- Home

- »

- Organic Chemicals

- »

-

Liquid Fertilizers Market Size, Share & Growth Report, 2030GVR Report cover

![Liquid Fertilizers Market Size, Share & Trends Report]()

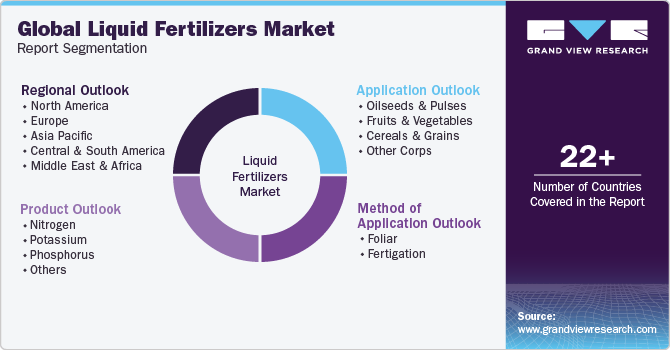

Liquid Fertilizers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Nitrogen, Potassium, Phosphorous), By Application (Oilseeds & Pulses, Fruits & Vegetables), By Method Of Application (Foliar, Fertigation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-187-1

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Fertilizers Market Summary

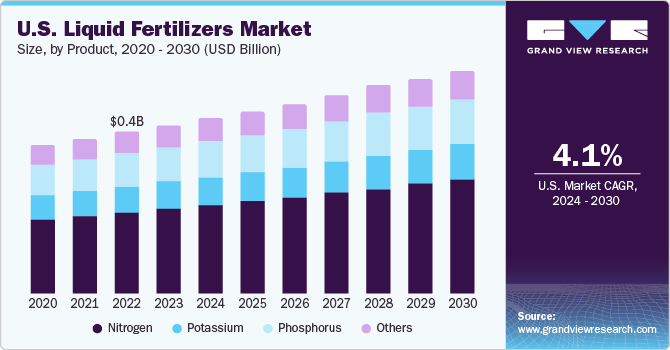

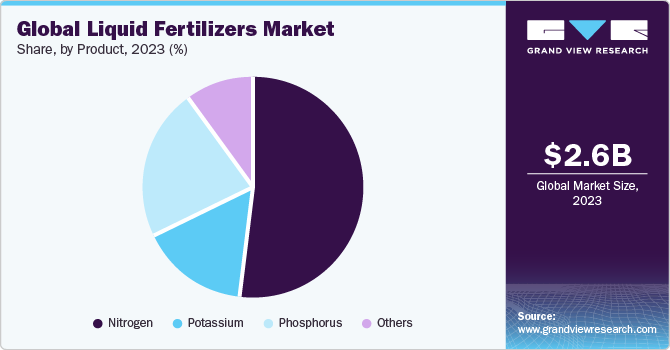

The global liquid fertilizers market size was estimated at USD 2.63 billion in 2023 and is projected to reach USD 3.41 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. The demand for liquid fertilizers is rising due to the growth in demand for enhanced high-efficiency fertilizers. The product provides crops with optimal nutrients during growth in an eco-friendly way that preserves water resources and soil quality. This is expected to drive the demand for liquid-soluble fertilizers. As a result, market participants are expanding their product offerings to meet this growing demand.

Key Market Trends & Insights

- Asia Pacific region dominated the market with a revenue share of more than 45.6% in 2023.

- By method of application, Foliar dominated the market with a revenue share of 68.7% in 2023.

- By application, Grains and cereals dominated the market with a revenue share of 38.7% in 2023.

- By product, the nitrogen dominated the market with a revenue share of 52.40% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.63 Billion

- 2030 Projected Market Size: USD 3.41 Billion

- CAGR (2024-2030): 4.4%

- Asia Pacific: Largest market in 2023

Liquid fertilizers, also known as liquid plant nutrients, are highly concentrated solutions containing essential plant nutrients. The plants can directly absorb these nutrients through their roots or leaves. The product market contains a balanced mixture of essential nutrients such as nitrogen, phosphorus, and potassium and micronutrients such as iron, zinc, and manganese. They are highly beneficial for crop growth and yield. The product market has several advantages, including providing quick nutrient availability to plants, efficient absorption, and uniform distribution. They can be applied to crops through various methods, such as foliar spraying, and fertigation, allowing precise and targeted delivery of nutrients. This flexibility makes the product ideal for various crops, including fruits, vegetables, field crops, and ornamental plants.

The precision of the product market helps minimize nutrient wastage and enhance crop yield and quality by maximizing nutrient absorption. Moreover, products are easy to apply and can be used in various ways, such as foliar spraying, and fertigation. This versatility saves time and reduces labor costs. The demand for high-quality crops is increasing due to the rising global population and changing dietary preferences. The product market is crucial in meeting this demand by promoting healthier plant growth and improving yield potential. Additionally, liquid fertilizers can be formulated to minimize environmental impact, reducing the risk of nutrient runoff and groundwater contamination.

The product market has become increasingly popular due to its advantages. One of the primary benefits of using products is that they are easier to mix and are generally better absorbed by the crop. The ease of using and applying the product is the primary factor driving industry growth. They are simple to handle and apply, requiring less labor since pumps are used for movement. Another advantage of the product is that some pesticides can be infused into the fluid, reducing the number of trips across the field. The rapid increase in greenhouse vegetable production also boosts the product market. Greenhouses require less land area for production and ensure higher crop yields and improved quality of vegetables. They also make efficient use of resources like water and nutrients. Furthermore, greenhouse farming can last longer and is highly profitable, making it a popular choice in developed nations.

Despite the COVID-19 pandemic, the liquid fertilizers price dropped during the pandemic. All governments have tried to ensure farmers can access fertilizers during the pandemic. However, global transportation and distribution of products markets have been disrupted due to shutdowns at country borders. The market's growth has been stifled due to worldwide lockdown and curfew practices.

According to the U.S. Department of Agriculture's Foreign Agricultural Services, in June 2022, the global fertilizer market's prices are reaching near-record levels. This is mainly due to the ongoing conflict between Russia and Ukraine. These high prices are expected to continue through 2022 and beyond. These elevated prices may have implications for crop production in 2022 and 2023. The conflict between Russia and Ukraine has worsened the already limited fertilizer supply situation and triggered restrictions on imports and exports, further compounding the shortage concerns. Russia has imposed restrictions on exports of nitrogen, phosphate, and potash fertilizers until June 2022, which will reduce the worldwide supply by almost 15%.

Increasing fertilizer production takes three to five years if the necessary reserves are available. Unfortunately, phosphate and potash reserves are limited in several countries. For instance, in March 2023, The U.S. government announced a grant of USD 29 million to address the fertilizer shortage. The grants have been provided to independent businesses to increase the production of fertilizer to be made in America. This will encourage competition, provide more options and fairer prices to U.S. farmers, and reduce dependence on unreliable foreign sources such as Russia and Belarus.

Method of Application Insights

Foliar dominated the market with a revenue share of 68.7% in 2023. Foliar spray is a method of providing nutrients to plants by applying product directly onto their leaves. This allows the plants to absorb essential elements through their leaves. The growth of the foliar spray market is the increasing demand for such sprays in the horticulture industry. Foliar applications are beneficial in providing micronutrients quickly to correct severe deficiencies that often occur during the early stages of growth. However, they are temporary solutions to the problem rather than a long-term substitute for soil fertilizers. During the summer, fruit trees can be treated for spider mite infestations by applying pesticides to the leaves. With a greater focus on sustainable farming practices and an increasing number of small-scale farms, horticulture has become more profitable than traditional agriculture.

Fertigation had significant growth with a market share of 31.3% over the forecast period. Fertigation is a technique used in agriculture that involves applying water and fertilizers through irrigation. This process allows farmers to increase their crop yield while reducing environmental pollution. Additionally, fertigation provides for the uniform application of nutrients to the entire field as needed. This market is expected to grow due to the global adoption of more efficient irrigation systems. Fertigation is a technique that helps farmers adopt precision agriculture methods. Farmers can customize nutrient dosages by combining fertigation with digital technologies according to real-time data such as soil moisture, nutrient content, and crop needs. This data-driven approach optimizes nutrient delivery and promotes sustainable farming practices.

Application Insights

Grains and cereals dominated the market with a revenue share of 38.7% in 2023. Grains and cereals are essential components of the global food supply and are consumed by billions of people worldwide. Due to the increasing population, the demand for these crops consistently remains high, making nutrient management critical to achieving optimal yields.

These crops are cultivated on a large scale across diverse agro-climatic regions, resulting in substantial demand for fertilizers, including liquid fertilizers, to ensure productive and consistent crop outcomes. Moreover, product market are versatile and can be applied through traditional methods or modern precision agriculture techniques, catering to the specific needs of different grain and cereal varieties. This flexibility in nutrient delivery offers a wide range of benefits to farmers.

Product Insights

Nitrogen dominated the market with a revenue share of 52.40% in 2023. Nitrogen is an essential nutrient that plays a crucial role in promoting healthy plant growth. It is a fundamental component of amino acids, proteins, and chlorophyll, vital for plant development and photosynthesis. Therefore, crops require a consistent and substantial nitrogen supply throughout their growth stages. Liquid nitrogen fertilizers are highly flexible in application methods, including foliar spraying and fertigation, making them popular among farmers.

This adaptability allows farmers to adjust nutrient delivery based on specific crop requirements and growth conditions. In addition, the need for higher crop yields to meet global food requirements further drives the demand for nitrogen-based fertilizers. Their rapid availability of plants and their significant impact on growth align to achieve increased agricultural productivity. The use of liquid nitrogen fertilizers is prominent due to their flexibility in application methods, including foliar spraying and fertigation. This adaptability enables farmers to fine-tune nutrient delivery based on crop requirements and growth conditions.

Regional Insights

Asia Pacific region dominated the market with a revenue share of more than 45.6% in 2023. The Asia Pacific region is home to a significant proportion of the world's population. This has led to a high demand for agricultural products to meet the food requirements of densely populated countries in the region. As a result, there is a continuous need to enhance crop productivity and yield. The Asia Pacific is dominating in agriculture. The diversity of crops grown there drives the demand for the product market in the Asia Pacific region. From staple foods like rice and wheat to cash crops such as fruits and vegetables, the agricultural landscape of Asia Pacific is vast and varied.

Furthermore, the prevalence of smallholder farming and the adoption of labor-intensive practices create a demand for efficient and easy-to-apply fertilization methods. Product market align with the needs of small-scale farmers due to their versatility in application techniques, making them an attractive choice. Additionally, there is an increasing awareness of sustainable farming practices and environmental concerns within the region. This drives the adoption of product markets, as they can be tailored to minimize runoff and pollution, aligning with the growing emphasis on responsible agriculture.

Key Companies & Market Share Insights

Players in the market have adopted the strategy of new product launches to enhance their product portfolios and increase their consumer reach. For instance, in April 2023, IFFCO recently launched Nano DAP Liquid fertilizer, which provides farmers with a tool to increase productivity and income. This is a significant step towards achieving the Prime Minister's vision of Sahkar Se Samriddhi and Atmanirbhar Bharat. This product launch was witnessed online by millions of farmers worldwide.

Moreover, in July 2022, BiOWiSH and SABIC evaluated BiOWiSH Crop Liquid technology coated on SABIC product urea fertilizer. It has been tested on nine crop types across five continents and nine countries. The fertilizer aims to enhance soil productivity and optimize yield potential by combining microbial cultures that can be added to dry or liquid fertilizers.

Key Liquid Fertilizers Companies:

- CSBP

- Nutrien Ltd.

- BMS Micro-Nutrients NV

- Compo Expert

- ICL

- IFFCO

- Yara International ASA

- AgroLiquid

- FoxFarm Soil & Fertilizer Co

- Nutri-Tech Solutions Pty Ltd

- EuroChem Group

- K+S Aktiengesellschaft

Liquid Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.75 billion

Revenue forecast in 2030

USD 3.41 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, method of application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; Russia; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Market Players

CSBP; Nutrien Ltd.; BMS Micro-Nutrients NV; Compo Expert; ICL; IFFCO; Yara International ASA; AgroLiquid; FoxFarm Soil & Fertilizer Co; Nutri-Tech Solutions Pty Ltd; EuroChem Group; K+S Aktiengesellschaft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Liquid Fertilizers Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the liquid fertilizers market report based on product, method of application, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Nitrogen

-

Potassium

-

Phosphorus

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Cereals & Grains

-

Other corps

-

-

Method of Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foliar

-

Fertigation

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Itay

-

Spain

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global liquid fertilizers market size was valued at USD 2.63 billion in 2023 and is expected to reach USD 2.75 billion in 2023.

b. The global liquid fertilizers is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030 to reach USD 3.41 billion by 2030.

b. Nitrogen dominated the market with a revenue share of 52.40% in 2023. Nitrogen is an essential nutrient that plays a crucial role in promoting healthy plant growth. It is a fundamental component of amino acids, proteins, and chlorophyll, vital for plant development and photosynthesis.

b. Some prominent players in the product market include: • CSBP • Nutrien Ltd. • BMS Micro-Nutrients NV • Compo Expert • ICL • IFFCO • Yara International ASA

b. The demand for liquid fertilizers is rising due to the growth in demand for enhanced high-efficiency fertilizers. The product provides crops with optimal nutrients during growth in an eco-friendly way that preserves water resources and soil quality. This is expected to drive the demand for liquid-soluble fertilizers. As a result, market participants are expanding their product offerings to meet this growing demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.