Law Enforcement And Military Clothing Market Size, Share & Trends Analysis Report By Function (Flame-resistant Apparel), By Material (Aramid, Nylon, Cotton Fibers, Viscose, Modacrylic, Polyester, FR Rayon), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-905-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

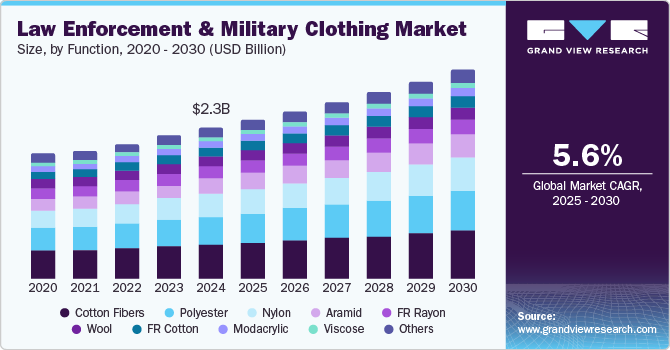

The global law enforcement and military clothing market size was estimated at USD 2.25 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. Rising global security concerns are driving increased investments by governments and defense organizations in modernizing equipment, including uniforms and tactical gear. This trend is fueling sustained demand for advanced fabrics and technologies that enhance protection, comfort, and durability in challenging environments.

The growing focus on personal protection for officers and soldiers is creating an increased need for clothing that provides ballistic resistance, weather protection, and other specialized features. In addition, advancements in materials science have enabled the development of lightweight, flexible fabrics that provide greater mobility while maintaining high protective standards.

Market Concentration & Characteristics

The law enforcement and military clothing industry is characterized by moderate fragmentation, with a mix of large multinational corporations and regional players vying for market share. Leading manufacturers are focusing on providing highly specialized apparel solutions designed for specific operational needs, such as tactical gear, ballistic-resistant clothing, and climate-adaptive uniforms. Innovations in fabric technology, such as lightweight materials, body armor integration, and enhanced camouflage options, are driving market growth. These advancements cater to the increasing demand for protection, mobility, and performance in challenging environments.

Regulatory bodies and defense procurement standards play a significant role in shaping the market, with strict requirements related to quality, safety, and compliance. Manufacturers must meet these standards to ensure their products are fit for use in military and law enforcement operations, where reliability and durability are paramount. As defense budgets increase globally, driven by security concerns, manufacturers are pushed to innovate and align with national defense strategies, which often include sustainability targets and eco-friendly materials.

The competitive landscape is also influenced by the growing trend of public-private partnerships in security and defense, as well as the increasing importance of advanced technology integration, such as wearable tech and smart fabrics, in military and law enforcement gear. Collaboration between manufacturers and tech companies is opening up new opportunities for creating more efficient, connected, and functional clothing solutions.

Additionally, the rising global focus on security due to terrorism, civil unrest, and geopolitical tensions has led to increased demand for specialized apparel, particularly in emerging markets, thus offering growth opportunities for manufacturers. However, competition from alternative solutions, such as specialized protective equipment or newer tactical gear innovations, poses challenges. To remain competitive, companies are expected to continually innovate, adapt to changing security needs, and navigate complex regulatory landscapes.

Drivers, Opportunities & Restraints

Global defense budgets play a significant role in driving market growth, as governments are consistently funding military modernization programs, which include upgrades to uniforms and related gear. This is particularly evident in countries investing in counterterrorism, border security, and peacekeeping missions.

A significant restraint for market growth is the high cost associated with advanced materials and specialized manufacturing. This can limit the adoption of high-tech uniforms in certain regions or smaller defense budgets. Additionally, the long lifespan of military and law enforcement uniforms means slower turnover, reducing the frequency of purchases and impacting market demand.

The growing emphasis on innovation, such as the development of smart textiles, body armor integration, and climate-adaptive clothing, presents significant opportunities for the market. Emerging markets with expanding military and law enforcement sectors offer new avenues for growth, as these regions invest in modernizing their uniform and gear systems, which can further enhance the value proposition for businesses seeking to reduce environmental footprints and lower operational costs.

Material Insights

The cotton fibers segment dominated the market in 2024, accounting for a revenue share of 22.1%, driven by the increasing demand for comfort and breathability in uniforms, especially in non-combat environments. Cotton’s natural properties make it a preferred choice for everyday wear in law enforcement and military applications, where comfort and ease of movement are necessary for extended periods of use.

The aramid material segment is experiencing growth due to its superior strength and heat-resistant properties, making it essential for law enforcement and military personnel who require durable, protective clothing. Aramid fibers, such as Kevlar, are increasingly used in ballistic vests, helmets, and protective suits, driving demand for these high-performance materials in the sector.

Function Insights

The flame-resistant function segment is expanding rapidly due to the rising need for protective clothing that ensures safety in high-risk environments, such as during combat or fire-related emergencies. This is particularly vital for military personnel and law enforcement officers working in hazardous conditions, where flame-resistant clothing can prevent serious injuries.

The others function segment includes ballistic-resistant apparel, chemical-resistant apparel, high-visibility apparel, cold-weather apparel, waterproof/breathable apparel, multi-hazard protective apparel encompassing specialized features like water-resistant, anti-stab, or ballistic protection. The segment held a substantial market share in 2024 driven by the increasing focus on multi-functional, high-performance gear fueling demand for uniforms that can provide a wide range of protective qualities tailored to specific operational requirements.

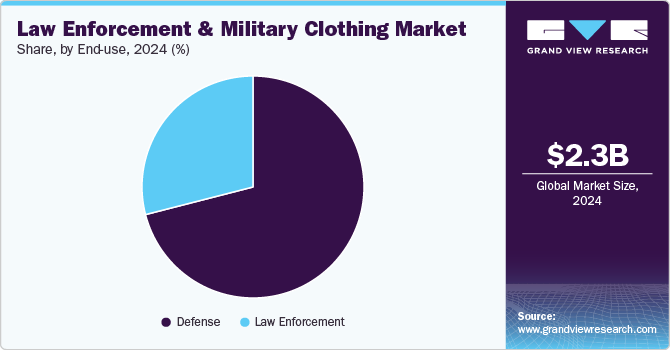

End-use Insights

The defense segment dominated the market, accounting for the largest revenue share in 2024, driven by increased military spending and modernization efforts globally. As armed forces around the world prioritize advanced, durable, and multifunctional uniforms, there is a growing demand for high-performance materials and designs that ensure protection, comfort, and operational effectiveness in combat situations.

The law enforcement segment is growing as global security concerns increase, necessitating better equipped and more protective uniforms for police officers. Rising public safety demands and the need for tactical readiness are driving investments in advanced clothing solutions for law enforcement agencies worldwide.

Regional Insights

The North America law enforcement and military clothing industry’s growth is driven by increasing defense and law enforcement budgets, particularly in the United States. Rising security threats, such as terrorism and civil unrest, are prompting governments to invest in advanced protective clothing for military and law enforcement personnel.

U.S. Law Enforcement and Military Clothing Market Trends

The law enforcement and military clothing industry in the U.S. is projected to expand at a CAGR of 4.0% in 2024. In the U.S., market growth is driven by large defense and law enforcement budgets, rising security concerns, and ongoing modernization of military and police equipment, alongside advancements in protective materials and technologies.

Asia Pacific Law Enforcement and Military Clothing Market Trends

The law enforcement and military clothing industry in Asia Pacific dominated in 2024, accounting for 30.2% of the market. This was driven by increasing investments in defense infrastructure and rising security threats, particularly in countries like China, India, and Japan. The growing need to equip military and law enforcement personnel with advanced, durable, and cost-effective uniforms plays a significant role in positively influencing market growth.

The China law enforcement and military clothing market is expected to grow at a CAGR of 7.3% over the forecast period. In China, the rapid expansion of military capabilities, coupled with rising security concerns and increased investment in law enforcement infrastructure, is boosting demand for advanced protective clothing for military personnel and police officers.

Thelaw enforcement and military clothing market in India is expected to grow at a rapid CAGR of 7.7% over the forecast period. Growing defense budgets, modernization efforts, and rising urban crime rates in India are driving the need for improved law enforcement and military clothing, with a focus on affordability and durability for diverse environments.

Europe Law Enforcement and Military Clothing Market Trends

In Europe, the demand for high-performance law enforcement and military clothing is growing due to heightened security concerns and ongoing efforts to modernize defense capabilities. Countries like the UK, France, and Germany are focusing on upgrading their military and law enforcement uniforms with advanced protective materials and multi-functional features.

The law enforcement and military clothing market in Russia is expected to grow at a CAGR of 5.2% over the forecast period. Geopolitical tensions and military conflicts are fueling the demand for advanced, durable military clothing, with a focus on ballistic protection and tactical gear for the country’s armed forces and law enforcement.

The UK law enforcement and military clothing market is expected to grow at a CAGR of 5.4% over the forecast period. In the UK, heightened security threats, counterterrorism efforts, and the need to upgrade military and law enforcement uniforms to meet modern challenges are driving the market, alongside a growing emphasis on sustainable and high-performance materials.

Middle East & Africa Law Enforcement and Military Clothing Market Trends

Political instability, military conflicts, and security threats are key drivers of market growth in the Middle East and Africa. Countries like Saudi Arabia, the UAE, and Israel are investing heavily in defense and law enforcement, leading to greater demand for advanced, durable, and protective clothing.

The law enforcement and military clothing market in Saudi Arabia is projected to grow at a CAGR of 6.8% over the forecast period. Defense spending, political instability, and the need for tactical gear in military and security operations is pushing the demand for high-performance clothing solutions tailored to extreme environments

Latin America Law Enforcement and Military Clothing Market Trends

In Latin America, the law enforcement and military clothing industry is growing due to rising concerns about public safety, especially in countries like Brazil and Mexico, where law enforcement agencies are investing in better gear to combat rising crime rates.

The Brazil law enforcement and military clothing market is expected to expand at a CAGR of 6.4% over the forecast period driven by the rising concerns about public safety and crime, along with increasing defense budgets, are driving the demand for protective clothing in law enforcement and military sectors, with a focus on advanced protection for personnel in high-risk situations

Key Law Enforcement And Military Clothing Company Insights

Some of the key players operating in the market include Safariland, LLC and Point Blank Enterprises, Inc.

-

Safariland, LLC designs, engineers, manufactures, and markets safety and survivability products for public safety, military, professional, and outdoor markets. Its product portfolio includes covert/concealable body armor, tactical body armor and gear, overt/external body armor, holster systems, holsters, and other products.

-

Point Blank Enterprises, Inc., is a developer, manufacturer, and distributor of protective solutions. It provides personal protective equipment for the U.S. Military and the Department of Defense, Federal Agencies, and international & domestic law enforcement and correction professionals.

Key Law Enforcement And Military Clothing Companies:

The following are the leading companies in the law enforcement and military clothing market. These companies collectively hold the largest market share and dictate industry trends.

- Ballistic Body Armour (Pty) Ltd.

- Lenzing AG

- Kermel

- Safariland, LLC

- Craig International Ballistics Pty. Ltd

- Hellweg Pty Ltd

- Kejo Limited Company

- Point Blank Enterprises, Inc.

- EnGarde body armor

- Seyntex

- GRASSI S.P.A.

- Massif

- Propper.

- Longworth Industries Inc.

- Blauer Manufacturing Co., Inc.

- Elbeco (LION Group, Inc.)

- Fechheimer

- W. L. Gore & Associates, Inc

- CROSHIELD

- Heathcoat Fabrics Limited

Recent Developments

-

In January 2024, Safariland, LLC announced it will unveil its APEX Covert Vest System at SHOT Show 2024, designed to enhance protection and mobility for law enforcement. This four-piece vest integrates side panels with front and rear components, allowing for superior articulation and comfort.

-

In January 2024, DuPont and Point Blank Enterprises, Inc. formed an exclusive partnership to produce body armor utilizing Kevlar EXO aramid fiber, aimed at enhancing protection for law enforcement in North America.

Law Enforcement And Military Clothing Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 2.36 billion |

|

Revenue forecast in 2030 |

USD 3.09 billion |

|

Growth rate |

CAGR of 5.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, function, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia; China; India; Japan; Australia; South Korea; Indonesia; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Ballistic Body Armour (Pty) Ltd.; Lenzing AG; Kermel; Safariland, LLC; Craig International Ballistics Pty. Ltd; Hellweg Pty Ltd; Kejo Limited Company; Point Blank Enterprises, Inc.; EnGarde body armor; Seyntex; GRASSI S.P.A.; Massif; Propper; Longworth Industries Inc.; Blauer Manufacturing Co., Inc.; Elbeco (LION Group, Inc.); Fechheimer; W. L. Gore & Associates, Inc.; CROSHIELD; Heathcoat Fabrics Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Law Enforcement And Military Clothing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global law enforcement and military clothing market report based on material, function, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aramid

-

Nylon

-

Cotton Fibers

-

Viscose

-

Modacrylic

-

Polyester

-

Wool

-

FR Rayon

-

FR Cotton

-

Kermel

-

Others

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Flame-resistant

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Law Enforcement

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global law enforcement and military clothing market size was estimated at USD 2.25 billion in 2024 and is expected to reach USD 2.36 billion in 2025.

b. The global law enforcement and military clothing market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 3.09 billion by 2030.

b. Asia Pacific dominated the market in 2024 accounting for 30.2% of the market share. The expanding defense budgets of emerging economies and increasing urbanization are creating new demand for modern protective clothing and fostering market growth in the region.

b. Some of the key players operating in the market are Ballistic Body Armour (Pty) Ltd., Lenzing AG, Kermel, Safariland, LLC, Craig International Ballistics Pty. Ltd, Hellweg Pty Ltd, Kejo Limited Company, Point Blank Enterprises, Inc., EnGarde body armor, Seyntex, GRASSI S.P.A., Massif, Propper, Longworth Industries Inc., Blauer Manufacturing Co., Inc., Elbeco (LION Group, Inc.), Fechheimer, W. L. Gore & Associates, Inc, CROSHIELD, and Heathcoat Fabrics Limited.

b. The growth of the law enforcement and military clothing market is driven by heightened security concerns, expanding defense budgets, and the rising demand for advanced protective gear to improve safety and operational efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."