- Home

- »

- Petrochemicals

- »

-

Linear Alkyl Benzene Market Size And Share Report, 2030GVR Report cover

![Linear Alkyl Benzene Market Size, Share & Trends Report]()

Linear Alkyl Benzene Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Linear Alkylbenzene Sulfonates (LAS), Other Applications), By Region, And Segment Forecasts

- Report ID: 978-1-68038-185-6

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Linear Alkyl Benzene Market Summary

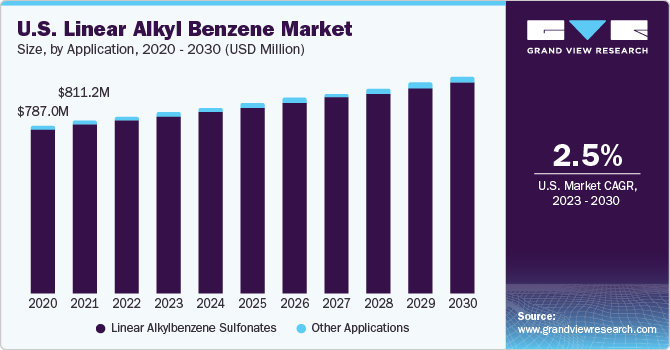

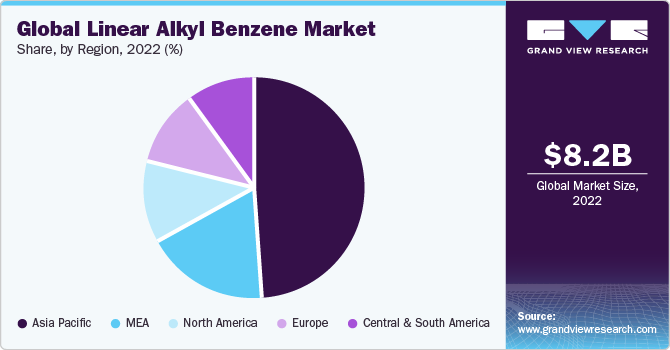

The global Linear Alkyl Benzene (LAB) market was estimated at USD 8.16 billion in 2022 and is projected to reach USD 11.54 billion by 2030, growing at a CAGR of 4.4% from 2023 to 2030. Rising demand for household and industrial cleaners is expected to stimulate the growth of the market. Increasing consumer spending is also anticipated to work in favor of the market.

Key Market Trends & Insights

- Asia Pacific dominated the global market in 2022 with a 48.5% revenue share.

- By application, the LAS segment held the largest revenue share of 97.7% in 2022.

- The other applications segment is expected to grow at the fastest CAGR of 5.7% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 8.16 Billion

- 2030 Projected Market Size: USD 11.54 Billion

- CAGR (2023-2030):4.4%

- Asia Pacific: Largest market in 2022

Universal Oil Products (UOP) Process is the most widely accepted method used for production and employs hydrogenated kerosene or n-paraffins as a major feedstock. Nearly all LAB produced is sulfonated to produce LAS/LABSA or directly supplied to various end-use industries. Major petroleum and petrochemical companies such as ExxonMobil, Shell, Sasol, and Chevron supply kerosene and benzene for the production of linear alkyl benzene (LAB). Sasol and Chevron have integrated their operations forward as they use their feedstock to produce LAB in order to reduce supplier costs.

The industry exhibits a moderate level of vertical integration. LAB is either converted to linear alkylbenzene sulfonate (LAS) or directly supplied for end-user applications. Few LAB producers have their source of kerosene. Cespa a Spain-based oil company acquired PETRESA to venture into the LAB industry. Forward integration helped the company to get a competitive edge.In addition, the growth of the cleaning industry is poised to have a positive influence on the regional market during the forecast period.

Demand for linear alkyl benzene is directly influenced by trends in the FMCG industry, which is considered to be a highly dynamic and commoditized industry. LAB is manufactured using petrochemicals and its price is directly linked with the prices of petrochemicals such as benzene. Hence, protean prices of benzene can be a major challenge for market participants over the forecast period.

To reduce reliance on petrochemical-derived LAB, the industry has shifted its focus towards the development of bio-based alternatives. Major chemical manufacturers have been forming joint ventures and collaborating with leading biotechnology firms to synergize their operations to manufacture bio-based alternatives.

Moreover, there is an increased demand for liquid soaps and detergents as consumers are shifting away from conventional soaps and detergents. Liquid detergents have higher surfactant levels per wash load compared to powder detergents. Liquids detergents are relatively costlier than conventional ones and consumers have been observed to pay that higher price for a premium product due to their increasing spending patterns. This trend is likely to drive the demand during the forecast period.

Application Insights

The linear alkylbenzene sulfonates (LAS) segment held the largest revenue share of 97.7% in 2022. The lower cost of laundry powders, as compared to laundry liquids, is anticipated to fuel the demand for linear alkylbenzene sulphonate. This, in turn, is estimated to escalate the growth of the linear alkyl benzene market. Moreover, LAS can be easily processed in powder form and has no adverse impact on enzyme stability. However, increased preference for liquid-based detergent products is poised to restrict the demand for LAS in laundry powders over the forecast period.

The other applications segment is expected to grow at the fastest CAGR of 5.7% over the forecast period. Light duty dish-washing liquids are intended for use in handwashing of dinnerware, hand laundering of fine fabrics, and hosier in automotive and industrial applications. Most of the companies in the market use LAS in combination with minute quantities of AES and fatty alkanolamides (FAA). Demand for LAS in light-duty washing liquids is expected to grow due to its increasing use in automatic dishwashers. Also, light-duty washing liquids also find their use in kitchen applications on stoves and countertops. Such trends are expected to benefit the market growth.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 48.5% in 2022 and is expected to grow at the fastest CAGR of 5.2% during the forecast period. The global LAB industry is highly fragmented and is likely to somewhat consolidate due to market participants from China and the Middle East.

The global market is forecasted to witness a significant increase in production capacity, particularly in high-growth regions such as the Middle East and the Asia Pacific. These regions, along with providing substantial potential demand centers, also offer advantages such as low-priced feedstock and competitive labor costs, in contrast to North America and Europe. Industry participants are shifting focus towards developing bio-based alternatives to achieve sustainability.

Key Companies & Market Share Insights

The market is highly competitive, with large number of manufacturers accounting for a majority of market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. Some of the prominent players in the global linear alkyl benzene market:

-

Sasol

-

Cepsa

-

Chevron Phillips Chemical

-

Deten Quimica

-

Fushun Petrochemicals

-

Honeywell

-

Huntsman Corporation

-

ISU Chemical

-

Jintung Petrochemical

-

Reliance Aromatics and Petrochemicals Pvt. Ltd

-

Unggul Indah Cahaya

Recent Developments

-

In January 2023, Cepsa unveiled a groundbreaking achievement - the world's first sustainable linear alkylbenzene. This remarkable innovation has revolutionized the synthesis of high-performance detergents, significantly mitigating their environmental impact. The new product is part of the NextLab family, a line of products dedicated to minimizing carbon footprints and promoting sustainability.

-

In July 2022, Sasol Chemicals accomplished significant sustainability milestones across its three largest European sites. The company received prestigious certifications from the International Sustainability and Carbon Certification (ISCC) system for their implementation of mass-balanced bio-based and recycled feedstocks in the production of alcohols, linear alkylbenzenes, and derivatives. This groundbreaking and innovative approach played a pivotal role in effectively reducing the company's carbon footprint.

Linear Alkyl Benzene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.51 billion

Revenue forecast in 2030

USD 11.54 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; & MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Sasol; CEPSA Quimica S.A.; Chevron Phillips Chemical; Deten Quimica; Fushun Petrochemicals; Honeywell; Huntsman Corporation; ISU Chemical; Jintung Petrochemical; Reliance Aromatics and Petrochemicals Pvt. Ltd; Unggul Indah Cahaya

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Linear Alkyl Benzene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global linear alkyl benzene market report on the basis of application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear Alkylbenzene Sulfonates (LAS)

-

Heavy-duty Laundry Liquids

-

Laundry Powders

-

Light-duty dish-washing Liquids

-

Industrial Cleaners

-

Household Cleaners

-

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global linear alkyl benzene market size was estimated at USD 8.16 billion in 2022 and is expected to reach USD 8.51 billion in 2023.

b. The global linear alkyl benzene market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 11.54 billion by 2030.

b. Asia Pacific dominated the linear alkyl benzene market with a share of 48.5% in 2022. This is attributable to its ability to provide substantial potential demand centers, also offering advantages such as low-priced feedstock and competitive labor costs

b. Some key players operating in the linear alkyl benzene market include ISU Chemical, CEPSA, Fushun Petrochemicals, Huntsman Performance Products, Jin Tung Petrochemicals

b. Key factors that are driving the market growth include increasing demand for household and industrial cleaners and rising consumer spending across regions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.