- Home

- »

- IT Services & Applications

- »

-

Latin America ERP Software Market Size Report, 2030GVR Report cover

![Latin America ERP Software Market Size, Share & Trends Report]()

Latin America ERP Software Market Size, Share & Trends Analysis Report By Deployment, By Function (Finance, HR, Supply Chain, Others), By Vertical, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-494-9

- Number of Report Pages: 76

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

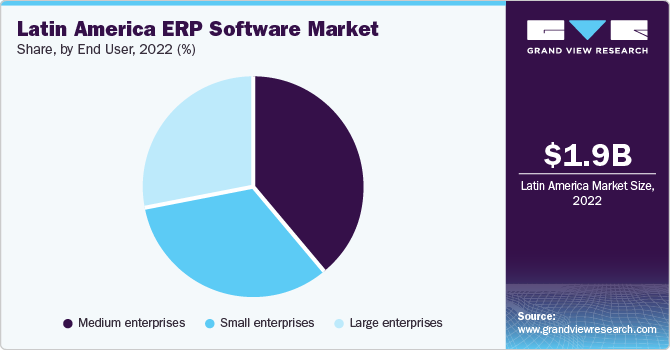

The Latin America ERP software market size was valued at USD 1.89 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. The market is driven by the emergence of many small and medium-sized enterprises (SMEs) in numerous sectors, including manufacturing, retail, telecom, and IT services. Some of the major factors driving the growth of this market are the growth of enterprise software and the workplace automation industry in the Latin America marketplace-high penetration of manufacturing companies in Chile, Peru, and Mexico. Specifically, the mining industry in Chile and Peru is anticipated to yield higher revenues in the ERP software segment than in other verticals.

Government organizations, one of the region's largest employers, are expected to boost ERP software economies further to optimize workflow and align revenue. Increasing demand for software that can enhance transparency and operational efficiency by streamlining various processes is expected to augment demand over the forecast period.

The ERP software vendors are updating their pricing models to protect their core offerings and remain competitive. The vendors focus on better integration architecture owing to the increasing adoption of specialized ERP software.

End User Insights

Based on end users, the Latin America ERP software market has been segmented into large, medium, and small enterprises. The medium enterprises segment accounted for the largest revenue share of 38.9% in 2022. ERP systems are designed to accommodate businesses of various sizes, including medium-sized enterprises. These systems offer scalability, allowing MEs to start with a basic ERP system and expand its functionalities as their business grows. The flexibility and adaptability of ERP solutions make them a suitable choice for MEs seeking to manage their operations more effectively.

The small enterprises segment is anticipated to witness the fastest CAGR of 16.4% over the forecast period. ERP systems are designed to accommodate the growth and changing needs of businesses. With their aspirations for expansion, small enterprises find ERP systems valuable as they can scale up operations and handle increasing volumes of transactions without major disruptions.

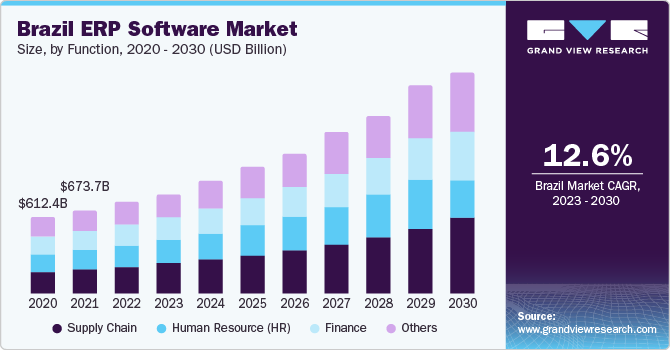

Function Insights

The supply chain function segment is anticipated to capture the highest market share of 25.7% in 2022. ERP modules in supply chain management allow manufacturing and distribution businesses to provide greater visibility into various supply chain operations while increasing speed, efficiency, and overall customer satisfaction.

The finance segment is anticipated to witness a significant CAGR of 13.3% over the forecast period. ERP finance modules help to automate payments, manage assets, and create financial reports. Furthermore, it facilitates gathering financial data and generating reports such as ledgers, trail balance data, overall balance sheets, and quarterly financial statements.

HR ERP function helps to automate, streamline, and extend the core human resource processes and activities such as workforce management, time and attendance, recruiting, and payroll maintenance, among others. Moreover, other ERP helps in effectively managing and automating sales and distribution and numerous other associated tasks.

Deployment Insights

The on-premise segment accounted for the largest revenue share of 79.0% in 2022. On-premise deployment of services gives control over systems or infrastructure and sensitive business data. The on-premise deployment model has a pre-built extract, transform, and load (ETL) framework that reduces implementation time.

The cloud segment is anticipated to witness the fastest CAGR of 18.8% over the forecast period. Lower upfront investments, faster implementation times, and less intensive business running methods have made cloud-based deployment models highly popular. Cloud-based deployment of ERP software enables scalability, immediacy, efficiency, accessibility, and optimization of resource planning activities.

ERP hybrid technology includes features of both on-premise and cloud technology, thus providing cost-effectiveness, data security, and agility in business processes. It overcomes issues such as high cost and security faced in on-premise and cloud deployment, respectively.

Vertical Insights

The manufacturing & services segment accounted for the largest revenue share of 26.1% in 2022 and is expected to retain its dominance over the forecast period. Manufacturing companies and service providers adopt ERP systems to streamline operations, address customization requirements, and manage complicated supply chains to build profitable, sustainable businesses.

The healthcare segment is anticipated to witness the fastest CAGR of 18.1% over the forecast period. ERP systems can provide real-time data to a healthcare organization or hospital and help departments make critical patient care or materials management decisions. ERP in retail carries out effective decision-making policies concerning sales planning, supply and merchandising activity, and customer service, reducing operational and marketing costs and optimizing business profitability and workflow.

Government ERP or GRP aids in operating with fiscal accountability, delivering service reliability, maintaining assets and infrastructure, and optimizing the public-sector workforce. ERP software helps in component maintenance, repair, and overhaul (MRO) for civil aviation, military, and service providers, as well as line maintenance or at-platform/asset support.

Telecom: ERP in telecom offers advantages such as real-time integration across the company, deep performance and financial visibility, careful management of regulatory compliance risk, and the deployment of new operational and technological models. The other segment includes using ERP in education, entertainment, and media verticals.

Regional Insights

The Latin American regional ERP software market includes Brazil, Chile, Peru, and Mexico. Brazil accounted for the largest revenue share of 39.2% in 2022 and is expected to retain its dominance over the forecast period. Enterprise software and the workplace automation industry is gaining momentum in the region. Manufacturing, finance, and tourism segments are expected to lead the ERP software market in terms of adoption in Chile.

Recent administrative endeavors of revenue source diversification have boosted the financial sector of the Chile region. The advent of cloud ERP technology and flexible pricing of connected devices may result in a bigger market turnaround.

Peru is anticipated to witness the fastest CAGR of 15.2% over the forecast period. The development of the manufacturing sector across Peru and increasing investment in corporate management solutions pave the way for adopting more sophisticated IT services, such as enterprise resource planning software and customer relationship management (CRM) services.

Key Companies & Market Share Insights

The market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. In January 2023, Unit4, a provider of enterprise cloud applications for people-centric organizations, introduced the Unit4 Marketplace. This newly launched platform is a hub for Unit4's ISV (Independent Software Vendor), Reseller, and Service partners to showcase their industry-specific and vertical applications that integrate with Unit4's ERP solutions. This initiative aims to provide customers with a comprehensive ecosystem of trusted partner applications that enhance their overall experience and address their unique business requirements.

Key Latin America ERP Software Companies:

- Microsoft

- IBM Corporation

- SAP

- Infor

- Oracle

- NetSuite, Inc.

- Unit4

- SYSPRO

- TOTVS

- Sage Group plc

Recent Developments

-

In March 2023, the central bank of Brazil has recently announced the commencement of a pilot project for a digital currency, aiming to emulate the achievements of its instant payment system, Pix, and foster the widespread usage of financial services across the nation.

-

In March 2023, a leading enterprise software company, SAP, introduced a new cloud-based Enterprise Resource Planning (ERP) offering for midsize companies. The cloud ERP solution aims to provide midsize businesses with a comprehensive and scalable software platform to manage their core business operations effectively.

-

In April 2023, SAP, a software and business intelligence solutions provider, introduced its GROW with SAP program in India. GROW with SAP in India encompasses various offerings, including SAP S/4HANA Cloud, mentorship programs, accelerated adoption services, and access to free learning resources. These comprehensive offerings are designed to enable customers to implement ERP solutions swiftly and efficiently, to go live in a matter of weeks.

-

In July 2022, Infor announced that Brandili, a textile organization based in Brazil, had chosen Infor CloudSuite Industrial Enterprise to modernize its business operations. This selection allowed for seamless integration with other systems and provided Brandili with a comprehensive and integrated solution.

-

In March 2022, Visma, a provider of business software, acquired Calipso, an Argentinian ERP cloud software company. This acquisition aimed to enhance Visma's offerings in Latin America and strengthen its presence in the region.

-

In June 2021, Aptean, a global provider of essential enterprise software solutions, introduced its widely successful Food and Beverage ERP Partner Program in the U.S. Furthermore, Aptean has outlined its plans to expand the program into Canada, Brazil, and Mexico. The Food and Beverage Partner Program assists its clients in leveraging Aptean's enterprise software to enhance operational efficiency, resulting in stronger and more streamlined businesses.

Latin America ERP Software Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.15 billion

Growth rate

CAGR of 13.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, deployment, end user, vertical, region

Country scope

Brazil; Mexico; Chile; Peru; Others

Key companies profiled

Microsoft; IBM Corporation; SAP; Infor; Sage Group plc; Oracle; Unit4; SYSPRO; TOTVS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America ERP Software Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Latin America ERP software market based on function, deployment, end user, vertical, and region:

-

Function Outlook (Revenue in USD Million, 2017 - 2030)

-

Finance

-

Human resource (HR)

-

Supply chain

-

Others

-

-

Deployment Outlook (Revenue in USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

End User Outlook (Revenue in USD Million, 2017 - 2030)

-

Large enterprises

-

Medium enterprises

-

Small enterprises

-

-

Vertical Outlook (Revenue in USD Million, 2017 - 2030)

-

Manufacturing & services

-

BFSI

-

Healthcare

-

Retail

-

Government Utilities

-

Aerospace & Defense

-

Telecom

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Peru

-

Others

-

-

Frequently Asked Questions About This Report

b. The Latin America ERP software market size was estimated at USD 1.89 billion in 2022 and is expected to reach USD 2.11 billion in 2023.

b. The Latin America ERP software market is expected to grow at a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 5.15 billion by 2030.

b. Brazil dominated the Latin America ERP software market with a share of 39.1% in 2022. This is attributable to gaining momentum in the enterprise software and workplace automation industry.

b. Some key players operating in the Latin America ERP software market include Microsoft; IBM Corporation; SAP; Infor; Oracle; NetSuite, Inc.; Unit4; SYSPRO; TOTVS; Sage Group plc

b. Key factors that are driving the market growth include the need for efficiency and transparency in organizations and rising demand from small & medium enterprises. The ERP software vendors are updating their pricing models to protect their core offerings and remain competitive.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."