- Home

- »

- Pharmaceuticals

- »

-

Latin America Insulin Market Size, Industry Report, 2030GVR Report cover

![Latin America Insulin Market Size, Share & Trends Report]()

Latin America Insulin Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Insulin Analog, Human Insulin), By Product, By Application (Type I Diabetes, Type II Diabetes), By Distribution, By Country And Segment Forecasts

- Report ID: 978-1-68038-145-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Latin America Insulin Market Size & Trends

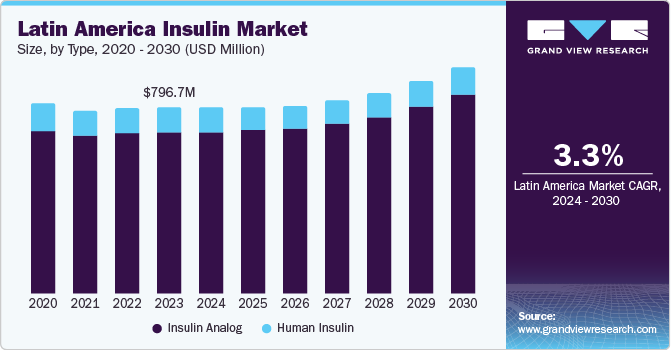

The Latin America insulin market size was valued at USD 796.7 million in 2023 and is projected to grow at a CAGR of 3.3% from 2024 to 2030. The projected growth is attributed to multiple factors, such as the increasing prevalence of diabetes, lifestyles characterized by a lack of physical activity and unhealthy diets, and growing technological advancements in insulin delivery methods and medical equipment manufacturing. Ease of use and availability, increasing awareness regarding the need for continuous attention and care for diabetes patients, and growing obesity rates in numerous countries are expected to generate an upsurge in demand for the insulin market in Latin America.

One of the most prominent factors accelerating demand for insulin in this market is the rising rate of newly diagnosed diabetes cases. In addition, the continuous increase in a group of individuals diagnosed with diabetes and aged 60 or more is contributing to the growing use of insulin. The increasing obesity rate and a genetic tendency for Type-2 diabetes are anticipated to play a significant role in the rise of the Type-2 diabetic population in the next few years. According to the International Diabetes Federation, nearly 537 million individuals are diagnosed with diabetes; this number is projected to reach approximately 700 million by 2045.

Patient awareness initiatives by government agencies, the healthcare industry, and other welfare organizations have also contributed to the growing use of insulin. The availability of technologically advanced devices such as continuous glucose monitoring and others has also influenced this market in recent years. Increasing market penetration attained by the key industry participants is expected to assist this market in generating greater growth during the forecast period.

Type Insights

The insulin analog segment has dominated the global market and accounted for a revenue share of 86.5% in 2023. This high percentage is attributed to insulin analogs developed to mimic natural insulin by improving their pharmacodynamic effects and faster impact capacities than insulin analogs on the body. The market is driven by a growing demand for insulin analogs compared to traditional insulin products due to the advantages such as the decreased likelihood of glycemic control or hypoglycemia, long-lasting impacts, and fewer side effects. Additionally, government policies and healthcare initiatives are anticipated to influence access to medications such as insulin analogs.

The human insulin segment is expected to experience a significant CAGR during the forecast period. The growth of this segment is driven by cost-effectiveness, the rising prevalence of diabetes, and changing lifestyles. Moreover, the availability of human insulin in various formulations such as solution, suspension, and subcutaneous injections allows diabetic patients to ingest insulin according to convenience. According to the World Health Organization (WHO) guidelines, using human insulin products, such as short-acting regular insulin and intermediate-acting Neutral Protamine Hagedorn (NPH) insulin, in low-resource settings is the primary choice for adults with type 1 DM and the third treatment option for those with type 2 DM.

Product Insights

Based on product, the long-acting insulin segment accounted for the largest revenue share in 2023. This is attributable to its ability to maintain normal blood sugar levels for longer periods and slow and steady insulin release. Insulin, detemir, Insulin degludec, and insulin glargine are some examples of long-acting insulin. These insulins mimic the body's natural basal insulin secretion and can remain effective for up to 36 hours. Ease of use, convenience factor assisting patients in enhanced adherence to treatment routines, increasing inclusion in treatment protocols by healthcare professionals and steady or prolonged insulin release through these products are expected to generate higher demand for this segment during forecast period.

The biosimilar products segment is projected to experience a significant CAGR during the forecast period. Biosimilars closely resemble reference products, showing no significant differences in safety or effectiveness. FDA-approved biosimilars and interchangeable biosimilars are nearly identical to FDA-approved reference products. Biosimilars offer additional medication choices to patients. They are available at potentially lower costs, as their manufacturers use the FDA's approval of the original biologics to streamline their drug development processes, driving the demand for the market. Moreover, these biosimilar products are anticipated to enhance insulin treatment availability, lower expenses for diabetes care, and broaden the range of insulin brands for individuals with diabetes.

Application Insights

The type 1 diabetes segment dominated the Latin America insulin market in 2023. The growth of this segment is attributed to the growing number of cases of Type 1 diabetes in the region, especially among young people. Population in Brazil is expected to record more than 11 million individuals with condition of diabetes in next few years. The growing prevalence of type 1 diabetes among young population, sedentary lifestyles, increasing awareness leading to growth in diagnostics, and ease of use associated with multiple insulin delivery devices is expected to generate growth for this segment in approaching years.

The type 2 diabetes segment is projected to grow at the fastest CAGR over the forecast period. According to the NCBI 2023 report, Type 2 diabetes mellitus (T2DM) accounts for about 90% of all diabetes cases. The individuals over the age of 45 most commonly experience type 2 diabetes. However, it is becoming more common among children, teenagers, and young adults due to the growing prevalence of obesity, lack of physical exercise, and unhealthy diets. In addition, increasing occurrence of conditions such as gestational diabetes mellitus (GDM) also affects 7% of pregnancies. Women with gestational diabetes and their children are more prone to risks of type 2 diabetes in later stages of life. These aspects are anticipated to influence the growth of this segment in approaching years.

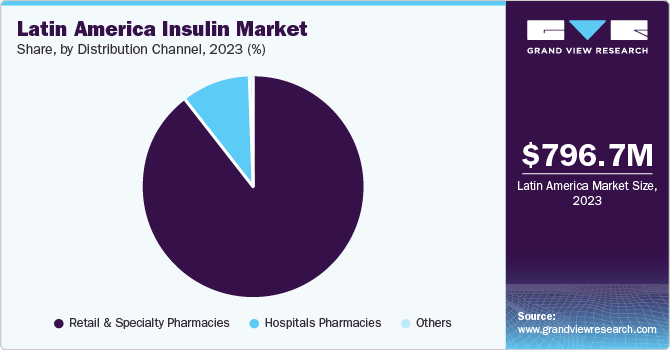

Distribution Channel Insights

The retail & specialty pharmacies segment dominated the Latin America insulin market in 2023. This is attributed to factors such as enhanced availability and accessibility, ease of transaction, and effective distribution by the key market participants in the insulin industry. The brands operating in this market focus on offline distribution channels such as retail & specialty pharmacies as this results in improved brand visibility and greater customer engagement.

The hospital pharmacies segment is projected to grow at a significant CAGR over the forecast period. Direct patient care drives the market, and hospital pharmacies contribute a major share in this category. Multiple regional care providers have adopted this strategy to provide enhanced patient assistance by providing pharmacies within the premises. The facility looks after tasks such as inventory management and prevention of shortages. Growing new cases of emergency care and unexpected health intricacies triggered by insulin are expected to drive demand for this segment during the forecast period. Guidelines and regulations regarding glucose levels for critically ill patients in ICU and other patients admitted to the facility for surgery and non-ICU treatments play a vital role in insulin distribution through hospital pharmacies.

Country Insights

Brazil Insulin Market Trends

Brazil insulin market dominated the regional insulin industry with a revenue share of 31.3% in 2023. The factors contributing to this growth are the increasing newly diagnosed cases of diabetes, rising awareness regarding the requirement of continuous insulin monitoring, growing availability of technologically advanced products and rising hospitalization of patients with diagnosed diabetic condition. Enhancements in healthcare industry and improvements in availability of diabetes treatment products and services has contributed to growth of this market in recent years. Public welfare organizations' involvement has also been a key factor in growing awareness regarding the use and availability of diligent care for diabetes patients. For Instance, the SUS (Sistema Único de Saúde), the public health system in Brazil, has focused on continuously increasing the assistance available for diabetes care.

Peru Insulin Market Trends

Peru insulin market is expected to experience the fastest CAGR of 3.7% from 2024 to 2030. This market is primarily driven by factors such as the rising prevalence of diabetes in the country, ease of availability through public and private pharmacies, and enhanced government initiatives to support diabetes treatments and care. Steady growth in the adoption of technological advancements in diabetes care is projected to contribute to the growth of this market during the forecast period.

Key Latin America Insulin Company Insights

Some of the key companies in the Latin America insulin market include Novo Nordisk A/S, Eli Lilly and Company, Sanofi, Biocon, Wockhardt, and others. To address the growing competition in the market, major players have adopted strategies such as vast distribution networks, enhanced research and development, innovation-based new product launches, portfolio expansions, collaboration with healthcare facilities, and more.

-

Sanofi, one of the key players in the pharmaceutical and healthcare industry, focuses on scientific advancements, continuous R & D and partnerships to deliver innovative healthcare solutions. The company offers various insulin products, such as insulin glargine (Lantus, Toujeo, Soliqua, and others), Admelog lispro, Apidra glulisine and others.

-

Novo Nordisk A/S, a multinational pharmaceutical company, offers wide range of products focused on driving change to defeat growing chronic diseases of different sorts. In Latin America, the company has presence in numerous locations such as Argentina, Colombia, Panama, Brazil, Mexico, Peru and Chile. Offerings related to insulin includes Novolin N, Novolin R, Victoza, insulin pens, and other treatments.S

Key Latin America Insulin Companies:

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Biocon.

- Wockhardt

- Boehringer Ingelheim International GmbH.

- Julphar

- United Laboratories International Holdings Limited.

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Xinbai Pharmaceutical

Recent Developments

-

In January 2024, Novo Nordisk announced a successful combination of three-phase 3a trials, resulting in the finding that IcoSema once a week is as effective as daily basal-bolus treatment in reducing HbA1c levels in individuals with type 2 diabetes. The company focuses on R&D activities to formulate innovative formulations for diabetes patients.

-

In April 2024, Biocon Limited signed an agreement with Biomm S.A. to exclusively license and supply Semaglutide (gOzempic) for improving glycemic control in adults with type-2 diabetes. According to this agreement, Biocon is anticipated to develop, produce, and distribute the medication. Biomm aims to take charge of commercialization and securing regulatory approval in the Brazilian market.

Latin America Insulin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 794.9 million

Revenue forecast in 2030

USD 966.2 million

Growth rate

CAGR of 3.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

Brazil, Argentina, Chile, Colombia, Peru, Venezuela, Rest of Latin America

Key companies profiled

Novo Nordisk A/S; Eli Lilly and Company.; Sanofi; Biocon.; Wockhardt; Boehringer Ingelheim International GmbH.; Julphar; United Laboratories International Holdings Limited.; Tonghua Dongbao Pharmaceutical Co. Ltd.; Xinbai Pharmaceutical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Insulin Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America insulin market report based on type, product, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin Analog

-

Human Insulin

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rapid-Acting Insulin

-

Long-Acting Insulin

-

Combination Insulin

-

Biosimilar

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Type I Diabetes

-

Type II Diabetes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals Pharmacies

-

Retail & Specialty Pharmacies

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Peru

-

Venezuela

-

Rest of Latin America

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.