- Home

- »

- Healthcare IT

- »

-

Lifestyle Diseases Apps Market Size & Share Report, 2030GVR Report cover

![Lifestyle Diseases Apps Market Size, Share & Trends Report]()

Lifestyle Diseases Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (iOS, Android), By Device (Smartphones, Tablets), By Indication (Obesity, Cardiovascular Health), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-984-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lifestyle Diseases Apps Market Trends

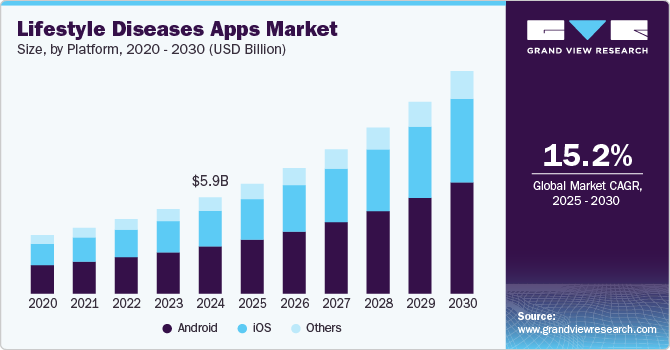

The global lifestyle diseases apps market size was estimated at USD 5.94 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. Factors such as a rising number of people focusing on healthy lives, the growing adoption of smartphones and wearable devices, and the availability of mobile health applications are contributing to the market growth. The increasing public awareness regarding lifestyle diseases linked to nutrition is boosting the demand for lifestyle disease management apps. For example, Cronometer is a comprehensive nutrition-tracking app that easily tracks diet and exercise habits. In addition, Cronometer Pro is available for healthcare professionals to track clients' nutrition targets.

Furthermore, the growing prevalence of lifestyle diseases such as diseases associated with alcohol and smoking, drug abuse, physical inactivity, atherosclerosis, and heart disease boost the market growth. For instance, the National Drug Strategy Household Survey 2022-2023, published by the Australian Institute of Health and Welfare, reported that around 1 in 5 individuals (17.9%) in Australia used an illicit drug in 2022-2023. This totals approximately 3.9 million individuals, an increase from 2019, when 3.4 million individuals used an illicit drug.

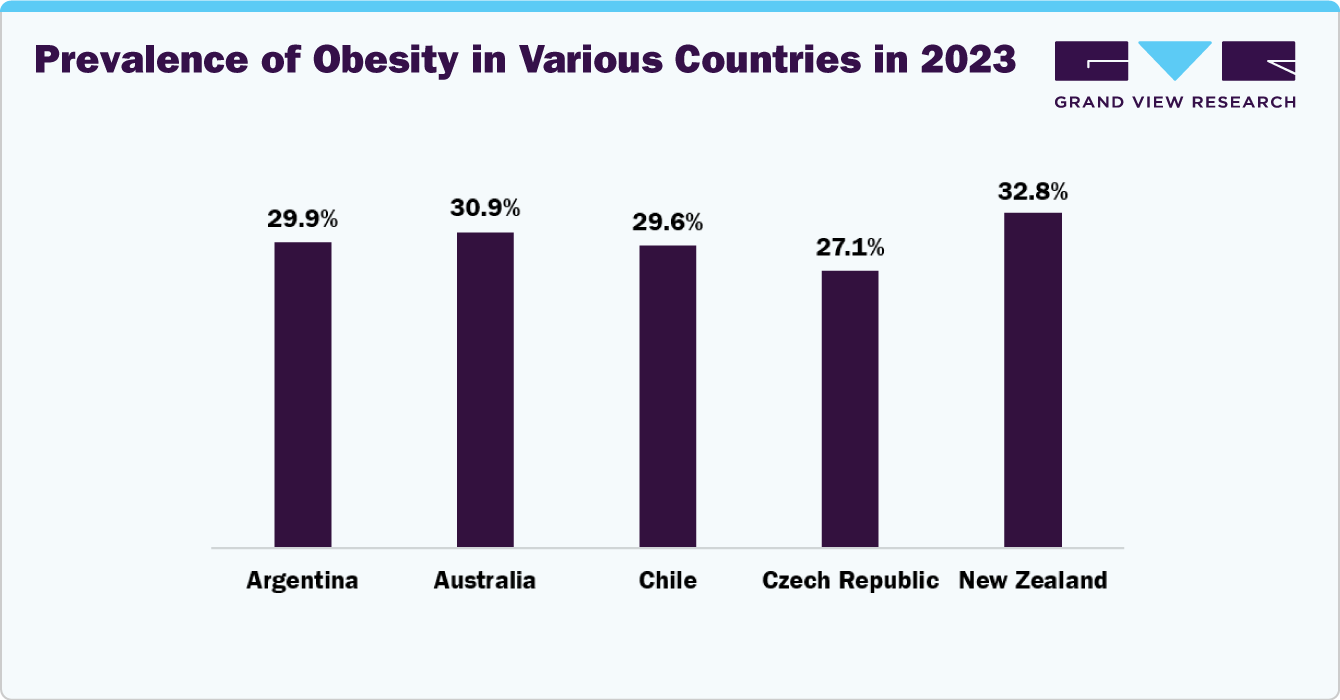

Moreover, the rising number of obese people has become a significant public health concern across the globe, leading to a rise in the demand and adoption of fitness, diet, and nutrition-related apps. For instance, according to data published by Wisevoter, the global prevalence of obesity among adults (18 and above) is 21.8% in 2023. The prevalence of obesity in some of the countries is as follows.

The lifestyle disease management apps offer users individualized exercise plans by leveraging artificial intelligence (AI), augmented reality (AR), machine learning (ML), and other advanced technologies. Moreover, it provides customized health and fitness plans with no-equipment workout programs, assigned trainers, diet monitoring, step tracking, and customizable diet charts. Thus, the demand for lifestyle management apps is expected to grow at a substantial rate due to their benefits over physical exercise and bodybuilding. For example, Gymnotize Gym Fitness Workout App, a training app, uses AR to display the correct method of lifting weights. In addition, it allows users to schedule workouts as per their comfort, monitor their count of repetitions, and use graphs to analyze their fitness process.

Furthermore, growing investments and favorable government initiatives propel the market growth. According to the International Year of Basic Sciences for Sustainable Development, tackling lifestyle diseases such as heart disease, cancer, and diabetes requires USD 18 million per year and around USD 140 billion by the end of 2030 by targeting policies to cut smoking, alcohol abuse, and unhealthy diets. Moreover, continuous improvements in network infrastructure and coverage are expected to increase the demand for lifestyle disease apps. Due to increasing smartphone adoption and fitness awareness, mobile network operators perceive these apps as an investment opportunity.

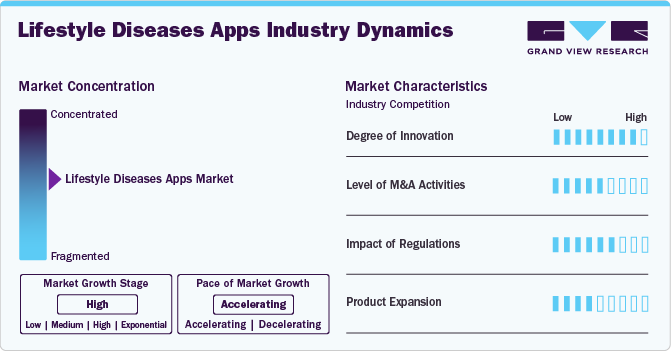

Market Concentration & Characteristics

The market is characterized by a high degree of innovation due to technological advancements and the incorporation of AI and ML in these apps. For example, FitnessAI, an app for iPhone users, employs AI to generate customized workouts. Based on workouts, the AI optimizes sets, repetitions, and weights for each exercise every time the user works out.

The market is characterized by a medium level of merger and acquisition (M&A) activity. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in January 2021, Google acquired Fitbit Inc., a fitness tracking company, for USD 2.1 billion to bolster its wearable capabilities.

Regulations play a vital role in shaping the market, ensuring the data security and privacy of users. In Mexico, the Federal Commission for the Protection against Sanitary Risks [Comisión Federal para la Protección contra Riesgos Sanitarios (COFEPRIS)] regulates digital health, including all kinds of mobile health apps. The National Institute for Transparency, Access to Information and Personal Data Protection (INAI) is the data protection regulator in Mexico.

Market players leverage this strategy to increase their product capabilities and promote the reach of their offerings. For instance, in January 2024, the Health Department of Kerala launched phase 2 of lifestyle disease screening in India. In the first phase, the Health Department used the Shaili app developed by e-Health Kerala to screen risk factors for various lifestyle diseases.

Platform Insights

The Android segment dominated the market with a revenue share of 49.1% in 2024 and is projected to grow at the fastest CAGR over the forecast period. The rising number of Android users and the growing adoption of smartphones globally led to the rise in the adoption of Android-based health apps more than iOS apps, which fuels the segment's growth. The widespread availability of affordable smartphones is one of the major factors responsible for the increased adoption of Android-based mobile apps. Several apps aimed at managing lifestyle diseases available on Android operating systems include Sleep Cycle, MyFitnessPal, Lose It, and Headspace.

The iOS segment in the market is anticipated to witness significant growth over the forecast period. Increased adoption of iOS devices over the past few years has fueled segment growth. For instance, according to data published by Business of Apps, 231 million iPhones and 49 million iPads were sold in 2023. Thus, such a rise in sales of iOS-based systems drives market growth. Moreover, continuous innovation in hardware and software by Apple is supplementing the market growth.

Device Insights

The smartphone segment held the largest market share of 50.5% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. With the advancement of technology in the fitness sector, an increasing number of people are choosing to utilize smartphones over enrolling in a gym or fitness club to improve their exercise routines. This preference is driven by the affordability of virtual fitness programs compared to traditional gym subscriptions. Thus, the growing adoption of smartphones for fitness activities is anticipated to contribute to segment growth. According to Harvard Health Publishing, in the U.S., one in five people uses a smartphone app or tracker to monitor exercise.

The wearables segment in the market is anticipated to witness considerable growth over the forecast period. Rapid advancements in the designs of wearables such as smartwatches and bands and developments such as gamification, predictive analytics, and cloud synchronization drive the adoption of such devices. For instance, according to data published by Business of Apps, 38 million Apple smartwatches were sold in 2023.

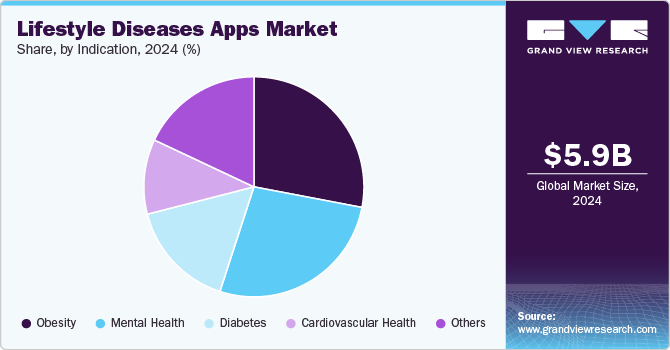

Indication Insights

The obesity segment dominated the market in 2024 with a revenue share of 28.5%. Many lifestyle management apps offer exercises and activities targeting obesity as a lifestyle disease. These lifestyle disease apps come with listing workout exercises, tracking fitness goals, monitoring the calories consumed, and guiding individuals with personal trainers. Thus, such offerings and features of these apps drive market growth. For example, “Lose It” is an American health and wellness mobile app that generates calorie intakes for users by tracking exercise, weight, food, and calorie intake to assist them in achieving weight loss.

The mental health segment is anticipated to register the fastest CAGR over the forecast period. Apps such as depression & anxiety management, meditation management, and wellness management are advantageous in maintaining an individual's mental health, thereby promoting a better lifestyle and reducing stress. For instance, in June 2023, HuddleHumans, a mental health and well-being company, introduced a social mental health app to support and connect the community to people facing mental health issues. In addition, it offers resources such as self-care tools and mental health articles.

Regional Insights

North America lifestyle diseases apps market dominated globally with a revenue share of 29.3% in 2024. The adoption of digital health is a key factor fueling the growth of fitness management apps in North America. Furthermore, the growing adoption of smart devices, rise in the prevalence of non-communicable diseases and rise in service network coverage area boost the market growth. For instance, in North America, over 328 million people were connected to the mobile internet in 2022.

U.S. Lifestyle Diseases Apps Market Trends

The lifestyle diseases apps market in the U.S. held the largest share in the North American region in 2024, owing to growing government initiatives and investments. Moreover, technological advancements and improved features, such as smartwatches, activity trackers, yearly, monthly, and weekly fitness totals, reminders to drink water, & daily diet plans, are leading to high demand for such applications. According to Fitbit Statistics, more than 73% of health and fitness tracker users in the U.S. used Fitbit in 2023.

Europe Lifestyle Diseases Apps Market Trends

Europe lifestyle diseases apps market is anticipated to register a significant growth rate during the forecast period. Factors such as the launch of new products, raising funds, and increased marketing & promotional activities by companies fuel the market growth. For instance, in September 2023, Teale, a French startup, raised funding of USD 10.83 million in a Series A funding round to offer mental health benefits to employers and employees, promoting workplace well-being.

UK lifestyle diseases apps market held the largest market share in Europe in 2024. There are various opportunities for app developers in the UK owing to the country’s high digital adoption and literacy. The presence of various healthcare app development companies in the UK, such as Exyte and Vention, boosts the market growth in the country.

Lifestyle diseases apps market in Germany anticipated to register a considerable growth rate during the forecast period. Favorable government initiatives, new app launches, and reimbursement policies propel the market growth in the country. For instance, in October 2021, Oviva Ltd. launched Oviva Direct for Obesity to treat severe obesity, and the app was included in the Directory of Digital Health Applications (DiGAs) at the Federal Institute for Drugs and Medical Devices (BfArm) for reimbursement.

Asia Pacific Lifestyle Diseases Apps Market Trends

The Asia Pacific lifestyle diseases apps market is anticipated to experience the fastest growth over the forecast period, owing to the growing penetration of smartphones and smart wearables. Moreover, advancements in healthcare infrastructure and increasing healthcare expenditure in countries such as China, India, and Japan are fostering the adoption of lifestyle disease apps. For instance, according to Healthnews, 24.9 million people downloaded health and fitness apps in Australia in 2023.

China lifestyle diseases apps market is anticipated to register a considerable growth rate during the forecast period. The growing patient population for heart-related issues and increasing internet penetration in China spur the country’s market growth. Moreover, mobile application providers are focusing on developing healthcare apps due to the increasing smartphone penetration in the country.

The Japan lifestyle diseases apps market is anticipated to register a significant growth rate during the forecast period. Advanced healthcare systems, with a strong focus on innovation and technological advancements in the digital health sector, including lifestyle disease apps, are boosting market growth. Moreover, the introduction of technologically advanced mobile and wearable devices is boosting the market growth.

Latin America Lifestyle Diseases Apps Market Trends

Latin America lifestyle diseases apps market is anticipated to witness considerable growth over the forecast period due to increasing awareness regarding their availability and benefits. Increasing affordability leads to the adoption of smartphones to access various fitness applications. Moreover, rising healthcare expenditure and increasing incidence of obesity fuel the market growth.

Brazil lifestyle diseases apps market is anticipated to register a significant growth rate during the forecast period. Increasing expenditure on electronic & mobile devices by buyers is contributing to market growth. For instance, according to Business of Apps, the number of smartphone users in Brazil reached 155 million in 2023, up from 143.4 million in 2022, further boosting access to mobile health apps across the country’s population.

Middle East & Africa Lifestyle Diseases Apps Market Trends

The Middle East and Africa lifestyle diseases apps market is anticipated to experience lucrative growth over the forecast period. With the increasing penetration of smartphones and government initiatives, entrepreneurs and healthcare professionals are inclined toward smartphones for better and healthier lifestyles. In addition, there is rising awareness among people regarding lifestyle diseases, and their advantages fuel the market growth in this region.

The UAE lifestyle diseases apps market is anticipated to register a significant growth rate during the forecast period. Favorable government innovation and high government funding to promote health and wellness apps are propelling market growth in the country. Key players are also focusing on developing newer products to meet the growing demand for better care. For example, Count’d, a healthy meal app, allows subscribers to browse and select their healthy meal of choice, ensuring they stay on track with their fitness goals.

Key Lifestyle Diseases Apps Company Insights

Some of the key players operating in the market are focusing on developing innovative models and undertaking strategies such as collaborations and partnerships to enhance their product offerings and expand their outreach to serve different regional markets.

Key Lifestyle Diseases Apps Companies:

The following are the leading companies in the lifestyle diseases apps market. These companies collectively hold the largest market share and dictate industry trends.

- MyFitnessPal, Inc.

- Noom, Inc.

- Fitbit, Inc.

- Azumio, Inc.

- Lifesum AB

- Sleep Cycle

- Headspace Inc.

- HealthifyMe Wellness Private Limited

- Nudge Coach, Inc.

Recent Developments

-

In February 2024, the Indian Council of Medical Research (ICMR)-National Institute of Nutrition launched NutriAIDE, a mobile health app that tracks micro and macronutrients to help users reflect on their eating habits.

-

In September 2022, Headspace Health, an American online company specializing in meditation, acquired Shine App, a mental health and well-being platform, to deliver mental health support to people worldwide.

Lifestyle Diseases Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.78 billion

Revenue forecast in 2030

USD 13.77 billion

Growth Rate

CAGR of 15.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast data

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, device, indication, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

MyFitnessPal, Inc., Noom, Inc., Fitbit, Inc., Azumio, Inc., Lifesum AB, Sleep Cycle, Headspace Inc., HealthifyMe Wellness Private Limited, Nudge Coach, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lifestyle Diseases Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global lifestyle diseases apps market report based on platform, device, indication and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

iOS

-

Android

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Wearables

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Cardiovascular Health

-

Mental Health

-

Diabetes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lifestyle diseases apps market size was estimated at USD 5.94 billion in 2024 and is expected to reach USD 6.78 billion in 2025.

b. The global lifestyle diseases apps market is expected to grow at a compound annual growth rate of 15.0% from 2025 to 2030 to reach USD 13.77 billion by 2030.

b. North America dominated the market with a share of 30.0% in terms of revenue in 2024 owing to the factors such as rise in the prevalence of non-communicable diseases, significant growth in usage of smart devices, increase in service network coverage area, growth in the senior population, the COVID-19 pandemic, among others.

b. Some of the key players operating in the market are MyFitnessPal, Noom Inc., Fitbit, Inc., Azumio, Inc., Lifesum, Sleep Cycle, Headspace, HealthifyMe, and Nudge Coach.

b. Key factors driving the market growth include increasing patient demand for virtually-delivered care at a lower co-pay than in-person appointments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.