- Home

- »

- Next Generation Technologies

- »

-

Lease Management Market Size, Industry Report, 2030GVR Report cover

![Lease Management Market Size, Share & Trends Report]()

Lease Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (Software, Services), By Deployment (Cloud, On-premise), By Application, By Organization Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-295-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lease Management Market Summary

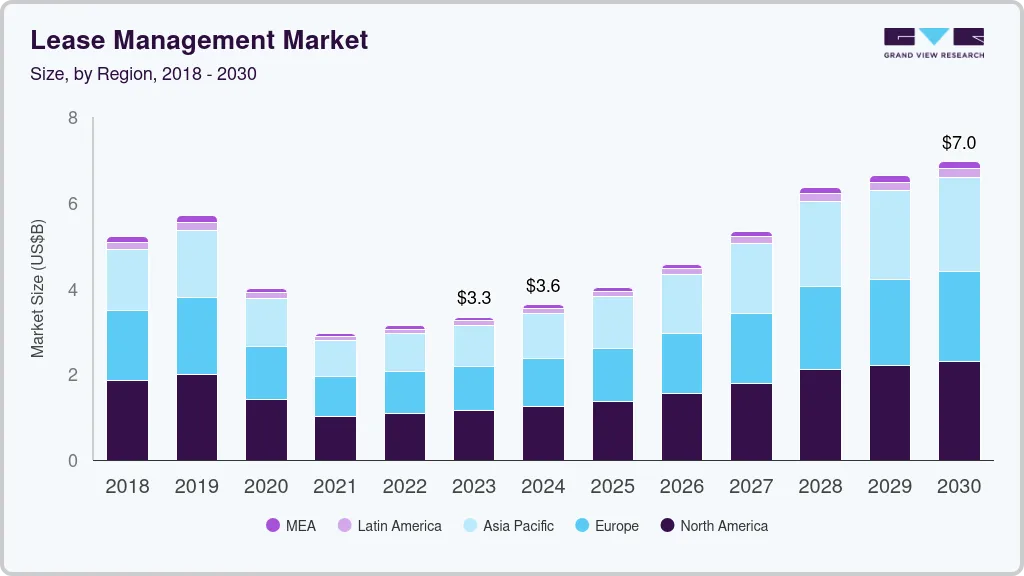

The global lease management market size was valued at USD 5.65 billion in 2024 and is projected to reach USD 8.13 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. This growth is attributed to the adoption of new lease accounting standards, such as IFRS 16 and ASC 842, which require efficient lease management.

Key Market Trends & Insights

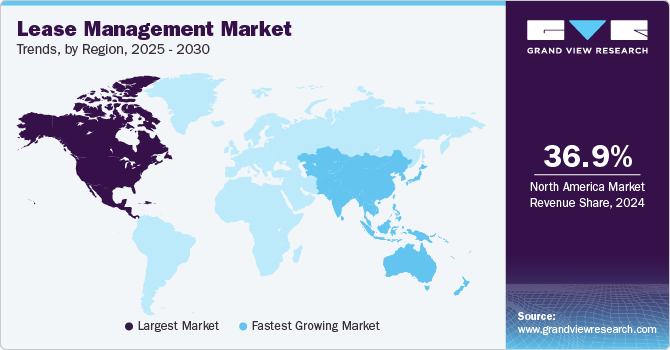

- North America lease management market dominated the global market and accounted for the largest revenue share of 36.9% in 2024.

- The lease management market in the U.S. is a significant contributor to the North American market, with the largest revenue share in 2024.

- Based on platform, the software segment dominated the global lease management industry and accounted for the largest revenue share of 78.3% in 2024.

- Based on application, the commercial segment led the market and held the largest revenue share of 49.6% in 2024

- Based on end-use, the hospitals and Intensive Care Units (ICUs) segment dominated the market in 2023.

Market Size & Forecast

- 2024 Market Size: USD 5.65 Billion

- 2030 Projected Market Size: USD 8.13 Billion

- CAGR (2025-2030): 6.4%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

In addition, the growth of real estate and property leasing, especially in urban areas, also fuels demand. Furthermore, the shift to cloud-based solutions and the need for cost optimization and operational efficiency contribute to market growth. Moreover, digital transformation and remote work trends further enhance the market's expansion. Lease management refers to the process of overseeing and administering lease agreements, ensuring compliance with regulations, and optimizing financial performance. This field is experiencing significant growth due to several key drivers. The proliferation of smart building projects worldwide has heightened the demand for advanced lease management solutions, as property managers seek to manage complex lease portfolios efficiently. Concurrently, the adoption of cloud-based lease management systems is gaining traction, offering scalability, real-time data access, and cost savings, which are particularly beneficial for small and medium-sized enterprises.

The increasing need for effective lease management is fueling the demand for Software-as-a-Service (SaaS) solutions, which provide enhanced operational efficiency and compliance. As lease portfolios become more complex and regulatory obligations intensify, organizations are turning to technology to streamline their lease management processes. The real estate sector's substantial economic impact, contributing significantly to national economies, underscores the importance of efficient lease management.

Furthermore, opportunities in the market are emerging from the growing demand for real estate and the integration of new technologies such as cloud computing and big data analytics. These technologies enable remote access, enhance collaboration, and facilitate data-driven decision-making, thereby improving operational efficiency and compliance. By leveraging these advancements, businesses can better manage lease processes, analyze leasing activities, and make informed decisions to secure favorable lease terms.

Platform Insights

The software segment dominated the global lease management industry and accounted for the largest revenue share of 78.3% in 2024, attributed to the demand for efficient solutions, particularly cloud-based and AI-driven platforms. These technologies automate processes, improve compliance with evolving standards, and enhance operational efficiency. Moreover, advanced analytics and automation tools provide real-time insights, reduce errors, and streamline lease management. This growth is further supported by the scalability and flexibility of cloud-based solutions, which cater to diverse organizational needs.

The services segment is expected to be the fastest growing segment, with a CAGR of 9.4% over the forecast period, owing to the need for customized lease management solutions. Cloud deployment and automation technologies offer flexibility and efficiency across the lease lifecycle. These services help organizations navigate evolving accounting standards and optimize lease performance. Furthermore, by leveraging specialized expertise, businesses can improve operational efficiency, reduce risks, and enhance overall lease management capabilities. This trend is expected to continue as organizations seek to optimize their lease management processes.

Deployment Insights

The cloud deployment segment held the largest share of 62.2% and dominated the market in 2024, primarily driven by its flexibility, scalability, and cost efficiency. Cloud solutions offer real-time access to leasing data, automation, and enhanced collaboration across locations. In addition, this shift from traditional on-premise systems is fueled by the need for efficient and accessible lease management tools, especially during remote work scenarios. Furthermore, Cloud-based systems reduce IT infrastructure costs and provide seamless updates, making them appealing to businesses seeking streamlined operations. As a result, cloud deployment is becoming the preferred choice for many organizations.

On-premises deployment is expected to grow at a CAGR of 5.7% over the forecast period, owing to security concerns and data control. Despite higher maintenance costs and limited scalability, on-premise systems are preferred for sensitive data and when organizations require full control over their infrastructure. In addition, this deployment option is often chosen by companies with strict data privacy regulations or those that have already invested heavily in on-premise infrastructure.

Application Insights

The commercial segment led the market and held the largest revenue share of 49.6% in 2024, driven by increasing demand for leasing commercial properties across various industries like retail, manufacturing, hospitality, and logistics. In addition, urbanization and industrialization, particularly in emerging economies, further fuel this demand. Furthermore, the need for efficient management of complex lease portfolios in these sectors supports market growth. Moreover, commercial properties require specialized lease management solutions to handle diverse tenant needs and regulatory compliance, making this segment a significant contributor to the market's expansion.

The industrial segment is expected to grow at a lucrative CAGR of 7.9% from 2025 to 2030, due to rising industrialization and the need for specialized lease management solutions. As industries expand, they require more efficient lease management to handle complex portfolios and ensure compliance with evolving regulations. In addition, industrial properties often involve large-scale leases with complex terms, necessitating advanced management systems to optimize operations and reduce costs. Furthermore, the integration of technology in industrial lease management is driving this segment's growth and enhancing operational efficiency.

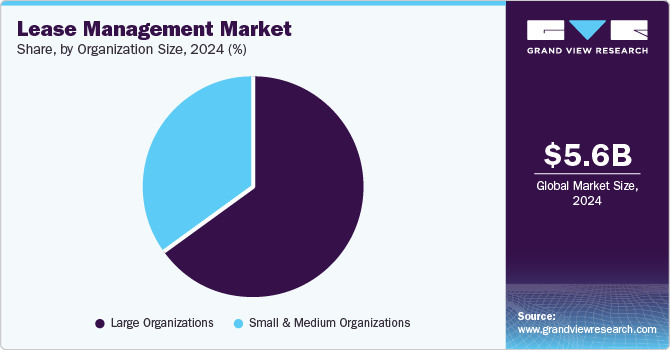

Organization Size Insights

Large organizations held the dominant position in the global lease management industry, with a share of 64.7% in 2024. This growth is primarily driven by their need for efficient management of extensive lease portfolios. In addition, these organizations rely on software solutions to handle complex leases and ensure compliance with evolving accounting standards. Furthermore, the demand for streamlined operations and cost optimization fuels this growth, as large organizations seek to maximize efficiency across their leased assets.

Small and medium organizations are expected to grow at a CAGR of 8.4% over the forecast period, owing to their increasing need for cost-effective and scalable lease management solutions. These businesses seek to manage lease complexities efficiently while reducing compliance costs. In addition, the adoption of cloud-based SaaS models offers them flexibility and affordability, enabling better risk management and operational efficiency. Furthermore, small and medium organizations benefit from the ease of implementation and lower upfront costs associated with cloud-based solutions, allowing them to compete more effectively in the market.

Regional Insights

North America lease management market dominated the global market and accounted for the largest revenue share of 36.9% in 2024. This growth is attributed to its mature commercial real estate sector and early adoption of lease management technologies. In addition, the region's robust economy and focus on optimizing lease administration processes further contribute to its dominance. Furthermore, the presence of numerous key players offering advanced lease management solutions supports this growth.

U.S. Lease Management Market Trends

The lease management market in the U.S. is a significant contributor to the North American market, with the largest revenue share in 2024, primarily driven by the need for businesses to comply with new accounting standards and manage complex lease portfolios. Furthermore, the country's strong regulatory environment and ongoing digital transformation in businesses fuel this growth. Moreover, the presence of large telecom giants and diverse industries that continuously adopt novel technologies enhances operational efficiency and productivity, supporting the market's expansion.

Asia Pacific Lease Management Market Trends

The Asia Pacific lease management market is expected to grow at the fastest CAGR of 7.9% over the forecast period, owing to increasing urbanization and industrialization. In addition, the development of smart cities and infrastructure projects boosts demand for efficient lease management solutions. Furthermore, as businesses expand in this region, they require sophisticated systems to manage complex lease portfolios and ensure compliance with evolving regulations.

The lease management market in China led the Asia Pacific market and held the largest revenue share in 2024. This was driven by its rapid industrialization and urbanization, which led to increased demand for commercial and residential properties. Furthermore, the need for efficient lease portfolio management, coupled with the integration of advanced technologies such as AI and cloud computing, supports market growth. Moreover, as China's real estate sector expands, the adoption of lease management software becomes more critical for managing complex leases and ensuring regulatory compliance.

Europe Lease Management Market Trends

The European lease management market is expected to experience significant growth over the forecast period, owing to the increasing complexity of lease portfolios and the need for compliance with evolving accounting standards. In addition, the region's diverse real estate landscape and growing demand for digital solutions drive the adoption of cloud-based lease management systems. Furthermore, European businesses are focusing on optimizing operational efficiency and reducing costs, which further fuels the demand for advanced lease management solutions.

Key Lease Management Company Insights

Key players in the global lease management industry include Accruent, CoStar Group, MRI Software, LLC, and others. These companies employ strategies such as strategic partnerships, acquisitions, and collaborations to expand their market presence. Furthermore, they focus on developing user-friendly, feature-rich software that addresses complex lease needs and integrates with existing systems.

-

CoStar Group operates in the real estate information and analytics segment, offering solutions for lease management through platforms like CoStar Real Estate Manager. This platform provides comprehensive lease lifecycle management, including lease accounting, administration, and transaction management. CoStar Group deals in commercial real estate data, analytics, and software solutions, helping businesses manage complex lease portfolios efficiently.

-

IBM Corporation operates in the technology segment, offering a wide range of products and services, including software solutions for various industries. Its technology and analytics capabilities can be applied to enhance lease management processes.

Key Lease Management Companies:

The following are the leading companies in the lease management market. These companies collectively hold the largest market share and dictate industry trends.

- Accruent

- CoStar Group

- IBM Corporation

- LeaseAccelerator

- MRI Software, LLC

- Nakisa Inc.

- Odessa

- Oracle

- RealPage, Inc.

- SAP

- Yardi Systems Inc.

Recent Developments

-

In November 2024, CoStar Group acquired Visual Lease, a leading lease administration and accounting platform. This strategic move enhanced both platforms' offerings, providing comprehensive solutions for customers. Visual Lease's integrated lease management platform serves over 1,500 organizations.

-

In May 2024, LeaseAccelerator and Uniqus announced a strategic alliance to enhance lease management. This partnership aimed at providing comprehensive lease lifecycle management solutions to companies.

Lease Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.97 billion

Revenue forecast in 2030

USD 8.13 billion

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, deployment, application, organization size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Accruent; CoStar Group; IBM Corporation; LeaseAccelerator; MRI Software, LLC; Nakisa Inc.; Odessa; Oracle; RealPage, Inc.; SAP; Yardi Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lease Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lease management market report based on platform, deployment, application, organization size, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Organizations

-

Small & Medium Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.