LiDAR Market Size, Share & Trends Analysis Report By Type (Airborne, Terrestrial), By Application (Engineering, Environment), By Component (GPS, Navigation), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-344-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

LiDAR Market Size & Trends

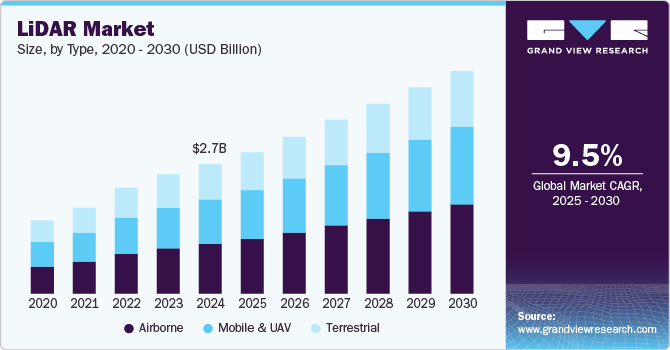

The global LiDAR market size was estimated at USD 2.74 billion in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. The market is growing rapidly due to advancements in autonomous vehicle technology. Companies increasingly adopt LiDAR sensors for self-driving cars, providing highly accurate 3D mapping and real-time object detection. This demand is fueled by the automotive industry's push toward safer, more reliable autonomous systems. Moreover, government regulations promoting advanced driver assistance systems (ADAS) have further boosted the adoption of LiDAR technology. Developing higher-resolution sensors and decreasing costs have made LiDAR more accessible for automotive applications. The growing integration of LiDAR into electric vehicles also contributes to market growth.

The market is expanding within the geospatial and mapping industries. LiDAR technology offers exceptional precision for topographical mapping, urban planning, and land surveying, helping professionals gather accurate data. Its applications in environmental monitoring, such as deforestation tracking and flood risk assessment, have also surged due to the increasing focus on climate change. Furthermore, LiDAR systems are becoming more essential in disaster management by enabling rapid terrain analysis and damage assessment. Government infrastructure projects, especially in developing regions, are turning to LiDAR for planning and development. The technology's ability to capture vast areas quickly and efficiently makes it a preferred construction and civil engineering tool.

The market also benefits from advances in drones and UAVs (unmanned aerial vehicles). LiDAR-equipped drones offer an efficient solution for industries like agriculture, mining, and forestry, providing detailed aerial surveys. These applications drive adoption due to the ease of use and reduced operational costs of drone-based LiDAR systems. Furthermore, technological innovations are enhancing the performance and portability of LiDAR sensors for UAV platforms. As industries prioritize real-time data collection and precision, drone-based LiDAR is becoming more widespread. The defense and security sectors also utilize LiDAR for surveillance and reconnaissance missions. Overall, the growing adoption of LiDAR in aerial applications further accelerates market growth.

Type Insights

Airborne accounted for the dominant share of 38.3% in 2024. This segment dominates the market due to its extensive use in large-scale mapping and surveying applications. Airborne LiDAR systems are preferred for their ability to cover vast areas quickly and accurately, making them ideal for topographic and infrastructure mapping. The technology's high precision in capturing elevation data is widely used in environmental monitoring and natural resource management. Government projects, such as infrastructure development and disaster response, rely heavily on airborne LiDAR for detailed geographical data. This dominance is also supported by continuous advancements in aircraft-based LiDAR systems, improving range and data resolution.

The mobile and UAV segment is experiencing rapid growth due to its versatility and cost-effectiveness. UAVs equipped with LiDAR provide a flexible solution for agriculture, mining, and forestry industries, offering detailed aerial surveys with minimal human intervention. Mobile LiDAR systems mounted on vehicles are increasingly used for urban planning, road mapping, and infrastructure inspection. The portability and ease of deployment of UAV and mobile LiDAR systems allow for real-time data collection in difficult-to-access or hazardous environments. Technological innovations enhancing sensor performance and data processing capabilities further drive the adoption of mobile and UAV-based LiDAR.

Application Insights

The corridor mapping segment accounted for the dominant share in 2024 due to its critical role in infrastructure projects such as highways, railways, and power lines. It provides highly accurate and detailed 3D maps, essential for planning and maintaining linear infrastructures. The precision and efficiency of LiDAR in capturing long stretches of land with minimal human intervention make it the preferred method for corridor mapping. Governments and private companies increasingly use LiDAR for monitoring and inspection purposes in utility corridors. This demand is further supported by growing infrastructure development projects worldwide, requiring precise and up-to-date geographical data.

The ADAS (Advanced Driver Assistance Systems) segment is growing rapidly as the automotive industry shifts toward automation and enhanced safety features. LiDAR sensors are essential for real-time 3D mapping and object detection and critical for advanced vehicle navigation and collision avoidance. With regulatory support for ADAS technologies, the adoption of LiDAR in automotive applications is rising, particularly for features like lane-keeping assistance and emergency braking. Improvements in LiDAR sensor resolution and cost reductions make the technology more accessible for a wider range of vehicles.

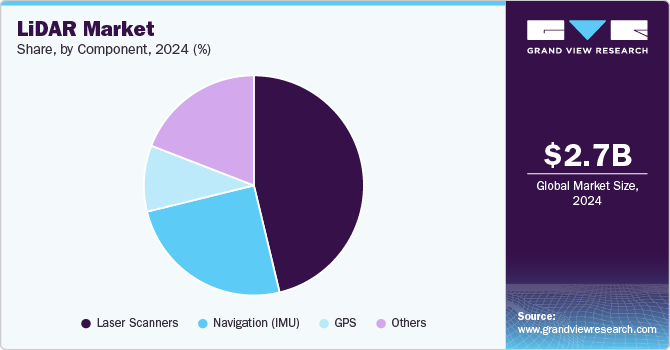

Component Insights

Laser scanners dominate the market in 2024 due to their ability to capture high-resolution 3D data with precision and speed. They are widely used in applications such as topographic mapping, construction, and forestry, where detailed surface measurements are critical. The growing need for accurate spatial data across various scanner accuracy and range improvement industries has cemented the role of laser scanners as the preferred LiDAR technology. Continuous scanner accuracy and range improvements have enhanced their effectiveness in large-scale surveying projects. Moreover, the affordability and adaptability of laser scanners for different environments contribute to their dominant position in the market.

The navigation segment, particularly using Inertial Measurement Units (IMU), is growing significantly. IMUs enhance LiDAR’s accuracy by providing real-time positioning and orientation data, especially in mobile and aerial platforms. Integrating IMUs with LiDAR is gaining traction in autonomous vehicles, UAVs, and other navigation-intensive applications. As industries increasingly prioritize precise geolocation and stable data collection in dynamic environments, IMU-based navigation systems are becoming essential. With advancements in IMU technology, LiDAR systems can offer more reliable navigation solutions, driving further growth in this segment.

Regional Insights

North America LiDAR market accounting for a leading share of 32.0% in 2024. North America is experiencing a robust market, driven by increasing adoption in sectors such as autonomous vehicles, smart cities, and defense. The push for advanced infrastructure projects across the region also accelerates demand for LiDAR technology, particularly in transportation and urban planning. Companies in North America are focusing on developing high-resolution LiDAR systems to enhance real-time mapping and data accuracy. The region’s established tech industry is fueling innovation in LiDAR applications, making it a hub for research and development. Moreover, government funding and partnerships with private firms are bolstering market expansion.

U.S. LiDAR Market Trends

The LiDAR market in the U.S. is growing primarily due to advancements in autonomous driving and aerial mapping technologies. The automotive sector is a key driver, with LiDAR integral to developing ADAS and self-driving vehicles. The country’s defense industry also heavily invests in LiDAR for surveillance, targeting, and reconnaissance operations. The U.S. also sees increased LiDAR use in agriculture and environmental monitoring, supporting precision farming and disaster management initiatives. Regulatory frameworks encouraging the use of LiDAR in improving road safety and infrastructure further support growth.

Europe LiDAR Market Trends

The LiDAR market in Europe is witnessing significant growth, largely propelled by smart mobility initiatives and the widespread adoption of ADAS technologies. LiDAR is crucial in Europe’s efforts to reduce carbon emissions and improve road safety, particularly by developing autonomous and electric vehicles. The region's strong environmental focus is also driving the use of LiDAR in sustainable land use and climate monitoring. Moreover, Europe’s investment in smart city projects and modern transportation systems creates new opportunities for LiDAR deployment.

Asia Pacific LiDAR Market Trends

The LiDAR market in Asia Pacific is rapidly emerging and growing, fueled by strong demand from the automotive industry and large-scale infrastructure development. Countries such as China and Japan are leading the way in integrating LiDAR into autonomous vehicles and public transportation systems. The region also sees increased LiDAR use in industrial automation, agriculture, and environmental monitoring. Governments in the Asia Pacific are heavily investing in smart city projects and upgrading infrastructure, boosting the demand for LiDAR technology.

Key LiDAR Company Insights

Some of the key companies in the market include Faro Technologies, Inc., Leica Geosystem Holdings AG, Teledyne Optech Incorporated, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Faro Technologies, Inc. focuses on high-precision 3D laser scanning systems for industrial applications. The company has developed portable and versatile LiDAR solutions used in manufacturing, construction, and forensic analysis, enhancing data capture accuracy. Their continuous innovation in sensor technology and software integration is expanding the use of LiDAR in complex environments, driving broader adoption across various sectors.

-

Quantum Spatial, Inc. utilizes LiDAR for high-resolution aerial mapping, focusing on applications such as environmental monitoring, infrastructure development, and natural resource management. Their expertise in processing large datasets and delivering precise geospatial insights has made Quantum Spatial a key player in supporting public and private sector projects across various industries.

Key LiDAR Companies:

The following are the leading companies in the LiDAR market. These companies collectively hold the largest market share and dictate industry trends.

- Faro Technologies, Inc.

- GeoDigital

- Hesai Group

- Innoviz Technologies Ltd.

- Leica Geosystem Holdings AG

- Quantum Spatial, Inc.

- RIEGL USA, Inc.

- Sick AG

- Teledyne Optech Incorporated

- Trimble Navigation Limited

- Velodyne LiDAR, Inc.

- YellowScan

Recent Developments

-

In September 2024, Teledyne Geospatial announced the launch of its new products and solutions, including the Galaxy Edge airborne LiDAR system and the Network Surveyor, at the INTERGEO 2024 event. This launch aims to provide advanced real-time data processing capabilities for enhanced mapping and analysis.

-

In August 2024, YellowScan collaborated with Nokia, a Telecommunications company in Finland, to integrate the YellowScan Surveyor Ultra LiDAR scanner into Nokia's Drone Networks. This collaboration aims to transform industrial operations through automated 5G-based LiDAR scanning for applications such as telecommunications towers and utility inspections.

-

In June 2024, Innoviz Technologies Ltd. announced a collaboration with an automotive OEM to improve its Level 4 autonomous vehicle functionalities by integrating Innoviz's new short-range LiDAR sensors into the OEM's platform. The short-range LiDAR, part of the InnovizTwo product platform, is designed for light commercial vehicles and aims to support the growing demand for safe and efficient autonomous driving solutions.

-

In April 2024, Hesai Group collaborated with Marelli Holdings Co., Ltd., a Japan-based multinational automotive parts manufacturer, to integrate its innovative headlamp design with Hesai's next-generation ATX lidar technology, enhancing vehicle safety and object detection while maintaining aesthetics and aerodynamics. This collaboration showcases a significant reduction in lidar volume and seamless integration into headlamps, emphasizing affordability and improved performance for cost-effective and luxury vehicle models.

LiDAR Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.99 billion |

|

Revenue forecast in 2030 |

USD 4.71 billion |

|

Growth rate |

CAGR of 9.5% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Type, application, component, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; Australia; KSA; UAE; South Africa |

|

Key companies profiled |

Faro Technologies, Inc.; GeoDigital; Hesai Group; Innoviz Technologies Ltd.; Leica Geosystem Holdings AG; Quantum Spatial, Inc.; RIEGL USA, Inc.; Sick AG; Teledyne Optech Incorporated; Trimble Navigation Limited; Velodyne LiDAR, Inc.; YellowScan. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global LiDAR Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LiDAR market report based on type, application, component, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Airborne

-

Terrestrial

-

Mobile & UAV

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Corridor Mapping

-

Engineering

-

Environment

-

Exploration

-

ADAS

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

GPS

-

Navigation (IMU)

-

Laser Scanners

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global LiDAR market size was estimated at USD 2.74 billion in 2024 and is expected to reach USD 2.99 billion in 2025.

b. The global LiDAR market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 4.71 billion by 2030.

b. Asia Pacific dominated the LiDAR market with a share of 36.7% in 2024. This is attributable to the rapid adoption of advanced technologies in various sectors, including automotive, aerospace, and construction, and significant investments in infrastructure development.

b. Some key players operating in the LiDAR market include Faro Technologies, Inc., Leica Geosystem Holdings AG, Teledyne Optech Incorporated, Trimble Navigation Limited, RIEGL USA, Inc., Quantum Spatial, Inc., Velodyne LiDAR, Inc., Sick AG, YellowScan, and GeoDigital

b. Key factors driving the growth of the LiDAR market include the increasing demand for high-precision mapping and surveying, advancements in autonomous vehicles requiring accurate distance measurements, growing applications in environmental monitoring and conservation, and rising investments in smart city initiatives.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."