- Home

- »

- Medical Devices

- »

-

Latin America Compression Therapy Market, Report, 2030GVR Report cover

![Latin America Compression Therapy Market Size, Share & Trends Report]()

Latin America Compression Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Static Compression, Dynamic Compression), By End-use, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-3-68038-581-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

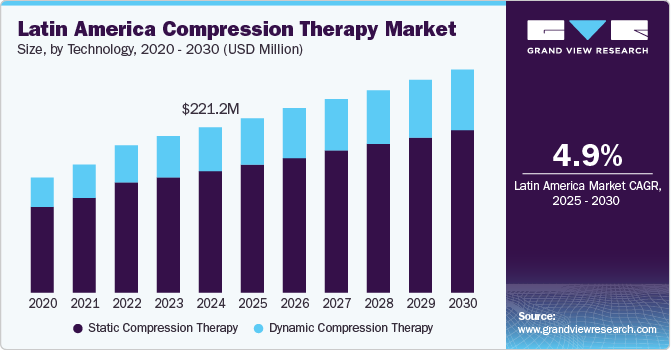

The Latin America compression therapy market size was valued at USD 221.2 million in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030. The increasing prevalence of chronic conditions such as venous disorders, lymphedema, and deep vein thrombosis drives this growth. In addition, the aging population in the region is contributing to the rise in these conditions, further fueling market growth. Advancements in compression therapy technology, including more comfortable and effective products, also play a significant role. Moreover, growing awareness about the benefits of compression therapy among healthcare professionals and patients is leading to higher adoption rates.

Innovations in compression therapy products are expected to drive significant market growth in the coming years. Key advancements include integrating smart technologies, such as wearable sensors and mobile apps, which facilitate real-time patient adherence and physiological metrics monitoring, enhancing treatment effectiveness. In addition, developing customizable compression garments through 3D scanning allows for tailored solutions that improve comfort and efficacy. Furthermore, dynamic compression therapy devices, which mimic natural muscle pumping, are gaining popularity for their effectiveness in promoting lymphatic drainage.

Technology Insights

The static compression therapy segment accounted for 73.9% of the total revenue generated in 2024, attributed to the widespread use of static compression products such as compression bandages, stockings, and garments commonly prescribed for conditions such as lymphedema, deep vein thrombosis, and chronic venous insufficiency. The effectiveness, ease of use, and relatively lower cost of static compression products make them a preferred choice among healthcare providers and patients alike.

The dynamic compression therapy segment is expected to grow at a CAGR of 5.5% over the forecast period owing to technological advancements, increasing awareness of its benefits, and a growing body of clinical evidence supporting its efficacy. Moreover, the rising adoption of these devices in home care settings and the increasing focus on preventive healthcare are expected to drive the demand for dynamic compression therapy in the coming years.

End-use Insights

The hospitals segment dominated the Latin America compression therapy market in 2024 due to the extensive use of compression therapy in hospital settings for treating various medical conditions such as venous leg ulcers, lymphedema, and post-surgical recovery. Hospitals are equipped with advanced medical infrastructure and skilled healthcare professionals, which ensures the effective application and monitoring of compression therapy. In addition, the high patient influx in hospitals, particularly for acute and chronic conditions requiring compression therapy, contributes significantly to the revenue generated from this segment. The preference for hospital-based treatments is also driven by the need for comprehensive care and the availability of specialized compression therapy devices that are often not accessible in other settings.

The home healthcare segment is expected to grow at the fastest CAGR from 2025 to 2030 attributed to several factors, including the increasing preference for home-based care due to its convenience and cost-effectiveness. Advances in compression therapy technology have led to the development of user-friendly devices that patients can use easily at home, reducing the need for frequent hospital visits. The shift towards preventive healthcare and the emphasis on improving the quality of life for patients with chronic conditions are also contributing to the rapid growth of this segment.

Distribution Channel Insights

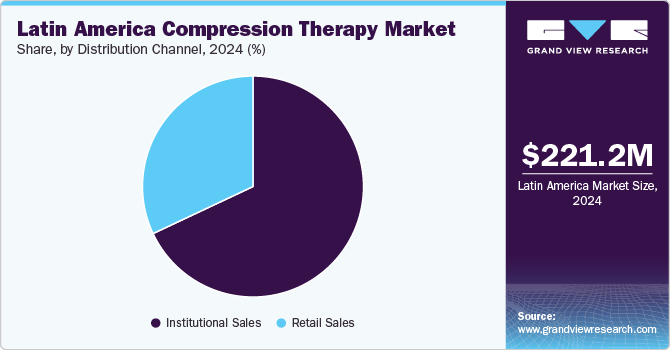

Institutional sales contributed the largest share of the total revenue in 2024 attributed to the high demand for compression therapy in clinical settings. These products play a critical role in managing chronic venous insufficiency, lymphedema, and post-surgical recovery, thus establishing their dominance in the market. Healthcare institutions often have the resources to invest in advanced compression therapy devices and ensure their proper application and monitoring by trained professionals. In addition, the bulk purchasing power of these institutions often leads to cost savings, making institutional sales a significant revenue driver in the compression therapy market.

The retail sales segment is expected to experience significant growth during the forecast period. Several factors, including the increasing availability of compression therapy products through pharmacies, online stores, and medical supply retailers, drive this growth. The convenience of purchasing these products directly from retail channels appeals to patients who prefer managing their conditions at home. Advances in e-commerce and the trend of self-care have also contributed to the rise in retail sales. As awareness of the benefits of compression therapy continues to grow, more patients are likely to seek out these products for home use, driving significant growth in retail sales over the coming years.

Country Insights

Mexico Compression Therapy Market Trends

Mexico accounted for a significant market share of the Latin American compression therapy market in 2024. The country’s growing awareness of healthcare, coupled with an expanding aging population, significantly influences this market. The rise in lifestyle diseases, such as obesity and diabetes, further contributes to the demand for these therapies, particularly for managing conditions such as venous insufficiency and lymphedema. For instance, nearly 30% of the adult population suffers from some form of obesity, creating a higher risk for vascular-related ailments that compression therapy can address. In addition, local manufacturers are emerging, offering cost-effective solutions that cater to the unique needs of the Mexican population, thereby enhancing the competitive landscape of the market.

Argentina Compression Therapy Market Trends

Argentina is expected to grow at a CAGR of 5.1% from 2025 to 2030, driven by an increasing prevalence of chronic diseases and a greater emphasis on preventive healthcare. The Argentine government’s initiatives to promote health education have raised awareness about the benefits of compression therapy, particularly for conditions related to poor circulation and varicose veins. Collaborations between local healthcare providers and international companies also facilitate access to innovative products, thereby fostering a competitive environment that benefits consumers.

Brazil Compression Therapy Market Trends

Brazil held the largest revenue share of 25.6% in the Latin American compression therapy market in 2024. The country's comprehensive healthcare system, encompassing both public and private sectors, facilitates widespread distribution and accessibility of compression therapy devices. A recent epidemiologic study revealed that 47.6% of adults over 15 years old suffer from varicose veins, a higher prevalence than in developed countries, creating a strong demand for compression solutions. In addition, Brazil's increasing emphasis on cutting-edge medical technologies, backed by investments in healthcare research and development, positions the country as a leader in adopting advanced compression therapy solutions.

Key Latin America Compression Therapy Company Insights

Some of the key companies in the Latin America compression therapy market include Bio Compression Systems, Inc., Cardinal Health, 3M, Juzo, PAUL HARTMANN AG, medi GmbH & Co. KG, SIGVARIS GROUP, and BSN Medical GmbH, among others.

-

Bio Compression Systems, Inc. manufactures pneumatic compression devices, which are widely recognized for their effectiveness in treating conditions such as lymphedema, venous insufficiency, and post-surgical edema.

-

Cardinal Health provides a wide range of compression therapy products, such as compression stockings, bandages, and wraps, essential for managing chronic venous disorders and lymphedema.

Key Latin America Compression Therapy Companies:

- Bio Compression Systems, Inc.

- Cardinal Health

- 3M

- Juzo

- PAUL HARTMANN AG

- medi GmbH & Co. KG

- SIGVARIS GROUP

- BSN Medical GmbH (Essity Health & Medical)

- Arjo (GETINGE GROUP)

- Spectrum Healthcare

- Smith+Nephew

- Tactile Systems Technology Inc.

- Zimmer Biomet

- DJO, LLC

- Lympha Press USA

- Medline

Recent Developments

-

In May 2023, HARTMANN and Sigvaris entered into a strategic alliance to develop and commercialize innovative compression therapy solutions. Combining HARTMANN's expertise in wound care with Sigvaris' renowned adjustable wrap technology, the partnership aims to offer a comprehensive range of high-performance compression products.

Latin America Compression Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 233.3 million

Revenue forecast in 2030

USD 297.1 million

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, distribution channel, region

Country scope

Brazil, Argentina, Mexico

Key companies profiled

Bio Compression Systems, Inc., Cardinal Health, 3M, Juzo, PAUL HARTMANN AG, medi GmbH & Co. KG, SIGVARIS GROUP, BSN Medical GmbH (Essity Health & Medical), Arjo (GETINGE GROUP), Spectrum Healthcare, Smith+Nephew, Tactile Systems Technology Inc., Zimmer Biomet, DJO, LLC, Lympha Press USA, Medline

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Compression Therapy Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America compression therapy market report based on technology, end-use, distribution channel, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Compression Therapy

-

Compression Bandages

-

Compression Stockings

-

Compression Tape

-

Others Compression Garments

-

-

Dynamic Compression Therapy

-

Compression Pumps

-

Compression Sleeves

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Frequently Asked Questions About This Report

b. The key players operating in the industry are Medi GmbH & Co.; Julius Zorn GmbH; SIGVARIS; ArjoHuntleigh; BSN Medical GmbH; Paul Hartmann AG; and Medtronic Plc.

b. Key factors driving the market growth include the increase in the prevalence of diabetes and venous disorders such as leg ulcers, deep vein thrombosis, blood clots, & lymphedema.

b. Latin America compression therapy market size was estimated at USD 221.2 million in 2024 and is expected to reach USD 233.3 million in 2025.

b. Latin America compression therapy market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 297.1 million by 2030.

b. Brazil dominated the market with a share of 25.6% in 2024. This is attributable to the high demand for compression products to treat various venous disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.