Latin America Nutritional Supplements Market Size, Share & Trends Analysis Report By Product, By Formulation, By Sales Channel, By Consumer Group, By Application, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-416-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The Latin America nutritional supplements market was estimated at USD 51.32 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The increasing health consciousness among consumers in Latin America is driving a shift toward better overall well-being. Many people seek products that help manage their weight, boost immunity, and prevent diseases. As awareness grows about the importance of maintaining good health, there is also a rise in the demand for nutritional supplements to support energy levels and mental well-being. The trend is increasingly focused on preventive healthcare, with individuals using supplements as a proactive measure to avoid illnesses. This growing health-conscious mindset is significantly shaping the Latin America nutritional supplements industry.

The increasing prevalence of chronic diseases such as obesity, diabetes, and cardiovascular conditions is contributing to a higher demand for nutritional supplements. Consumers are looking for products that support heart health, aid in weight management, and improve overall wellness. In addition, the aging population in Latin America is creating a need for supplements that address age-related health issues, such as joint health, cognitive function, and bone density. As more people seek ways to manage these health concerns, the demand for targeted supplements grows. These trends are significantly influencing the Latin America nutritional supplements industry.

The expansion of the middle class in Latin America has led to higher disposable incomes, making nutritional supplements more affordable and accessible to a larger portion of the population. As more people enter the middle class, there is a growing willingness to spend on health-related products to improve overall well-being. Urbanization has also played a significant role in this trend, as people in major cities become more aware of global health and wellness trends. Consumers in urban areas are increasingly exposed to various nutritional supplements through digital platforms and retail stores. This growing purchasing power and awareness drives the growth of the Latin America nutritional supplements industry.

Product Insights

The functional foods and beverages segment dominated the market with a revenue share of 52.8% in 2024, driven by the increasing consumer awareness regarding health benefits associated with these products. As individuals become more health-conscious, there is a growing demand for nutrient-enriched foods that offer benefits beyond basic nutrition, such as improved digestion and enhanced immunity. In addition, the rise of clean-label products, which emphasize natural ingredients and transparency, has further fueled this segment's growth. Introducing innovative products, including plant-based options and functional beverages infused with probiotics, has also played a crucial role in attracting health-oriented consumers.

The sports nutrition segment is projected to grow at the highest CAGR of 9.3% over the forecast period, fueled by the increasing popularity of fitness activities and sports among various demographics. This growth can be attributed to a heightened focus on physical fitness and performance optimization, particularly among younger consumers. The proliferation of social media has also contributed to this trend by promoting fitness culture and raising awareness about the importance of proper nutrition for athletic performance. Furthermore, introducing specialized products aimed at athletes and fitness enthusiasts has expanded market opportunities within this segment.

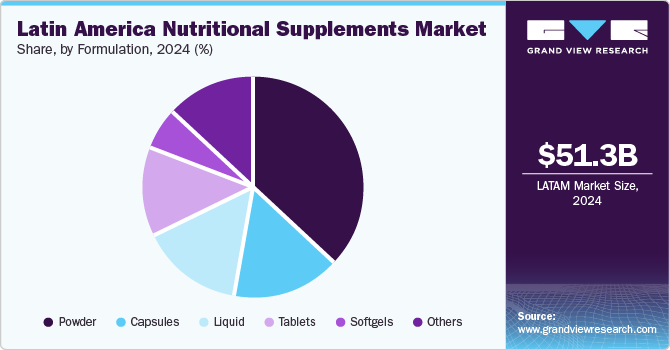

Formulation Insights

The powder segment dominated the market with the largest revenue share in 2024, which can be attributed to its versatility and convenience for consumers. Powdered supplements such as protein powders and meal replacements are favored for their ease of use and ability to be integrated into various diets. The growing trend of home workouts, accelerated by recent global events, has also increased demand for these products as individuals seek effective weight management and muscle recovery solutions. Moreover, the customization potential offered by powders allows users to tailor their intake according to personal health goals, further driving the growth of the Latin America nutritional supplements industry.

The capsules segment is projected to grow at the highest CAGR over the forecast period due to the manufacturers focusing on developing innovative capsule-based supplements. This growth is fueled by consumer preferences for convenient dosage forms that are easy to consume and transport. Capsules often provide precise dosages of active ingredients, appealing to those who prioritize accuracy in their nutritional intake. Moreover, advancements in capsule technology, including vegetarian and gelatin options, cater to diverse dietary needs and preferences, enhancing their appeal in the market.

Sales Channel Insights

The brick & mortar segment dominated the market with the largest revenue share in 2024, fueled by its established presence and consumer familiarity. Physical retail stores offer immediate access to products, allowing consumers to make informed purchasing decisions through personal interaction with staff and product examination. In addition, promotional events and in-store tastings enhance customer engagement and drive sales within this channel. The convenience of shopping in local stores continues to resonate with many consumers who prefer traditional shopping experiences over online alternatives.

The e-commerce segment is projected to grow at the highest CAGR over the forecast period due to more consumers shifting toward online shopping for convenience and variety. The rapid expansion of digital platforms has made it easier for consumers to access a wide range of nutritional supplements from the comfort of their homes. Enhanced delivery options and competitive pricing strategies have further encouraged this trend. Moreover, online retailers often provide detailed product information and customer reviews that assist consumers in making informed choices about their purchases.

Consumer Group Insights

The adults segment dominated the market with the largest revenue share in 2024, driven by increasing health awareness among this demographic. Adults increasingly seek functional foods supporting overall wellness, energy levels, and disease prevention as they navigate busy lifestyles. The rising prevalence of lifestyle-related health issues has prompted many adults to adopt preventive measures through dietary choices that include functional supplements. This proactive approach towards health management significantly contributes to the sustained growth of this segment in the Latin America nutritional supplements industry.

The geriatric segment is projected to grow at a significant CAGR over the forecast period, which can be attributed to an aging population increasingly focused on maintaining health and vitality. Older adults are more likely to seek nutritional supplements supporting cognitive function, joint health, and overall well-being as they age. This demographic shift emphasizes the need for products specifically addressing age-related health concerns. Moreover, growing awareness about preventive healthcare among seniors drives demand for functional foods that can enhance quality of life.

Application Insights

The weight management segment dominated the market with the largest revenue share in 2024, fueled by rising obesity rates and increasing consumer interest in maintaining healthy weight. Functional foods that assist with weight control are gaining traction as individuals seek effective solutions for managing their diets without compromising nutrition. The emphasis on holistic wellness has led consumers to favor products that aid weight loss and promote overall health benefits such as improved metabolism and enhanced energy levels.

The sports & athletics segment is anticipated to grow at the highest CAGR over the forecast period, which can be attributed to an increasing focus on fitness and athletic performance across various age groups. As more individuals engage in sports activities or fitness regimes, there is a corresponding demand for specialized nutritional products that support energy levels and recovery processes. The influence of social media on fitness trends also plays a significant role in promoting awareness of sports nutrition's importance among amateur athletes and fitness enthusiasts alike.

Key Latin America Nutritional Supplements Company Insights

Some key companies operating in the market are Herbalife International of America, Inc; Amway Corp; Bayer AG; Sanofi, and Abbott. Companies are undertaking strategic initiatives such as mergers, acquisitions, and formulation launches, to expand their market presence and address the evolving healthcare demands in Latin America nutritional supplements market.

-

Herbalife International of America, Inc. offers a wide range of nutritional products in Latin America, including protein shakes, meal replacement bars, vitamins, and dietary supplements to support weight management, energy, and overall health. The company also promotes nutrition clubs, where consumers can enjoy products socially while emphasizing natural ingredients that align with local cultural preferences.

-

Amway Corp offers a wide range of nutritional products in Latin America through its Nutrilite brand, including vitamins, minerals, and dietary supplements that support immune function, energy, and overall wellness. The brand also provides plant-based protein powders, meal replacement shakes for consumers seeking convenient and nutritious options, and personalized nutrition solutions tailored to individual needs.

Key Latin America Nutritional Supplements Companies:

- Herbalife International of America, Inc

- Amway Corp

- Bayer AG

- Sanofi

- Abbott

- Nestlé

- Pfizer Inc.

- GNC Holdings, LLC

- Higher Ground Supplements

- Shaklee Corporation

Recent Developments

-

In April 2023, Herbalife launched 106 new product SKUs across 95 markets, expanding its wellness offerings in nutrient supplementation, weight management, and digestion. The latest products include the Active Mind Complex with Neumentix, a youth shake for children, new flavors of popular items like High protein iced coffee, and regional variations of its Formula 1 meal replacement shake. This move aims to meet the rising demand for personalized nutrition solutions and support healthier lifestyles.

-

In September 2024, Bayer launched a new healthy aging ecosystem to help consumers manage aging more effectively. The ecosystem features the One A Day Age Factor Cell Defense supplement, designed to support cellular health, a wellness app, and a biological age test. From its Precision Health unit, this initiative combines digital tools and nutritional support to provide personalized health solutions, empowering consumers to make informed health decisions.

Latin America Nutritional Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 55.43 billion |

|

Revenue forecast in 2030 |

USD 82.17 billion |

|

Growth rate |

CAGR of 8.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product,formulation, sales channel, consumer group, application, country |

|

Country scope |

Brazil, Argentina |

|

Key companies profiled |

Herbalife International of America, Inc; Amway Corp; Bayer AG; Sanofi; Abbott; Nestlé; Pfizer Inc.; GNC Holdings, LLC; Higher Ground Supplements; Shaklee Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, country & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Latin America Nutritional Supplements Market Report Segmentation

This report forecasts Latin America and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Latin America nutritional supplements market report based on product, formulation, sales channel, consumer group, application and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamin

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Food

-

Protein Bars

-

Energy Bars

-

Protein Gels

-

-

Meal Replacement Products

-

Weight Loss Products

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods & Beverages

-

Probiotics

-

Omega-3

-

Others

-

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hyper Markets

-

Super Markets

-

-

E-commerce

-

-

Consumer Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infants

-

Children

-

Adults

-

Age group 21 To 30

-

Age group 31 To 40

-

Age group 41 to 50

-

Age group 51 to 65

-

-

Pregnant

-

Geriatric

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/Hair/Nails

-

Sexual Health

-

Women’s Health

-

Anti-aging

-

Weight Management

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brazil

-

Argentina

-

Frequently Asked Questions About This Report

b. The powder segment dominated the Latin American nutritional supplements market with a share of 36.92% in 2024. This is attributable to its advantages over other formulations, its availability in higher concentrations and higher absorption rate as compared to pills and other forms.

b. Some key players operating in the Latin American nutritional supplements market include Herbalife International of America, Inc.; Amway International; Bayer AG; Sanofi; Abbott Nutrition; Nestle Nutrition; Pfizer, Inc.; GNC Holdings, Inc.; Ground & Pound Supplements

b. Key factors that are driving the Latin American nutritional supplements market growth include the increasing prevalence of chronic diseases, the geriatric population, and a trend of active living.

b. The Latin American nutritional supplements market size was estimated at USD 51.32 billion in 2024 and is expected to reach USD 55.43 billion in 2025.

b. The Latin American nutritional supplements market is expected to grow at a compound annual growth rate of 8.19% from 2025 to 2030 to reach USD 82.17 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."