Linear LED Strip Fixture Market Size, Share, & Trends Analysis Report By Output Voltage (12V, 24V), By Application (Retail, Hospitality), By Mounting Type, By Fixture Wattage, By Color Temperature, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-095-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

The global linear LED strip fixture market size was estimated at USD 2.13 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. The need for smart lighting solutions is likely to increase as a result of the strong growth being seen by the market for linear LED strip fixtures, which is primarily driven by an increase in new construction across the residential, commercial, and industrial sectors. In addition, it is anticipated that government prohibitions on the use of incandescent lighting and different incentive schemes will promote the use of linear LED strip fixtures. Because of advantages including lower power consumption, longer life, and accessibility to a variety of contemporary decorative lighting items, the use of linear LED strip fixtures is anticipated to grow.

When compared to alternative light sources like fluorescent, halogen, and CFL lights, the demand for LED strips from the business sector is rising. Similarly, governments are concentrating on promoting the usage of LED lighting solutions with a focus on reducing energy consumption, which is anticipated to help the growth of the linear LED strip fixture market. One of the main reasons influencing the need for linear LED strip fixture solutions is the increase in building construction. It is anticipated that new commercial and industrial buildings would generate a significant amount of demand for smart LED lighting solutions.

Moreover, it is anticipated that government prohibitions on the use of incandescent lighting and different incentive programs to promote the use of linear LED strip fixtures will open new growth opportunities for the manufacturers of those fixtures. Despite the COVID-19 pandemic, new home development is still taking place in India, the U.S., UAE, and other nations. The COVID-19 pandemic has not stopped new residential development in California since the state government has classified construction, including residential construction, as an essential service as the housing shortage was already the most urgent problem faced by the state before the pandemic.

The need for linear LED strip fixture solutions has been expanding, along with the replacement of the existing lighting fixtures, as more new homes, hospitals, malls, and businesses are being built. Particularly, households prefer stylish, opulent lighting. Consumers looking to improve the aesthetic appeal of their houses are likely to adopt premium decorative lights. By incorporating linear LED stripes in the kitchen, wardrobe, stairway, etc., interior designers improve the home's atmosphere. As required by homeowners, these stripes can produce the right impression and atmosphere. For instance, John Cullen's linear LED stripes can be utilized to highlight items like decorations, books, and workstations as well as to generate enticing levels of light in a place.

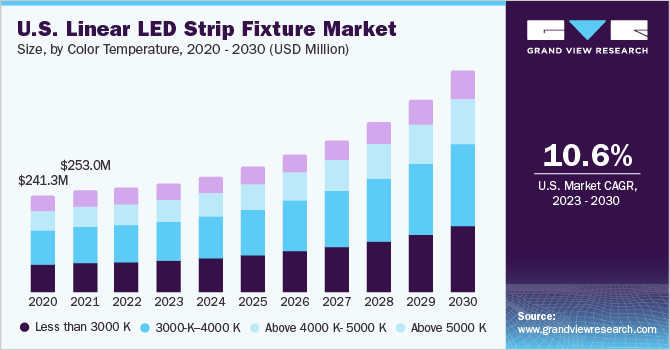

Color Temperature Insights

The 3000 K-4000 K segment accounted for the largest revenue share of 33.2% in 2022. LED technology is significantly more energy efficient than conventional lighting sources like incandescent bulbs or fluorescent tubes. With a mix of warm and cool lighting, LED linear fixtures in the 3000- to 4000-K color temperature range are appropriate for a variety of indoor lighting applications. In residential, business, and hospitality environments, the 3000-K to 4000-K color temperature range is frequently selected for general lighting applications.

The less than 3000 K segment is expected to register the fastest CAGR of 12.6% over the forecast period. Low-color temperature LED linear fixtures give forth a soft, comforting light that makes a space feel warm and welcoming. These fixtures are frequently chosen for home settings including living rooms, bedrooms, and dining rooms where people want a cozy and laid-back atmosphere. Owing to these factors, many residential, commercial, and hospitality applications prefer LED linear lamps with a color temperature below 3000 K.

Output Voltage Insights

The 24V segment accounted for the largest revenue share of 52.0% in 2022. Compared to their 12V counterparts, 24V LED linear fixtures have the advantage of supporting longer continuous runs. A greater voltage reduces the voltage drop along the strip, enabling longer deployments without noticeable fluctuations in light output. This makes 24V LED linear fixtures perfect for significant projects that need consistent lighting over long distances. The 12V segment is expected to register a CAGR of 11.3% from 2023 to 2030.

12V LED linear fixtures are incredibly adaptable and simple to install in a variety of applications. They are frequently employed in smaller-scale initiatives or places with constrained space. Due to their small size, 12V strips can be installed in a variety of places, including awkward angles, curved surfaces, and complex patterns. Residential spaces like restrooms, bedrooms, home theatres, and kitchens frequently use 12V LED linear lighting. They are widely used to produce ambient or mood lighting effects, accent lighting, and under-cabinet lighting. They are suitable for DIY projects due to their low voltage and easy installation.

Fixture Wattage Insights

The 15W to 50W segment accounted for the largest revenue share of more than 54.0% in 2022. Compared to lower wattage options, LED linear lighting in the 15W to 50W power range have higher brightness and light output. Due to this, they are appropriate for applications requiring more intense lighting, such as those for big commercial venues, outdoor signage, or architectural lighting where visibility is essential. The above 50W segment is expected to witness a significant CAGR of 11.2% from 2023 to 2030.

In industrial and commercial spaces requiring powerful lighting, LED linear lights with power ratings above 50W are frequently employed. Large spaces like warehouses, factories, sports arenas, or outdoor stadiums might benefit from the high-brightness lighting provided by these fixtures. On account of the higher power, they can produce enough light for such demanding applications.

Mounting Type Insights

The recessed segment accounted for the largest share of 37.4% in 2022. LED linear fixtures can be covertly concealed into ceilings, walls, or other surfaces due to recessed installation. This gives the area a clean, minimalist look that improves its overall beauty. It is common for modern and contemporary settings to use recessed fixtures since they offer seamless integration with the architecture and interior design. The surface segment is expected to grow at a CAGR of 12.6% over the forecast period. Surface-mounting LED linear fixtures are comparatively easy to install.

Without requiring any cutting or architectural modification, they can be placed directly onto ceilings, walls, or other surfaces. They are appropriate for both new building projects and retrofit applications. LED linear fixtures with surface mounting can be positioned in a variety of positions and directions, providing versatility in lighting design. They enable imaginative and personalized lighting setups as they can be installed in straight lines, curves, or patterns. Surface-mounted linear lighting fixtures are adaptable for illuminating various areas and architectural details.

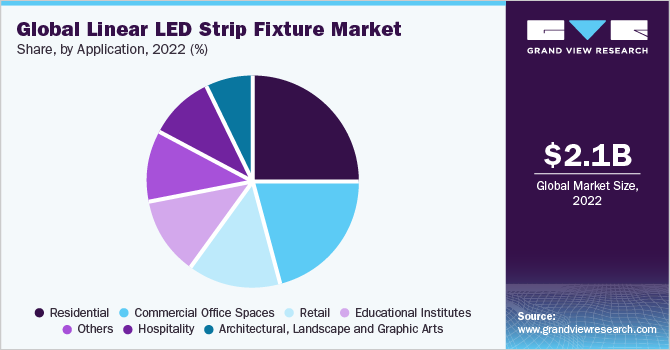

Application Insights

The residential segment accounted for the largest market share of more than 25.1% in 2022. Modern residential interiors are complemented by the sleek and contemporary design of LED linear lighting. The linear form factor gives home areas a neat, basic appearance that has a hint of refinement. Since they are adaptable, LED linear fixtures can be employed in a variety of household settings. They are frequently used in dining rooms, corridors, living rooms, and home offices. They offer both ambient and task lighting, brightly illuminating the area and improving vision for daily tasks.

The commercial office spaces segment is expected to witness a CAGR of 13.3% from 2023 to 2030. When compared to conventional fluorescent or incandescent lighting alternatives, linear LED strip fixtures are well renowned for their superior energy efficiency. Since commercial office buildings frequently operate for lengthy periods of time, the energy savings offered by linear LED strip fixtures can significantly lower the cost of electricity bills. They provide consistent and even lighting across the office, eliminating glare and fostering a pleasant working environment. This lessens the strain on the eyes of employees, thereby boosting productivity. In addition, by distributing the light evenly throughout the office, dark spots, and uneven illumination are eliminated.

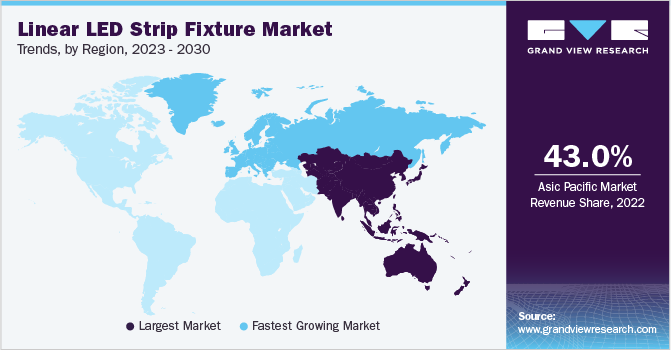

Regional Insights

The Asia Pacific regional market dominated the global industry market in 2022 and accounted for the largest share of 43.0% in the same year. Construction of office buildings, retail stores, and residential complexes are among the many signs of the region's rapid urbanization and infrastructure development. For these applications, linear LED strip fixtures are recommended due to their high energy efficiency, durable construction, and varied illumination capabilities. To encourage the use of sustainable lighting options, many nations in the Asia Pacific region have established energy efficiency laws and government initiatives.

Linear LED fixtures assist companies and organizations in adhering to these rules by meeting the strict energy efficiency criteria. Europe is anticipated to rise as the fastest-growing regional market at a CAGR of 12.6% over the forecast period. Energy efficiency programs and environmentally friendly behaviors have been pioneered in Europe. Energy-efficient lighting options like LED linear fixtures have become more popular as a result of EU legislation and efforts, such as the Eco-design Directive and Energy Performance of Buildings Directive. These factors support the market growth in Europe.

Key Companies & Market Share Insights

Industry participants utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions, to gain higher revenue shares. For instance, in October 2021, Cree Lighting introduced the CPY500 Series, a series of canopy lighting solutions with a modern and innovative design that provides curb appeal and visual comfort. The introduction of the new series is expected to help the company with widening its customer base and strengthening its position in the lighting industry. Some of the prominent players in the global linear LED strip fixture market include:

-

Acclaim Lighting, LLC

-

Acolyte LED

-

Acuity Brands Lighting, Inc.

-

American Lighting, Inc.

-

Cree Lighting

-

Ecosense

-

Elemental LED, Inc. (Diode LED)

-

Haichang Optotech Co., Ltd

-

Hubbell Inc.

-

Insight Lighting

-

Kelvix LLC

-

Ledrise Limited (Lumistrips)

-

LLI ARCHITECTURAL LIGHTING

-

Luminii

-

Nova Flex LED

-

OSRAM GmbH

-

Q-Tran Inc.

-

Signify Holding

Linear LED Strip Fixture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2.24 billion |

|

Revenue forecast in 2030 |

USD 4.97 billion |

|

Growth rate |

CAGR of 12.0% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Color temperature, output voltage, fixture wattage, mounting type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Acclaim Lighting, LLC; Acolyte LED; Acuity Brands Lighting, Inc.; American Lighting, Inc.; Cree Lighting; Ecosense; Elemental LED, Inc. (Diode LED); Haichang Optotech Co., Ltd.; Hubbell Inc.; Insight Lighting; Kelvix LLC; Ledrise Ltd. (Lumistrips); LLI ARCHITECTURAL LIGHTING; Luminii; Nova Flex LED; OSRAM GmbH; Q-Tran Inc.; Signify Holding |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Linear LED Strip Fixture Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the linear LED strip fixture market based on color temperature, output voltage, fixture wattage, mounting type, application, and region:

-

Color Temperature Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 3000 K

-

3000-K- 4000 K

-

Above 4000 K- 5000 K

-

Above 5000 K

-

-

Output Voltage Outlook (Revenue, USD Billion, 2018 - 2030)

-

5 V

-

12 V

-

24 V

-

-

Fixture Wattage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 15 W

-

15 W to 50 W

-

Above 50 W

-

-

Mounting Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Suspended

-

Recessed

-

Surface

-

Pendant

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Hospitality

-

Architectural, Landscape and Graphic Arts

-

Educational Institutes

-

Commercial office Spaces

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global linear LED strip fixture market size was estimated at USD 2.13 billion in 2022 and is expected to reach USD 2.24 billion by 2023.

b. The global linear LED strip fixture market is expected to grow at a compound annual growth rate of 12.0% from 2023 to 2030 to reach USD 4.97 billion by 2030.

b. 3000-K–4000 K dominated the linear LED strip fixture market with a share of 33.24% in 2022. This is attributable to the propelling demand for a mix of warm and cool lighting, LED linear fixtures in the 3000- to 4000-K color temperature range are appropriate for a variety of indoor lighting applications.

b. Some key players operating in the linear LED strip fixture market include Linear LED Strip Fixture Acclaim Lighting, LLC, Acolyte LED, Acuity Brands Lighting, Inc., American Lighting, Inc., CREE LIGHTING, Ecosense, Elemental LED, Inc. (Diode LED), Haichang Optotech Co., Ltd, Hubbell Incorporated, Insight Lighting, Kelvix LLC, Ledrise Limited (Lumistrips), LLI ARCHITECTURAL LIGHTING, Luminii, Nova Flex LED, OSRAM GmbH, Q-Tran Inc, and SIGNIFY HOLDING.

b. Key factors driving the linear LED strip fixture market growth is the use of incandescent lighting and different incentive programs to promote the use of linear LED strip fixture will open new growth opportunities for the manufacturers of those fixtures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."