Latin America Low Voltage Cables Market Size, Share & Trends Analysis Report By Type (Overhead, Underground), By End-use (Residential, Industrial, Commercial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-532-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The Latin America low voltage cables market size was valued at USD 10.03 billion in 2023 and is projected to grow at a CAGR of 4.0% from 2024 to 2030. The growth is driven by surging energy demand due to population growth and urbanization. Furthermore, industrial expansion, renewable energy integration, and infrastructure development requires extensive power distribution networks relying on these cables.

Urbanization and population growth have spurred the construction of new residential and commercial buildings. These constructions require a reliable electricity supply, boosting the demand for low voltage cables. In addition, renovation projects in older buildings necessitate the replacement of outdated electrical networks, further driving the demand for low voltage cables.

The growth of manufacturing and industrial sectors is driving the need for efficient power distribution within factories and plants, boosting the demand for low voltage cables. The increasing adoption of renewable energy sources such as solar and wind power requires efficient power distribution from generation sites to end-users, creating opportunities for low voltage cable installations.

The region’s growing population and economic development are leading to a surge in electricity consumption, necessitating extensive power distribution networks. Low voltage cables are crucial components of these networks. The advancement of electronic technologies in various sectors has contributed to the increased demand for low voltage cables. Technologies such as internet services, computer systems, security cameras, and IoT devices all rely on efficient power supply systems that utilize low voltage cables.

Type Insights

The overhead segment accounted for the largest market revenue share of 63.8% in 2023 due to the rapid urbanization and industrialization in developing countries. Overhead low voltage cables are preferred for long-distance power transmission due to their cost-effectiveness and ease of installation compared to underground cables. Furthermore, the increasing focus on electrification of rural areas and the need for reliable power supply in agricultural sectors are further driving the demand for overhead low voltage cables.

The underground segment is expected to register the fastest CAGR of 4.2% during the forecast period. The growing preference for aesthetic and environmentally friendly power distribution solutions is propelling the adoption of underground cables. Moreover, advancements in cable design and insulation technologies have made underground low voltage cables more durable, efficient, and environmentally friendly, driving their adoption in smart city projects and modern infrastructure developments.

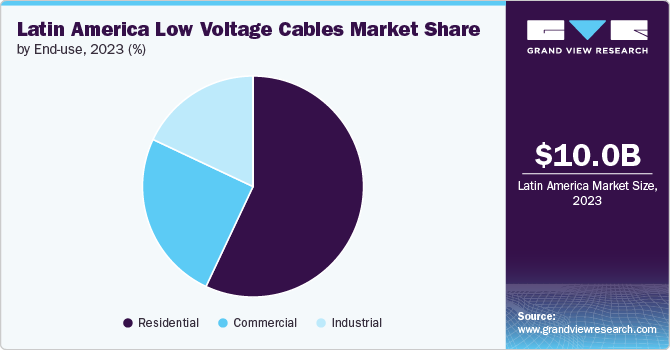

End-use Insights

The residential segment accounted for the largest market revenue share of 56.5% in 2023. The increasing urbanization and rising disposable incomes are leading to a surge in residential construction and renovation activities. Furthermore, the growing trend of smart homes and the integration of various electronic devices necessitate robust and efficient electrical infrastructure, boosting the demand for low voltage cables.

The industrial segment is expected to grow at a CAGR of 5.1% during the forecast period. The automation of industrial processes, coupled with the increasing adoption of electric machinery and equipment, requires a substantial amount of low voltage cables. Moreover, the rising focus on energy efficiency and the need for reliable power supply within industrial facilities are further driving the demand for these cables.

Country Insights

Latin America low voltage cables market is anticipated to witness significant growth. The region is witnessing significant investments in infrastructure development, including power grid upgrades and expansions, which drive demand for low voltage cables.

Brazil Low Voltage Cables Market Trends

The Brazil low voltage cables market dominated the Latin America market with a share of 56.4% in 2023. Increasing emphasis on urbanization in Brazil owing to increased purchasing power is the major factor driving demand over the forecast period. Growing safety regulations related to the electrical distribution and utility products in the Latin American region is expected to support the industry.

Key Latin America Low Voltage Cables Company Insights

Some key companies in Latin America low voltage cables market include ABB, Encore Wire Corporation, Finolex Cables, Prysmian S.p.A, Southwire Company, LLC, Sumitomo Electric Industries, Ltd.and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry.

-

Encore Wire Corporation is a manufacturer of copper and aluminum residential, commercial, and industrial building wire and cables. It offers a comprehensive range of wires and cables for various applications, including residential, commercial, and industrial projects.

Key Latin America Low Voltage Cables Companies:

- ABB

- Encore Wire Corporation

- Finolex Cables

- General Cable

- Hangzhou Cable

- Leoni AG

- Nexans

- Prysmian S.p.A

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

Recent Developments

-

In April 2024, Encore Wire announced that it has entered into a definitive merger agreement with Prysmian. Through this, Prysmian will enhance its portfolio and geographic mix.

Latin America Low Voltage Cables Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.47 billion |

|

Revenue forecast in 2030 |

USD 13.25 billion |

|

Growth Rate |

CAGR of 4.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, country |

|

Regional scope |

Latin America |

|

Country scope |

Brazil |

|

Key companies profiled |

ABB; Encore Wire Corporation; Finolex Cables; General Cable; Hangzhou Cable; Leoni AG; Nexans; Prysmian S.p.A; Southwire Company, LLC; Sumitomo Electric Industries, Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Latin America Low Voltage Cables Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America low voltage cables market report based on type, end-use and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Overhead

-

Underground

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Rest of LA

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."