- Home

- »

- Clothing, Footwear & Accessories

- »

-

Leather Goods Market Size & Share Analysis Report, 2030GVR Report cover

![Leather Goods Market Size, Share & Trends Report]()

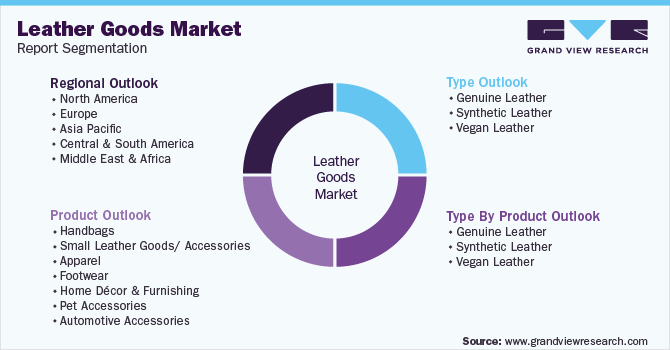

Leather Goods Market Size, Share & Trends Analysis Report By Type (Genuine Leather, Synthetic Leather, Vegan Leather), By Product, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-061-3

- Number of Report Pages: 217

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

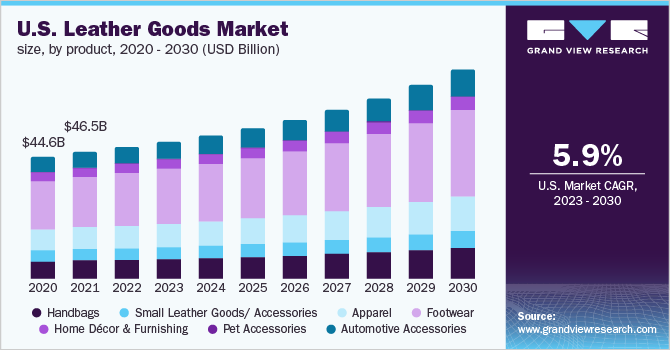

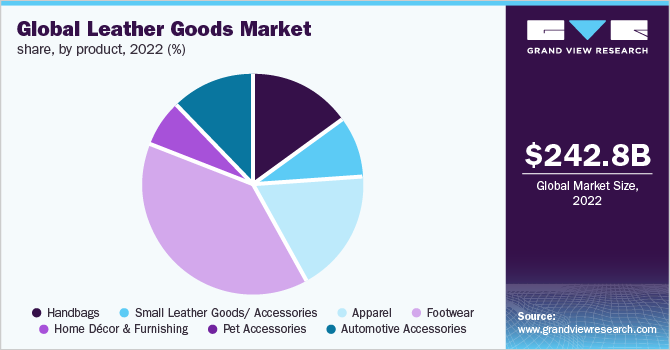

The global leather goods market size was valued at USD 242.85 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The market is primarily driven by rising consumer disposable income, improved living standards, changing fashion trends, and growing domestic and international tourism. The rising demand for comfortable, trendy, and fancy leather apparel, footwear, and accessories, along with growing brand awareness, is expected to have a positive impact on the leather goods market.

The COVID-19 pandemic has hurt the overall leather industry, including the footwear, apparel, and accessories categories. Retailers faced severe losses during the first two quarters of 2020. According to a report by World Footwear, the sales of footwear declined by close to 32% in the U.S. at the end of the first two quarters of 2020. Low demand for footwear, in general, is subsequently expected to decrease the sales of leather shoes. Many manufacturers in the market have historically relied on China for finished products as well as raw materials used in the manufacturing of various leather goods. The pandemic has, however, disrupted the supply chain, causing severe losses in terms of product shipment and on-time delivery.

Designers worldwide showcase new apparel through fashion shows & events, thereby attracting more consumers toward leather clothing. Various design techniques, such as brocade, Lamé, and applique, are widely used on leather apparel and other elegant dresses. For instance, in September 2020, the Forever Leather Fashion show was organized in Shanghai, China. The show displayed a variety of leather products, including a range of modern-style jackets, cross-stitched trench coats, travel bags, leather sneakers, duffel bags, and ankle boots. Such instances bring together hundreds of thousands of leather buyers, manufacturers, and designers from different provinces.

An increasing number of High-Net-Worth Individuals (HNWIs), coupled with the growing trend of designer & branded clothes in major markets, such as the U.S., France, and China, is boosting the demand for leather products. Leather goods are exclusive and often premium priced. The demand for leather products is significantly growing in China owing to the increasing number of HNWIs and Ultra-High Net Worth Individuals (UHNWIs) in the country. According to the Global Wealth Report 2019, published in October 2019, by Credit Suisse Group AG, in 2018, China had 10% of the world’s total HNWIs.

Rising awareness regarding the detrimental effects of unethical practices in the production of apparel and footwear has boosted the demand for sustainable products. Sustainable fashion is steadily attracting consumers as many renowned designers have been promoting the concept of sustainability. For instance, designers, such as Stella McCartney, have been promoting sustainable fashion products, including footwear, in affordable stores, such as Top Shop and Zara which is expected to drive the market for leather goods during the forecast period.

Type Insights

The genuine leather segment led the market with a share of around 53.6% in 2022. Synthetic leather goods are less expensive than genuine leather products and are equally attractive in terms of design, which is driving their demand among consumers. Synthetic leather is primarily derived from artificial sources, such as Polyurethane (PU) and Polyvinyl Chloride (PVC). PU leather is considered to be more eco-friendly as compared to its vinyl-based counterpart, as it does not emit dioxins.

The synthetic type segment is projected to register a CAGR of 7.0% from 2023 to 2030. The growth is attributed to the low-cost and heavy-duty construction of these product types. Like paper, plastic leather goods are also available in a variety of eco-friendly options. For example, leather goods made of PLA corn plastic are compostable and offer complete product visibility for enhanced marketability. Products made from materials, such as PET, are heavy-duty, flexible, and have a medium wall construction that flexes but remains crack-resistant. These factors are projected to drive segment growth in the coming years.

Product Insights

The footwear segment led the market in 2022 with a share of over 39.3%. Major players in the athletic footwear segment, such as Nike, New Balance, Adidas, Puma, Reebok, All birds, and Converse, have been venturing into leather athletic manufacturing, taking into consideration the increasing consumer demand for leather athletic footwear. For instance, in 2017, Nike, Inc. launched sneakers made from fly leather, a new material made by combining leftover leather scraps from tanneries and a polyester blend.

The automotive accessories segment is expected to grow at the fastest CAGR of 7.3% from 2023 to 2030. Increasing expenditure on luxury cars, the ability of leather to be stain resistant, and the luxury look it imparts are major factors leading to the demand for leather automotive accessories, especially in the elite class.

Regional Insights

Asia Pacific dominated the global market in 2022 accounting for a revenue share of about 36%. Led by countries, such as China and India, the Asia Pacific regional market is driven by the increasing demand for premium and luxury products. Bangladesh and Pakistan are important sources of primary leather (raw material) in Asia. According to Mohammed Nazmul Hassan, the Managing Director of Leatherex Footwear Industries Ltd., 15 to 20 new leather products & footwear manufacturing plants open in Bangladesh every year. Considerably low tariff rates on exported leather products make Bangladesh an attractive market for foreign leather goods brands.

Europe is set to grow at a CAGR of about 6.7% during the forecast period. Handbags, belts, and similar categories pose to be lucrative leather items that will generate demand for leather products in the region. In the global leather trade, Europe is a significant player. There are more than 36,000 businesses in the European leather and related goods sector. Some of the most expensive calfskins in terms of leather and raw materials come from the region. Due to the continued high demand for leather purses and travel bags, the market for leather accessories will expand rapidly in Europe.

Key Companies & Market Share Insights

The market is characterized by the presence of various well-established players. The increasing demand for leather footwear & other goods by consumers is primarily driving the competition in the market. Major players manufacture products that cater to specific consumer needs, such as bags of various sizes, including backpacks, tote bags, messenger bags, suitcases, briefcases, pouches, and duffel bags.

The increasing demand for such products, particularly in the emerging economies of North America, Europe, Asia Pacific, and Central & South America, offers growth opportunities to manufacturers. The research & development initiatives undertaken by some companies to enhance their product specifications and market reach are expected to further intensify the competition during the forecast period. The key players operating in the leather goods market are focusing on strategic initiatives such as product launches, acquisitions, sponsorships, collaborations, participation in events, and business expansions to drive revenue growth and reinforce their position in the global market.:

-

In January 2021, Adidas AG announced the launch of a new line of trainers made from mushroom leather as a part of its sustainability drive. The company has collaborated with biotech startup Bolt Threads, Stella McCartney, and lululemon to create plant-based vegan leather trainers.

-

In January 2021, Nike, Inc. launched its first SB Dunk sneakers made from vegan leather. The sneakers are cruelty-free and are part of the Zero Waste Initiative 2019 by Nike.

-

In August 2020, PUMA SE announced the release of its first three Xetic sneakers with Porsche design. The collection included both casual as well as performance wear made with 100% recycled mesh material, 100% chrome-free leather, and liners with 30% algae.

Some prominent players in the global leather goods market include:

-

Adidas AG

-

Nike, Inc.

-

Puma SE

-

Fila, Inc.

-

New Balance Athletics, Inc.

-

Knoll, Inc.

-

Samsonite International S.A.

-

VIP Industries Ltd.

-

Timberland LLC

-

Johnston & Murphy

-

Woodland Worldwide

-

Hermès International S.A.

-

Louis Vuitton Malletier

-

VF Corp.

-

COLLAR Company

-

LUCRIN Geneva

-

Nappa Dori

-

Saddles India Pvt. Ltd.

-

Lear Corp.

Leather Goods Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 253.82 billion

Revenue forecast in 2030

USD 405.28 billion

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, type by product, product, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

Country scope

U.S.; Germany; U.K.; France; Italy; China; India; Brazil

Key companies profiled

Adidas AG; Nike, Inc.; Puma SE; Fila, Inc.; New Balance Athletics, Inc.; Knoll, Inc.; Samsonite International S.A.; VIP Industries Ltd.; Timberland LLC; Johnston & Murphy; Woodland Worldwide; Hermès International S.A.; Louis Vuitton Malletier; VF Corporation; COLLAR Company; LUCRIN Geneva; Nappa Dori; Saddles India Pvt. Ltd.; Lear Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leather Goods Market Segmentation

This report forecasts revenue growth at global, regional & country levels and analyzes the latest industry trends and opportunities in each sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global leather goods market report based on type, type by product, product, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Genuine Leather

-

Synthetic Leather

-

Vegan Leather

-

-

Type By Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Genuine Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

Synthetic Leather

-

Polyurethane Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

PVC Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

-

Vegan Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Handbags

-

Tote Bag

-

Clutch

-

Satchel

-

Others

-

-

Small Leather Goods/ Accessories

-

Wallets

-

Pouches

-

Card Holders

-

Phone Covers/Cases

-

Watch Straps

-

Others (Luggage Tags, Pencil Cases, etc.)

-

-

Apparel

-

Men

-

Shirts

-

Pants

-

Suits, Coats & Jacket

-

Overalls

-

Others (Kilts, Vests, Chaps, etc.)

-

-

Women

-

Skirts

-

Coats & Jackets

-

Pants

-

Others (Vests, Chaps, etc.)

-

-

Children

-

Suits, Coats & Jackets

-

Vests

-

Pants

-

Skirts

-

Chaps

-

-

-

Footwear

-

Athletic

-

Men

-

Women

-

Children

-

-

Non-athletic

-

Men

-

Women

-

Children

-

-

-

Home Décor and Furnishing

-

Decorative Wall Hangings’

-

Tabletop decorative items

-

Hanging Storage

-

Leather Furniture

-

Other

-

Pet Accessories

-

Pet Collar and Leads

-

Leather Pet Toys

-

-

Automotive Accessories

-

Seating Systems

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global leather goods market size was estimated at USD 242.85 billion in 2022 and is expected to reach USD 253.82 billion in 2023.

b. The global leather goods market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 405.28 billion by 2030.

b. Asia Pacific dominated the global leather goods market in 2022 accounting for a revenue share of over 36%.

b. Some key players operating in the leather goods market include Adidas AG; Nike, Inc.; Puma SE; Fila, Inc.; New Balance Athletics, Inc.; Knoll, Inc.; Timberland LLC; Johnston & Murphy; and Woodland.

b. Key factors that are driving the leather goods market growth include rising consumer spending in Asian markets and the increasing popularity of leather-based casual athletic and running-inspired sneakers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."