- Home

- »

- Consumer F&B

- »

-

Lecithin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Lecithin Market Size, Share & Trends Report]()

Lecithin Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Soy, Sunflower, Rapeseed), By End Use (Convenience Foods, Animal Feed, Industrial, Bakery), By Form (Liquid, Powder, Granules), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-858-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lecithin Market Summary

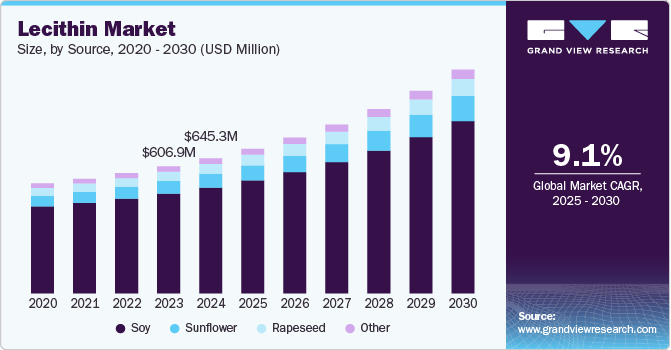

The global lecithin market size was estimated at USD 645.1 million in 2024 and is projected to reach USD 1,068.8 million by 2030, growing at a CAGR of 9.1% from 2025 to 2030. One of the primary factors fueling this growth is the increasing demand for natural and clean-label ingredients in food and beverage products.

Key Market Trends & Insights

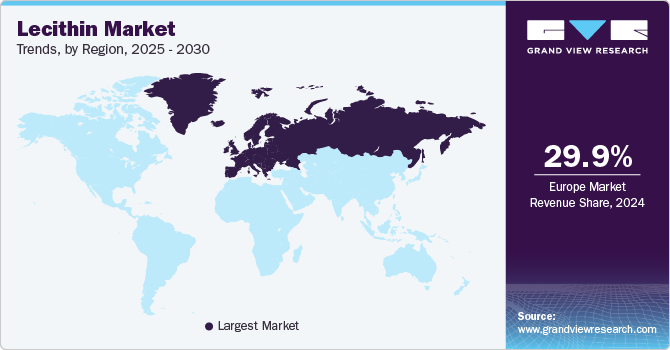

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, France is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, soy accounted for a revenue of USD 469.3 million in 2023.

- Sunflower is the most lucrative source segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 645.1 Million

- 2030 Projected Market Size: USD 1,068.8 Million

- CAGR (2025-2030): 9.1%

- Europe: Largest market in 2023

As consumers become more health conscious and aware of the ingredients in their food, the demand for lecithin, a natural emulsifier derived primarily from soybeans, sunflower, and egg yolks, has escalated. This trend aligns with the broader movement towards transparency and sustainability in food production, resulting in more manufacturers seeking phospholipids as a wholesome alternative to synthetic additives.

Lecithin manufacturers contend on the grounds of competitive pricing due to the existence of price-sensitive buyers. Moreover, manufacturers emphasize process innovation and low-cost raw material origins to gain a competitive edge in the marketplace. In addition, the rapid growth of end use industries such as food, beverage, feed, and pharmaceutical, as well as the rise in lecithin production, tends to overwhelm and fill the gap between supply and demand, and moderate price increases are expected during the forecast period.

Furthermore, the expansion of the plant-based food sector has significantly influenced the lecithin market. With a growing number of consumers adopting vegetarian and vegan diets, there is an increasing need for plant-derived ingredients that can enhance the texture, flavor, and shelf life of food products. Lecithin serves as an effective emulsifier and stabilizer, making it an essential component in a variety of plant-based alternatives, including dairy substitutes, meat analogs, and baked goods. As plant-based products gain mainstream acceptance, the market is expected to benefit immensely from this accelerated demand.

Another critical market growth driver is the rising interest in functional foods and health supplements. With an emphasis on health and wellness, consumers are increasingly seeking out products that offer additional nutritional benefits. Lecithin is known for its positive effects on cholesterol levels, liver health, and cognitive function, which makes it an attractive ingredient in health-oriented products. As more health and nutrition companies incorporate phospholipids into their formulations, the market for this versatile emulsifier is expected to continue expanding, particularly in the dietary supplement sector.

Changing consumer preferences toward the consumption of non-GMO and hypoallergenic food products have forced lecithin manufacturers to improve their product portfolios by introducing new products. For example, in 2018, Cargill Incorporated, one of the prominent contributors to the lecithin market, launched an entirely new portfolio of defatted lecithin products. Industry players are focusing on improving the quality of their products.

Source Insights

Soy lecithin accounted for a revenue share of 78.3% in 2024. This is attributable to the growing food industry in regions of Europe and Asia Pacific due to the presence of extensive areas of land under soybean cultivation and production. It is mainly used for manufacturing dairy products, ice creams, dietary supplements, infant formulas, bread, margarine, and other convenience foods. However, growing concerns regarding increasing cholesterol levels and allergic properties of soybeans are expected to lower their demand during the forecast period.

The sunflower lecithin market is expected to grow at a CAGR of 10.9% from 2025 to 2030. Consumers are increasingly looking for natural and minimally processed ingredients. Sunflower lecithin, derived from sunflower seeds without the use of harsh chemicals, aligns with clean-label trends in the food and beverage industry. Sunflower lecithin’s versatility as an emulsifier and stabilizer makes it popular in a wide range of applications, from food products like chocolate and baked goods to pharmaceutical formulations and natural cosmetics. Its multifunctionality is driving broader adoption across industries.

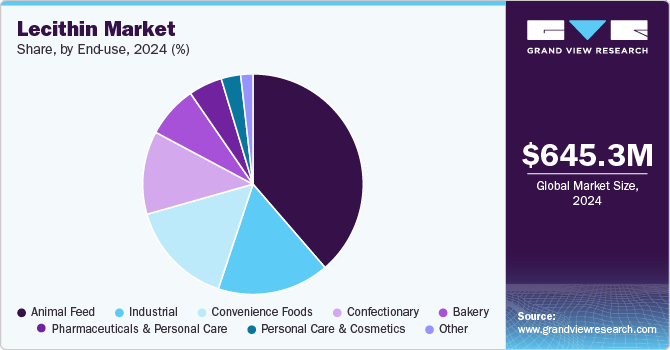

End Use Insights

Animal feed accounted for a revenue share of 39.8% in 2024. Lecithin enhances the digestibility of fats and nutrients in animal feed, leading to better absorption and overall health for livestock. This improves feed efficiency, making it an attractive additive for animal nutrition. It provides a concentrated source of energy due to its high-fat content, helping to boost the caloric value of animal feed. This makes it a valuable ingredient in formulating balanced diets for livestock, particularly in poultry and swine production.

Convenience foods are expected to grow with a CAGR of 9.9% from 2025 to 2030. Convenience foods save time and energy when preparing food at home or in a restaurant. Lecithin is used in convenience food products to assist in binding fat and keeping it in suspension, improving the hydration of high-protein ingredients, lowering the fat cap throughout the retort process, and enhancing the dispersion of high-fat powders. Furthermore, its exceptional qualities to improve mouthfeel and texture, as well as facilitate the even distribution of ingredients, are expected to fuel its inclusion in the convenience food category.

Form Insights

Liquid lecithin accounted for a revenue share of 86.2% in 2024. This high share is attributable to a sharp rise in demand for liquid form from multiple end use application industries, such as industrial coatings, cosmetics, food processing, and confectionaries. While liquid form is used in several food products, either as a food additive or naturally, it is also consumed as a dietary supplement. Liquid lecithin in the dietary supplement is frequently a mixture of choline, inositol, phosphatidylcholine, phosphatide, and other compounds and is not merely phosphatidylcholine. Also, the liquid form tends to effortlessly disperse in oil as compared to its other forms.

The powder lecithin market is expected to grow at a CAGR of 9.8% from 2025 to 2030. Lecithin powder is utilized as an ingredient in several end use industries, namely feed, food and beverage, cosmetics, and pharmaceuticals. The product is frequently used in bakery and confectionery products. The powder form is added to cooking sprays to prevent baked goods from sticking to the pans. It also has the unique property of binding with non-lipids and lipids, consequently keeping ingredients with water and oil together. For the same reason, key manufacturers prefer powder in food products such as butter and candy over liquid.

Regional Insights

The North America lecithin market is expected to grow at a CAGR of 8.1% from 2025 to 2030. The demand in the North American region is driven by the presence of key end users and the easy availability of raw materials. The presence of large soy fields in the U.S. and canola fields in Canada are boosting the market growth in this region. Soybeans are one of the major sources used in the manufacturing of lecithin. Large-scale cultivation of soybeans, coupled with the increasing number of small-scale crushing facilities, is augmenting the production of soybeans in North America.

U.S. Lecithin Market Trends

The lecithin market in the U.S. is expected to grow at a CAGR of 5.7% from 2025 to 2030. Americans are increasingly seeking natural and clean-label products. Lecithin, a natural emulsifier and stabilizer, aligns with this trend, driving its usage in food, beverages, and personal care products. The health-conscious population in the U.S. is driving demand for phospholipids in dietary supplements, functional foods, and nutraceuticals due to its health benefits, such as supporting brain function and improving lipid metabolism.

Europe Lecithin Market Trends

The lecithin market in Europe accounted for a revenue share of 29.9% in 2024. European consumers are highly focused on clean-label, natural ingredients in food, cosmetics, and pharmaceuticals. Lecithin, derived from natural sources like soy and sunflower, fits this trend as a preferred emulsifier and stabilizer, boosting its demand in various industries. European food and pharmaceutical industries adhere to high regulatory standards for natural and safe ingredients. Lecithin, being a naturally derived, non-GMO ingredient, is favored in food formulations and pharmaceutical applications that require strict adherence to these guidelines.

Asia Pacific Lecithin Market Trends

The lecithin market in Asia Pacific is expected to grow at a CAGR of 10.6% from 2025 to 2030. The expanding processed food and beverage sector in Asia Pacific, driven by urbanization and changing consumer preferences, is boosting the demand for lecithin as a natural emulsifier and stabilizer in products like bakery, confectionery, and dairy items. Consumers in Asia Pacific are becoming more health-conscious, leading to an increased demand for functional foods and dietary supplements. Lecithin is used in these products for its health benefits, such as supporting brain function and improving lipid metabolism.

The India lecithin market is expected to grow at a CAGR of 9.2% from 2025 to 2030. A greater awareness of the health benefits associated with lecithin such as improved brain function and heart health has spurred demand in both the food and dietary supplement segments. The Indian government's initiatives supporting the food processing industry, including the "Make in India" campaign, have paved the way for enhanced lecithin production, particularly from soy and sunflower seeds, which are widely cultivated in the region. The rise of the organic food movement and the growing preference for non-GMO products have further catalyzed the demand for plant-based lecithin among health-conscious consumers. Furthermore, India's burgeoning bakery, confectionery, and dairy industries are significant contributors to lecithin consumption.

Central & South America Lecithin Market Trends

The lecithin market in Central and Central & South America is driven primarily by increasing consumer awareness regarding health and wellness, alongside the growing demand for natural emulsifiers in food processing. With countries like Brazil and Argentina becoming significant players in the food and beverage industry, the rising trend of clean-label products has prompted manufacturers to seek naturally derived ingredients such as lecithin. This demand aligns with the regional agricultural strengths, particularly the production of soy, which serves as a primary source for lecithin extraction. Moreover, the growing population and rising disposable incomes in this region have led to an increased consumption of processed foods, further driving the demand for lecithin as an essential ingredient.

The Brazil lecithin market stands out as a key player in the global market, backed by its vast agricultural resources and significant soy production. As one of the world's largest exporters of soybeans, Brazil has a natural advantage for lecithin extraction, which is predominantly derived from soy. The ongoing trend toward healthier eating habits among consumers is driving the demand for functional foods, where lecithin serves as an essential ingredient in a variety of processed foods, ranging from baked goods to dairy products. Additionally, the Brazilian government's support for sustainable agricultural practices enhances the appeal of soy lecithin, aligning with international demand for eco-friendly ingredients.

Middle East & Africa Lecithin Market Trends

The lecithin market in Middle East & Africa is expected to grow at a CAGR of 8.4% from 2025 to 2030. The rising population and urbanization in countries such as the United Arab Emirates and South Africa have led to increased demand for convenience and processed food products, where lecithin serves a critical function in improving texture and shelf life. Additionally, the region has seen an influx of health-conscious consumers, prompting food manufacturers to incorporate lecithin as a clean-label ingredient that appeals to the growing preference for natural additives. The expansion of the food service industry, particularly in fast-casual dining and takeaway services, has also contributed to the demand for high-quality lecithin.

Key Lecithin Company Insights

The global lecithin market is characterized by numerous well-established and emerging players. Manufacturers are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends.

Key Lecithin Companies:

The following are the leading companies in the lecithin market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Inc.

- ADM

- Lipoid GmbH

- Bunge Limited

- American Lecithin Company

- Global River Food Ingredients

- DuPont de Nemours, Inc.

- Stern-Wywiol Gruppe GmbH & Co. KG

- Haneil Soyatech Pvt. Ltd.

- NOW Foods

Lecithin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 690.6 million

Revenue forecast in 2030

USD 1.07 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, end use, form, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Cargill, Inc.; ADM; Lipoid GmbH; Bunge Limited; American Lecithin Company; Global River Food Ingredients; DuPont de Nemours, Inc.; Stern-Wywiol Gruppe GmbH & Co. KG; Haneil Soyatech Pvt. Ltd.; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lecithin Market Report Segmentation

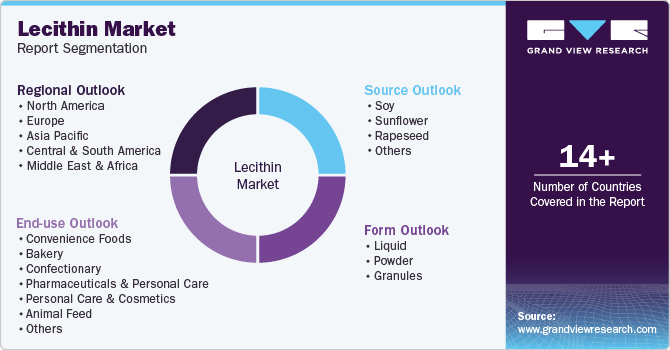

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segments the global lecithin market report based on source, end use, form, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Sunflower

-

Rapeseed

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Convenience Foods

-

Bakery

-

Confectionary

-

Pharmaceuticals & Personal Care

-

Personal Care & Cosmetics

-

Animal Feed

-

Industrial

-

Other

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Granules

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lecithin market size was estimated at USD 645.3 million in 2024 and is expected to reach USD 690.6 million in 2025.

b. The global lecithin market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030, reaching USD 1.07 billion by 2030.

b. Europe dominated the lecithin market with a share of 29.9% in 2024. This is attributable to the growing consumption of healthy foods and nutritional supplements. Furthermore, the growing research on non-GMO soy lecithin is expected to further boost the demand.

b. Some key players operating in the lecithin market include Cargill, Archer Daniels Midland, DuPont Nutrition and Health, Lipoid GmbH, and American Lecithin Company. The other companies are Bunge Ltd., Sternchemie GmbH & Co. KG, NOW Foods, Thew Arnott & Co., Ltd., and GIIAVA.

b. Key factors that are driving the lecithin market growth include the growing demand for food ingredients derived from natural sources and awareness regarding phospholipids.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.