- Home

- »

- Biotechnology

- »

-

Leukapheresis Market Size, Share & Growth Report, 2030GVR Report cover

![Leukapheresis Market Size, Share & Trends Report]()

Leukapheresis Market Size, Share & Trends Analysis Report By Product (Leukapheresis Devices, Leukapheresis Disposables), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Leukapheresis Market Size & Trends

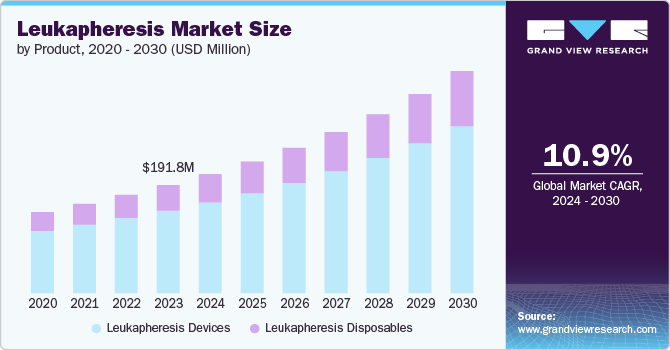

The global leukapheresis market size was estimated at USD 191.8 million in 2023 and is projected to grow at a CAGR of 10.94% from 2024 to 2030. The increasing prevalence of blood disorders and autoimmune diseases, technological advancements in leukapheresis procedures and growing demand for personalized medicine are expected to drive the market growth. Moreover, the increasing investments in research and development activities is further contributing to the market growth.

The rising incidence of blood disorders like leukemia, lymphoma, and autoimmune diseases such as rheumatoid arthritis and multiple sclerosis are significantly driving the market growth. For instance, the Leukemia & Lymphoma Society reports that an estimated total of 184,720 people in the U.S. are expected to receive a diagnosis of leukemia, lymphoma, or myeloma in 2023. Similarly, in May 2023, a study in The Lancet involving 22 million people finds autoimmune disorders affect 1 in 10 individuals, highlighting the influence of socioeconomic, seasonal, and regional factors, and offers insights into the causes of these diseases including Rheumatoid arthritis, Type 1 diabetes, and Multiple sclerosis. Thus, propelling the demand for leukapheresis over the forecast period.

The advancements in leukapheresis technologies are improving the efficiency, safety, and outcomes of the procedure. The introduction of automated systems, continuous flow centrifugation systems, and closed-system devices is expected to enhance the precision and effectiveness of leukapheresis. Thereby reducing the procedure times, minimize donor discomfort, and optimize cell collection yields. In October 2022, the Clinical Applications Committee of The American Society for Apheresis (ASFA), along with the IEC Therapy Subcommittee, AABB, and various other organizations, prepared a white paper. This document outlines guidelines for performing leukapheresis to retrieve mononuclear cells from pediatric and adult patients who are part of immune effector cell therapies, whether for commercial endeavors or research initiatives. Thus, anticipated to propel the market growth over the forecast period.

The shift towards personalized medicine approaches that tailor treatment strategies to individual patient profiles are fueling the demand for leukapheresis procedures. Leukapheresis plays a crucial role in cell-based therapies, such as chimeric antigen receptor (CAR) T-cell therapy and stem cell transplantation. In December 2023, an article in Transfusion and Apheresis Science underscored the challenges in manufacturing CAR-T cells, beginning with the extraction of T cells through leukapheresis from peripheral blood. The article emphasized the critical role of an effective leukapheresis product in achieving successful CAR-T cell therapy and highlighted the significance of comprehending the factors that impact T cell quality.

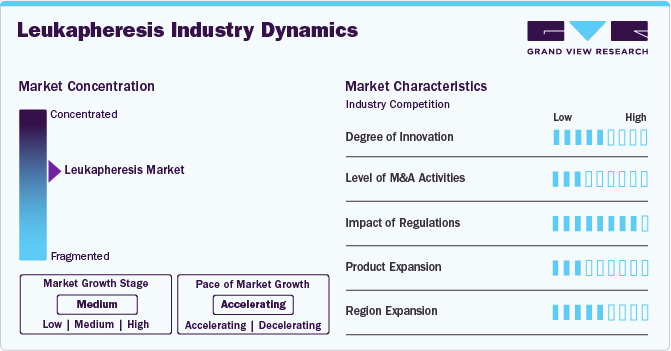

Market Concentration & Characteristics

The industry is anticipated to experience a medium degree of innovation in the global market owing to the advancements in technology leading to more efficient and precise procedures. Companies such as Terumo BCT introduced innovative leukapheresis systems such as the Spectra Optia Apheresis System, which offers automated mononuclear cell collection for cell therapy applications. Thereby significantly improving the efficacy and safety of leukapheresis procedures and impelling the demand.

The market has seen a low level of merger and acquisition activity. The market is characterized by a smaller number of specialized players, primarily focusing on developing and manufacturing leukapheresis devices and related technologies. Moreover, the regulatory complexities associated with medical devices and biotechnologies, including leukapheresis systems, are hampering the market growth. However, despite these challenges, the increasing demand for leukapheresis procedures driven by rising incidences of hematologic disorders and advancements in biotechnology is anticipated to boost the activity in M&A within the global market.

Regulations profoundly impact the market growth owing to the stringent standards for safety, efficacy, and quality, which manufacturers are expected to gain for market approval. These requirements create significant barriers to entry, as companies must navigate complex approval processes and rigorous clinical validation.

The leukapheresis industry has been experiencing relatively low growth in terms of product expansion. This is attributed to regulatory hurdles, stringent clinical validation requirements, and the high cost of research & development anticipating significant challenges for companies seeking to introduce new leukapheresis products.

Regional expansion efforts are ongoing in the global market, at a moderate level compared to other factors. Companies such as Haemonetics Corporation expand their presence globally through strategic partnerships and collaborations. These initiatives aim to increase market penetration in key regions and capitalize on emerging opportunities in developing healthcare markets worldwide.

Product Insights

The leukapheresis devices segment led the market with the largest revenue share of 76.4% in 2023. The leukapheresis devices segment is further segmented into centrifugation-based devices and membrane filtration-based devices. Growing prevalence of blood disorders such as leukemia and lymphoma, increasing demand for stem cell transplantation procedures, and advancements in technology leading to more efficient and automated systems is anticipated to drive the centrifugation-based devices. Furthermore, the rising incidence of autoimmune diseases and chronic conditions requiring therapeutic apheresis, along with the need for selective depletion or collection of specific cell populations like white blood cells, are significantly fueling the demand of membrane filtration-based devices. In January 2023, StemExpress introduced CellsExpress, aiming to accelerate research and development by providing bulk, customized isolated cell types from their high-quality Leukopaks, streamlining processes for researchers. Thus, these new product launches are anticipated to propel the demand for the leukapheresis devices overt the forecast period.

The leukapheresis disposables segment is expected to grow at the fastest CAGR over the forecast period. This is attributed to the increasing procedural volumes, growing awareness about blood component separation techniques, and stringent regulatory guidelines ensuring patient safety. Owing to the expanding patient pool with hematologic disorders and solid tumors, is boosting the demand for disposables used during these procedures, thereby propelling the number of leukapheresis procedures. For instance, Haemonetics Corporation offers comprehensive disposable kits compatible with its MCS+ system to facilitate efficient cell collection and processing during leukapheresis procedures. Thus anticipating segmental growth over the forecast period.

Application Insights

Based on application, the research application segment led the market with the largest revenue share of 67.9% in 2023. Research applications in this market are primarily driven by the increasing focus on developing novel therapies for various diseases, such as cancer and autoimmune disorders. Owing to the need for isolating specific cell populations, like T cells or stem cells, for further study and therapeutic development the demand for leukapheresis procedures in research is anticipated to boost over the forecast period. In December 2023, the journal Cancers reported that patients with acute myeloid leukemia (AML) who have FLT3-ITD mutations showed better outcomes and lower early mortality rates after undergoing emergency leukapheresis, compared to other patients with leukocytosis.

The therapeutics application segment is anticipated to grow at the fastest CAGR of 11.51% over the forecast period: Therapeutic applications of leukapheresis are being driven by the increasing adoption of cell-based therapies and personalized medicine approaches. In an article from August 2022 in the journal Transfusion Medicine and Hemotherapy, discussed that even with a diminished patient count, therapeutic leukapheresis continues to be a viable, safe, and effective treatment option for certain cases.

End-use Insights

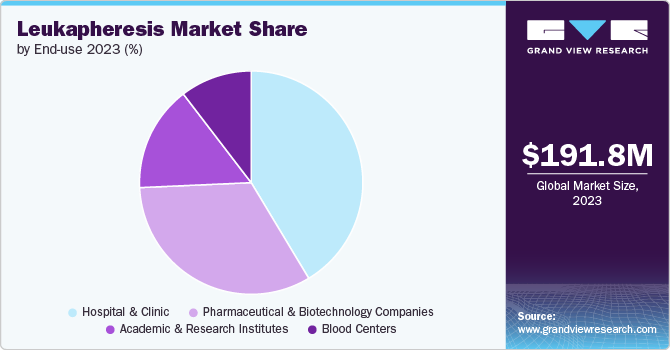

Based on end use, the hospitals & clinics segment led the market with the largest revenue share of 41.37% in 2023. Owing to the complicated role in healthcare, including direct patient care, therapeutic procedures, and diagnostic services. In July 2022, the Hoxworth Blood Center at the University of Cincinnati unveiled its newly renovated Apheresis Center. The center partners with UCH (UCMC and West Chester). The Christ Hospital, and Cincinnati Children's Hospital Medical Center for therapeutic procedures. These collaborations are anticipated to propel the growth of the segment over the forecast period.

The pharmaceutical & biotechnology companies’ segment is expected to witness at the fastest CAGR over the forecast period. Pharmaceutical and biotechnology companies utilize leukapheresis products for research, drug development, and manufacturing processes. Moreover, the growing emphasis on personalized medicine and cell-based therapies is driving companies. Leukapheresis process enables the isolation of specific cell populations, such as T cells or monocytes, for both research and therapeutic applications, supporting the demand towards precision medicine. In November 2023, Charles River Laboratories International, Inc. announced the addition of CliniPrime Cryopreserved Leukopaks to its GMP-compliant offerings, enhancing cell therapy development and manufacturing. These cryopreserved leukopaks serve as crucial, donor-derived starting material for gene-modified cell therapy research and development. Thus, propelling the demand for leukapheresis over the forecast period.

Regional Insights

North America dominated the leukapheresis market with the revenue share of 36.96% in 2023. This is attributed to well-established healthcare infrastructure, high healthcare expenditures, increasing prevalence of diseases such as cancer & autoimmune disorders, and robust research and development activities. Moreover, the presence of leading pharmaceutical and biotechnology companies focusing on innovative therapies and treatments further bolstered market growth. These factors collectively are anticipated to propel market growth for leukapheresis over the forecast period.

U.S. Leukapheresis Market Trends

The leukapheresis market in the U.S. is expected to grow at the fastest CAGR over the forecast period. The advancements in healthcare infrastructure and technology, paired with rising healthcare expenditure, are expected to facilitate greater adoption of leukapheresis procedures across various healthcare settings.

Europe Leukapheresis Market Trends

The leukapheresis market in Europe was identified as a lucrative region in this industry. The increasing healthcare expenditure and growing awareness about therapeutic advancements is expected to contribute to the market's growth. Moreover, collaborations between research institutions, pharmaceutical companies, and healthcare providers enhance the development and adoption of new leukapheresis technologies and therapies in Europe.

The UK leukapheresis market is expected to grow at a significant CAGR over the forecast period. The increasing incidence of blood cancers and autoimmune diseases in the UK is expected to drive the demand for leukapheresis procedures, which is important for both treatment and research purposes.

The leukapheresis market in Franceis anticipated to grow at a substantial CAGR over the forecast period. The ongoing research and development efforts in biotechnology and healthcare, joined with favorable government initiatives promoting medical innovation, are likely to accelerate market growth.

The Germany leukapheresis marketis expected to grow at the fastest CAGR over the forecast period driven by the growing investments in research and development of novel leukapheresis techniques and devices. These advancements pave the way for the emergence of personalized medicine approaches in the treatment of blood-related disorders

Asia Pacific Leukapheresis Market Trends

The leukapheresis market in Asia Pacific is anticipated to witness at the fastest CAGR of 12.2% from 2024 to 2030. Increasing healthcare expenditure, improving healthcare infrastructure, and rising awareness about advanced treatment options are expected to contribute significantly to market expansion. Moreover, the region's large and aging population, coupled with a rising prevalence of chronic diseases such as cancer and autoimmune disorders, is likely to fuel the demand for leukapheresis procedures.

The China leukapheresis market is expected to grow at the fastest CAGR over the forecast period. The increasing healthcare reforms and investments in medical infrastructure, particularly in major cities around China, are expected to expand access to advanced therapies such as leukapheresis. Thus, propelling the demand for leukapheresis over the forecast period.

The leukapheresis market in Japan is anticipated to grow at a significant CAGR over the forecast period. Growing improvements in leukapheresis devices and procedures are expected to fuel market growth, resulting in improved patient outcomes. Furthermore, heightened research efforts to develop new therapies using leukapheresis techniques are broadening the market.

The India leukapheresis marketis anticipated to grow at a rapid CAGR over the forecast period. Owing to the country's large and diverse population, coupled with a rising prevalence of hematologic disorders, increasing investments in medical infrastructure and advancements in healthcare technologies is anticipated to impel the demand for market growth over the forecast period.

Middle East And Africa Leukapheresis Market Trends

The leukapheresis market in the Middle East and Africa is expected to grow at a significant CAGR during the forecast period, owing to the increasing incidence of leukemia and other blood-related disorders. A report from the Journal of the Egyptian National Cancer Institute in October 2022 noted a rapid increase in cancer rates in the region, predicting a 1.8-fold rise in incidence by 2030. Thus, anticipating the impel market growth over the forecast period.

The Saudi Arabia leukapheresis marketis expected to grow at the fastest CAGR over the forecast period. This growth is driven by government initiatives focused on enhancing healthcare infrastructure and services, leading to better support for leukapheresis technologies.

The leukapheresis market in Kuwait is anticipated to witness at a significant CAGR growth over the forecast period. Increased investments in R&D for leukapheresis technologies are fueling the market growth.

Key Leukapheresis Company Insights

Key players operating in the global market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Leukapheresis Companies:

The following are the leading companies in the leukapheresis market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories International, Inc.

- Adacyte Therapeutics

- AllCells, LLC

- Asahi Kasei Medical

- Haemonetics Corporation

- Macopharma

- Cerus Corporation

- SB-Kawasumi Laboratories, Inc.

- StemExpress, LLC.

- Haemonetics Corporation

- Lonza Group AG

Recent Developments

-

In March 2024, the FDA approved Breyanzi from Bristol Myers Squibb, a novel CAR T cell treatment for adults with certain types of leukemia and lymphoma. Starting with leukapheresis, the treatment collects patients' white blood cells to produce the therapy

-

In August 2023, the Reveos Automated Whole Blood Processing System, developed by Terumo Blood and Cell Technologies, was approved by the FDA. This device enhances the processing of whole blood into white blood cells and various components, with the goal of augmenting the blood supply in the U.S.

-

In May 2023, Akadeum Life Sciences introduced a new range of products for cell therapy research, enhancing their BACS Microbubble technology for easy isolation of T cells and PBMCs from leukapheresis material, avoiding traditional lysis or centrifugation steps

Leukapheresis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 211.3 million

Revenue forecast in 2030

USD 394.1 million

Growth rate

CAGR of 10.94% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories International, Inc.; Adacyte Therapeutics; AllCells, LLC; Asahi Kasei Medical; Haemonetics Corporation; Macopharma; Cerus Corporation; SB-Kawasumi Laboratories, Inc.; StemExpress, LLC.; Lonza Group AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leukapheresis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global leukapheresis market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Leukapheresis Devices

-

Centrifugal Devices

-

Membrane Separators

-

-

Leukapheresis Disposables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Application

-

Cancer Research

-

Immunology Research

-

Others

-

-

Therapeutics Application

-

Hematologic Disorders

-

Autoimmune Diseases

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Centers

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global leukapheresis market size was estimated at USD 191.8 million in 2023 and is expected to reach USD 211.3 million in 2024.

b. The global leukapheresis market is expected to grow at a compound annual growth rate of 10.94% from 2024 to 2030 to reach USD 394.1 million by 2030.

b. North America dominated the leukapheresis market with a share of 36.96% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This is attributable to growing technological advancements and the presence of key players operating in the market.

b. Some key players in the leukapheresis market include Charles River Laboratories International, Inc., Adacyte Therapeutics, AllCells, LLC, Asahi Kasei Medical, and Haemonetics Corporation.

b. Key factors driving the leukapheresis market growth include the increasing prevalence of blood disorders and autoimmune diseases, technological advancements in leukapheresis procedures, and growing demand for personalized medicine.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."