Linear Motion Bearing Market Size, Share & Trends Analysis Report By Type (Single-axis Linear Motion System, Multi-axis Linear Motion System), By End-use (Aerospace, Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-365-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Linear Motion Bearing Market Size & Trends

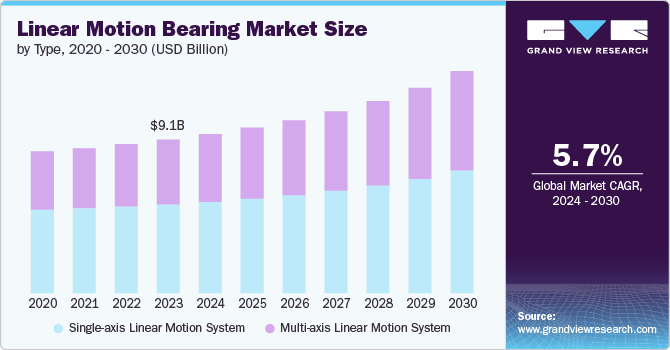

The global linear motion bearing market size was estimated at USD 9.13 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. The surge in industrial automation and the integration of robotics in manufacturing and other sectors have significantly propelled the demand for linear-motion bearings. As industries increasingly automate processes to enhance efficiency, precision, and productivity, the need for components that ensure smooth and accurate motion has grown. Linear-motion bearings are crucial for various automated systems, including robotic arms, CNC machines, and conveyor systems, where they facilitate precise linear movement, reduce friction, and extend the lifespan of machinery. This trend toward automation and robotics will continue driving the market as businesses seek to optimize their operations.

In addition, the electronics and semiconductor industry is another significant market driver. This sector relies heavily on these bearings to produce electronic devices and components requiring precise and reliable motion control. The growing demand for consumer electronics, including smartphones, tablets, and wearable devices, has increased the need for linear-motion bearings in manufacturing processes. Moreover, advancements in semiconductor fabrication and the miniaturization of electronic components have further amplified the demand for these bearings, as they play a critical role in the delicate and precise operations required in this industry.

The market has seen significant advancements in the materials and coatings used in manufacturing bearings. Newer materials, such as ceramics and advanced polymers, are being used to enhance performance characteristics. These materials offer superior properties like reduced friction, increased wear resistance, and higher durability than traditional steel bearings. In addition, innovative coatings, such as diamond-like carbon (DLC) and ceramic coatings, are being applied to bearings to reduce friction further and enhance their operational lifespan, making them suitable for high-speed and high-load applications.

Furthermore, integrating the Internet of Things (IoT) and smart technologies into linear-motion bearings is a notable trend. Smart bearings equipped with sensors can monitor real-time data on various parameters such as temperature, vibration, and load. This data can be analyzed to predict maintenance needs, prevent failures, and optimize performance. IoT-enabled bearings facilitate predictive maintenance, reducing downtime and operational costs. This trend aligns with the broader move towards Industry 4.0, where connectivity and data-driven decision-making are paramount.

However, the high initial costs associated with advanced linear-motion bearing systems are a significant restraint. Cutting-edge technologies, materials, and manufacturing processes contribute to the high cost of these bearings. For many small and medium-sized enterprises (SMEs), the substantial upfront investment required can be a deterrent, limiting the adoption of these advanced systems. This is particularly challenging in price-sensitive markets where cost considerations heavily influence purchasing decisions. In addition, the complexity involved in installing and maintaining linear-motion bearing systems can act as a barrier to market growth. These systems often require specialized knowledge and skills for proper installation, alignment, and maintenance. The lack of trained personnel and the need for specialized equipment can increase operational costs and downtime, discouraging potential users from adopting these advanced systems.

Type Insights

Based on the type, the market is segmented into single-axis LMS and multi-axis LMS. The single-axis linear motion system segment held the largest market share of 57.82% in 2023. Single-axis linear motion systems are relatively simpler in design and operation compared to multi-axis systems. Their straightforward construction makes them more cost-effective, both in terms of initial investment and maintenance. For many applications, especially those in industries where budget constraints are significant, the affordability of single-axis systems is a key advantage. They provide the necessary functionality without the complexity and expense associated with more advanced multi-axis systems.

The multi-axis linear motion segment registered the highest CAGR of 6.6% over the forecast period. The growing complexity and versatility of modern industrial applications have driven the demand for multi-axis linear motion systems. These systems offer enhanced capabilities for handling more sophisticated tasks that require coordinated movements across multiple axes. Industries such as robotics, aerospace, and manufacturing increasingly rely on multi-axis systems for precise and complex operations, contributing to the segment's rapid growth. Moreover, manufacturing processes across various industries, including electronics, automotive, and semiconductors, require high precision and efficiency. Multi-axis linear motion systems provide the necessary precision for intricate manufacturing tasks, such as assembling electronic components or machining complex parts.

End-use Insights

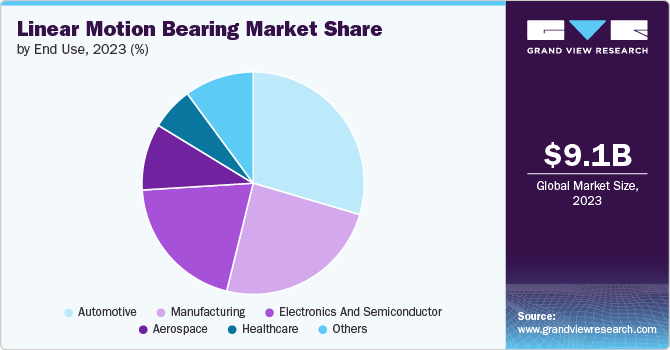

The automotive segment held the largest market share of 29.56% in 2023. The automotive industry requires highly precise and durable components to ensure the reliable operation of vehicles. Linear-motion bearings are crucial in various automotive manufacturing processes, including assembly lines, robotics, and automation systems. The need for precision and durability in these processes drives the demand for high-quality linear-motion bearings, contributing to the industry's dominance in the market. Moreover, the automotive industry is forefront of technological advancements and innovations. The development of electric vehicles (EVs), autonomous driving technologies, and advanced driver-assistance systems (ADAS) requires sophisticated manufacturing processes and high-performance components. Linear-motion bearings are essential for producing these advanced automotive technologies, further boosting their demand in the industry.

The electronics and semiconductor segment registered the highest CAGR of 8.0% over the forecast period. Rapid technological advancements and constant innovation characterize the electronics and semiconductor industry. The need to produce increasingly complex and miniaturized electronic components drives the demand for highly precise and reliable linear-motion bearings. These bearings are essential in manufacturing processes that require exact positioning, such as wafer processing, PCB assembly, and semiconductor fabrication. The continuous innovation in this sector creates a growing market for advanced linear-motion bearing solutions, contributing to the high CAGR. In addition, the electronics and semiconductor industry adopt advanced manufacturing techniques like surface mount technology (SMT), 3D printing, and nanotechnology. These techniques require precise and reliable linear motion components to achieve high-quality outputs. Linear-motion bearings play a crucial role in these advanced processes, ensuring the accuracy and efficiency needed for cutting-edge production methods.

Regional Insights

Asia Pacific accounted for the largest revenue share of 37.24% in 2023 and is expected to continue its dominance over the forecast period. Rapid industrialization and infrastructure development in Asia Pacific countries have spurred demand for automation and advanced manufacturing technologies. Linear-motion bearings are crucial components in automated systems and machinery, further boosting their consumption in the region. In addition, countries like China, Japan, South Korea, and Taiwan in Asia Pacific serve as global hubs for manufacturing. The region's extensive industrial base and manufacturing capabilities drive significant demand for linear-motion bearings used in various machinery and equipment across industries such as automotive, electronics, semiconductor, and industrial machinery.

North America Linear Motion Bearing Market Trends

The North America market is projected to grow at a significant CAGR of 5.3% over the forecast period. North American manufacturers are at the forefront of technological advancements in linear-motion bearings, focusing on innovations that improve efficiency, reduce maintenance costs, and enhance operational performance. This innovation drives replacement and upgrade cycles, further stimulating demand. In addition, the region's strong manufacturing base, particularly in the U.S. and Mexico, continues to drive demand for linear-motion bearings. These components are integral to machinery used in manufacturing processes, such as CNC machines, material handling equipment, and assembly lines.

U.S. Linear Motion Bearing Market Trends

The linear-motion bearing market in the U.S. held the largest revenue share of 74.2% in 2023 in North America. U.S. industries are significantly adopting automation and robotics to enhance productivity, efficiency, and operational flexibility. Linear-motion bearings play a crucial role in these automated systems, driving their demand in the market. Moreover, ongoing investments in infrastructure projects across the U.S., including transportation (railways, highways), construction, and renewable energy sectors, contribute to the demand for linear-motion bearings used in heavy-duty applications.

Europe Linear Motion Bearing Market Trends

The linear-motion bearing market in Europe is embracing automation and Industry 4.0 initiatives across its manufacturing sectors. Linear-motion bearings are critical components in automated production lines, robots, CNC machines, and other industrial equipment, driving their demand in the market. In addition, Europe has stringent regulatory standards and quality requirements for industrial components, including bearings. This drives demand for bearings that meet environmental and safety standards, encouraging innovation and product development in the market.

Key Linear Motion Bearing Company Insights

Some of the key companies operating in the market include NSK Ltd., Bosch Rexroth AG, among others.

-

NSK Ltd., headquartered in Tokyo, Japan, is a multinational corporation specializing in manufacturing and distributing bearings and precision components. The company operates in 3 business segments: automotive, industrial machinery, and others. The industrial machinery segment offers industrial machinery bearings and precision components. Its product range spans from miniature to extra-large bearings, serving diverse industrial applications. This segment also includes precision machinery and parts such as ball screws, linear guides, and mechatronics components like the Megatorque Motor. The company operates a global network of manufacturing facilities, sales offices, and distribution centers strategically located to serve diverse industries worldwide, including automotive, industrial machinery, aerospace, medical equipment, and more.

PBC Linear and Thomson Industries Inc. are some of the emerging market companies in the target market.

-

Thomson Industries Inc., an Altra Industrial Motion Corp. subsidiary, specializes in motion control technologies, particularly linear motion systems. They provide a comprehensive range of products, including linear actuators, linear bearings, ball screws, and linear guides. Thomson Industries Inc. serves various industries, such as aerospace, automotive, medical, packaging, and material handling, offering solutions that enhance precision, efficiency, and reliability in mechanical operations. The company offers its products and services in Europe, Asia, and America.

Key Linear Motion Bearing Companies:

The following are the leading companies in the linear motion bearing market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch Rexroth AG (Robert Bosch GmbH)

- SCHNEEBERGER Group

- Ewellix (Schaeffler Group)

- Hiwin Corporation

- Thomson Industries Inc.

- Rockwell Automation

- THK Co., Ltd.

- Nippon Thompson Co., Ltd.

- NSK Ltd.

- PBC Linear

Recent Developments

-

In March 2024, NSK Ltd. announced that they had developed a new high-performance bearing designed specifically for servomotors that feature low particle emissions. This innovation is aimed at enhancing the performance and reliability of servomotors, which are critical components in precision machinery and automation systems. The bearing reduces contamination and particle emissions, contributing to cleaner and more efficient operation. This makes it particularly suitable for use in clean environments and industries where maintaining low levels of contaminants is crucial, such as semiconductor manufacturing and cleanroom applications. NSK's new bearing technology aims to extend the lifespan and efficiency of servomotors while ensuring high performance in demanding conditions.

-

In March 2023, Ewellix (Schaeffler Group) launched a new range of actuators designed for factory automation and handling applications. These actuators offer high performance, precision, and reliability, enabling improvements in operational efficiency and productivity. Ewellix emphasizes the robustness and adaptability of their actuators, which can be customized to meet specific application requirements. The new product range is aimed at industries such as automotive, packaging, and general manufacturing, providing solutions that enhance automation processes and support advanced manufacturing technologies.

-

In January 2023, Thomson Industries, Inc. announced a new compact linear motion system designed to offer modularity for small-space application development. This system aims to provide flexibility and ease of integration in constrained environments where space optimization is critical. Leveraging modular components enables engineers and developers to customize and scale their linear motion solutions according to specific application requirements. This innovation is intended to enhance efficiency and simplify the design process for industries such as automation, medical devices, packaging, and more, where compact and precise linear motion capabilities are essential.

Linear Motion Bearing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.46 billion |

|

Revenue forecast in 2030 |

USD 13.21 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Bosch Rexroth AG (Robert Bosch GmbH); SCHNEEBERGER Group; Ewellix (Schaeffler Group); Hiwin Corporation; Thomson Industries Inc.; Rockwell Automation; THK Co., Ltd.; Nippon Thompson Co., Ltd.; NSK Ltd.; PBC Linear |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Linear Motion Bearing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global linear motion bearing market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single-axis Linear Motion System

-

Multi-axis Linear Motion System

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Electronics and Semiconductor

-

Manufacturing

-

Aerospace

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global linear motion bearing market size was estimated at USD 9.13 billion in 2023 and is expected to reach USD 9.46 billion in 2024.

b. The global linear motion bearing market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 13.21 billion by 2030.

b. The single-axis linear motion system segment claimed the largest market share of 57.8% in 2023 in the linear-motion bearing market. The primary driver is the widespread adoption of single-axis linear motion systems in various industries due to their simplicity, cost-effectiveness, and ease of installation. Additionally, single-axis systems are particularly popular in applications requiring straightforward linear motion control, such as automation, packaging, and material handling. Its ability to provide precise, reliable motion along a single axis makes it ideal for tasks where multidirectional movement is not required.

b. Prominent players in the linear motion bearing market are Bosch Rexroth AG, SCHNEEBERGER Group, Ewellix (Schaeffler Group), Hiwin Corporation, Thomson Industries Inc., Rockwell Automation, THK Co., Ltd., Nippon Thompson Co., Ltd., NSK Ltd., PBC Linear.

b. The growth of the linear-motion bearing market is driven by increasing automation, technological advancements, demand for precision, expansion in key end-user industries, economic growth, energy efficiency, customization capabilities, low maintenance requirements, and the need for cleanroom-compatible solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."