- Home

- »

- Clinical Diagnostics

- »

-

Latin America PoC Infectious Disease Testing Market, Report, 2030GVR Report cover

![Latin America PoC Infectious Disease Testing Market Size, Share & Trends Report]()

Latin America PoC Infectious Disease Testing Market Size, Share & Trends Analysis Report By Type (POC Rapid Diagnostic Single Test, POC Rapid Diagnostic Combo Test), By Disease (HIV POC, Malaria), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-458-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

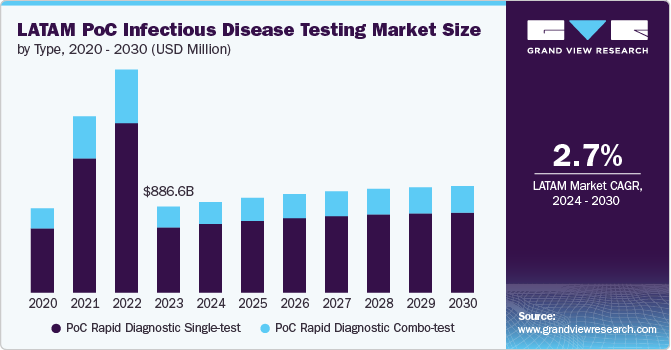

The Latin America PoC infectious disease testing market size was estimated at USD 886.6 million in 2023 and is anticipated to grow at a CAGR of 2.7% from 2024 to 2030. This growth is driven by the high prevalence of infectious diseases, advancements in diagnostic technologies, supportive regulatory environments, and proactive government and international initiatives. According to a report published by UNAIDS, in 2023, there were over 140,000 adults and children living with HIV in Argentina. Moreover, about 4,200 new cases were detected in 2023, while over 1,400 people died due to the disease. Hence, a high prevalence of HIV/AIDS is anticipated to fuel the demand for point-of-care testing (POCT).

Increased government spending, the rising focus of multinational key players in this region, and an increase in patient awareness are expected to drive market growth over the forecast period. The region is witnessing a trend toward decentralized IVD testing and increasing demand for affordable POC tests, especially concerning infectious diseases. For instance, in June 2020, 10 million PCR kits were procured in the Americas (including South American countries) through the Pan American Health Organization (PAHO) strategic fund. PAHO is a cooperation aimed at pooling essential strategic health and medical supplies to support the region's capacity to detect & confirm COVID-19 cases. Growth in economic & political stability has led to economic growth in Latin America, positively affecting the market growth.

Government and international initiatives have been crucial in propelling the growth of the point of care (PoC) testing market in Latin America, emphasizing improved disease management and public health outcomes. The Healthy Brazil initiative, launched in April 2023, established the Interministerial Committee for the Elimination of Tuberculosis and Other Socially Determined Diseases (CIEDDS), targeting 175 cities with high incidences of diseases such as TB and other socially determined conditions. Similarly, in May 2024, the Ministry of Health and Social Protection of Colombia, in collaboration with PAHO member states, introduced the Disease Elimination Initiative. This program aims to eradicate communicable diseases including malaria, tuberculosis, HIV, and neglected tropical diseases, further driving the need for advanced diagnostic solutions. These initiatives collectively enhance the demand for PoC testing technologies by focusing on early detection and effective disease management, thereby supporting market expansion.

Market Concentration & Characteristics

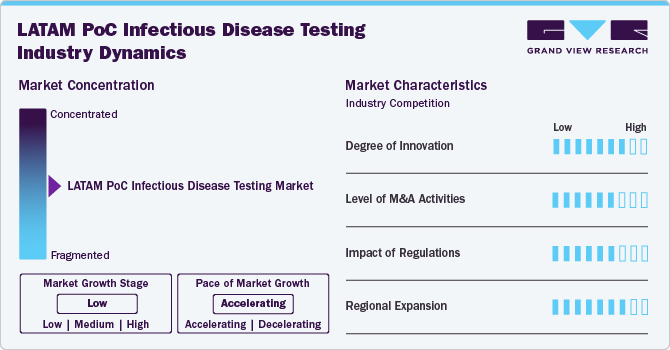

The Latin America PoC infectious disease testing market is characterized by a high degree of innovation driven by the need for rapid, accurate, and accessible diagnostic solutions. Innovations in this market are predominantly focused on improving the speed, accuracy, and usability of diagnostic tests. Recent advancements include the development of multiplex assays that can simultaneously detect multiple pathogens, such as those for COVID-19, influenza, and other respiratory infections. For instance, Roche’s cobas SARS-CoV-2 Test and Abbott’s Panbio COVID-19 Antigen Test are examples of innovations that provide quick and accurate results for COVID-19. Another significant development is the integration of digital health technologies, such as mobile health applications and telemedicine platforms, which enhance the efficiency of diagnostics and patient management.

Mergers and acquisitions (M&A) in the LATAM market have been active, reflecting the strategic importance of expanding technological capabilities and market reach. Companies are actively engaging in M&A to broaden their product portfolios, integrate advanced diagnostic technologies, and extend their geographic footprint. These activities are not only about consolidating expertise but also about harnessing synergies to improve service delivery in response to the rising demand for PoC testing solutions across the region.

Regulations play a critical role in shaping this market. Regulatory bodies in LATAM, such as ANVISA in Brazil and COFEPRIS in Mexico, oversee the approval and market entry of diagnostic tests. Regulatory frameworks are increasingly focusing on ensuring the accuracy and reliability of PoC tests. For instance, Brazil’s ANVISA has been working to streamline the approval process for new diagnostics to enhance the response to emerging infectious diseases. In December 2023, ANVISA announced its priorities for 2024-2025 in its ‘Regulatory Agenda’ document. This document outlines 172 topics across 66 themes. These priorities are aligned with ANVISA’s 3-year plan. In addition, ANVISA’s Regulatory Agenda covers medical devices, which include POC diagnostics. Furthermore, ANVISA is revising the regulations on essential safety & performance requirements for medical devices, which include POC diagnostics. They released Resolution RDC 848/2024 for diagnosis purposes. Regulatory support for innovation and the adoption of new testing technologies is crucial for meeting the region’s public health needs and ensuring high-quality diagnostic solutions.

The LATAM market is experiencing significant regional expansion driven by high disease prevalence and increasing healthcare infrastructure investments. Countries like Brazil, and Argentina are key markets due to their large populations and high burden of infectious diseases such as dengue, Zika, and tuberculosis. Governments and international organizations are supporting this expansion through various initiatives. For instance, Brazil’s Ministry of Health has been investing in expanding diagnostic infrastructure to improve disease surveillance and management through the Healthy Brazil initiative.

Type Insights

The market is segmented into PoC rapid diagnostic single-test and PoC rapid diagnostic combo-test. In 2023, the PoC Rapid Diagnostic Single-test segment dominated the market with more than 70% of revenue share, driven by its practicality and effectiveness. Single-test devices are highly valued in Latin America due to their ability to provide rapid, accurate results for individual pathogens within 10 to 30 minutes. This makes them particularly useful in point-of-care settings, such as remote clinics and emergency units, where access to comprehensive diagnostic facilities is limited.

Single-test solutions are cost-effective and user-friendly, facilitating swift clinical decision-making and efficient patient management. Recent advancements have improved the accuracy and affordability of these tests, making them more accessible. The COVID-19 pandemic further accelerated the adoption of rapid diagnostic technologies, including single-test devices, as healthcare systems prioritized rapid and reliable testing to control disease spread. Continued innovation in test sensitivity and specificity supports the segment's growth, underscoring its essential role in managing infectious diseases in the region.

The PoC rapid diagnostic combo test segment is expected to grow at the fastest CAGR of 3.2% during the forecast period. POC rapid diagnostic combo tests are diagnostic assays that detect multiple biomarkers, such as both antigens and antibodies, in a single test. According to the Pan American Health Organization (PAHO), diseases like dengue and Zika are endemic in the region, necessitating efficient diagnostic tools that can address multiple conditions simultaneously. POC rapid diagnostic combo-test offers comprehensive results by identifying various infection stages or strains simultaneously, improving diagnostic accuracy. The ability of these tests to provide rapid and accurate results for multiple conditions from a single sample makes them an essential tool in managing infectious diseases in resource-limited settings.

Disease Insights

The COVID-19 segment dominated the market and accounted for 45.8% of the total share in 2023. This dominance is primarily driven by several factors, including the continued impact of the pandemic, high testing demand, and significant advancements in diagnostic technology. The COVID-19 pandemic has had a profound and lasting effect on global healthcare systems, with LATAM experiencing severe outbreaks and high infection rates. According to the Pan American Health Organization (PAHO), Latin America has faced some of the highest COVID-19 case numbers and mortality rates in the world. As of August 2023, it is the world's sixth leading country in the number of coronavirus disease 2019 (COVID-19) cases, with 37,717,062 confirmed cases and 704,659 reported deaths. This ongoing public health crisis has led to a persistent demand for reliable and rapid diagnostic tools to manage and control the spread of the virus.

The HIV POC is expected to grow at the fastest CAGR of 3.8% during the forecast period. This growth is driven by the high prevalence of HIV in the region, advancements in diagnostic technologies, and increased public health initiatives. HIV remains a significant public health concern in Latin America, where the epidemic continues to pose challenges. According to UNAIDS, Latin America accounted for approximately 2.1 million people living with HIV by 2021, with around 0.5 million new infections occurring annually in the region. This high prevalence underscores the urgent need for effective and accessible testing solutions. Point-of-care HIV tests, which offer rapid and accurate results, are particularly valuable in this context as they facilitate early diagnosis and prompt initiation of treatment, crucial for managing the disease and preventing its spread.

End Use Insights

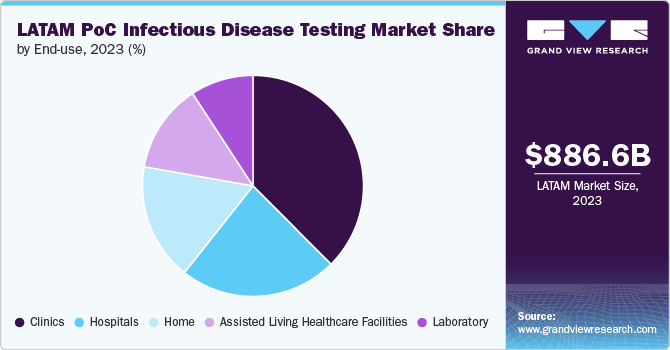

The clinics segment held the largest share of 37.5% in 2023. Clinics are pivotal in providing primary healthcare services, including diagnostic testing for infectious diseases. They serve as the first point of contact for many patients, making them critical venues for the administration of PoC tests. In Latin America, where healthcare infrastructure can be unevenly distributed, clinics play a crucial role in delivering accessible and timely care. According to the Pan American Health Organization (PAHO), a significant portion of infectious disease management occurs at the primary care level, underscoring the reliance on clinics for early detection and intervention.

The home segment is anticipated to register the fastest growth from 2024 to 2030. As consumers become more proactive about their health, there is a growing demand for convenient and accessible home-based testing solutions. This trend is fueled by the increasing prevalence of chronic diseases and heightened health awareness, which emphasizes the importance of personal health management. The COVID-19 pandemic has played a pivotal role in accelerating the adoption of home testing. With the need for frequent and accessible testing to manage the spread of the virus, home-based tests have become highly sought after. The convenience of conducting tests at home, without the need to visit healthcare facilities, has proven particularly beneficial for individuals in remote or underserved areas. This shift has resulted in increased investment in home testing products and expanded availability, reflecting the rising consumer preference for self-care solutions.

Country Insights

Brazil PoC Infectious Disease Testing Market Trends

Brazil PoC infectious disease testing market held the largest revenue share in 2023. This is expected to drive by the initiatives by companies in the country to develop efficient POC diagnostic tests are expected to drive growth in this country in the coming decade. For instance, in November 2020, Chembio Diagnostics received regulatory approval from the Agência Nacional de Vigilância Sanitária for marketing its DPP SARS-CoV-2 Antigen test system in the country. In addition, the company introduced a POC diagnostic test for Zika virus in Brazil. Furthermore, it has been working in collaboration with Bio-Manguinhos for over 12 years and has established & marketed POC tests for Leishmaniasis, HIV, and Syphilis.

Argentina PoC Infectious Disease Testing Market Trends

The PoC Infectious Disease Testing Market in Argentina is thriving due to the increasing prevalence of infectious diseases, such as tuberculosis, malaria, and sexually transmitted infections. Furthermore, key players in the region are undertaking initiatives for the development of new offerings. In July 2020, Argentina-based CASPR Biotech and renegade.bio entered a strategic collaboration for the development of cost-effective and highly precise POC diagnostics for SARS-CoV-2 detection. The partnership focuses on combining the capabilities of the companies to accelerate the development & commercialization of a CLIA-waived test based on CRISPR technology. Such initiatives are expected to boost the country's market.

Key Latin America PoC Infectious Disease Testing Company Insights

The market is characterized by the presence of several key players who dominate the landscape with substantial market share. These companies are leading the industry through extensive distribution networks, and a broad portfolio.

Key Latin America PoC Infectious Disease Testing Companies:

- InTec Products, Inc.

- Assure Tech (Hangzhou) Co., Ltd

- Getein Biotech, Inc.

- Xiamen Biotime Biotechnology Co., Ltd.

- Nantong Egens Biotechnology Co., Ltd.

- Xiamen Boson Biotech Co., Ltd.

- F Hoffman-La Roche Ltd.

- Abbott

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare AG

- Becton, Dickinson, and Company (BD)

- CTK Biotech

Recent Developments

- In May 2024, BioPerfectus received approval from Brazil’s ANVISA for its dengue and malaria diagnostic kits. In collaboration with the China CDC, the company developed the Malaria Pf/Pan (HRP2/pLDH) Antigen Rapid Test Kit, supplied to Papua New Guinea, to support local efforts in managing infectious diseases.

Latin America PoC Infectious Disease Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 934.6 million

Revenue forecast in 2030

USD 1.1 billion

Growth rate

CAGR of 2.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, diseases, end use, country

Regional scope

Latin America

Country scope

Brazil; Argentina; Rest of LATAM

Key companies profiled

InTec Products, Inc.; Assure Tech (Hangzhou) Co., Ltd; Getein Biotech, Inc.; Xiamen Biotime Biotechnology Co. Ltd.; Nantong Egens Biotechnology Co., Ltd.; Xiamen Boson Biotech Co., Ltd.; F Hoffman-La Roche Ltd.; Abbott; Thermo Fisher Scientific, Inc.; Siemens Healthcare AG; Becton, Dickinson, and Company (BD); CTK Biotech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America PoC Infectious Disease Testing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America PoC infectious disease testing market report based on type, disease, end use, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

PoC Rapid Diagnostic Single-test

-

PoC Rapid Diagnostic Combo-test

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

HIV PoC

-

Chlamydia & Gonorrhea

-

Adenovirus

-

Rotavirus

-

Norovirus

-

Shigella

-

Dengue

-

Zika

-

Typhoid

-

Syphilis

-

Malaria

-

Anti-TP (Treponema pallidum)

-

Monkeypox

-

Strep A

-

H. pylori

-

HBV POC

-

Pneumonia Or Streptococcus Associated Infections

-

Respiratory Syncytial Virus (RSV) POC

-

HPV POC

-

Influenza/Flu POC

-

HCV POC

-

MRSA POC

-

TB & Drug-resistant TB POC

-

HSV POC

-

COVID-19

-

Other Infectious Diseases

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Home

-

Assisted Living Healthcare Facilities

-

Laboratory

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Frequently Asked Questions About This Report

b. The Latin America PoC infectious disease testing market was estimated at USD 886.6 million in 2023 and is expected to reach USD 934.6 million in 2024.

b. The Latin America PoC infectious disease testing market is expected to grow at a compound annual growth rate of 2.7% from 2024 to 2030 to reach USD 1.1 billion by 2030.

b. In 2023, the POC Rapid Diagnostic Single-test segment dominated the market with more than 70% of market share, driven by its practicality and effectiveness. Single-test devices are highly valued in Latin America due to their ability to provide rapid, accurate results for individual pathogens within 10 to 30 minutes

b. Some prominent players in the market include InTec Products, Inc., Assure Tech (Hangzhou) Co., Ltd, Getein Biotech, Inc., Xiamen Biotime Biotechnology Co., Ltd., Nantong Egens Biotechnology Co., Ltd., Xiamen Boson Biotech Co., Ltd., F Hoffman-La Roche Ltd., Abbott, Thermo Fisher Scientific, Inc., Siemens Healthcare AG, Becton, Dickinson, and Company (BD), CTK Biotech

b. This growth is driven by the high prevalence of infectious diseases, advancements in diagnostic technologies, supportive regulatory environments, and proactive government and international initiatives

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."