- Home

- »

- Next Generation Technologies

- »

-

Less-than-truckload Market Size And Share Report, 2030GVR Report cover

![Less-than-Truckload Market Size, Share & Trends Report]()

Less-than-Truckload Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Type (Long-haul Carriers, Superregional Carriers, Regional Carriers), By Capacity (Light, Heavy), By Destination (Domestic, International), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-471-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Less-than-Truckload Market Summary

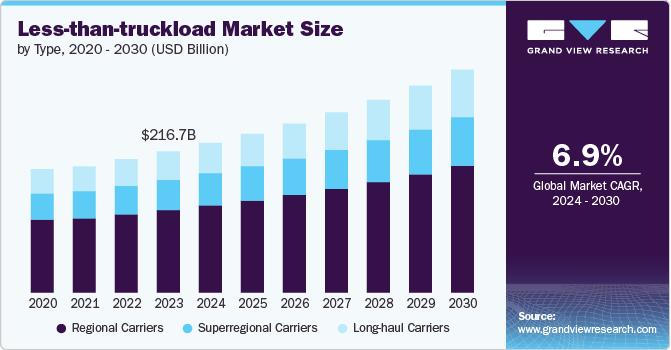

The global less-than-truckload (ltl) market size was estimated at USD 216.68 billion in 2023 and is projected to reach USD USD 342.09 billion by 2030, growing at a CAGR of 6.9% from 2024 to 2030. The growth of regional distribution centers and micro-fulfillment hubs has led to higher demand for LTL services, which enable the movement of goods across shorter distances and in smaller quantities.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 8.2% from 2024 to 2030.

- By type, the regional carriers segment dominated the market in 2023 with a revenue share of more than 58.0%.

- By capacity, the heavy LTL segment is projected to register a significant growth rate from 2024 to 2030.

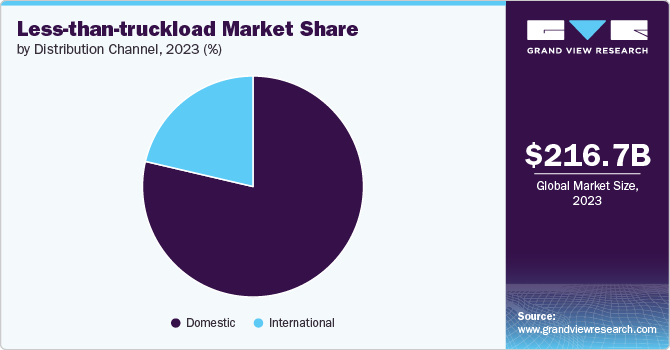

- By destination, the domestic segment dominated the market in 2023 and accounted for more than 78.0% share of global revenue.

Market Size & Forecast

- 2023 Market Size: USD 216.68 Billion

- 2030 Projected Market Size: USD 342.09 Billion

- CAGR (2024-2030): 6.9%

- North America: Largest market in 2023

The growth of e-commerce and digital marketplaces has fundamentally changed consumer expectations. Consumers now expect fast, flexible, and reliable delivery options. Less-than-truckload (LTL) carriers, due to their ability to consolidate smaller shipments, offer a cost-effective and efficient way to meet these demands, particularly for last-mile and regional deliveries.Urbanization trends have significantly impacted the Less-than-truckload (LTL) market positively. As cities grow and expand, the demand for efficient intra-city and regional freight delivery is increasing. LTL carriers are positioned to handle deliveries in urban areas where full truckload services may not be cost-efficient or practical. Furthermore, with the rise of online shopping, there has been an increase in demand for smaller, more frequent shipments, which is perfectly suited for LTL services. Retailers and e-commerce companies such as Amazon.com, Inc. and Walmart Inc. are utilizing LTL to handle last-mile deliveries more efficiently.

With growing concerns about environmental impact, LTL carriers are prioritizing sustainability in their operations. Shippers are opting for LTL as a greener alternative to full truckload services since consolidating shipments reduces the number of trucks on the road, lowering carbon emissions. Furthermore, LTL companies are investing in electric vehicles (EVs), fuel-efficient fleets, and alternative fuel technologies to meet sustainable goals. Additionally, smart routing and optimization technologies are minimizing empty miles and reducing fuel consumptions.

The reliance on third-party logistics (3PL) providers has increased significantly within the LTL space. Many businesses outsource their logistics needs to 3PLs to streamline operations, optimize shipping costs, and gain access to broader carrier networks. This trend is driving the demand for LTL services, as 3PLs often utilize LTL to transport partial loads for multiple clients. Less-than-truckload (LTL) provides a cost-effective solution for companies that do not need to ship full truckloads. By sharing trailer space with other shippers, businesses can reduce freight costs significantly. This is particularly attractive to small and medium-sized enterprises (SMEs) looking to optimize their shipping expenses.

The emergence of digital freight matching platforms is transforming the way LTL careers to connect with shippers. These platforms allow shippers to find LTL carriers with available capacity in real-time, optimizing trailer utilization and reducing empty miles. Furthermore, automation in LTL warehouses is improving operational efficiency and reducing labor costs. Automated storage and retrieval systems, and sorting robots are streamlining the handling of LTL freight, further driving the growth of the market during the forecast period.

Type Insights

In terms of type, the market is classified into regional carriers, superregional carriers, and long-haul carriers. The regional carriers segment dominated the market in 2023 and accounted for more than 58.0% share of global revenue. One of the most significant trends in the regional carrier segment is the growing demand for e-commerce fulfillment and last-mile deliveries. With the continued rise of online shopping, businesses are increasingly relying on regional carriers to quickly move goods between local distribution centers and customers. Furthermore, regional carriers are adopting advanced tracking systems and route optimization software to minimize transit times and reduce costs. This trend has been accelerated by the need for transparency in shipment tracking, as consumers and businesses alike demand real-time updates on their deliveries.

The long-haul carrier segment is projected to witness the highest CAGR of 7.8% from 2024 to 2030. The expansion of cross-border trade has significantly impacted on the long-haul segment market. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, has streamlined trade between demand for long-haul carriers. Blockchain technology is emerging as a critical tool for long-haul carriers, especially in cross-border shipping. It offers greater transparency, security, and efficiency by digitizing paperwork and streamlining customer processes.

Capacity Insights

In terms of capacity, the market is classified as light LTL and heavy LTL. The light LTL segment dominated the market in 2023 and accounted for more than 66.0% share of global revenue. Customer expectations are evolving in the age of digital commerce, and they expect faster and more flexible shipping options. This is driving the growth of the light LTL segment, as businesses seek more cost-effective ways to ship smaller loads quickly. Furthermore, rising consumer demand for next-day or same-day deliveries is also pushing LTL carriers to adopt technologies that improve delivery speed and accuracy.

The heavy LTL segment is projected to register a significant growth rate from 2024 to 2030. As global supply chains become more fragmented and complex, businesses are turning to Less-than-truckload (LTL) providers to move smaller shipments across multiple locations. This trend has particularly benefited the heavy LTL segment, as companies need to move bulky, multi-pallet loads across regional or national distribution networks. Companies with complex supply chains, particularly those in the manufacturing, automotive, and construction industries, are driving demand for heavy LTL services that offer scalability and the ability to handle large, specialized shipments.

Destination Insights

In terms of destination, the market is classified as domestic and international. The domestic segment dominated the market in 2023 and accounted for more than 78.0% share of global revenue. The resurgence of regional manufacturing hubs, particularly in North America and Europe, has bolstered the domestic LTL market. As businesses focus to shorten their supply chains and reduce lead times, LTL carriers play a vital role in moving raw materials, components, and finished goods between factories and distribution centers. Furthermore, the proliferation of local distribution hubs and fulfillment centers has enhanced the reach and speed of domestic LTL services, ensuring timely deliveries to even the most remote locations.

The international segment is projected to register a significant growth rate from 2024 to 2030. As businesses expand their reach in new markets, the demand for cross-border and intercontinental LTL services is rising. LTL carriers are optimizing their routes and developing partnerships with international freight forwarders to streamline cross-border transportation. Moreover, growth in the international online shopping, businesses are increasingly shipping smaller loads across borders to meet customer demands. The growth of cross-border e-commerce has created a need for cost-effective international LTL solutions that can handle frequent shipments of smaller packages.

Regional Insights

North America dominated the global Less-than-truckload market and accounted for a revenue share of over 37.0% in 2023. The improvement of transportation infrastructure, including highways and rail networks, supports the growth of the regional LTL segment. Market players in the region are focusing on differentiation through superior customer service, technology integration, and service reliability is further driving the market growth in the region.

U.S. Less-than-truckload Market Trends

The Less-than-truckload market in the U.S. is expected to grow at a CAGR of 5.8% from 2024 to 2030. The rapid expansion of e-commerce has led to increased demand for LTL services in the U.S. The adoption of advanced technologies such as real-time tracking and automated routing systems has enhanced the efficiency and transparency of regional LTL operations.

Europe Less-than-truckload Market Trends

The Less-than-truckload market in Europe is expected to register a considerable growth rate from 2024 to 2030. European regulations and consumer preferences drive the focus on sustainability. Regional LTL providers in Europe are adopting eco-friendly practices, including low-emission vehicles and energy-efficient facilities.

Asia Pacific Less-than-truckload Market Trends

The Less-than-truckload market in Asia Pacific is expected to grow at a highest CAGR of 8.2% from 2024 to 2030. The rapid economic growth and industrialization in countries like China and India are fueling the demand for regional LTL services. The expansion of manufacturing and retail sectors contribute to increased regional freight movement is further driving the growth of LTL market in the Asia Pacific region.

Key Less-than-Truckload Company Insights

Some of the key companies operating in the Less-than-Truckload (LTL) market include FedEx Freight, Old Dominion Freight Line, XPO, and Estes Express Line, among others.

- FedEx Freight is a provider of LTL carrier services. The company offers a range of LTL services, including expedited and specialized solutions, catering to various customer needs. The company has invested in advanced technology and streamlined processes, which help optimize routes, improve delivery times, and reduce costs.

Challenger Motor Freight Inc., Central Transport, and First Call Logistics are some of the emerging companies in the target market.

- First Call Logistics is engaged in providing logistics services, including LTL, warehousing, cross-border freight, and sprinter van, among others. The company serves customers in various industries, including manufacturing, food & beverage, retail, healthcare, and automotive. The company utilizing advanced technology for tracking, routing, and logistics management can improve operational efficiency and customer satisfaction.

Key Less-than-Truckload Companies:

The following are the leading companies in the less-than-truckload market. These companies collectively hold the largest market share and dictate industry trends.

- ABF Freight

- Central Transport

- Challenger Motor Freight Inc.

- Estes Express Line

- FedEx Freight

- Old Dominion Freight Line

- R+L Carriers

- Saia Inc

- TFI International

- XPO

Recent Developments

-

In May 2024, Challenger Motor Freight Inc. announced a cross-border expansion by launching Challenger USA, anchored with a terminal in Detroit. The launch would allow the company to enhance asset-based operations with the U.S.

-

In June 2024, ABF Freight, a subsidiary of ArcBest collaborated with DRŌV to install small trailer technology - AirBoxOne, in its rigs. The technology integrates truck and trailer sensors and provides real-time information of city trailers while the trailers are in motion.

Less-than-Truckload (LTL) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 229.60 billion

Revenue forecast in 2030

USD 342.09 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, capacity, destination, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABF Freight; Central Transport; Challenger Motor Freight Inc.; Estes Express Line; FedEx Freight; Old Dominion Freight Line; R+L Carriers; Saia Inc.; TFI International; XPO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Less-than-Truckload (LTL) Market Report Segmentation

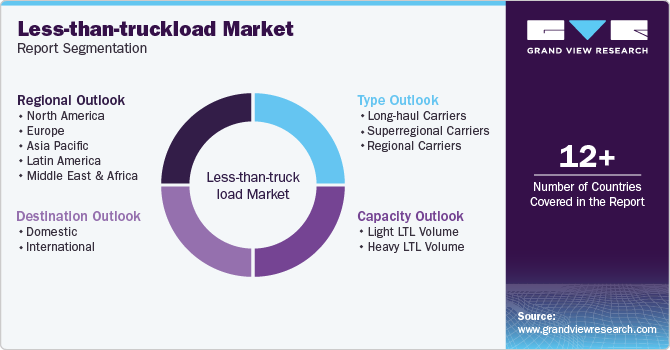

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Less-than-truckload market report based on type, capacity, destination, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Long-haul Carriers

-

Superregional Carriers

-

Regional Carriers

-

-

Capacity Outlook (Revenue, USD Billion, 2017 - 2030)

-

Light LTL Volume

-

Heavy LTL Volume

-

-

Destination Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Less-than-truckload market size was estimated at USD 216.68 billion in 2023 and is expected to reach USD 229.6 billion in 2024.

b. The global Less-than-truckload market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 342.09 billion by 2030.

b. The regional carriers segment dominated the market in 2023 and accounted for more than 58.0% share of global revenue. One of the most significant trends in the regional carrier segment is the growing demand for e-commerce fulfillment and last-mile deliveries. With the continued rise of online shopping, businesses are increasingly relying on regional carriers to quickly move goods between local distribution centers and customers.

b. Some of the key companies operating in the Less-than-truckload market include FedEx Freight, Old Dominion Freight Line, XPO, and Estes Express Line.

b. The growth of regional distribution centers and micro-fulfillment hubs has led to higher demand for LTL services, which enable the movement of goods across shorter distances and in smaller quantities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.