Latin America Molecular Methods Market For Food Safety Testing Size, Share & Trends Analysis Report By Product (Instrument), By Technology (PCR, Immunoassay, Biosensors), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-244-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

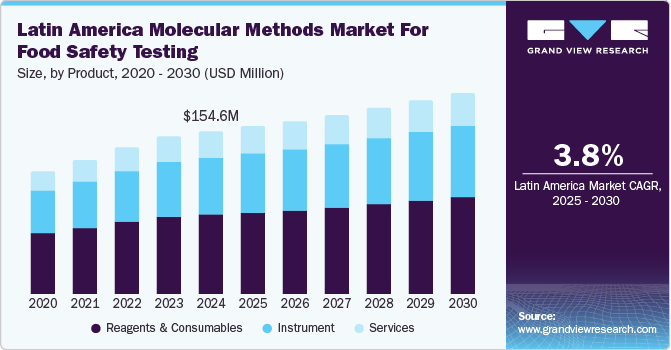

The Latin America molecular methods market for food safety testing size was valued at USD 154.6 million in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. The molecular methods market for food safety testing in Latin America is driven by the region’s strong export sector, which requires high safety standards for markets such as the U.S. and Europe. Rising consumer awareness of food safety and recent contamination events have increased demand for rapid and accurate testing methods.

The region's stringent food labeling regulations, which mandate transparent nutritional information and quality compliance for consumer health, boost demand for reliable testing methods. Technological advances such as PCR and next-generation sequencing make these methods more accessible. At the same time, high rates of foodborne diseases highlight the need for effective pathogen detection to protect public health. According to the Organization for Economic Cooperation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO), the Caribbean and Latin America were expected to account for 25% of global agricultural and fisheries exports by 2028.

Technological advances such as polymerase chain reaction (PCR) and next-generation sequencing drive the market by making food safety testing faster, more accurate, and affordable. These innovations allow labs to detect contaminants more efficiently, meeting stringent export standards and addressing regional foodborne illness concerns. As costs decrease, adoption across food safety facilities rises, enhancing overall food quality and consumer confidence.

According to the SGS Société Générale de Surveillance SA., digital PCR (dPCR) enhances precision and sensitivity in quantifying target DNA by dividing the reaction into thousands of partitions, allowing for absolute quantification using a Poisson distribution. This method reduces bias, is inhibitor-tolerant, and offers cost benefits over real-time PCR due to high multiplexing and no need for calibration curves.

The food labeling regulations boost the demand for accurate and reliable testing methods to ensure compliance with safety standards, supporting transparency and accountability in food production. For instance, Brazil's food labeling regulations, including RDC #727/2022, RDC #429/2020, and RDC #332/2019, aim to enhance transparency and consumer health by mandating clear nutritional information on packaged foods. RDC #727/2022 consolidates previous regulations for consistent labeling practices, while RDC #429/2020 requires front-of-pack warnings for foods high in critical nutrients such as sugars and fats, with phased implementation through 2025. RDC #332/2019 mandates nutritional labeling on foods sold in bulk or served in restaurants, promoting informed choices.

Product Insights

The reagents and consumables segment dominated the market and accounted for a share of 49.4% in 2024. The need for advanced diagnostic solutions to detect and prevent foodborne diseases, including those transmitted by vectors, drives demand for molecular testing tools in the region. According to the World Health Organization (WHO), chagas disease, caused by the Trypanosoma cruzi parasite, affects around 6-7 million people, primarily in Latin America. It can be transmitted through various routes, including vector-borne, oral, congenital, and blood or organ transplants. Early antiparasitic treatment in the acute phase can cure the disease, while in chronic cases, treatment helps prevent progression and complications, such as cardiac, digestive, or neurological issues.

The instrument segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. The increasing demand for rapid, accurate, and reliable testing solutions is driven by the need to ensure food safety and meet strict regulatory standards. Companies are investing in advanced testing technologies to detect contaminants and pathogens efficiently. This shift boosts the growth of food safety testing markets as consumers and regulatory bodies demand higher quality and faster results. For instance, Neogen Corporation provides services across several sectors, including food safety testing through molecular methods in Latin America. Their offerings are vital for ensuring the quality and safety of food products by identifying pathogens, allergens, and contaminants using molecular techniques that provide rapid and accurate testing solutions, which are crucial for food producers and regulatory bodies to maintain safety standards.

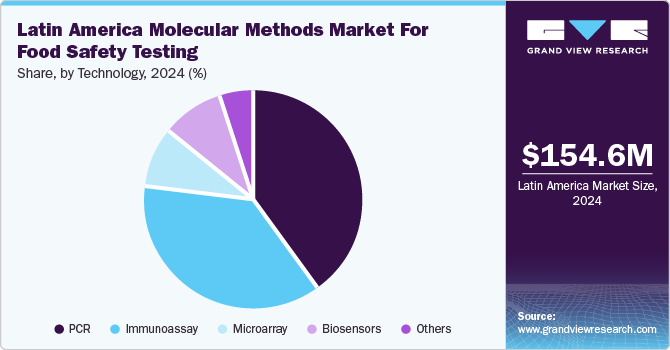

Technology Insights

The PCR segment accounted for the largest market revenue share in 2024. Initiatives to enhance food safety and regional cooperation drive the adoption of PCR technology for efficient and accurate food safety testing across the region. The IAEA supports the Data Sharing Committee (DSC) in the Caribbean and Latin America, which aims to enhance food safety and facilitate international food trade. Launched in June 2023, it allows official food safety labs in 17 countries to share analytical data. The initiative seeks to establish a regional food safety preparedness system for long-term public health benefits.

The biosensors segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing demand for accurate, rapid, and cost-effective detection of foodborne pathogens and contaminants, driven by growing health concerns and stricter food safety regulations. Biosensors offer real-time, on-site testing, which enhances the efficiency and reliability of food safety monitoring. In addition, the rise in consumer awareness regarding food safety and the need for traceability in the food supply chain further pushed the adoption of biosensor technologies.

Regional Insights

Brazil Molecular Methods Market For Food Safety Testing Trends

The Brazil molecular methods market for food safety testing dominated the Latin America market with a share of 38.0% in 2024 due to the growing need for efficient and cost-effective regulatory frameworks to ensure biosafety in the agriculture sector, driven by the adoption of innovative genome-editing technologies. In Brazil, the regulation of genome editing techniques such as CRISPR has evolved through the Biosafety Law (Law No. 11,105/2005) and the creation of the National Biosafety Council (CNBS) and the National Technical Biosafety Commission (CTNBio). In 2015, CTNBio analyzed New Breeding Technologies (NBTs) and proposed that some gene-edited products, similar to those obtained through traditional mutagenesis, may not be classified as GMOs. The updated regulation, outlined in CTNBio Normative Resolution No. 16, aims to streamline safety standards while fostering technological innovation in agriculture.

Argentina Molecular Methods Market For Food Safety Testing Trends

Argentina molecular methods market for food safety testing is expected to grow at the fastest CAGR over the forecast period. Stringent food safety regulations and import control measures, including traceability requirements and inspection protocols for animal origin and fishery products, drive the demand for advanced molecular methods in food safety testing. For instance, in Argentina, food safety testing, particularly molecular techniques such as DNA-based pathogen detection, is regulated through various laws, including Resolution No. 816/2002 for animal-origin products, Decree No. 1812/1992 for traceability and inspection, and Resolution No. 3823 for monitoring imports. The Sistema Integral de Monitoreo de Importaciones (SIMI) requires detailed licenses for fishery and aquaculture products, ensuring compliance and protecting public health by verifying the safety of imported goods.

Key Latin America Molecular Methods Market For Food Safety Testing Company Insights

Some of the key companies in the Latin America molecular methods market for food safety testing include QIAGEN, Eurofins Scientific, 3M, and others. Organizations focus on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

QIAGEN provides molecular testing solutions, specializing in technologies for isolating and processing DNA, RNA, and proteins from various samples. Its offerings include assay technologies for pathogen detection, bioinformatics for genomic data analysis, and automated workflows for efficient testing. The company's global presence serves diverse markets such as healthcare, forensics, veterinary diagnostics, food safety, and life sciences research.

-

3M manufactures and distributes various industrial products and solutions, including advanced materials, safety equipment, home care items, and medical solutions. The company serves diverse automotive, electronics, healthcare, and energy industries. 3M operates facilities across the America, Asia Pacific, Europe, the Middle East, and Africa.

Key Latin America Molecular Methods Market For Food Safety Testing Companies:

- QIAGEN

- Eurofins Scientific

- 3M

- Bio-Rad Laboratories, Inc.

- Société Générale de Surveillance SA. (SGS)

- BIOMÉRIEUX

- NEOGEN Corporation

- Hygiena LLC

- Seegene Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

-

In September 2024, QIAGEN expanded its QIAcuity digital PCR platform by adding over 100 new assays, enhancing its utility for gene expression, copy number variation, and rare mutation detection. These assays, available via the GeneGlobe platform, support QIAGEN's goal to improve precision diagnostics and molecular analysis. This expansion strengthens the platform's applicability for clinical and research sectors.

-

In January 2022, Eurofins announced a rapid pathogen risk testing service using the Enteric Pathogen Risk Indicator (EPRI). This tool utilizes advanced genetic testing (PCR) to identify potential risks from pathogens such as Shiga toxigenic E. coli (STEC) and Salmonella. EPRI offers a faster, more efficient screening process than traditional methods by combining the benefits of rapid genetic tests with the advantages of indicator testing, thus improving food safety management.

Latin America Molecular Methods Market For Food Safety Testing Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 159.3 million |

|

Revenue forecast in 2030 |

USD 191.8 million |

|

Growth Rate |

CAGR of 3.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, region |

|

Regional scope |

Latin America |

|

Country scope |

Brazil, Argentina, Chile, Colombia, Peru, Ecuador, Dominican Republic, Guatemala, Cuba, Panama, Venezuela, Costa Rica, and Uruguay |

|

Key companies profiled |

QIAGEN; Eurofins Scientific; 3M; Bio-Rad Laboratories, Inc.; Société Générale de Surveillance SA. (SGS); BIOMÉRIEUX; NEOGEN Corporation; Hygiena LLC; Seegene Inc.; Thermo Fisher Scientific Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Latin America Molecular Methods Market For Food Safety Testing Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America molecular methods market for food safety testing report based on product, technology, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Reagents & Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

Immunoassay

-

Biosensors

-

Microarray

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Peru

-

Ecuador

-

Dominican Republic

-

Guatemala

-

Cuba

-

Panama

-

Venezuela

-

Costa Rica

-

Uruguay

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."