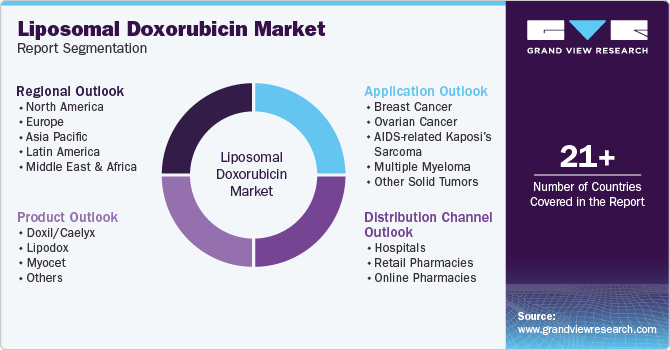

Liposomal Doxorubicin Market Size, Share & Trends Analysis Report By Product, By Application (Multiple Myeloma, Ovarian Cancer, Breast Cancer), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-743-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Liposomal Doxorubicin Market Size & Trends

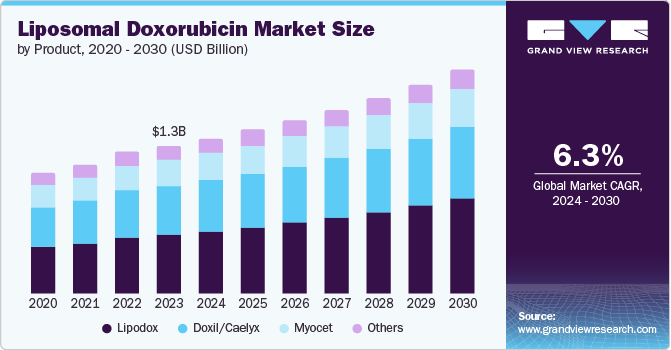

The global liposomal doxorubicin market size was valued at USD 1.25 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The rising tide of cancer cases, particularly breast cancer, fuels the liposomal doxorubicin market. Advancements in nanotech for innovative drug formulations further strengthen this market. Liposomal delivery revolutionizes cancer treatment by offering increased effectiveness and lower side effects than traditional forms. Furthermore, ongoing research to improve delivery and stability and explore new therapeutic applications is propelling the market's rapid growth.

Rising cancer diagnoses propel the liposomal doxorubicin market, as it offers targeted chemotherapy with reduced side effects, making it a preferred treatment. For instance, the International Agency for Research on Cancer (IARC) estimates 20 million new cancer cases in 2022, projected to rise to 35 million by 2050, highlighting a growing global cancer burden.

Nano-technological advancements in the drug delivery of liposomal doxorubicin are driving the market by increasing the demand for advanced liposomal doxorubicin formulations. For instance, according to a study published in ACS Publications, Nanobowl-supported liposomal DOX (DOX@NbLipo) is more resistant towards the plasma proteins and blood flow shear force that resulted in minimal drug leakage in the drug delivery at targeted tissue. The study showed that DOX@NbLipo led to prolonged survival of the mice (up to 50 days) compared to other controls. The DOX@NbLipo treatment also led to the biggest increase in the lifespan of the mice by 108.3%.

Ongoing research on liposomal doxorubicin for different indications is propelling the market. For instance, a study published in the European Journal of Cancer demonstrated the higher efficacy of TLD-1 (Novel liposomal doxorubicin) as compared to conventional doxorubicin formulations in patients with advanced solid tumors.

Product Insights

The lipodox segment dominated the market with 40.0% share in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. The FDA-approved generic formulations of liposomal doxorubicin for the treatment of ovarian cancer impacted the market, resulting in a decrease in sales of branded liposomal doxorubicin formulations. The availability of FDA-approved generic liposomal doxorubicin formulations drives the market because it lowers the treatment cost for various cancers.

The myocet segment is expected to grow significantly between 2024 to 2030. According to Cambridge University estimates, the global number of breast cancer cases is expected to reach over 3 million by 2040. The worldwide rise of breast cancer cases is driving the market because Myocet is a U.S. FDA-approved first-line drug in the treatment of metastatic breast cancer.

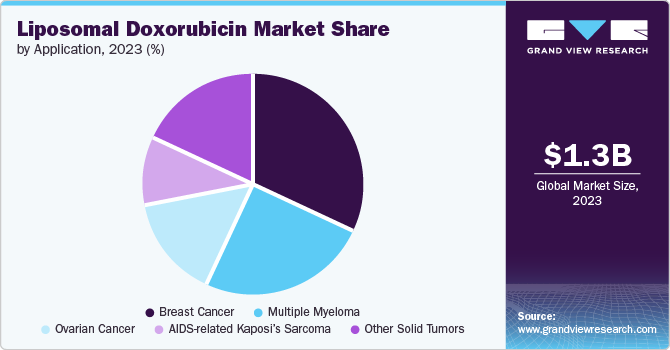

Application Insights

In 2023, breast cancer dominated the market with a revenue share of 31.7% in 2023 and is expected to grow at a CAGR of 7.36% over the forecast period. An increase in the incidence of breast cancer, among other cancers, is driving the market. For instance, according to International Agency for Research on Cancer (IARC) reports published in December 2020, 1 in 4 cancer-diagnosed patients had breast cancer. Different environmental and hormonal factors cause breast cancer. Environmental factors responsible for the induction of breast cancer are radiation exposure and oncogenic chemical exposure.

The multiple myeloma segment is expected to grow at a significant rate over the forecast period. The rising global incidence of Multiple Myeloma, where liposomal doxorubicin is a first-line treatment, fuels the market growth. For instance, according to the Lancet Haematology study in 2020, data showed a higher incidence of Multiple Myeloma, particularly in men above 50 age people, and those from higher-income countries.

Distribution Channel Insights

The hospital pharmacies segment dominated the market revenue share with 55.6% in 2023. Hospital pharmacies play a critical role in treatment as they prepare and dispense chemotherapy drugs and other therapies to patients. They are also responsible for managing the inventory and storage of these drugs, ensuring that they are stored and handled according to strict regulations.

The online pharmacy segment shows the highest growth at 11.7% CAGR in the forecast period due to the convenience of choosing websites offering various products and detailed product information. The market segment is expected to grow due to lucrative offers and discounts on different websites. Thus, the rise in e-commerce drives the market by facilitating consumers' convenience in purchasing products.

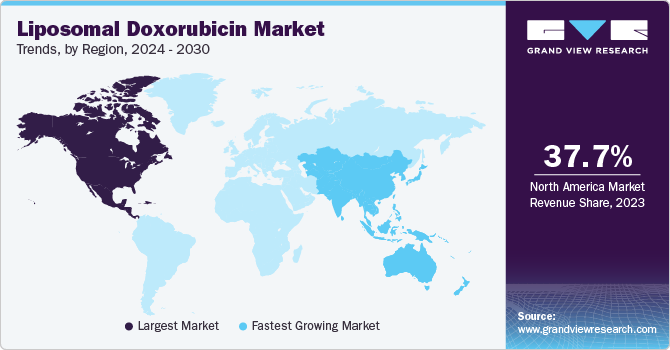

Regional Insights

North America liposomal doxorubicin dominated the market share in 2023. Liposomal doxorubicin's market is expected to rise due to ongoing trials exploring its use for new medical conditions. For instance, an ongoing study by the National Cancer Institute on the effectiveness of Pegylated Liposomal Doxorubicin Hydrochloride with Atezolizumab and/or Bevacizumab in the treatment of patients with recurrent Fallopian Tube, Ovarian, or Primary Peritoneal Cancer.

U.S. Liposomal Doxorubicin Market Trends

The US liposomal doxorubicin market dominated, with a share of 89.3% in 2023. Recent investments in combining doxorubicin with other anti-cancer drugs have made the US Liposomal Doxorubicin market lucrative for investors. For instance, the current research being conducted by the National Cancer Institute on the testing of Low-Dose Common Chemotherapy (Liposomal Doxorubicin) combined with the anti-cancer drug Peposertib in advanced sarcoma.

Europe Liposomal Doxorubicin Market Trends

Europe liposomal doxorubicin market was identified as a lucrative region in 2023. The growth is due to rapidly growing number of breast cancer cases in the region. For instance, in February 2024, WHO released a study predicting in cancer cases increase of over 20% in Europe by 2045.

The UK market for liposomal doxorubicin is poised for rapid growth, driven by rising demand and potential regulatory approvals for its use in treating various cancers. For instance, in July 2023, the WHO released a new essential medicine list that included liposomal doxorubicin for treating Kaposi Sarcoma.

Asia Pacific Liposomal Doxorubicin Market Trends

In the Asia Pacific liposomal doxorubicin market is expected to witness significant growth over the forecast period, the growing number of patients, market potential, and increasing healthcare expenditure are expected to provide a favorable chance for established global firms looking to expand in the market. Recent findings in new targets of liposomal doxorubicin are anticipated to drive exponential growth in the market. For instance, a research paper released on Dovepress in April 2024 detailed how targeting the EGFR with liposomal doxorubicin enhances the detection and control of non-small cell lung cancer.

China held a significant market share in the liposomal doxorubicin market in 2023 due to high demand and ongoing research into its use with other cancer drugs for treating children with solid tumors. For instance, a study published in Lancet in June 2024, the research investigated the safety and effectiveness of combining pegylated liposomal doxorubicin with cyclophosphamide and vincristine for treating relapsed/refractory solid tumors in pediatric patients.

Latin America Liposomal Doxorubicin Market Trends

The Latin American liposomal doxorubicin market is anticipated to grow significantly over the forecast period. Collaborations and investments from key industry leaders are currently propelling the market.

In 2023, the liposomal doxorubicin market in Brazil had a significant market share, and it is predicted to increase significantly because of its higher effectiveness in treating Kaposi Sarcoma. For instance, a retrospective study published in the ESMO OPEN Journal in March 2024, proved the optimal efficiency of liposomal doxorubicin compared to Paclitaxel in the first-line treatment of Kaposi Sarcoma.

Middle East and Africa Liposomal Doxorubicin Market Trends

The Middle East and Africa market for liposomal doxorubicin is expected to see substantial growth. This is fueled by advancements in drug formulations, attracting investment in innovative products from various players in the region.

South Africa's liposomal doxorubicin market is expected to surge due to rising demand for treating AIDS-related Kaposi Sarcoma. For instance, in March 2020, the National Cancer Institute is exploring a new treatment standard for advanced Kaposi sarcoma in sub-Saharan Africa with AIDS. Their research uses liposomal doxorubicin with other anti-cancer drugs based on promising results from a large clinical trial.

Key Liposomal Doxorubicin Company Insights

Some of the key companies in the liposomal doxorubicin market include Sun Pharmaceutical Industries Ltd., Johnson & Johnson Services, Inc., Merck & Co., Inc., Cipla, Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co.,ltd, Lupin, Cadila Pharmaceuticals, SRS Life Sciences, Cadila Pharmaceuticals, GSK plc., Pfizer Inc., Sanofi, and Sigma-Aldrich Co. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Johnson & Johnson Services, Inc., through its subsidiary Janssen Pharmaceuticals, operates in the oncology market, including developing and distributing liposomal doxorubicin. Their focus on innovative drug delivery systems and commitment to enhancing cancer treatment options position them as a significant contributor to the liposomal doxorubicin market, which aims to improve therapeutic outcomes and patient safety.

-

Merck & Co., Inc. is involved in the oncology sector, developing advanced chemotherapy formulations such as liposomal doxorubicin. By leveraging its extensive research capabilities and commitment to innovative cancer therapies, Merck contributes to the advancement and availability of liposomal doxorubicin to improve patient outcomes.

Key Liposomal Doxorubicin Companies:

The following are the leading companies in the liposomal doxorubicin market. These companies collectively hold the largest market share and dictate industry trends.

- Sun Pharmaceutical Industries Ltd.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Cipla

- Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd.

- Lupin

- Cadila Pharmaceuticals

- SRS Life Sciences

- GSK plc

- Pfizer Inc.

- Sanofi

- Sigma-Aldrich Co.

Recent Developments

-

In January 2024, the CHEPLAPHARM Group gained commercial rights for Myocet in Europe from Teva, broadening its oncology portfolio. The drug is prescribed as the initial therapy for metastatic breast cancer in women who are adults. Myocet is the initial product that CHEPLAPHARM purchased from Teva.

-

In January 2024, Johnson & Johnson Services, Inc. officially announced acquiring Ambrx Biopharma, Inc. through a firm agreement. Ambrx is a biopharmaceutical company developing a distinct synthetic biology technology platform for creating advanced antibody-drug conjugates (ADCs) in the clinical stage.

-

In September 2020, Zydus Cadila received the U.S. FDA approval for a liposomal doxorubicin injection, a chemotherapy drug for cancers such as ovarian and AIDS-related Kaposi's sarcoma. It works by slowing down or stopping cancer cell growth.

Liposomal Doxorubicin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.31 billion |

|

Revenue forecast in 2030 |

USD 1.89 billion |

|

Growth Rate |

CAGR of 6.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Sun Pharmaceutical Industries Ltd.; Johnson & Johnson Services, Inc., Merck & Co.; Cipla, Inc.; Cadila Pharmaceuticals; Cipla; SRS Life Sciences; GSK plc.; Pfizer Inc.; Sanofi; Sigma-Aldrich Co.; Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co.,ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Liposomal Doxorubicin Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the liposomal doxorubicin market based on product, application, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Doxil/Caelyx

-

Lipodox

-

Myocet

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Ovarian Cancer

-

AIDS-related Kaposi’s Sarcoma

-

Multiple Myeloma

-

Other Solid Tumors

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global liposomal doxorubicin market size was estimated at USD 1.02 billion in 2019 and is expected to reach USD 1.08 billion in 2020.

b. The global liposomal doxorubicin market is expected to grow at a compound annual growth rate of 6.2% from 2016 to 2024 to reach USD 1.39 billion by 2024.

b. North America dominated the liposomal doxorubicin market with a share of 48.5% in 2019. This is attributable to the high prevalence of sarcomas and ovarian, breast, and liver cancers, as well as several other cancers in the region. In addition, the presence of advanced healthcare facilities and high patient awareness levels regarding the various available treatments are key factors driving the growth in this region.

b. Some key players operating in the liposomal doxorubicin market include Sun Pharmaceutical Industries Ltd.; Johnson & Johnson, Merck & Co.; Cipla, Inc.; Cadila Pharmaceuticals; and SRS Pharmaceuticals Pvt. Ltd.

b. Key factors that are driving the market growth include an increasing number of market players, rising applications of liposomal doxorubicin, and arising number of cancer cases globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."