Learning Management System Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Delivery Mode (Distance Learning), By End-use (Academic, Corporate), By Enterprise Size, By Deployment, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-946-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

LMS Market Size & Trends

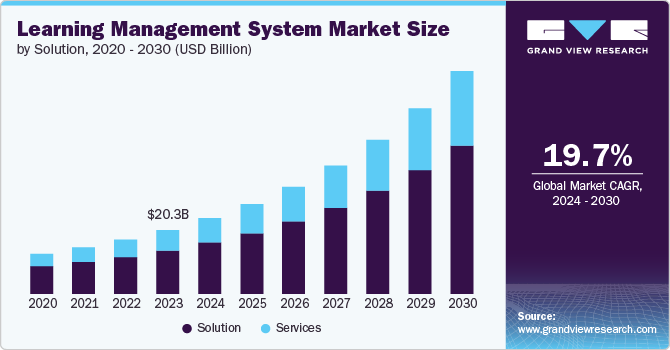

The global learning management system market size was valued at USD 24.05 billion in 2024 and is expected to grow at a CAGR of 19.9% from 2025 to 2030. This rapid growth is driven by the increasing demand for e-learning platforms across corporate, academic, and individual segments. Businesses are increasingly investing in learning management system (LMS) solutions to support remote training and employee skill development, especially as hybrid work models become more prevalent. Additionally, the adoption of AI and analytics is enhancing LMS capabilities, offering personalized learning experiences and better performance tracking.

LMS platforms enable the delivery of learning materials in various formats, including videos, simulations, and interactive elements, which significantly enrich the learning process and make it more engaging for learners. This rich content delivery supports active participation and enhances comprehension and retention of learning materials. Additionally, the data on learner behavior, engagement, and performance generated by digital learning platforms can be utilized by educators and trainers to personalize learning experiences, identify areas for improvement, and measure the effectiveness of training programs more effectively. The rising popularity of gamification in the LMS industry is adding elements such as badges, points, and leaderboards further to drive user engagement, particularly among younger learners.

The increasing adoption of online learning bodes well for the growing demand for LMS platforms that can accommodate diverse learning styles and preferences. At the same time, there is an evolving need for inducing flexibility in learning methodologies, prompting the integration of features, such as microlearning modules and mobile accessibility. As such, LMS platforms are evolving to meet these changing requirements of both learners and businesses, offering adaptable solutions aligned with contemporary learning trends. By prioritizing online learning strategies, LMS industry providers are looking forward to reaching a wider audience, ensuring inclusivity and active participation. The emphasis on flexibility highlights the significance of agile learning solutions that can be accessed at any time and from any location. In response to these changing demands, LMS platforms are evolving to facilitate comprehensive tools and functionalities that can enhance the learning experience for businesses and their employees.

Component Insights

The solution segment led the industry in 2024, accounting for over 67% share of the global revenue. LMS solutions boast a wide array of features, such as content management, assessment tools, communication channels, analytics, and seamless integration capabilities with other software systems. By providing a holistic suite of functionalities, LMS proves to be an all-encompassing solution capable of meeting the multifaceted demands of modern learning environments. Furthermore, the segment’s dominance is driven by its ability to address users' diverse needs through customization, comprehensive features, scalability, robust support, enhanced user experience, and cost-effective pricing models. Additionally, the ongoing advancements in AI and machine learning within LMS solutions have made these platforms more adaptable and personalized, enhancing learner engagement and retention.

The services segment is predicted to foresee significant growth in the coming years. The growth of the service segment can be attributed to the rising demand for installation and the need for technical assistance. Education and learning providers offer various educational services, including implementation, consultancy, and support. Learners can leverage these services for effective curriculum development and the smooth performance and maintenance of current activities. Integration-as-a-service is a feature of the advanced system that reduces installation time and complexity.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024 in the LMS industry due to its substantial investment capacity and diverse training needs. Large organizations have extensive employee bases and multiple departments, driving the need for comprehensive LMS solutions to support diverse learning paths, compliance training, and skill development programs. These enterprises also demand advanced LMS features, including analytics, integration with existing HR systems, and customization capabilities to meet their unique training requirements. Additionally, large companies often operate across different regions and require centralized platforms that can support multiple languages and cater to a global workforce.

The small & medium enterprises segment is expected to experience significant growth in the coming years due to the increasing accessibility of affordable, scalable, cloud-based LMS solutions. As more SMEs recognize the importance of continuous learning and skill development, they are investing in LMS platforms to train employees, improve productivity, and stay competitive. Cloud-based LMS offerings enable SMEs to access robust training tools without requiring substantial upfront investment in IT infrastructure. Moreover, as SMEs expand their remote workforces, they benefit from LMS platforms that support flexible, on-demand training accessible from any location.

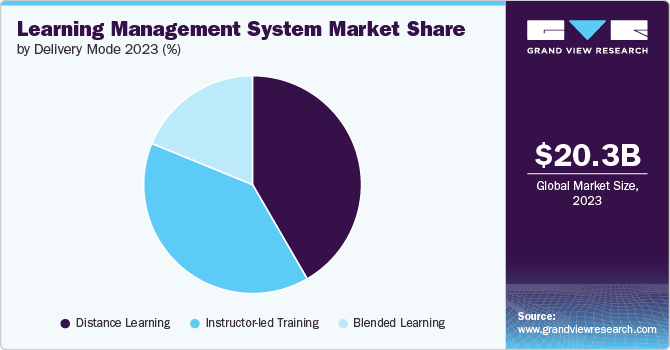

Delivery Mode

The distance learning segment accounted for the largest market revenue share in 2024, driven by the surging demand for online education across both academic institutions and corporate training. The flexibility and accessibility of distance learning have made it popular among students and working professionals seeking to upgrade skills without geographical or time constraints. LMS platforms tailored for distance learning offer essential features such as virtual classrooms, content libraries, and assessment tools, making it easier for institutions to deliver structured, interactive online courses. Furthermore, the rise in mobile and digital device usage has increased the reach and engagement of distance learning programs.

The instructor-led training segment will witness significant growth in the coming years due to the continued demand for live, interactive learning experiences that foster real-time engagement and feedback. While e-learning has gained prominence, many organizations and educational institutions still value the personalized touch and dynamic nature of instructor-led sessions, particularly for complex topics and skills development. The integration of virtual classrooms within LMS platforms is enabling organizations to offer instructor-led training remotely, eliminating the constraints of location and enhancing flexibility for learners and instructors alike. Furthermore, the growing trend of hybrid learning models, combining online and in-person components, has amplified the need for platforms that support live, instructor-led sessions alongside other learning formats.

End-use Insights

The academic segment accounted for the largest market revenue share in 2024 due to the widespread adoption of digital learning tools in schools, colleges, and universities globally. Educational institutions increasingly rely on LMS platforms to manage and deliver online courses, facilitate communication between students and teachers, and track academic progress. Furthermore, the growing demand for personalized learning experiences, where students learn at their own pace, is driving institutions to adopt LMS platforms equipped with features such as adaptive learning, assessments, and analytics. With ongoing investments in digital education infrastructure, the academic sector continues to lead in LMS adoption, further fueling its market dominance.

The corporate segment is expected to witness significant growth in the coming years in the LMS market due to the increasing emphasis on continuous learning, employee development, and upskilling in response to evolving industry demands. As businesses face rapid technological advancements, they are investing in LMS platforms to enhance workforce productivity, ensure compliance, and improve overall employee performance. The rise of remote and hybrid work models has further driven the need for flexible, scalable, and accessible training solutions that can be delivered online, making LMS platforms ideal for corporate training. Additionally, the integration of advanced features such as data analytics, personalized learning paths, and AI-driven insights is enabling companies to better track employee progress and tailor training to specific business needs.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. The widespread adoption of cloud-based solutions can be attributed to their accessibility, scalability, and cost-effectiveness. Cloud infrastructure enables organizations to access the LMS platform from any location with an internet connection, facilitating remote learning and collaboration on a global scale. Cloud platforms offer virtually limitless scalability, enabling organizations to effortlessly accommodate growing user bases, and expanding learning initiatives without the need for costly infrastructure investments or manual intervention. This scalability empowers organizations to adapt to changing demands and scale their learning programs dynamically, ensuring optimal resource utilization and user satisfaction.

The on-premises segment is expected to showcase significant growth over the forecast period in the LMS industry. Organizations with stringent data security and compliance requirements, such as those in healthcare, finance, and government sectors, prefer on-premises solutions for greater control over data storage and access. This deployment model allows for customization based on specific organizational needs, making it useful for large enterprises that require tailored features and enhanced data privacy. Additionally, on-premises LMS solutions operate independently of internet connectivity, which is beneficial for organizations in regions with limited or unreliable online access.

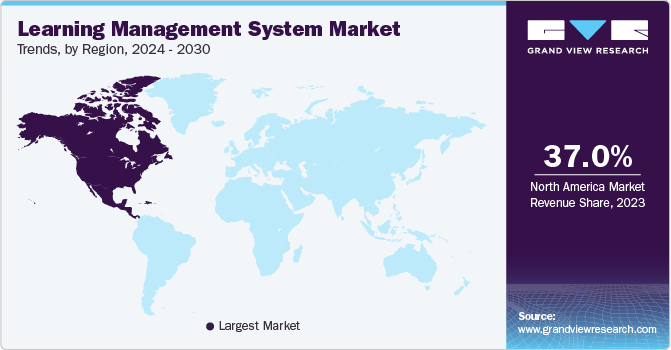

Regional Insights

North America learning management system market dominated the global industry with a revenue share of over 36% in 2024. The region’s growth is attributed to the rising demand for online education across all levels and the subsequent need for efficient content delivery, course management, and remote student engagement. In addition, advancements in technologies such as AI, machine learning, and data analytics are enhancing LMS capabilities to personalize learning experiences and improve learning outcomes. Moreover, government initiatives promoting digital learning and workforce development, alongside funding programs for educational institutions and businesses, further strengthen the North American LMS market.

U.S. Learning Management System Market Trends

The U.S. learning management system market is driven by the digitization of higher education and the increasing adoption of LMS platforms in universities, colleges, and online institutions. Corporate sectors, mainly in healthcare, finance, and manufacturing, are leveraging LMS for mandatory training and compliance. Government funding, through initiatives such as the CARES Act, is enhancing digital infrastructure in K-12 schools and universities, further supporting LMS integration. The rise of online learning platforms, such as Coursera, Inc, and Udemy, has also accelerated LMS demand to manage courses and enhance learning experiences.

Europe Learning Management System Market Trends

The learning management system (LMS) market in Europe is expected to witness significant growth over the forecast period. The regional market growth can be attributed to the European Union's increased focus on enhancing digital competencies and technology integration within the education sector via the Digital Education Action Plan. This has increased LMS adoption across educational institutions in the region. In addition, the growing focus of governments and education authorities on workforce development and learning is driving the demand for flexible and accessible training solutions, positioning LMS platforms as essential tools for upskilling and reskilling the workforce.

Asia Pacific Learning Management System Market Trends

The Asia Pacific learning management system market in is anticipated to register the highest CAGR over the forecast period. The region has seen rapid growth in digital education adoption, fueled by increasing internet penetration, mobile device usage, and government initiatives promoting e-learning. The growing demand for workforce training, mainly in countries such as India, China, and Southeast Asia, is also driving the adoption of LMS solutions in corporate environments.

Key Learning Management System Company Insights

Some key players in the LMS industry, such as Chegg Inc.; Qkids Teacher; Varsity Tutors; and Vedantu are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products. This proactive approach allows them to enhance their market presence and innovate in response to evolving needs.

-

Instructure, Inc. operates as a wholly-owned subsidiary of Thoma Bravo. The company provides its learning content through Canvas and Bridge, its cloud-based platforms. Canvas acts as a learning management platform for K-12 and higher education segments, whereas Bridge serves as an employee development and engagement platform. Bridge and Canvas platforms provide data analytics access through open application programming interfaces, which allow for individual analysis. Instructor, Inc. delivers its applications through a Software-as-a-Service business model. Education and corporate organizations are the main end-users of the company’s products and services.

-

Adobe provides a wide range of multimedia solutions and digital marketing products. Conventionally, the company has focused on developing creativity and multimedia software. It delivers its products either through the managed service delivery model or the Software-as-a-Service (SaaS) delivery model. Moreover, its products are offered through pay-per-use and term subscription models. The company offers Adobe Learning Manager, a cloud-based LMS.

Key Learning Management System Companies:

The following are the leading companies in the learning management system market. These companies collectively hold the largest market share and dictate industry trends.

- Cornerstone.

- Anthology Inc.

- D2L Corporation

- PowerSchool

- Instructure, Inc.

- Adobe.

- Oracle

- SAP

- Moodle

- McGraw Hill

Recent Developments

-

In October 2024, Obrizum Group Ltd., an AI and analytics specialist, partnered with Anthology Inc. to enhance the Blackboard LMS. This collaboration aims to deliver hyper-personalized adaptive learning and advanced insights to Blackboard users. By integrating Obrizum Group Ltd's AI-powered technology, Anthology Inc. will create tailored learning experiences for its global user base.

-

In April 2024, Thomas International Ltd launched Thomas Elevate, an innovative Learning Management System (LMS) designed to enhance professional upskilling. It offers a comprehensive learning experience through microlearning, peer-to-peer training, multimedia formats, workshops, and certification programs. Additionally, the platform gamifies learning with badges, leaderboards, and friendly competition, making it both informative and engaging for users.

-

In January 2024, PowerSchool, a leader in K-12 cloud-based educational software, is making a big push into the Indian market. They plan to nearly double their India-based workforce, growing from 1,300 to 2,000 employees in the next 3-5 years. To accommodate this growth, PowerSchool is significantly expanding its Centre of Excellence (CoE) in Bengaluru and plans to further develop its Chennai office in 2024. These investments demonstrate PowerSchool's commitment to the Indian EdTech sector.

Learning Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 28.58 billion |

|

Revenue forecast in 2030 |

USD 70.83 billion |

|

Growth Rate |

CAGR of 19.9% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, delivery mode, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Cornerstone.; Anthology Inc.; D2L Corporation; PowerSchool; Instructure, Inc.; Adobe.; Oracle; SAP; Moodle; McGraw Hill |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Learning Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global learning management systems market report based on component, deployment, enterprise size, delivery mode, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Distance Learning

-

Instructor-led Training

-

Blended Learning

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Academic

-

K-12

-

Higher Education

-

-

Corporate

-

Healthcare

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunication

-

Retail

-

Manufacturing

-

Government & Defense

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global learning management system market size was estimated at USD 24.05 billion in 2024 and is expected to reach USD 28.58 billion in 2025.

b. The global learning management system market is expected to grow at a compound annual growth rate of 19.9% from 2025 to 2030 to reach USD 70.83 billion by 2030.

b. North America dominated the learning management system market with a share of 36% in 2024. The region’s growth is attributed to the rising demand for online education across all levels and the subsequent need for efficient content delivery, course management, and remote student engagement.

b. Some key players operating in the learning management system market include Cornerstone., Anthology Inc., D2L Corporation, PowerSchool, Instructure, Inc., Adobe., Oracle, SAP, Moodle, McGraw Hill

b. Key factors that are driving the learning management system market growth include increasing digitalization of education and corporate training, integration of emerging technologies into LMS platforms, and growing Internet adoption and smartphone penetration.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."