Latin America Flow Cytometry Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Consumables), By Technology, By Application (Research), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-619-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Latin America Flow Cytometry Market Trends

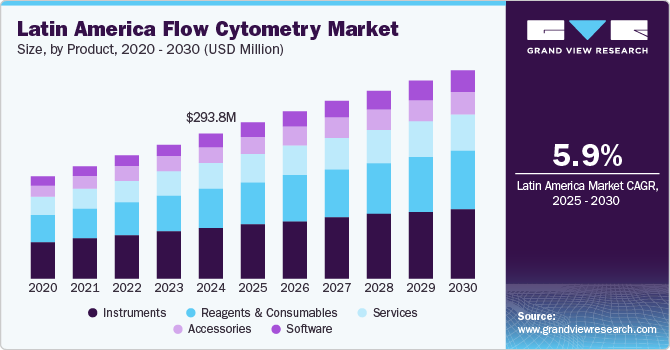

The Latin America flow cytometry market size was valued at USD 293.8 million in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The rising R&D initiatives in clinical, biotechnology, and life sciences research, increasing technological advancements in reagents and instruments, increasing demand for point-of-care diagnostics, and an increasing prevalence of infectious and chronic diseases drive market growth.

According to the National Cancer Institute, there were approximately 20 million new cancer cases and 9.7 million cancer-related deaths worldwide in 2022. In addition, this number is expected to rise to 29.9 million and 15.3 million, respectively. This increasing prevalence of chronic diseases, such as cancer, is expected to boost research in life sciences to develop advanced diagnostic and treatment solutions and drive market growth.

In addition, increasing investments and financing have further resulted in strong research and development in biotechnology, clinical, biopharmaceutical, and life sciences research. These investments are likely to strengthen R&D for cell analysis in drug discovery and development operations using flow cytometry techniques. Moreover, technological advances in instrumentation have improved the accuracy, efficiency, and cost-effectiveness of these systems, which is likely to open growth potential for the sector.

According to the Pan American Health Organization (PAHO), from 2010 to 2023, the number of new HIV infections in Latin America was estimated to have increased by 9%, with about 120,000 new cases in 2023. The rising awareness regarding such diseases and early diagnosis have resulted in increased need for point-of-care diagnostics for HIV and other sexually transmitted diseases, further driving market demand.

The rising awareness among healthcare professionals about the precision and sensitivity associated with flow cytometry is also aiding market expansion. Supportive government initiatives and the availability of improved instruments capable of multiplexing applications are two of the key factors driving the rapid rise of this technique in point-of-care healthcare facilities. Furthermore, clinics and other healthcare institutions are focusing on offering effective and speedy diagnostic results using point-of-care tests, which is projected to further fuel market expansion.

Product Insights

The instrument segment accounted for the largest market share of 34.9% in 2024. The large market share of the segment can be attributed to the increasing adoption of flow cytometers and increasing emphasis on technological advancements. The increased focus on technological advancements can help provide products with improved accuracy, cost-effectiveness, and portability, driving further growth in the market. For instance, in May 2024, BD announced the worldwide release of BD FACSDiscover S8 Cell Sorters. The product is expected to support research in areas such as cancer research, cell biology, and immunology. The increasing focus on developing advanced diagnostics tools to improve the level of accuracy in diagnostics is further expected to boost market growth.

The software segment is expected to grow at the fastest CAGR over the forecast period. Flow cytometry software helps control and capture data provided by cytometers, analyze the information, and provide statistical insights into the results. This software is utilized in both research applications for cell capture and data processing, and in clinical diagnostics for disease detection through the analysis of patient samples. The rising prevalence of various diseases, along with the ongoing focus of leading companies on developing innovative software solutions, is further expected to drive the market growth. For instance, in February 2023, Agilent Technologies Inc. introduced the NovoExpress software, which integrates compliance tools specifically designed for NovoCyte flow cytometer systems.

Technology Insights

The cell-based segment accounted for the largest market share in 2024. The large market share can be attributed to the growing awareness of the benefits of cell-based assays and the increasing demand for early disease diagnosis. In addition, advancements in cell-based assay technologies, including innovations in software, equipment, algorithms, and reagents, are expected to further enhance their adoption in the future. These technological developments help improve the precision of diagnostic tools and contribute to the broader application of cell-based assays in various research and clinical settings, further driving market growth.

The bead-based segment is expected to grow at the fastest CAGR over the forecast period. Bead-based assays are used to evaluate intracellular soluble proteins, including growth factors, chemokines, cytokines, and phosphorylated cell signaling proteins. This method, when combined with high-throughput flow cytometry, can help conduct multiplex experiments. The ability to perform multiplex analysis offers significant potential for advancing diagnostics in various areas, including infectious disease research, diagnosis, and treatment. The increasing demand for bead-based products is also fueled by advancements in molecular engineering, monoclonal antibody production, and the benefits of these technologies, such as cost-effectiveness, fast turnaround times, and the ability to handle micro-sampling. These factors are expected to drive further adoption and growth of bead-based assays in the future.

Application Insights

The clinical segment accounted for the largest market share in 2024, driven by increased research and development in cancer and infectious diseases. For instance, in May 2024, the National Cancer Institute of Brazil (INCA) collaborated with the International Agency for Research on Cancer (IARC) to set up an IARC-Brazil Learning Centre. This center focuses on enhancing the skills of researchers and healthcare practitioners and further assists in advancing clinical research. Flow cytometry can also help diagnose, guide therapy regimens, and monitor disease recurrence or relapse.

The industrial segment is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing applications of flow cytometry in cell culture processes. This technique is widely used in the pharmaceutical industry to target discovery, drug property analysis, compound screening, and non-clinical safety evaluations and clinical research. Flow cytometry offers several advantages, such as high throughput and speed, which are critical for large-scale drug development and testing. It enables the detection of multiple factors on cell surfaces, generating detailed data while minimizing false positive results, which can be common in single-parameter tests. These capabilities are especially valuable in bioprocessing for drug discovery, where the demand for efficient and scalable testing solutions continues to rise. The increasing reliance on flow cytometry for bioprocessing and drug development is expected to drive substantial market growth.

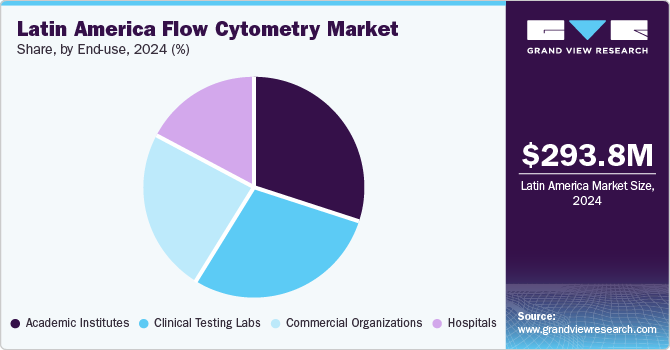

End-use Insights

Academic institutes accounted for the largest market share in 2024. Flow cytometry is used to detect cell parameters such as physical features of cells, cell type, lineage, and maturation stage in biology and molecular diagnostics research. Flow cytometry has applications across a wide range of educational and research fields, from molecular biology and immunology to plant and marine biology. The expanding demand for advanced cellular analysis methods, fueled by increased R&D initiatives, is expected to drive growth of this segment over the forecast period.

Clinical testing labs are estimated to grow at the fastest CAGR over the forecast period. There is a rising need for and emphasis on early diagnosis of various diseases, such as cancer, infectious diseases, and immunological disorders. Flow cytometry is a widely adopted tool for diagnosing various diseases, and an increasing prevalence of these diseases in the region is propelling the demand for advanced diagnostic tools to facilitate accurate and cost-effective diagnosis, further driving the segment growth in the market.

Regional Insights

Brazil Flow Cytometry Market Trends

The Brazil flow cytometry market accounted for the largest market share in 2024. The increasing prevalence of chronic diseases such as cancer and autoimmune disorders is driving market growth. For instance, according to a study published in the National Library of Medicine in August 2023, the Brazilian National Cancer Institute (INCA) estimated approximately 704,000 new cases of cancer annually from 2023 to 2025. In addition, the growing proportion of Brazil's aging population adds to the demand for diagnostics and monitoring technologies, such as flow cytometry, as this age group is more susceptible to diseases.

Dominican Republic Flow Cytometry Market Trends

The Dominican Republic flow cytometry market is expected to grow significantly over the forecast period from 2025 to 2030. The increasing investment in the healthcare sector for public and private players are likely to help develop and introduce advanced diagnostic tools and drive market growth. For instance, in December 2023, the World Bank announced the approval of a project worth USD 190 million, which is aimed at strengthening the capacity of the healthcare sector in the country to deliver quality health services to poor and vulnerable populations.

Key Latin America Flow Cytometry Company Insights

Some key companies operating in the Latin America flow cytometry market include Cytiva, Sartorius AG, BD, Agilent Technologies, Inc., Sysmex Corporation, and others. These players are focusing on various strategies, such as developing and launching advanced products, mergers and acquisitions, and research to gain a competitive edge in the market.

-

BD is a global medical technology company operating across several segments, such as medication management, infection prevention, and diagnostics. The company offers a wide range of flow cytometry instruments, reagents, and software solutions that cater to research and clinical applications such as BD FACSDuet Sample Preparation System.

-

Cytiva operates in the life sciences sector and offers products and services for cell and gene therapy, protein research, and bioprocessing. The company also provides innovative flow cytometry solutions for research and clinical diagnostics, such as Flow Cells.

Key Latin America Flow Cytometry Companies:

- Cytiva

- Sartorius AG

- BD

- Agilent Technologies, Inc.

- Sysmex Corporation

- Apogee Flow Systems Ltd.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Cytek

- Miltenyi Biotec.

View a comprehensive list of companies in the Latin America Flow Cytometry Market

Recent Developments

-

In June 2023, BD announced the introduction of a new robotic system, BD FACSDuet, which is expected to help automate clinical flow cytometry.

-

In February 2023, Cytek Biosciences announced the acquisition of an imaging and flow cytometry segment from DiaSorin S.p.A.

Latin America Flow Cytometry Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 316.3 million |

|

Revenue forecast in 2030 |

USD 420.5 million |

|

Growth rate |

CAGR of 5.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end-use, region |

|

Regional scope |

Latin America |

|

Country scope |

Brazil, Argentina, Colombia, Peru, Chile, Uruguay, Dominican Republic, Costa Rica, Panama |

|

Key companies profiled |

Cytiva; Sartorius AG; BD; Agilent Technologies, Inc.; Sysmex Corporation; Apogee Flow Systems Ltd.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories; Inc.; Cytek; Miltenyi Biotec |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Latin America Flow Cytometry Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America Flow Cytometry Market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Cell Analyzers

-

Cell Sorters

-

-

Reagents & Consumables

-

Software

-

Accessories

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-based

-

Bead-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Pharmaceutical

-

Drug Discovery

-

Stem Cell

-

In Vitro Toxicity

-

Apoptosis

-

Cell Sorting

-

Cell Cycle Analysis

-

Immunology

-

Cell Viability

-

-

-

Industrial

-

Clinical

-

Cancer

-

Organ Transplantation

-

Immunodeficiency

-

Hematology

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Organizations

-

Biotechnology Companies

-

Pharmaceutical Companies

-

CROs

-

-

Hospitals

-

Academic Institutes

-

Clinical Testing Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Argentina

-

Peru

-

Chile

-

Uruguay

-

Dominican Republic

-

Costa Rica

-

Panama

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."