Laundry Detergent Market Size, Share & Trends Analysis Report By Product, By Application (Household, Industrial OR institutional), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-034-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Laundry Detergent Market Size & Trends

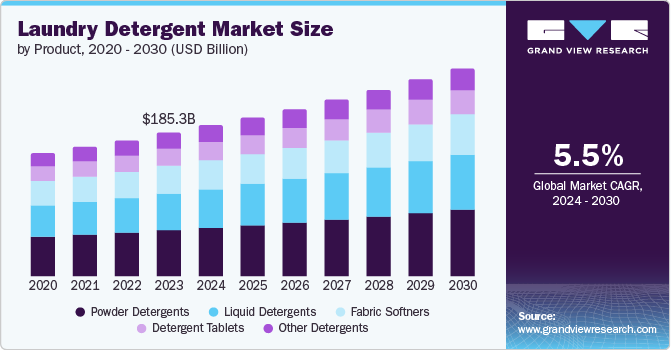

The global laundry detergent market size was valued at USD 185.28 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The rapid advancement in the chemical research industry has resulted in improved laundry detergent formulations, which have improved cleaning performance and more effective stain removal functions. Developing economies like China and India have witnessed significant market saturation, providing significant opportunities for laundry detergent manufacturers.

Marketing strategies and branding efforts contribute to the surge in demand. Companies increasingly use digital platforms and social media to engage with consumers, showcasing their products' effectiveness and unique benefits through influencer partnerships and targeted advertising campaigns. This digital outreach has broadened the reach of laundry detergent brands, making it easier to connect with a wider audience and drive sales. The focus on brand transparency and clear communication about product benefits has built consumer trust and encouraged brand loyalty and repeat purchases.

Convenience is crucial in driving the demand; modern consumers' busy lifestyles have increased their preference for laundry solutions that save time and effort. Innovations such as single-dose pods and pre-measured packets offer a hassle-free laundry experience, which appeals to consumers looking for efficiency.

Additionally, the increasing adoption of smart appliances that integrate seamlessly with high-efficiency detergents has fueled the demand as consumers seek products that enhance their laundry routines with minimal manual intervention. Increased use of automatic washing machines and changing consumers' lifestyles, especially in the developing economies, are also increasing demand for the detergent market. For instance, in April 2024, Unilever announced the launching of a new laundry detergent, Wonder Wash, under its Dirt Is Good brand, which includes Persil, OMO, and Skip. This innovation addresses the growing demand for short-cycle washes, driven by changes in consumer habits and technological advancements in washing machines. Wonder Wash leverages robotics and AI for optimal performance in 15-minute cycles, tackling issues like malodor, residues, and fabric care. The product aims to save energy and reduce environmental impact while providing superior cleaning.

Product Insights

The powder detergents segment dominated the market in 2023 with a revenue share of 32.0%. Consumers increasingly prefer powered detergents because of their superior cleaning efficiency, cost-effectiveness, and longer shelf life. Additionally, the growing emphasis on sustainability and eco-friendly products has led manufacturers to develop concentrated formulas that reduce packaging waste and transportation costs. The rise in disposable incomes, urbanization, and the proliferation of washing machines, particularly in developing regions, further fuel this demand. Furthermore, innovations in detergent formulations that enhance performance in cold water and cater to specific fabric care needs contribute to the growing popularity of powered detergents. Powder detergents align well with this shift toward sustainability, offering a greener option that reduces plastic consumption. For instance, in March 2023, Sainsbury's announced the launch of new cardboard packaging for its own-brand laundry detergents, replacing the previous plastic bottles. The new cartons are 35% lighter, reduce carbon emissions by 50%, and are made from Forest Stewardship Council (FSC) certified cardboard.

The fabric softeners segment is expected to grow significantly during the forecast period. Consumers are increasingly buying products that enhance the feel and scent of their laundry, leading to a preference for fabric softeners that offer these benefits. The growing awareness of the benefits of fabric softeners, such as reducing static cling, softening fabrics, and making ironing more accessible, has also contributed to this trend. Expanding product offerings, including eco-friendly and hypoallergenic options, have attracted environmentally conscious and sensitive-skin consumers. Marketing efforts highlighting the added value of fabric softeners, coupled with innovations in formulation and packaging, have further boosted their popularity.

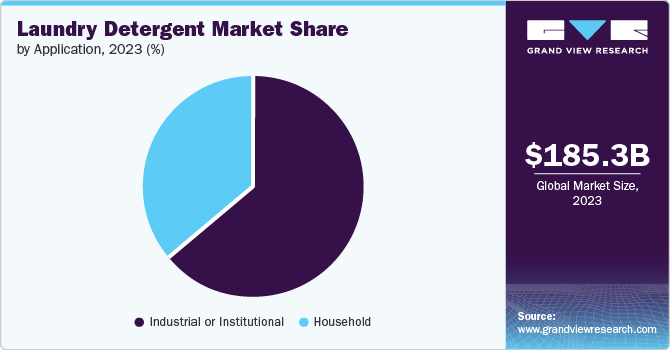

Application Insights

The industrial or institutional segment dominated the market in 2023. The rising demand in the various industrial sectors, such as healthcare, hotel industry, and food processing industry, for high standards of cleanliness drives the demand for laundry detergent. Expansion of the hotel industry, attributed to the rise in the tourism trend, boosts the demand for high-quality laundry detergent in the market. Many people following a busy life schedule, particularly in the urban areas, contribute to a growing number of laundry service providers, which results in a significant drive in demand for laundry detergents.

The household segment is expected to grow significantly over the forecast period. The demand for laundry detergent in household applications is increasing due to the growing global population, particularly in urban areas. As more people migrate to cities, there is an increased need for convenient and effective cleaning products to manage daily laundry needs. This urbanization trend is coupled with rising disposable incomes, which allow households to spend more on premium and specialized detergent products that promise better performance and cater to specific fabric care requirements. Technological advancements and product innovations have also been crucial in driving demand. Manufacturers are continuously developing new formulations that are more effective at removing stains, preserving fabric quality, and being environmentally friendly.

Regional Insights

North America is expected to grow significantly over the forecast period. Technological advancements and product innovations have considerably transformed North America's laundry detergent market, catering to evolving consumer needs. Concentrated formulas reduce packaging and transportation costs, while laundry pods and tablets provide convenient, pre-measured solutions. High-efficiency detergents designed for modern washing machines save water and energy. Eco-friendly and biodegradable detergents address environmental concerns and are safer for sensitive skin. Specialized detergents target specific fabrics and stains, offering advanced garment care. Hypoallergenic and fragrance-free options cater to those with sensitivities. Smart appliances enhance detergent use by automatically dispensing the right amount. Innovations in cold water formulations save energy, and sustainable packaging reduces plastic waste. Advanced stain removal technologies ensure thorough cleaning of tough stains. These innovations enhance user convenience, efficiency, and sustainability, driving demand for regional laundry detergents.

U.S. Laundry Detergent Market Trends

The U.S. dominated the regional laundry detergent market in 2023. Innovation and marketing by detergent manufacturers have further stimulated demand. Companies are continually developing new formulations that offer enhanced cleaning power, convenience, and added benefits such as fabric care or fragrance. For instance, the introduction of concentrated detergents, which provide better cleaning in smaller amounts, has been well-received by consumers. Aggressive marketing campaigns, including strategic partnerships with major retailers, have effectively increased brand visibility and product uptake. These efforts ensure that consumers are aware of new products and enticed to try them. In March 2024, Tide announced the launch of its latest innovation, Tide Evo, a laundry detergent in tile form. This product aims to simplify laundry by offering a lightweight, efficient, and environmentally friendly option. Tide Evo's design features six layers of concentrated cleaning ingredients, activated instantly in water. It replaces plastic packaging with recyclable paperboard and is manufactured using renewable energy.

Europe Laundry Detergent Market Trends

The Europe market held the largest revenue share in 2023. One prominent insight is the strong inclination among European consumers towards sustainability and eco-friendliness. Countries like Germany, Sweden, and the Netherlands are at the forefront of environmental consciousness, driving demand for biodegradable detergents, reduced plastic packaging, and products free from harmful chemicals. Consumers in these markets are willing to invest in premium eco-friendly brands, encouraging manufacturers to innovate and promote green products extensively. For instance, in April 2024, Attirecare, a UK-based company, announced the launch of a plant-based laundry detergent on Kickstarter, focusing on eco-friendly and sustainable cleaning solutions. The detergent is designed to be effective while minimizing environmental impact, using natural ingredients, and being free from harsh chemicals. The Kickstarter campaign aims to raise funds for production and distribution, reflecting a growing consumer trend towards environmentally conscious products. This launch aligns with the increasing demand for sustainable household products and showcases the potential for innovative companies to meet this market need.

The U.K. laundry detergent market held the largest market share in 2023. The laundry detergent market in the U.K. has seen significant innovation, with manufacturers introducing various products to cater to consumer needs. The variety is available to a broad spectrum of consumers, from eco-friendly and biodegradable options to detergents designed for specific fabric types and advanced stain removal. Innovations in packaging, such as concentrated formulas and single-dose pods, have also made laundry products more convenient and attractive, further driving demand. With urbanization and the fast-paced lifestyle in the U.K., there is a growing preference for products that save time and effort. Busy households favor laundry detergents that offer quick and efficient cleaning solutions. Single-dose pods and all-in-one detergents that combine detergent, softener, and stain remover cater to this demand for convenience.

Germany market held a substantial market share in 2023. The increasing urbanization in Germany drives the demand for laundry detergents. As more people move to urban areas, the convenience of ready-to-use household products becomes paramount. Urban dwellers often prefer purchasing branded and specialized laundry detergents that promise superior cleaning and fabric care, driving the market growth. Another contributing factor is the rising disposable income and the willingness to spend on premium and eco-friendly products. German consumers are increasingly becoming environmentally conscious, leading to a surge in demand for eco-friendly and biodegradable laundry detergents. Companies are responding by offering sustainable options, which appeal to the growing segment of green consumers, further propelling the market.

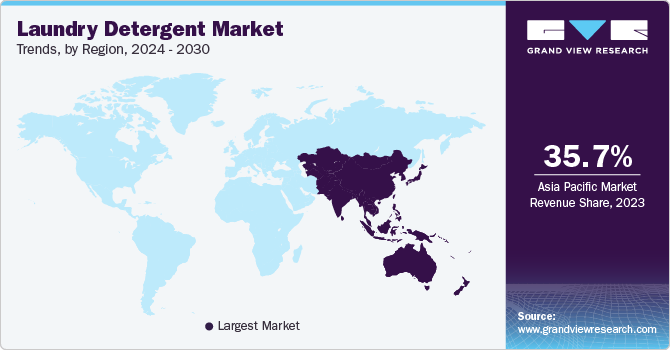

Asia Pacific Laundry Detergent Market Trends

Asia Pacific dominated the laundry detergent market, with a market share of 35.7% in 2023. Rapid urbanization and industrialization across countries like China, India, and Southeast Asia drive the demand for laundry detergents. As more people move to urban areas, there is an increased need for convenient and efficient cleaning solutions, which has led to higher consumption of laundry detergents. Additionally, the rise in disposable income among middle-class populations has allowed consumers to spend more on quality household products, including premium and specialized laundry detergents.

The China market dominated the laundry detergent market in 2023. China's rapid urbanization and the expansion of its middle class have significantly influenced consumer behavior. As more people migrate to urban centers, the accessibility and usage of modern household appliances, including washing machines, have increased. Urban households often have higher disposable incomes and are more inclined to purchase quality laundry detergents, including premium and specialized products that offer enhanced cleaning power, fabric care, and appealing fragrances. This shift indicates a broader trend where rising living standards directly impact consumption patterns.

Latin America Laundry Detergent Market Trends

Latin America is anticipated to witness the fastest growth during the forecast period. Increasing urbanization and a growing middle class have significantly increased the need for convenient and efficient household products. Additionally, increasing consumer awareness about hygiene and cleanliness has bolstered detergent usage. Expanding retail networks, including supermarkets and online platforms, have made these products more accessible. Furthermore, product innovations, such as eco-friendly and concentrated formulas, have attracted environmentally conscious consumers.

Key Laundry Detergent Company Insights

Some of the key companies include Unilever; Procter & Gamble; Lion Corporation; Kao Corporation.

-

Unilever is a consumer goods company. The company's diverse product portfolio spans foods and refreshments, including well-known brands like Knorr, Hellmann's, and Lipton; beauty and personal care with Dove, TRESemmé, and Axe; home care products such as Omo and Domestos; and health and well-being supplements like Olly and Liquid I.V. Unilever also focuses on sustainability, marketing, research and development, and corporate social responsibility, driving initiatives that aim to enhance health and well-being, reduce environmental impact, and support communities globally.

-

Procter & Gamble (P&G) specializes in numerous personal care and household products. The company offers multiple products across different categories, including laundry and fabric care, baby care, grooming, health care, and beauty. Some of its most recognized brands are Tide, Ariel, Pampers, Gillette, Oral-B, Head & Shoulders, and Pantene. P&G is renowned for its commitment to innovation, quality, and meeting the everyday needs of consumers worldwide, making it a trusted household name in over 180 countries.

Key Laundry Detergent Companies:

The following are the leading companies in the laundry detergent market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Procter & Gamble

- Lion Corporation

- Kao Corporation

- Method products, PBC.

- Reckitt Benckiser Group plc.

- Colgate-Palmolive Company

Recent Developments

-

In June 2024, Whirlpool India announced a partnership with Hindustan Unilever to enhance the laundry experience in India. The collaboration aims to combine Whirlpool's advanced washing machines with Hindustan Unilever's range of detergents to offer a superior laundry solution. This partnership focuses on innovation and customer satisfaction, intending to transform how consumers handle laundry by integrating cutting-edge technology with high-quality cleaning products.

-

In July 2022, Unilever launched its most advanced and sustainable laundry capsules. These new capsules are designed to be more effective in cleaning and reduce environmental impact. The innovation aims to meet the growing consumer demand for sustainable products. The capsules feature a unique formula that performs well in cold washes, saves energy, and comes in fully recyclable packaging.

Laundry Detergent Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 194.91 million |

|

Revenue forecast in 2030 |

USD 269.52 million |

|

Growth Rate |

CAGR of 5.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

July 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; Russia; China; Japan; India; Brazil; Saudi Arabia |

|

Key companies profiled |

Unilever; Henkel AG & Co. KGaA; Church & Dwight Co., Inc.; Procter & Gamble; Lion Corporation; Kao Corporation; Method products, PBC.; Reckitt Benckiser Group plc.; Colgate-Palmolive Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laundry Detergent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laundry detergent market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder Detergents

-

Liquid Detergents

-

Fabric Softners

-

Detergent Tablets

-

Other Detergents

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Industrial or Institutional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."