Legionella Testing Market Size, Share, & Trends Analysis Report By Type (Water Testing, IVD Testing), By End Use (Microbial Culture, Direct Fluorescent Antibody (DFA) Stain, PCR, Others), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-372-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Legionella Testing Market Size & Trends

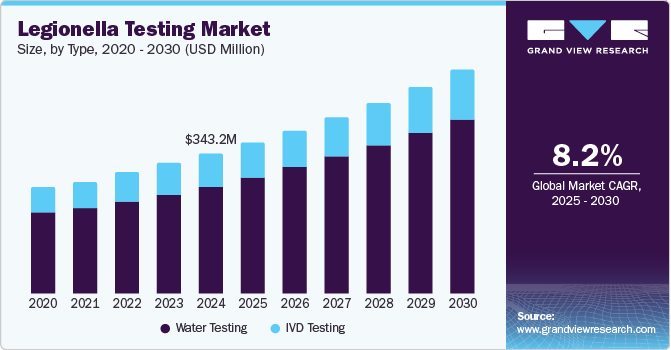

The global legionella testing market size was valued at USD 343.2 million in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The increasing incidence of Legionella-related disorders and rising awareness about preventive management is expected to drive market growth. Legionella can cause Legionellosis, a respiratory disorder (a form of pneumonia). It requires intensive care and hospitalization; hence, it is considered one of the public health concerns.

The rising prevalence of bacteria-driven diseases and the increasing inclination among governments to incorporate programs to protect public health are expected to fuel the growth of this market. The growing new incidences of Legionnaires disease reported in multiple regions, especially in Europe, are leading to growth in demand for effective legionella testing solutions. For instance, according to the Communicable Disease Threats Report by the European Center for Disease Prevention and Control for week 9, 22-28 February 2025, Austria experienced an outbreak of Legionnaires in Vorarlberg.

Numerous countries in Europe have experienced such outbreaks. For instance, in 2024, 49 cases and 3 deaths associated with the Legionnaires outbreak were reported in Lombardy, Italy, whereas London, UK, experienced 30 cases and 2 deaths. Such incidences result in increasing awareness regarding timely interventions and significant steps by local authorities to limit the consequences of outbreaks. These factors are likely to fuel growth for this market.

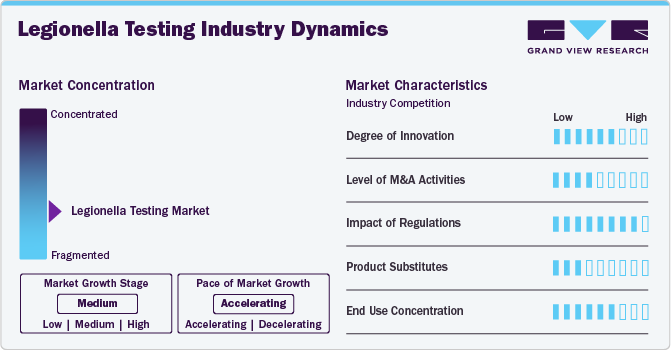

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating . The legionella testing industry is characterized by a medium degree of innovation owing to rapid technological advancements and increasing demand for novel diagnostic technologies. Innovation is mainly driven by the increasing investment by biotechnology companies and organizations operating in diagnostic solutions.

The legionella testing market has been experiencing moderate levels of mergers and acquisitions. The key strategic advancements associated with acquisitions are mainly driven by the initiatives embraced by key market participants and large enterprises to strengthen the market positioning. For instance, in September 2024, LuminUltra, one of the market participants in the biological diagnostic testing industry, acquired legionella testing business assets of Canada-based biotech company Genomadix Inc.

The legionella testing market experiences high degree impact of regulatory scenario. The legionella testing solutions are subjected to the health and safety regulations, standards for medical devices and others regulatory requirements. The threat of substitute products primarily stimulates from inability of traditional testing solutions to identify dead and live bacteria. Innovation-based new product launches equipped with advanced technology features are expected to capture greater market share in coming years.

Type Insights

The water testing segment held the largest revenue share of the legionella testing industry and accounted for revenue share of 76.8% in 2024. The factors contributing to the segment growth primarily include government laws that mandate the testing for Legionella. For instance, in numerous European countries, authorities implement Legionella testing regulations. Greater turnaround time is one of the key drawbacks of traditional testing methods, as these tests can take weeks to deliver results, which reduces the possibility of timely intervention. The absence of adequate diagnostics can lead to presumptive treatment or delay it. It can further hamper the treatment measures and cause outbreaks. Therefore, there is a need for the development of new and advanced diagnostic tools.

Traditional testing methods are labor-intensive and involve manual interference, which can cause contamination and affect the outputs. Advancements associated with diagnostic technologies in automation and digitization are responsible for market growth. Automation facilitates up to 50% timesaving in diagnostic procedures, as it reduces the burden of manual efforts. In addition, results are reliable, precise, and sensitive. Diagnostic lab automation generates standardized and reproducible results. Therefore, advanced rapid diagnostic methods are gaining popularity, and their demand is expected to expand in the coming years. However, a limited number of manufacturing companies can challenge market growth.

The IVD testing segment is expected to experience significant growth over the forecast period. Urinary antigen tests and PCR are widely used for legionella testing, combined with traditional culture methods. Reduced turnaround time associated with IVD testing facilitates quick diagnosis and timely interventions. These aspects are expected to support the growth of this segment.

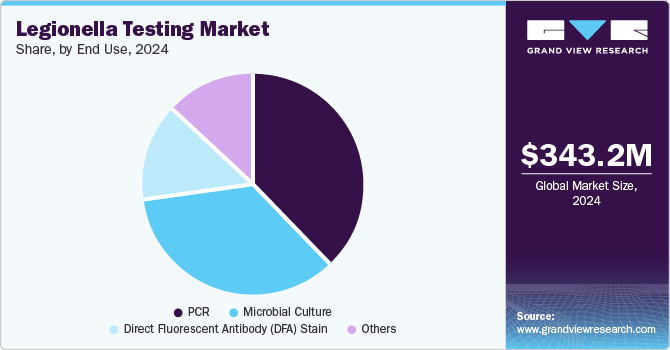

End Use Insights

The PCR segment accounted for the largest revenue share of legionella testing industry in 2024. PCR is mainly preferred for its rapid pace, less turnaround time, sensitivity, and capacity to identify both viable and non-viable bacteria. PCR offers high sensitivity and quick detection capabilities, enabling accurate identification of Legionella bacteria quickly. Advancements in molecular diagnostics and increasing regulatory support for incorporating faster and more reliable testing methods drive the growth of this segment.

The microbial culture segment is expected to grow significantly from 2025 to 2030. Microbial culture offers high specificity and sensitivity, accurately identifying Legionella bacteria. Regulatory guidelines often recommend or require its use, ensuring water safety in various settings. It is increasingly used in routine legionella testing and case confirmations. The method is also used in risk assessment and regular water testing.

Regional Insights

North America was identified as one of the key regions of the legionella testing industry in 2024. The increasing incidence of Legionnaires' cases of pneumonia-like illness caused by the Legionella bacteria is a major driver for this regional market. Rising awareness regarding the risks associated with disease, stringent regulations, and growing investments in R&D to develop innovative testing solutions are likely to drive growth in this market.

U.S. Legionella Testing Market Trends

The U.S. dominated the North America legionella testing market in 2024 with the largest revenue share due to its strict water safety stipulations, robust healthcare infrastructure, and high awareness of Legionnaires' disease. The increasing availability of advanced diagnostic solutions and the significant focus of government authorities on protecting public health and welfare are expected to add lucrative growth opportunities to this market.

Europe Legionella Testing Market Trends

Europe dominated the global legionella testing industry and accounted for the largest revenue share of 39.7% in 2024. The governments in some countries, such as the UK and Germany, have made Legionella testing mandatory to protect public health. This is primarily due to the high levels of awareness regarding Legionellosis related diseases and associated risks.

The UK legionella testing market held the largest revenue share of the regional market in 2024. Key factor influencing the growth of this market is increasing prevalence of Legionnaires disease driven by easy spread of bacteria, presence of multiple purpose-built water systems especially in public buildings such as hospitals, government buildings, and hotels.

Asia Pacific Legionella Testing Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 9.5% during the forecast period. The rising geriatric population in this region, which is more prone to infections, is expected to develop a greater demand for diagnostic solutions related to bacteria-driven diseases. In addition, increasing disposable income and growing penetration of Legionella testing products via a strong distribution network of global market participants are expected to drive market growth over the forecast period. Significant enhancements associated with healthcare infrastructure in the region, the focus of multiple countries such as China and India to provide public health improvement support, and the growing availability of advanced solutions are anticipated to generate greater opportunities for this market.

China held a substantial revenue share of regional legionella testing industry in 2024 owing to rapid urbanization, industrialization and the increasing awareness of waterborne diseases. The focus of local authorities on the implementation of preventive measures is also driving the growth of this market.

Key Legionella Testing Company Insights

Key players in the global legionella testing industry include Abbott, Beckman Coulter, Inc. (Danaher Corporation), BD, BIOMÉRIEUX, F. Hoffmann-La Roche Ltd. and others. The key market participants focus on innovation, research and development investment, and the delivery of advanced technology-driven solutions to strengthen market positioning.

-

Abbott is one of the global market participants in diagnostics and it plays a significant role in the legionella testing market. It offers rapid diagnostic tools such as the BinaxNOW Legionella Urinary Antigen Card for aiding the presumptive diagnosis of disease.

-

Beckman Coulter, Inc. (Danaher Corporation) specializes in products associated with biomedical testing. It offers microbiology panels, systems, and analyzers. It also provides products and reagents which are utilized in the Legionella urinary antigen testing.

Key Legionella Testing Companies:

The following are the leading companies in the legionella testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Beckman Coulter, Inc. (Danaher Corporation)

- BD

- Bio-Rad Laboratories, Inc.

- BIOMÉRIEUX

- Eiken Chemical Co., Ltd.

- Hologic, Inc

- Pro Lab Diagnostics Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

-

In September 2024, LuminUltra Technologies Ltd., a Canadian molecular diagnostics company, acquired the Legionella testing assets of Genomadix Inc. This acquisition includes the Genomadix Cube qPCR platform, a portable device capable of delivering Legionella detection results in under an hour with laboratory-grade sensitivity

-

In May 2024, Dubai Central Laboratory, affiliated with Dubai Municipality, recently adopted a novel artificial intelligence (AI) powered technology developed to identify Legionella pulmonary bacteria which causes numerous acute respiratory infections. The first-of-its-kind application in the region is expected to support the growing demand for effective testing technologies equipped with less turnaround time.

Legionella Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 369.9 million |

|

Revenue forecast in 2030 |

USD 547.4 million |

|

Growth Rate |

CAGR of 8.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

April - 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait |

|

Key companies profiled |

Abbott; Beckman Coulter, Inc. (Danher Corporation); BD; Bio-Rad Laboratories, Inc.; BIOMÉRIEUX; Eiken Chemical Co., Ltd.; Hologic, Inc.; Pro Lab Diagnostics Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Takara Bio Inc.;Thermo Fisher Scientific Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Legionella Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legionella testing industry report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Testing

-

IVD Testing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Microbial Culture

-

Direct Fluorescent Antibody (DFA) Stain

-

PCR

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."