- Home

- »

- Automotive & Transportation

- »

-

Light-duty Truck Steering System Market Size Report, 2030GVR Report cover

![Light-duty Truck Steering System Market Size, Share & Trends Report]()

Light-duty Truck Steering System Market Size, Share & Trends Analysis Report By Type, By Vehicle Type (Pick Up Truck, Vans), By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-401-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

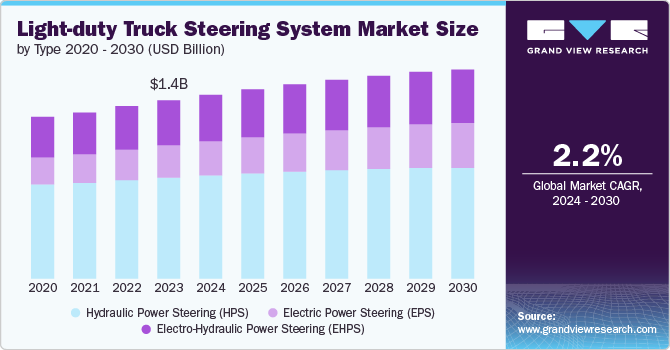

The global light-duty truck steering system market size was estimated at USD 1.42 billion in 2023 and is projected to grow at a CAGR of 2.2% from 2024 to 2030. The market growth is primarily driven by the increasing demand for light-duty trucks in various industries such as logistics, construction, and agriculture. These vehicles are essential for transporting goods and materials, making them indispensable in these sectors. In addition, the rise in e-commerce has led to a surge in delivery services, further boosting the demand for light-duty trucks and, consequently, their steering systems. The emphasis on driver safety and comfort is another significant driver, as manufacturers focus on developing steering systems that offer better handling, control, and reduced driver fatigue.

Technological advancements have significantly transformed light-duty truck steering systems, leading to enhanced performance and safety features. The integration of electronic power steering (EPS) systems has replaced traditional hydraulic steering, offering improved fuel efficiency, reduced weight, and easier maintenance. Advanced driver assistance systems (ADAS) are also being incorporated into steering systems, enabling features like lane-keeping assist and automatic parking. Furthermore, the development of steer-by-wire technology, which replaces mechanical linkages with electronic controls, promises to revolutionize the market by providing more precise steering responses and facilitating the integration of autonomous driving systems

Government initiatives aimed at reducing vehicle emissions and improving road safety are playing a crucial role in shaping the global market. Regulations that mandate the reduction of CO2 emissions have pushed manufacturers to develop more efficient steering systems that contribute to overall vehicle fuel economy. In addition, safety regulations that require the incorporation of advanced safety features, such as ADAS, have driven the adoption of new steering technologies. Incentives and subsidies for the development and adoption of electric and hybrid light-duty trucks are also encouraging innovation in steering systems to support these eco-friendly vehicles.

Manufacturers are increasingly focusing on the development of innovative steering systems for light-duty trucks to meet the evolving demands of the market. Companies are investing in research and development to create systems that enhance vehicle performance, safety, and driver comfort. The shift towards electric and autonomous vehicles is pushing manufacturers to develop steering systems that are compatible with these new technologies. Collaborations and partnerships with technology firms are also becoming more common as manufacturers seek to integrate advanced electronics and software into their steering systems. The focus on reducing the overall weight of steering systems to improve fuel efficiency is another area where manufacturers are concentrating their efforts.

The market presents several key opportunities for growth. The increasing adoption of electric vehicles (EVs) and hybrid light-duty trucks is creating a demand for new steering systems that are compatible with these powertrains. The expansion of the logistics and e-commerce sectors, particularly in emerging markets, offers significant opportunities for market growth as the demand for efficient and reliable light-duty trucks rises. In addition, the growing interest in autonomous driving technology provides an avenue for the development of advanced steering systems that can support self-driving capabilities. Besides, the need for efficient last-mile delivery solutions presents opportunities for manufacturers to develop compact and highly maneuverable steering systems for urban light-duty trucks.

Type Insights

Based on type, the hydraulic power steering (HPS) segment led the market with the largest revenue share of 56.65% in 2023. HPS has maintained a significant share in the global market due to its established reliability, robust performance, and familiarity within the industry. HPS systems offer a consistent steering feel and strong assistance, especially in vehicles requiring high torque, making them a preferred choice for light-duty trucks. This system operates by using hydraulic fluid to amplify the steering input from the driver, providing enhanced control and ease of maneuverability. Despite the increasing adoption of newer technologies, HPS remains popular because of its proven durability and the long-standing trust of manufacturers and consumers alike in its performance under demanding conditions.

The electric power steering (EPS) segment is anticipated to grow at the fastest CAGR over the forecast period, due to the broader automotive industry's shift towards electrification and energy efficiency. Unlike Hydraulic Power Steering, EPS uses an electric motor to assist the driver, reducing the need for a hydraulic pump, hoses, and fluid, which translates into lower maintenance costs and improved fuel efficiency. The growing emphasis on reducing vehicle emissions and improving fuel economy is accelerating the adoption of EPS, especially as it aligns with the trend towards more sustainable and lightweight vehicle designs. In addition, the technological advancements in EPS, such as variable assistance and integration with advanced driver-assistance systems (ADAS), make it an attractive option for modern light-duty trucks, further propelling its market growth.

Vehicle Type

Based on vehicle type, the pick-up trucks segment led the market with the largest revenue share of 67.29% in 2023. Pickup trucks have consistently dominated the market, largely due to their widespread use across various industries and consumer segments. These vehicles are highly favoured for their versatility, robust performance, and ability to handle both personal and commercial tasks efficiently. The strong demand for pickup trucks, especially in regions like North America, where they are a staple on the roads, has translated into a significant market share for steering systems designed specifically for these vehicles. In addition, advancements in technology have led to the development of more sophisticated steering systems that enhance the driving experience, contributing to the sustained high market share of pickup trucks.

The significant growth of the vans segment is attributed to the rising demand for efficient urban delivery and passenger transport solutions. Vans are increasingly being adopted by logistics companies, especially with the surge in e-commerce, which requires reliable and agile vehicles to navigate urban environments. This demand has spurred significant innovations in steering system technologies tailored to vans, focusing on manoeuvrability, fuel efficiency, and driver comfort. Moreover, the expanding electric van market, supported by stringent emissions regulations and growing environmental consciousness, has further accelerated the growth of this segment. As businesses and consumers alike prioritize sustainability and efficiency, the vans segment is expected to continue its robust expansion in global market.

Sales Channel Insights

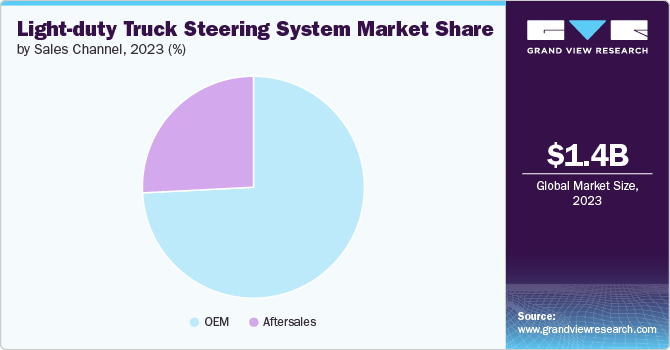

Based on sales channels, the OEM segment led the market with the largest revenue share of 85.35% in 2023.The Original Equipment Manufacturer (OEM) segment holds a significant share in the global market. This dominance can be attributed to the increasing demand for new vehicles, coupled with advancements in steering technologies that OEMs are rapidly adopting. OEMs benefit from established relationships with automakers, enabling them to integrate the latest innovations seamlessly into new vehicle models. In addition, the rising emphasis on safety and efficiency in vehicle design has prompted OEMs to develop steering systems that meet stringent regulatory standards. As automakers continue to focus on improving vehicle performance and enhancing the driving experience, the reliance on OEMs for high-quality, reliable steering systems is expected to remain strong.

The aftermarket segment is expected to grow at a significant CAGR over the forecast period. As vehicles age, the demand for replacement parts, including steering systems, increases, fueling the expansion of the aftermarket sector. In addition, many consumers are opting to extend the life of their existing vehicles rather than purchasing new ones, leading to a surge in the demand for aftermarket steering components. The aftermarket segment also benefits from the availability of cost-effective solutions and the growing trend of customization among truck owners who seek to enhance their vehicle's performance. Furthermore, the increasing penetration of e-commerce platforms has made it easier for consumers to access a wide range of aftermarket parts, contributing to the segment's rapid growth.

Regional Insights

TheNorth America light-duty truck steering system marketis expected to grow at the fastest CAGR of 1.8% from 2024-2030. The robust demand for light-duty trucks, especially in the United States and Canada, is driving thelight-duty truck steering system. This demand is fuelled by the increasing preference for pickup trucks for both personal and commercial use. In addition, the region's strong automotive manufacturing base, coupled with advancements in steering technology like electronic power steering (EPS), supports market growth. Stringent safety regulations and consumer demand for enhanced driving comfort and safety features further drive innovation and adoption of advanced steering systems in this market.

U.S. Light-duty Truck Steering System Market Trends

The light-duty truck steering system market in the U.S. is driven by the high consumer demand for pickup trucks, which are among the top-selling vehicle types in the country. The market is also supported by the presence of major automotive manufacturers and their continuous investment in research and development to improve vehicle performance and safety. The push towards electrification and autonomous driving technology in the U.S. is also influencing the market, as steering systems are being upgraded to integrate with these advanced vehicle systems. In addition, the growing trend of vehicle customization and aftermarket modifications is contributing to the demand for advanced and specialized steering systems.

Asia Pacific Light-duty Truck Steering System Market Trends

Asia Pacific dominated the light-duty truck steering system market with the largest revenue share of 42.08% in 2023. The market growth in Asia Pacific is driven by rapid urbanization, industrialization, and the expansion of the e-commerce industry, which is increasing the demand for efficient light-duty trucks. Emerging economies like China and India are witnessing significant growth in their automotive sectors, driven by rising disposable incomes and government initiatives promoting domestic manufacturing. The increasing adoption of electric and hybrid vehicles in the region is also influencing the market growth, as manufacturers focus on developing systems compatible with these vehicles. Moreover, the growing focus on vehicle safety and the introduction of regulations mandating advanced safety features are propelling the adoption of advanced steering systems in light-duty trucks.

Europe Light-duty Truck Steering System Market Trends

The light-duty truck steering system market growth in Europe is primarily driven by stringent environmental regulations and the region’s strong emphasis on vehicle safety and efficiency. European consumers' preference for technologically advanced and environmentally friendly vehicles has led to increased demand for electric and hybrid light-duty trucks, which require sophisticated steering systems. The presence of leading automotive manufacturers in countries like Germany, France, and Italy, who are heavily investing in the development of innovative steering technologies, further propels market growth. In addition, the push towards autonomous driving and the development of smart cities are encouraging the adoption of advanced steering systems that integrate with broader vehicle automation and connectivity features.

Key Light-duty Truck Steering System Company Insights

Key players operating in the global market include Robert Bosch GmbH, JTEKT Corporation, Nexteer Automotive Group Limited, and among others. The companies are focusing on developing new products, partnerships, and collaborations to achieve a competitive edge over their competitors.

Key Light-duty Truck Steering System Companies:

The following are the leading companies in the light-duty truck steering system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- JTEKT Corporation

- Nexteer Automotive Group Limited

- Knorr-Bremse AG

- NSK Ltd.

- Thyssenkrupp AG

- Showa Corporation

- Mando Corporation

- Zhejiang Wanda Steering Gear Co. Ltd.

- TRW Automotive Holdings Corp.

Recent Developments

-

In September 2023, Titan has introduced a adavanced electric steering system designed specifically for niche, low-volume vehicle manufacturers. This system is ideal for both commercial vehicles and hypercars

-

In April 2023, Nexteer Automotive Group Limited Modular Rack-Assist Electric Power Steering (mREPS) system meets the demands of manufacturers as it advanced steering systems in EVs, light and heavy commercial vehicles

Light-duty Truck Steering System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.47 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 2.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, vehicle type, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Robert Bosch GmbH; JTEKT Corporation; Nexteer Automotive Group Limited; Knorr-Bremse AG; NSK Ltd.; Thyssenkrupp AG; Showa Corporation; Mando Corporation; Zhejiang Wanda Steering Gear Co. Ltd; TRW Automotive Holdings Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light-duty Truck Steering System Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global light-duty truck steering system market report based on type, vehicle type, sales channel, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pick Up Truck

-

Vans

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydraulic Power Steering (HPS)

-

Electric Power Steering (EPS)

-

Electro-Hydraulic Power Steering (EHPS)

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftersales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global light-duty truck steering system market size was estimated at USD 1.42 billion in 2023 and is expected to reach USD 1.47 billion in 2024.

b. The global light-duty truck steering system market is expected to grow at a compound annual growth rate of 2.2% from 2024 to 2030, reaching USD 1.67 billion by 2030.

b. The Hydraulic Power Steering (HPS) segment accounted for the largest market share, exceeding 56.6% in 2023. HPS has maintained a significant share in the light-duty truck steering system market due to its established reliability, robust performance, and familiarity within the industry. HPS systems offer a consistent steering feel and strong assistance, especially in vehicles requiring high torque, making them a preferred choice for light-duty trucks.

b. Some of the players operating in the light-duty truck steering system market include Robert Bosch GmbH, JTEKT Corporation, Nexteer Automotive Group Limited, Knorr-Bremse AG, NSK Ltd., Thyssenkrupp AG, Showa Corporation, Mando Corporation, Zhejiang Wanda Steering Gear Co., Ltd. and TRW Automotive Holdings Corp. among others.

b. The growth of the light-duty truck steering system market is primarily driven by the increasing demand for light-duty trucks in various industries such as logistics, construction, and agriculture.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."