- Home

- »

- Homecare & Decor

- »

-

Laundry Detergent Pods Market Size & Share Report, 2030GVR Report cover

![Laundry Detergent Pods Market Size, Share & Trend Report]()

Laundry Detergent Pods Market (2024 - 2030) Size, Share & Trend Analysis Report By Product (Non-biological, Biological), By Distribution Channel, By Application (Household, Commercial), And Segment Forecasts

- Report ID: GVR-3-68038-366-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laundry Detergent Pods Market Summary

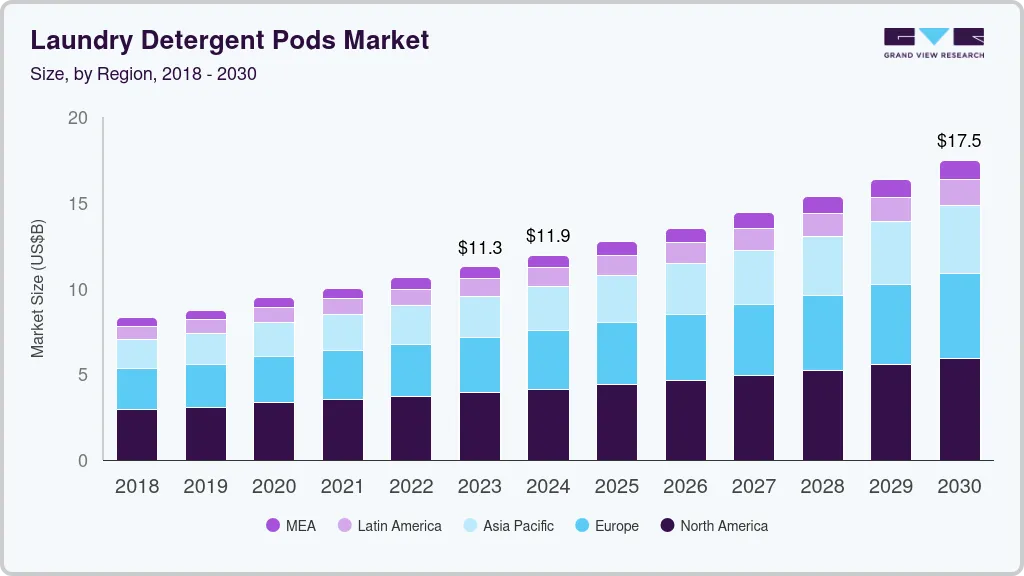

The global laundry detergent pods market size was estimated at USD 11,270.8 million in 2023 and is projected to reach USD 17,481.5 million by 2030, growing at a CAGR of 6.5% from 2024 to 2030. Major factors driving the growth of market revenue include shifts in consumer lifestyles, a growing reliance on smart home technology, and an increasing demand for practical and efficient washing solutions.

Key Market Trends & Insights

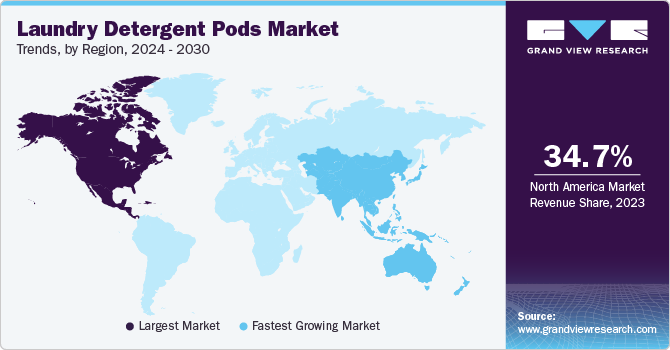

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, China is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, non-biological accounted for a revenue of USD 11,270.8 million in 2023.

- Non-Biological is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 11,270.8 Million

- 2030 Projected Market Size: USD 17,481.5 Million

- CAGR (2024-2030): 6.2%

- North America: Largest market in 2023

Laundry detergent pods, also known as laundry detergent packs or liquitabs, are soluble pouches filled with concentrated laundry detergent, softener, and other laundry products.

Laundry detergent pods, an innovative and practical washing solution, have become popular due to the trend of fast-paced living because they are easy to use and do not require measuring or pouring. Consumers are increasingly favoring laundry detergent pods due to their convenience, portability, and effectiveness at cleaning. Furthermore, the increasing adoption of smart home technology has boosted their utility, as laundry detergent pods can be used with automated washing systems and can be controlled through smart devices from a distance.

Major players in the laundry pods market include well-known consumer goods and chemical companies that invest in research and development to create innovative formulations. These formulas are crafted to provide scent, fabric care, and stain elimination in a single dissolvable pod. The industry is characterized by a diverse range of products catering to different customer preferences, including various perfumes, environmentally friendly options, and specialized formulas for specific fabrics or laundry needs.

Laundry detergents are being developed more frequently to effectively eliminate stains and soften fabrics. Due to the increasing demand, manufacturers and sellers of laundry detergent are changing their marketing strategies. Besides being displayed on shelves, popular companies also emphasize their global, online, and social media presence. Non-biological capsules without enzymes are considered more beneficial for the skin compared to biological ones.

Product Insights

Non-biological laundry detergent pods accounted for the largest market revenue share of 57.0% in 2023. The growing focus on water conservation has led to a rise in low-water washing practices, which can result in detergent residue buildup on clothing. This residue can cause allergic reactions and skin irritations, especially among children and individuals with sensitive skin. In contrast, enzyme-free non-biological laundry capsules are considered a more skin-friendly option, and their competitive pricing compared to biological alternatives is expected to have a significant impact.

Biological laundry detergent pods are expected to register the fastest CAGR of 6.9% over the forecast period. Biological products have enzymes that can efficiently eliminate dirt and stains from the fabric when using water below a certain temperature. Heating water is not necessary for washing clothes to achieve optimal results, which helps to save energy and maintain the softness of the fabric. Increased awareness about conserving energy is anticipated to be a key factor that will positively impact the favorability of choosing organic capsules instead of synthetic ones.

Distribution Channel Insights

The supermarkets & hypermarkets segments dominated the market in 2023 with a substantial share. Supermarkets and hypermarkets offer a wide range of laundry detergent pod brands, allowing consumers to compare and choose based on their preferences. These retail outlets provide one-stop shopping, competitive pricing, and frequent promotions, attracting price-conscious consumers. Prominent in-store placement increases brand awareness and drives impulse purchases, making them a preferred channel for laundry detergent pod sales globally.

The online distribution channel is expected to grow at the fastest rate from 2024 to 2030, driven by e-commerce’s increased accessibility, convenience, and availability of laundry detergent pods in rural areas. Online platforms offer easy price comparison, reviews, and home shopping, while online grocery delivery services integrate laundry detergent pods into regular routines. Targeted digital marketing campaigns also boost demand, making online sales a preferred channel for laundry detergent pods globally.

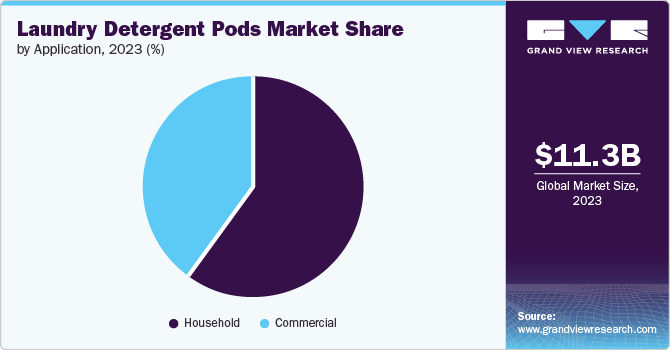

Application Insights

Household applications accounted for the largest market revenue share of 59.6% in 2023. IFB, Whirlpool, and Panasonic, along with other washing machine manufacturers, suggest using laundry detergent pods to ensure machines last longer. The dense liquid does not contain any slow dissolving ingredients that could become trapped in various areas of the washing machine, creating a build-up that hampers the machine’s efficiency. Celebrity endorsements and promotions by social media influencers have had a beneficial impact on the adoption of products in the household sector.

Commercial is expected to register the fastest CAGR of 7.0% over the forecast period. The increase in popularity of laundry detergent pods in businesses like hotels, hospitals, and laundromats has fueled the growth of this market segment. Laundry detergent pods offer a convenient and cost-effective solution to meet the high demand for large amounts of detergent in these scenarios. Furthermore, business clients often prefer laundry detergent pods because of their ease of use and pre-measured quantities, which can lower expenses related to labor and enhance efficiency.

Regional Insights

North America laundry detergent pods market dominated the global laundry detergent pods market with a revenue share of 34.7% in 2023. Market growth in the region is attributable to the increasing demand for convenient and easy washing solutions, as well as the rising consumer awareness of the environment. People in the region are seeking eco-friendly and sustainable washing options that support energy efficiency and reduce water wastage. The popularity of natural and biodegradable laundry detergent pods has risen due to this trend.

U.S. Laundry Detergent Pods Market Trends

The laundry detergent pods market in the U.S. dominated the North America laundry detergent pods market in 2023. The country is witnessing a surge in demand for convenient, sustainable, and flexible laundry solutions, driving the revenue of laundry detergent pods. The hotel industry is a significant user of these products, seeking to provide premium service. E-commerce has expanded accessibility, while celebrity endorsements and social media marketing have contributed to their increasing popularity, catering to consumers’ evolving needs.

Europe Laundry Detergent Pods Market Trends

Europe laundry detergent pods market was identifies as a lucrative region in this industry. The area is seeing a growth in the amount of single-person households, leading to a higher need for convenient and uncomplicated laundry solutions. Consumer awareness of the benefits of laundry detergent pods, including their ease of use and limited environmental impact, is increasing, driving the growth of the market.

The laundry detergent pods market in the UK is expected to grow rapidly in the coming years due to the market is being affected by the increasing popularity of eco-friendly and organic laundry products. This encourages a variety of sellers to offer organic and eco-friendly products. It is forecasted that this request will lead to a rise in the revenue.

Germany laundry detergent pods market held a substantial market share in 2023 owing to the adoption of next generation laundry products. In addition, the rising agreements between detergent makers and e-commerce businesses to quickly reach the greatest number of consumers and map out new distribution routes are projected to increase demand in the country.

Asia Pacific Laundry Detergent Pods Market Trends

Laundry detergent pods market in Asia Pacific is projected to witness the fastest growth in the global laundry detergent market, registering a CAGR of 7.4% over the forecast period. The primary factors contributing to the growth of the market in this region are the increasing urbanization rates, higher disposable incomes, and changing consumer behaviors. As people shift towards lifestyles that prioritize time and convenience, there has been a rise in the popularity of laundry detergent pods. These pods are convenient to use and require less storage space. Furthermore, the availability of a diverse range of laundry detergent pods in the area, as well as the increasing e-commerce industry, are expected to drive the growth of market revenue.

China laundry detergent pods market is fueled by manufacturers’ investments in R&D, resulting in innovative products catering to consumers’ needs. E-commerce growth, driven by smartphone adoption, has also boosted demand. The expanding textile and service industries provide new opportunities, while celebrity endorsements have increased consumer awareness and driven demand for laundry detergent pods in China.

Laundry detergent pods market in India is expected to grow significantly over the forecast period, driven by widespread adoption of washing machines and Indian consumers’ growing demand for convenient and effective laundry solutions. Innovative products offering superior stain removal and fabric care have also gained traction. Celebrity endorsements and targeted marketing campaigns have effectively raised awareness, driving demand and popularity for laundry detergent pods in India.

Key Laundry Detergent Pods Company Insights

Some key companies in the laundry detergent pods market include Reckitt Benckiser Group plc; Seventh Generation, Inc.; Unilever; Waitrose & Partners; and Ecozone. Companies are focusing on expanding their customer base by implementing strategic initiatives such as mergers and acquisitions, collaborations, and partnerships with prominent industry players.

-

Reckitt Benckiser Group plc is a significant player offering products under brands like Woolite and Vanish. The company focuses on innovation, developing products that cater to consumer demand for convenience and effectiveness. Its pods provide superior stain removal and fabric care while using recyclable packaging.

-

Seventh Generation, Inc. offers eco-friendly laundry detergent pods. Formulated without harsh chemicals, dyes, or fragrances, they are biodegradable and non-toxic. Effective at cleaning clothes while gentle on fabrics and the environment, Seventh Generation’s pods have gained popularity among environmentally-conscious consumers.

Key Laundry Detergent Pods Companies:

The following are the leading companies in the laundry detergent pods market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group plc

- Seventh Generation, Inc.

- Unilever

- Waitrose & Partners

- Ecozone

- Church & Dwight Co., Inc.

- Procter & Gamble

- Henkel AG & Co. KGaA

- The Clorox Company

- Colgate-Palmolive Company

Recent Developments

-

In April 2024, Pine-Sol expanded its range of Multi-Surface Cleaners with an enhanced formula. The updated formula for scented cleaners like Lemon Fresh, Lavender Clean, and Refreshing Clean is twice as concentrated as before, providing increased cleaning strength without increasing the product size.

Laundry Detergent Pods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.95 billion

Revenue forecast in 2030

USD 17.48 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

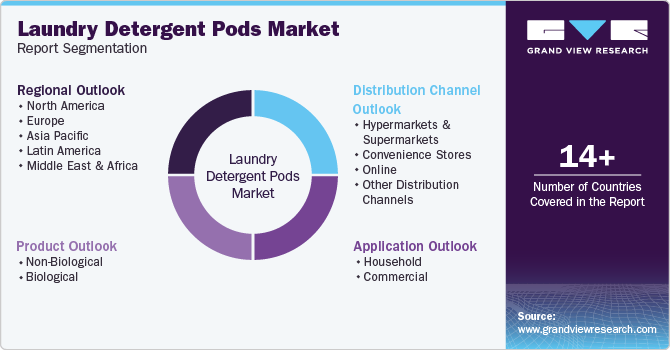

Product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Unilever; Procter & Gamble; Ecozone; Waitrose & Partners; Henkel AG & Co. KGaA; Church & Dwight Co., Inc.; The Clorox Company; Reckitt Benckiser Group plc; Colgate-Palmolive Company; Seventh Generation, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laundry Detergent Pods Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laundry detergent pods market report based on product, distribution channel, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Biological

-

Biological

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Other Distribution Channels

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.