterized by the presence of numerous players. Companies are increasingly focusing on innovation to gain market share in the world. For instance, in February 2022, Fenty Beauty launched its new range of refillable lipsticks; lip luminizer, liquid highlighter, and the new mini pro filter soft matte foundation. This launch will help the market to gain consumer traction for liquid makeup. New product launches, innovation, geographical expansion, and mergers & acquisitions are some of the key strategies adopted by the players to strengthen their position in the market and gain a higher market share. Some of the prominent players in the global liquid makeup market include:

-

Shiseido Co., Ltd.

-

FENTY BEAUTY

-

Benefit Cosmetics LLC

-

Estée Lauder Inc.

-

Dior

-

L’Oreal Paris

-

The Avon Company

-

KIKO USA, Inc. (KIKO MILANO)

-

HUDA BEAUTY

Liquid Makeup Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 8136.9 million

Revenue forecast in 2030

USD 12,429.0 million

Growth Rate

CAGR of 5.4% from 2022 to 2030 in terms of revenue

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country Scope

U.S., Canada, Germany, France, China, India, Brazil

Key companies profiled

Shiseido Co., Ltd. , FENTY BEAUTY, Benefit Cosmetics LLC, Estée Lauder Inc., Dior, L’Oreal Paris, The Avon Company, KIKO USA, Inc. (KIKO MILANO), HUDA BEAUTY

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Liquid Makeup Market report based on the product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Foundation

-

Eye Products

-

Concealer

-

Lip Products

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

France

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global liquid makeup market size was estimated at USD 7.74 billion in 2021 and is expected to reach USD 8.14 billion in 2022

b. The global liquid makeup market is expected to grow at a compound annual growth rate of 5.4% from 2022 to 2030 to reach USD 12.43 billion by 2030.

b. Asia Pacific dominated the liquid makeup market with a share of 30.1% in 2021. . Consumers are becoming aware of organic products and thus, consumption of chemical-free products is high in the U.S. as compared to other regions. Moreover, the growing influence of adopting a trending makeup look is expected to fuel the demand for liquid makeup in the region. Furthermore, factors such as easy product availability, and pocket-friendly pricing is expected to fuel the demand for liquid makeup in the coming years.

b. Some key players operating in the liquid makeup market include Shiseido Co., Ltd., FENTY BEAUTY, Benefit Cosmetics LLC, Estée Lauder Inc., Dior, L'Oréal Paris, The Avon Company, KIKO USA, Inc. (KIKO MILANO), HUDA BEAUTY.

b. The market's growth is reliant upon the global consumer trend toward well-being. Additionally, the market is being driven by changing consumer behavior patterns for beauty and personal care globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."