Law Enforcement Software Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (On-premises, Cloud), By End User (Municipalities, Police Departments), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-373-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Law Enforcement Software Market Trends

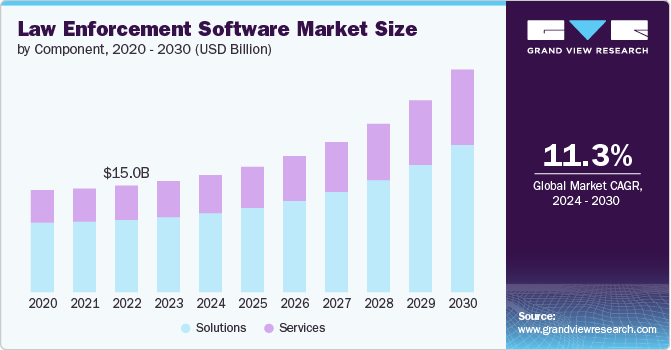

The global law enforcement software market size was estimated at USD 15.65 billion in 2023 and is anticipated to grow at a CAGR of 11.3% from 2024 to 2030. Several key factors drive the growth of the law enforcement software market. Foremost among these is the increasing need for efficient and effective crime prevention and investigation tools as law enforcement agencies strive to enhance public safety amid rising crime rates. In addition, the adoption of advanced technologies such as artificial intelligence, machine learning, and big data analytics has revolutionized law enforcement operations, enabling agencies to analyze vast amounts of data for predictive policing, resource allocation, and incident management.

Stringent regulatory requirements and the need for compliance with legal standards also compel agencies to adopt sophisticated software solutions to ensure transparency and accountability. Furthermore, the growing prevalence of cybercrime necessitates specialized software to combat digital threats and protect critical infrastructure. Finally, government initiatives and funding to modernize law enforcement infrastructure and improve operational efficiency propel the market's growth as agencies seek to leverage cutting-edge technology to meet evolving challenges.

The increasing need for efficient and effective crime prevention and investigation tools significantly drives the growth of the law enforcement software market. As crime rates rise and become more complex, law enforcement agencies are under immense pressure to enhance their operational capabilities. Advanced software solutions provide these agencies with the tools to streamline and optimize various aspects of their work, from data collection and analysis to case management and real-time communication. These tools enable law enforcement professionals to analyze crime patterns, predict potential incidents, and deploy resources more strategically quickly and accurately. By improving the efficiency and effectiveness of crime prevention and investigations, such software enhances public safety. It ensures that agencies can respond to criminal activities more swiftly and precisely. Consequently, the demand for sophisticated law enforcement software continues to grow as agencies seek to leverage technology to address the challenges of modern crime fighting.

Component Insights

The solutions segment accounted for the largest market share of over 67% in 2023 in the law enforcement software market. The adoption of law enforcement software solutions is primarily driven by the need for advanced tools to enhance operational efficiency and effectiveness. These solutions encompass various functionalities, such as crime analytics, records management, and digital evidence management, enabling agencies to streamline their workflows and improve data accuracy. Integrating artificial intelligence and machine learning in these solutions further empowers law enforcement agencies to perform predictive analysis and resource optimization, thereby enhancing their crime prevention and investigation capabilities. As agencies strive to keep pace with the increasing sophistication of criminal activities, the demand for comprehensive and technologically advanced software solutions continues to rise.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The adoption of law enforcement software services is driven by the necessity for ongoing support, maintenance, and training to ensure optimal utilization of these advanced tools. Services such as system integration, technical support, and user training are essential for law enforcement software solutions' seamless implementation and operation. In addition, as technology evolves, continuous updates and upgrades are required to maintain the effectiveness and security of these systems. Agencies also rely on consulting services to customize software solutions to meet their specific operational needs and compliance requirements.

Deployment Insights

The cloud segment accounted for the largest market share in 2023. Several key advantages, including scalability, cost-efficiency, and accessibility, drive the adoption of cloud-based law enforcement software. Cloud solutions allow law enforcement agencies to scale their operations seamlessly, adjusting resources based on demand without significant upfront investment in hardware. This flexibility is particularly beneficial for agencies with fluctuating workloads or limited budgets. In addition, cloud-based software provides remote access to critical data and applications, enabling real-time collaboration and information sharing among officers and departments regardless of physical location. This accessibility enhances operational efficiency and responsiveness. Furthermore, cloud solutions often include automatic updates and robust security measures, ensuring that agencies remain up to date with the latest technological advancements and compliance standards without incurring additional maintenance costs.

The on-premises segment is anticipated to expand at a compound annual growth rate of over 10% during the forecast period. Adopting on-premise law enforcement software is primarily driven by the need for enhanced control, security, and compliance. Agencies dealing with highly sensitive or classified information often prefer on-premise solutions to maintain direct oversight of their data infrastructure. This component allows for greater customization and integration with existing systems, providing agencies with tailored solutions that meet their specific operational requirements. On-premise software also ensures that data is stored and processed within the agency’s secure environment, mitigating potential risks associated with third-party data handling and cloud service vulnerabilities.

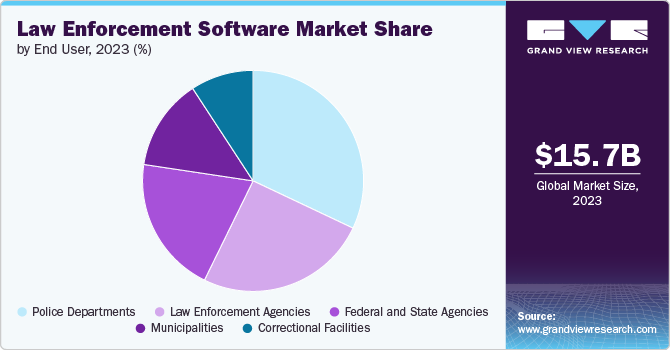

End User Insights

The police departments end user segment accounted for the largest market share of over 32% in 2023 in the law enforcement software market. The imperative drives the use of law enforcement software by police departments to enhance operational efficiency, improve crime prevention and investigation, and ensure effective resource management. Police departments rely on advanced software solutions to streamline their workflows, automate routine tasks, and manage vast amounts of data more accurately. These tools enable officers to perform real-time data analysis, track crime patterns, and predict potential incidents, enhancing their ability to effectively prevent and respond to criminal activities. In addition, software solutions facilitate better case management, evidence tracking, and inter-departmental communication, ensuring officers can collaborate more efficiently and swiftly make informed decisions. Adopting these technologies also supports transparency and accountability, as they provide robust audit trails and reporting capabilities essential for maintaining public trust and compliance with regulatory standards.

The municipalities segment is anticipated to grow at the highest CAGR during the forecast period. Municipalities adopt law enforcement software to improve public safety, optimize budget allocation, and enhance community well-being. Municipalities are responsible for ensuring the safety and security of their residents, and advanced software solutions provide them with the tools to monitor and manage law enforcement activities comprehensively. These solutions enable municipalities to analyze crime data, allocate resources more effectively, and implement proactive measures to reduce crime rates. By leveraging technology, municipalities can enhance the efficiency of their law enforcement agencies, ensuring that officers are better equipped to handle emergencies and routine patrols. Moreover, law enforcement software supports strategic planning and policymaking, allowing municipalities to address specific safety concerns, improve community relations, and foster a safer living environment for their citizens.

Regional Insights

North America held the major share of over 35% of the law enforcement software market in 2023. In North America, the law enforcement software market is characterized by integrating advanced technologies such as artificial intelligence, machine learning, and big data analytics. Agencies increasingly adopt predictive policing tools, digital evidence management systems, and real-time data-sharing platforms to enhance operational efficiency and crime-solving capabilities. In addition, the focus on cybersecurity and data protection is intensifying, driven by the rising prevalence of cybercrime and stringent regulatory requirements.

U.S. Law Enforcement Software Market Trends

The law enforcement software market in the U.S. is expected to grow significantly from 2024 to 2030. The U.S. market is driven by the need for comprehensive solutions to address complex and evolving crime patterns. There is a strong emphasis on interoperability and integrating various law enforcement systems to facilitate seamless communication and data sharing across jurisdictions. Furthermore, federal and state funding initiatives support the modernization of law enforcement infrastructure, promoting the adoption of cutting-edge software solutions to improve public safety and community policing efforts.

Europe Law Enforcement Software Market Trends

The law enforcement software market in Europe is growing significantly at a CAGR of over 10% from 2024 to 2030. In Europe, the General Data Protection Regulation (GDPR) and other stringent data privacy laws influence the law enforcement software market. Agencies prioritize compliance with these regulations while implementing sophisticated data management and analytics tools to enhance their investigative capabilities. The focus on digital transformation is evident, with investments in cloud-based solutions and mobile applications that enable officers to access critical information in the field.

Asia Pacific Law Enforcement Software Market Trends

The law enforcement software market in Asia Pacific is growing significantly at the highest CAGR of over 13% from 2024 to 2030. The market is expanding rapidly in the Asia Pacific region due to increasing urbanization and the corresponding need for advanced public safety solutions. Governments are investing in smart city initiatives, including deploying integrated law enforcement software to monitor and manage urban security. The adoption of AI-powered surveillance systems and automated reporting tools is growing, driven by the need to enhance situational awareness and response times in densely populated areas.

Key Law Enforcement Software Company Insights

Key players operating in the network emulator market include CSRware, Inc., Datamaran, EcoVadis, OneTrust, LLC., Refinitiv, SAS Institute Inc., Sustainalytics, TruValue Labs, Verisk Analytics, Inc., and Wolters Kluwer N.V. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2023, Kyndryl, an IT infrastructure services provider, announced the implementation of a suite of technology services for ClaimSearch Israel Ltd., a subsidiary of Verisk and Israel's official fraud detection database operator for the country’s compulsory insurance market. This new solution utilizes Kyndryl’s robust computing resources and Verisk’s extensive domain expertise to rapidly analyze new auto claims for bodily injury and identify potential fraud indicators. Insurance fraud in Israel costs insurers hundreds of millions of New Israeli Shekel (NIS) annually, leading to increased premiums for policyholders.

-

In May 2024, Wolters Kluwer N.V. introduced the Index to meet the increasing demand for data-driven intelligence among compliance executives, thereby enhancing compliance risk management efforts. The Regulatory Violations Intelligence Index provides a comprehensive analysis of penalties U.S. financial services regulators imposed in recent years. By examining key violation categories and regulatory trends, this tool offers compliance officers strategic insights to improve regulatory compliance strategies effectively.

Key Law Enforcement Software Companies:

The following are the leading companies in the law enforcement software market. These companies collectively hold the largest market share and dictate industry trends.

- CSRware, Inc.

- Datamaran

- EcoVadis

- OneTrust, LLC.

- Refinitiv

- SAS Institute Inc.

- Sustainalytics

- TruValue Labs

- Verisk Analytics, Inc.

- Wolters Kluwer N.V.

Law Enforcement Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 16.51 billion |

|

Revenue forecast in 2030 |

USD 31.37 billion |

|

Growth rate |

CAGR of 11.3% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, end user, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

CSRware, Inc.; Datamaran; EcoVadis; OneTrust, LLC.; Refinitiv; SAS Institute Inc.; Sustainalytics; TruValue Labs; Verisk Analytics, Inc.; Wolters Kluwer N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Law Enforcement Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global law enforcement software market report based on component, deployment, end user, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Computer-Aided Dispatch

-

Record Management

-

Case Management

-

Jail Management

-

Incident Response

-

Digital Policing

-

Others

-

-

Services

-

Implementation

-

Training and Support

-

Consulting

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Police Departments

-

Law Enforcement Agencies

-

Federal and State Agencies

-

Municipalities

-

Correctional Facilities

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global law enforcement software market size was estimated at USD 15.65 billion in 2023 and is expected to reach USD 16.51 billion in 2024

b. The global law enforcement software market is expected to grow at a compound annual growth rate of 11.3% from 2024 to 2030 to reach USD 31.37 billion by 2030

b. North America dominated the law enforcement software market with a market share of 35.29% in 2023. In North America, the law enforcement software market is characterized by integrating advanced technologies such as artificial intelligence, machine learning, and big data analytics. Agencies increasingly adopt predictive policing tools, digital evidence management systems, and real-time data-sharing platforms to enhance operational efficiency and crime-solving capabilities

b. Some key players operating in the law enforcement software market include CSRware, Inc., Datamaran, EcoVadis, OneTrust, LLC., Refinitiv, SAS Institute Inc., Sustainalytics, TruValue Labs, Verisk Analytics, Inc., and Wolters Kluwer N.V.

b. Several key factors drive the growth of the law enforcement software market. Foremost among these is the increasing need for efficient and effective crime prevention and investigation tools as law enforcement agencies strive to enhance public safety amid rising crime rates.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."