- Home

- »

- Conventional Energy

- »

-

LGC And VLGC LNG Shipyard Carrier Market Report, 2040GVR Report cover

![LGC And VLGC LNG Shipyard Carrier Market Size, Share & Trends Report]()

LGC And VLGC LNG Shipyard Carrier Market Size, Share & Trends Analysis Report By Containment Type (Moss Type, Membrane Type), By Region, And Segment Forecasts, 2024 - 2040

- Report ID: GVR-4-68040-258-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

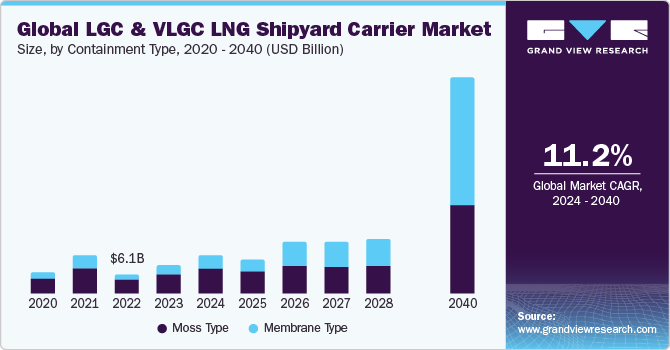

The global LGC and VLGC LNG shipyard carrier market size was estimated at USD 8,988.76 million in 2023 and is projected to grow at a CAGR of 11.2% from 2024 to 2040. The demand for liquefied natural gas (LNG) has increased significantly in recent years, driven by several geopolitical and environmental factors. The rise in the consumption of natural gas is the primary driver for robust growth in demand.

Countries around the world are shifting toward natural gas to reduce carbon emissions. This transition has led to an increased demand for LNG tankers to transport LNG from production facilities to consumption centers.Moreover, the growing demand for LNG tankers is closely tied to the expansion of liquefaction and regasification infrastructure. As more countries invest in LNG terminals for both import and export purposes, the demand for tankers to transport LNG between these facilities increases. The market growth is driven by a shift toward natural gas, geopolitical dynamics, and the expansion of gas infrastructure over the forecast period.

The development of new LNG projects and expansion of existing LNG facilities around the world, which include collaborations and cross-border investments, fuels the requirement for LNG tankers globally. Trade relations, diplomatic ties, and political agreements have influenced the supply and demand of LNG, which fosters the demand for LNG tankers across various regions. For instance, in October 2023, Qatar signed an agreement with the government of Netherlands to supply Shell’s gas for 27 years. The Gulf state will compete with the U.S. to help Europe replace lost Russian supplies. Qatar is the world’s top exporter of LNG, which has recently focused on long-term supplies to the Asian Market.

The growing global trade of LNG has a significant impact on the demand for large gas carriers (LGC) and very large gas carriers (VLGC) shipyard carriers. The increase in LNG trade results in higher demand for specialized carriers capable of transporting LNG safely. Shipping companies and operators often need to expand their LNG fleets for increasing the supply of LNG globally.

Market Concentration & Characteristics

For the next several years, the market is likely to witness significant supply additions, even as European nations are expected to import large volumes of LNG to replace Russian pipeline gas. Weak supply growth and high demand are expected to increase LNG prices for several years. Five new export-scale LNG projects are expected to come online over the next two years, which will add 5.8 million metric tons per annum (mtpa) of liquefaction capacity in 2023 and 9.1 mtpa in 2024.

To meet the rising LNG demand, shipbuilding and management companies are expanding their fleets to ensure they have the infrastructure and workforce to deliver vessels within adequate timelines. Increasing global demand and upcoming large-scale LNG projects are expected to boost the demand for LGC and VLGC LNG shipyard carriers over the forecast period.

Containment Type Insights

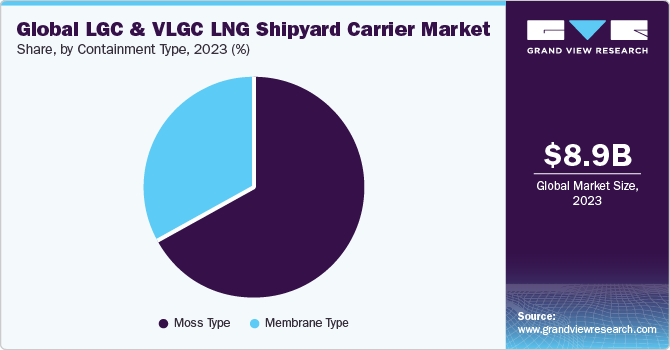

Based on containment type, the market is segregated into moss type and membrane type. The moss type segment led the market with the largest revenue share of 67.1% in 2023. Moss Type LNG carriers are made up of spherical tanks, which are supported by an internal framework. Mainly, these carriers consist of 4-5 tanks with a working pressure of 22 kPa (3.2 Psi), which can be increased or decreased in case of need. These tanks are designed to contain cargo in a liquid state and prevention of leaks. This Containment Type of carrier is considered less efficient and less safe than membrane carriers. The only advantage of Moss Type LNG carriers is the large capacity to store cargo. Moss Type carriers are preferred by players engaged in high-volume LNG trade. Thus, the increasing demand for LNG in various regions is expected to boost the demand for Moss Type LGC and VLGC LNG carriers over the forecast period.

The membrane type segment is anticipated to grow at a CAGR of 14.8% during the forecast period. Market players like LNG vessel builders and fleet operators are mainly focused on investment in Membrane Type LNG shipyard carriers owing to strict international maritime regulations and safety standards. The aforementioned factors are expected to fuel the demand for membrane type LNG shipyard carriers over the forecast period.

Regional Insights

The LGC and VLGC LNG shipyard carrier market in North America is anticipated to grow at the fastest CAGR during the forecast period. These large shale reserves in the region are expected to propel the demand for LGC and VLGC LNG shipyard carrier for import/export of LNG in the North America region.

U.S. LGC And VLGC LNG Shipyard Carrier Market Trends

The U.S. LGC and VLGC LNG shipyard carrier market has a well-developed natural gas infrastructure and established key end-user industries, which are the major demand drivers for LNG. The country has a diverse energy mix, where natural gas accounts for the largest share in terms of primary energy production. Policymakers around the world are focused on development of sustainable energy generation sources, which, in turn, is anticipated to increase the demand for LNG in the country.According to the Energy Information Administration, gas fired power generation increased from 54.6% to 57.7% in 2022. This would continue over the forecast period and would lead to enhancement in gas power plants with expected rise in power demand, which would further boost the market growth over the forecast period.

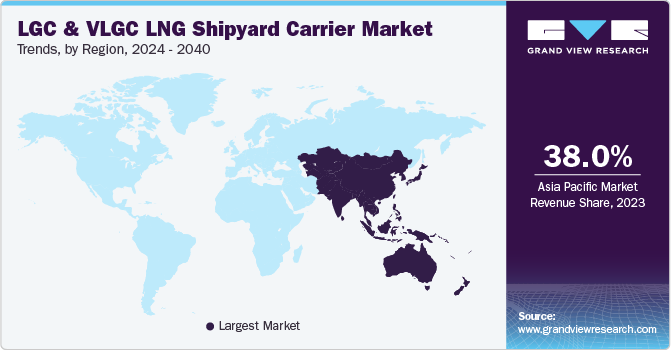

Asia Pacific LGC And VLGC LNG Shipyard Carrier Market Trends

The LGC and VLGC LNG shipyard carrier market in Asia Pacific accounted for the largest revenue share of 38% in 2023. Asia Pacific countries, such as China and India, are the major markets for LGC and VLGC LNG shipyard carriers. The high growth of industrial sectors in China, India, and Japan has triggered the demand for power through clean Sources, driving the need for natural gas. The establishment of heavy equipment, oil & gas, and process companies in China, on account of low labor and utility costs, has been one of the factors responsible for the penetration of natural gas in industrial applications in the region. The decentralization of power sector in Thailand coupled with the abundant availability of natural gas is projected to boost the market growth in China over the forecast period. Government initiatives in India are encouraging industrial establishments in the country. Power generation sector in India is inclined toward coal-based production. Limited coal reserves and limitations on the expansion of coal mines in India are likely to result in a shortfall of coal in the coming years. This is expected to result in the implementation of favorable governmental regulations for the use of gas turbine systems, in turn, driving the demand for LGC and VLGC LNG shipyard carriers in the region over the forecast period.

The China LGC and VLGC LNG shipyard carrier market accounted for largest revenue share of 37.1% in Asia Pacific in 2023. China is one of the most prominent countries in terms of the growth of the LGC and VLGC shipyard carriers market in the region. China is the second-largest LNG importer in the world. According to CNOOC Gas and Power Group's Research Centre, China’s natural gas demand is expected to grow by 8% from 2022, and the country’s total gas demand may reach 369.4 Thousand CBM in 2023. The import value of LNG in China is expected to reach 70.79 million tons in 2023, which is a 10.9% increase from 2022.

The LGC and VLGC LNG shipyard carrier market in Indonesia is expected to grow at the significant CAGR of 16.6% during the forecast period. Indonesia market is expected to grow at a moderate CAGR during the forecast period, owing to the government’s objective to ban LNG exports to deal with domestic requirements. According to the Upstream Oil and Gas Special Regulatory Taskforce (SKK Migas), in 2020, Indonesia’s natural gas production reduced by 7.8% of the targeted 5.8 billion standard cubic feet per day. Decreasing LNG production and the ban on LNG exports are expected to restrain the demand for LGC and VLGC LNG shipyard carriers over the forecast period.

Europe LGC And VLGC LNG Shipyard Carrier Market Trends

The LGC and VLGC LNG shipyard carrier market in Europe is expected to grow at the fastest CAGR during the forecast period. The region has seen a surge in investments in LNG terminals which is expected to bolster the import/export of LNG. This, in turn, will fuel the demand for LGC and VLGC LNG shipyard carriers in the country over the forecast period.

The Germany LGC and VLGC LNG shipyard carrier market accounted for the largest revenue share of 20.3% in Europe in 2023. Russia-Ukraine has significantly affected the LNG imports of Germany, as the country was highly reliant on Russian gas supply for domestic consumption. Russia contributed 52% of German gas imports in 2021, with a total import of 55 Thousand CBM of gas to Germany. However, in 2022, Germany’s Russian LNG import levels stood at 953 million cu m. This drastic fall in LNG imports from Russia has forced Germany to invest in its LNG infrastructure. In July 2023, EU approved a USD 44.14 million funding for Germany’s first onshore LNG terminal to end its reliance on Russia and improve the country’s LNG import infrastructure. Increasing investments in LNG infrastructure and the government’s focus on reducing Russian gas imports are expected to fuel the demand for LGC and VLGC LNG shipyard carriers in the country over the forecast period.

The LGC and VLGC LNG shipyard carrier market in Italy is also expected to grow at the fastest CAGR of 9.5% during the forecast period. Italy is an attractive market for natural gas in Europe. The growing demand for LNG in the country is attributed to the shifting focus toward power generation through cleaner Sources, including natural gas. The country is highly dependent on LNG imports from countries like Russia, Algeria, Libya, the Netherlands, and Qatar.The heavy reliance of the country on LNG imports and increasing investments in its LNG infrastructure are expected to fuel the demand for LGC and VLGC LNG shipyard carriers in the country over the forecast period.

Central & South America LGC And VLGC LNG Shipyard Carrier Market Trends

The LGC and VLGC LNG shipyard carrier market in Central & South America is expected to grow at the fastest CAGR of 16.6% during the forecast period. Increasing LGN imports and government inclination toward the adoption of LNG for power generation is expected to propel the demand for LNG, which will boost the demand for LGC and VLGC LNG shipyard carriers for transportation applications.

The Brazil LGC and VLGC LNG shipyard carrier market accounted for significant share in 2023 in Central & South America.And, it is expected to witness at a significant CAGR over the forecast period, owing to the rising LNG imports and heavy investments in LNG infrastructure. In 2021, state-led oil company, Petrobras, tripled its LNG imports with import value of 23 million cu m/d, significant increase from 7.5 million cu m/d in 2020. Moreover, LNG imports peaked in October 2021 with 40 million cu m. In December 2023, Equinor, Petrobras, and Repsol Sinopec announced an investment of USD 9 billion to enhance the gas market of Brazil. Heavy investments in gas market by major players and increasing imports of LNG are expected to foster the demand for LGC and VLGC LNG shipyard carriers in the country over forecast period.

Middle East & Africa LGC And VLGC LNG Shipyard Carrier Market Trends

The LGC and VLGC LNG shipyard carrier market in Middle East and North Africa accounted for largest revenue share of 70% in 2023, According to the U.S. Energy Information Administration. Moreover, Qatar emerged as one the largest LNG exporters in the world averaging 10.3 billion cu feet per day within a decade. In Africa, Algeria and Egypt are the only countries with a history of 40 years of LNG exports. Egypt’s exports peak during winter season owing to low domestic demand. In turn, it leads to increased natural gas exports from the country. The presence of major LNG exporting countries in the region is expected to drive the market growth over the forecast period.

The Saudi Arabia LGC and VLGC LNG shipyard carrier market accounted for largest revenue share of 49.7% in 2023 in Middle East & Africa. Energy consumption in the region is growing at a significant rate. LNG is considered one of the cleanest fossil fuels. The various governments in the region are seeking cost-effective ways to reduce their reliance on fossil fuels. These factors are anticipated to boost market growth over the forecast period.

Key LGC And VLGC LNG Shipyard Carrier Company Insights

The market players are continuously involved in adopting various organic and inorganic growth strategies to expand their global footprint. The key players in this industry include Royal Dutch Shell PLC, Nippon Yusen Kabushiki Kaisha, Mitsui O.S.K. Lines Ltd (MOL), Ltd, and Kawasaki Heavy Industries, Ltd, among others.

Key LGC And VLGC LNG Shipyard Carrier Companies:

The following are the leading companies in the LGC and VLGC LNG shipyard carrier market. These companies collectively hold the largest market share and dictate industry trends.

- Royal Dutch Shell PLC

- Nippon Yusen Kabushiki Kaisha

- Mitsui O.S.K. Lines Ltd (MOL)

- China State Shipbuilding Corporation

- STX Offshore & Shipbuilding Co. Ltd.

- Kawasaki Heavy Industries

- Hyundai Heavy Industries Co.

- Mitsubishi Heavy Industries

- Daewoo Shipbuilding and Marine Engineering (DSME)

- Samsung Heavy Industries

Recent Developments

-

In November 2023, Capital product partners signed with Capital Maritime and Capital GP to acquire 11 newly built LNG carriers for USD 3.3 billion. LNG carriers operate on a two-stroke Mark III with a capacity of 174,000 cu m, built by Hyundai Samho Heavy Industries and Hyundai Heavy Industries in South Korea

-

In November 2023, BW LNG announced an investment of USD 30 million in Confidence Petroleum India (CONF.NS) to develop import infrastructure

-

In August 2023, TotalEnergies announced the bunkering of one of its VLCCs with LNG at Rotterdam Port. The company recently delivered 2,900 mt of LNG bunkers to its chartered VLCC, the Antonis Angelicousssis, at Rotterdam port

LGC And VLGC LNG Shipyard Carrier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12,318.64 million

Revenue forecast in 2040

USD 67,323.12 million

Growth rate

CAGR of 11.2 % from 2024 to 2040

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2040

Quantitative units

Revenue in USD million/billion, capacity in Billion cu m, volume in units, and CAGR from 2024 to 2040

Report coverage

Revenue forecast, volume forecast, capacity forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Containment type, region

Regional Scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; UK; Denmark; Turkey; Greece; Netherlands; Belgium; China; India; Japan; South Korea; Australia; Indonesia; Taiwan; Brazil; Saudi Arabia

Key companies profiled

Royal Dutch Shell PLC; Nippon Yusen Kabushiki Kaisha; MISC Berhad; Mitsui O.S.K. Lines Ltd (MOL); Seapeak; China State Shipbuilding Corporation; Dynagas Ltd; STX Offshore & Shipbuilding Co. Ltd.; Kawasaki Heavy Industries; GasLog Ltd; Hyundai Heavy Industries Co.; Mitsubishi Heavy Industries; Daewoo Shipbuilding and Marine Engineering (DSME); Samsung Heavy Industries; Nakilat

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LGC And VLGC LNG Shipyard Carrier Market Report Segmentation

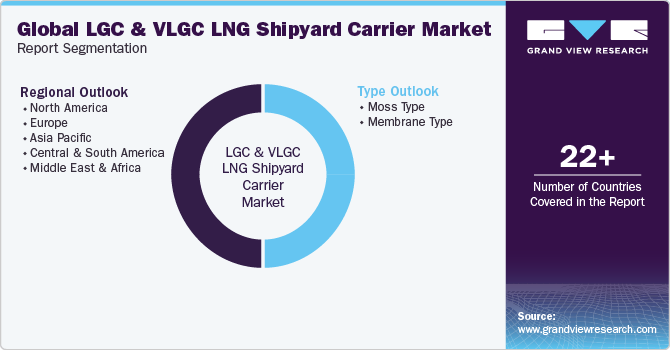

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2040. For this study, Grand View Research has segmented the global LGC and VLGC LNG shipyard carrier market report based on containment, type and region:

-

Type Outlook (Volume, Units; Capacity, Billion cu m; Revenue, USD Million, 2018 - 2040)

-

Moss Type

-

Membrane Type

-

-

Regional Outlook (Volume, Units; Capacity, Billion cu m; Revenue, USD Million, 2018 - 2040)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Spain

-

UK

-

Denmark

-

Turkey

-

Greece

-

Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Taiwan

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global LGC and VLGC LNG shipyard carrier market size was estimated at USD 8,988.76 million in 2023 and is expected to reach USD 12,318.64 million in 2024.

b. The global LGC and VLGC LNG shipyard carrier market is expected to witness a compound annual growth rate of 11.2% from 2024 to 2040 to reach USD 67,323.12 million by 2040

b. The moss type accounted for a revenue share of 67.10% in the global market in 2023 owing to its proven track record of safety, reliability, and efficiency. The design's widespread acceptance is attributed to its effective insulation capability, ensuring secure transportation of LNG. Moss-type containment systems have consistently met stringent industry standards, making them preferred choice for the transportation of LNG, which is a key driver of their market dominance.

b. Some key players operating in the LGC and VLGC LNG shipyard carrier market include Royal Dutch Shell PLC, Nippon Yusen Kabushiki Kaisha, MISC Berhad, Mitsui O.S.K. Lines Ltd (MOL), Seapeak, China State Shipbuilding Corporation, Dynagas Ltd, STX Offshore & Shipbuilding Co. Ltd., Kawasaki Heavy Industries, GasLog Ltd, Hyundai Heavy Industries Co., Mitsubishi Heavy Industries, Daewoo Shipbuilding and Marine Engineering (DSME), Samsung Heavy Industries, Nakilat

b. Key factors driving the LGC and VLGC LNG shipyard carrier market growth include growing demand for natural gas and rising LNG trade

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."