Laser Sensor Market Size, Share & Trend Analysis Report By Component (Solution, Services), By Type, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-408-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Laser Sensor Market Size & Trends

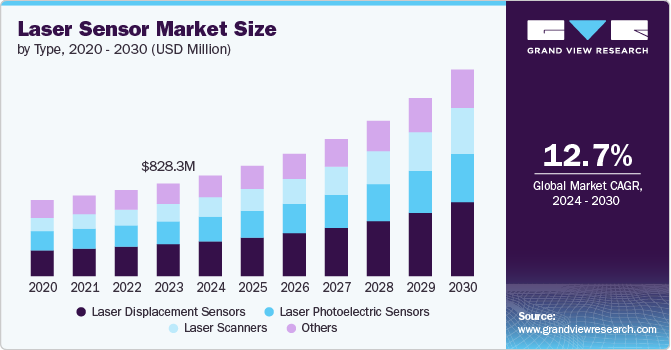

The global laser sensor market size was estimated at USD 828.3 million in 2023 and is estimated to grow at a CAGR of 12.7% from 2024 to 2030. The increasing adoption of automation and Industry 4.0 principles across manufacturing sectors is a primary driver, as laser sensors play a crucial role in precision measurement and quality control. In addition, the rising demand for non-contact sensing technologies in various applications, from automotive to healthcare, is fueling market expansion. The need for high-accuracy distance measurement and object detection in robotics and autonomous systems is also contributing to the market growth. Furthermore, stringent safety regulations in industrial environments are boosting the adoption of laser sensors for personnel safety and machine guarding applications.

Current trends in the laser sensor market include the miniaturization of sensors, allowing for integration into smaller and more compact devices. There's also a growing focus on developing multi-functional laser sensors that can perform multiple sensing tasks simultaneously, reducing the need for multiple sensors and lowering overall system costs. The integration of artificial intelligence and machine learning capabilities into laser sensor systems is another significant trend, enabling more intelligent data analysis and predictive maintenance. In addition, advancements in laser technology are leading to the development of sensors with improved range, accuracy, and resilience to challenging environmental conditions.

The market is also seeing a shift towards the development of laser sensors for emerging applications. This includes their increasing use in smart cities for traffic management and infrastructure monitoring, in agriculture for precision farming techniques, and in the rapidly growing field of 3D sensing for augmented reality and facial recognition technologies. Moreover, there's a rising demand for laser sensors in the automotive sector, particularly for advanced driver assistance systems (ADAS) and autonomous vehicles. As these trends continue to evolve, the laser sensor market is expected to witness further innovation and expansion into new application areas.

Component Insights

The solution segment dominated the market accounting for 65.3% of the market revenue share in 2023. This is attributable to strong reliance on physical components such as laser emitters, detectors, and associated hardware in various applications across industries. The significant market share of hardware suggests that end users are investing heavily in tangible, high-quality laser sensing equipment to meet their measurement, detection, and automation needs.

The software segment is expected to expand with the highest CAGR during the forecast period of 2024 to 2030. This projected growth trend in software reflects the increasing importance of data processing, analysis, and integration capabilities in laser sensor systems. As industries continue to digitalize and adopt more sophisticated automation and Industry 4.0 technologies, the demand for advanced software solutions that can interpret and utilize laser sensor data more effectively is likely to surge. This shift towards software-driven solutions may indicate a future where the value proposition of laser sensor systems increasingly lies in their ability to provide actionable insights and seamlessly integrate with other digital systems.

Type Insights

Laser displacement sensors segment accounted for a leading share in 2023. The significant market share is owing to the widespread adoption and importance of laser displacement sensors across various industries. These sensors are likely favored for their ability to provide highly accurate, non-contact measurements of distance, position, and dimensions. Their leading market share suggests they are essential in applications such as quality control, process monitoring, and precision manufacturing, where exact measurements are critical.

The laser scanners segment is projected to witness prominent growth over the coming years. This anticipated rapid growth reflects the increasing demand for more comprehensive and versatile sensing solutions. Laser scanners offer the ability to capture detailed 3D information of objects and environments, making them valuable in emerging fields such as autonomous vehicles, robotics, and advanced manufacturing processes. The projected high growth rate of this segment suggests a shift towards more sophisticated, data-rich sensing technologies that can support complex automation and decision-making processes in various industries.

Application Insights

The process monitoring & quality control segment is estimated to account for a leading revenue share in 2023. This leadership position underscores the critical role that laser sensors play in ensuring product quality and optimizing manufacturing processes across various industries. The businesses are heavily investing in laser sensor technologies to enhance their quality assurance procedures, reduce defects, and improve overall production efficiency. This trend likely reflects the increasing demand for high-precision, real-time monitoring solutions in industries where product quality and process consistency are paramount.

The manufacturing plant management segment is expected to expand with the highest growth rate during forecast period of 2024 to 2030. The projected rapid growth reflects a shift towards more comprehensive and integrated applications of laser sensor technology in manufacturing environments. Industries are moving beyond isolated quality control applications and towards holistic plant management solutions. This could involve the use of laser sensors in conjunction with other technologies to create smart factories, optimize resource allocation, enhance predictive maintenance, and improve overall operational efficiency. The high growth rate in this segment likely reflects the increasing adoption of Industry 4.0 principles and the drive towards more automated, data-driven manufacturing processes.

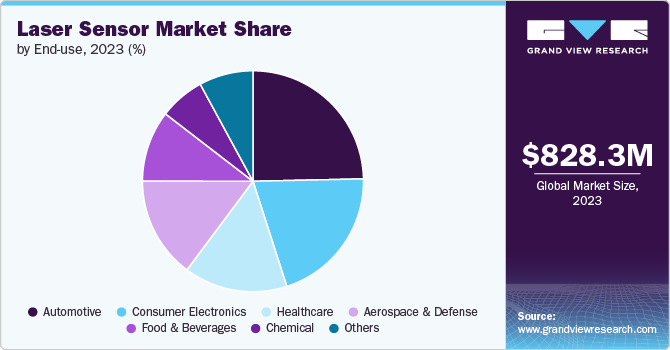

End-use Insights

The automotive segment held a leading share of laser sensor market in 2023. The laser sensors play a critical role in modern automotive manufacturing and vehicle systems. The significant market share is attributed to the widespread adoption of laser sensors in various automotive applications, such as advanced driver assistance systems (ADAS), quality control in production lines, and precise component assembly. The automotive industry's focus on improving safety features, enhancing manufacturing precision, and developing autonomous vehicles has likely driven this high adoption rate of laser sensor technologies.

The healthcare segment is projected to expand at the highest CAGR owing to a rapidly growing integration of laser sensor technologies in medical and healthcare applications. The expected high growth rate may be attributed to increasing demand for non-invasive diagnostic tools, precision surgical equipment, and advanced patient monitoring systems. As healthcare continues to embrace technological advancements, laser sensors could play a crucial role in improving medical imaging, enhancing the accuracy of surgical procedures, and enabling more sophisticated biomedical research. This trend also aligns with the broader movement towards personalized medicine and data-driven healthcare, where precise measurements and real-time monitoring are becoming increasingly important.

Regional Insights

The Asia Pacific region accounted to hold leading share in the market capturing a 34.2% share of global revenue in 2023. The leading share is driven by rapid industrialization, increasing automotive production, and growing investment in advanced manufacturing technologies. Countries such as China, Japan, and South Korea are at the forefront of adopting laser sensors in electronics manufacturing, particularly in the semiconductor and consumer electronics sectors. There's a rising trend in the use of laser sensors for smart city applications, including traffic management and air quality monitoring. The region is also seeing increased adoption of laser sensors in agriculture, with applications in precision farming and crop monitoring. As manufacturing processes become more automated across the region, there's growing demand for laser sensors in quality control and process optimization applications.

North America Laser Sensor Market Trends

The North American laser sensor market is characterized by robust growth, driven by advanced manufacturing sectors, automotive innovation, and increasing automation across industries. The region's strong focus on research and development, particularly in the United States, is fostering the adoption of cutting-edge laser sensor technologies. There's a growing trend towards the integration of laser sensors with IoT and AI technologies, especially in smart manufacturing and Industry 4.0 applications. The aerospace and defense sectors are also significant contributors to market growth, with increasing demand for high-precision measurement and detection systems.

U.S. Laser Sensor Market Trends

As the largest market within North America, the U.S. accounted for a market size of 154.4 million in 2023. The U. S. is at the forefront of laser sensor technology adoption and innovation. The country's automotive industry is a major driver, with increasing implementation of laser sensors in vehicle safety systems and autonomous driving technologies. There's also a rising trend in the use of laser sensors for quality control and process optimization in high-tech manufacturing. The healthcare sector in the U.S. is showing rapid adoption of laser sensors in medical devices and diagnostic equipment. In addition, there's growing interest in laser sensor applications for environmental monitoring and smart city initiatives, reflecting the country's focus on technological solutions for urban challenges.

Europe Laser sensor Market Trends

The European laser sensor market is marked by a strong emphasis on industrial automation and precision engineering. Countries such as Germany, with its robust manufacturing base, are leading in the adoption of laser sensors for quality control and process monitoring. There's a growing trend towards the use of laser sensors in renewable energy applications, particularly in wind turbine monitoring and solar panel manufacturing. The region's stringent environmental and safety regulations are driving the adoption of laser sensors in automotive emissions testing and workplace safety applications. In addition, there's increasing interest in laser sensor technologies for cultural heritage preservation and architectural surveying.

Key Laser Sensor Company Insights

The competitive landscape of the Laser sensor Market is characterized by a mix of established players, tech giants, and innovative startups. Competition is fierce in terms of technological advancements. Companies are constantly striving to develop more accurate, faster, and more versatile laser sensor technologies. This includes improvements in miniaturization, energy efficiency, and integration with other technologies such as AI and IoT. Alongside the major players, there are numerous smaller companies that specialize in specific types of laser sensors or cater to niche markets. These companies often compete by offering highly specialized solutions or by focusing on particular industry verticals.This competitive landscape is likely to continue evolving as new technologies emerge and market demands shift, making it a dynamic and challenging environment for both established players and new entrants.

Key Laser Sensor Companies:

The following are the leading companies in the laser sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Keyence Corporation

- Banner Engineering

- SICK AG

- Rockwell Automation

- OMRON Corporation

- Baumer Group

- Panasonic Corporation

- Leuze electronic GmbH

- Schneider Electric

- Schmitt Industries Inc

- SmartRay GmbH

Recent Developments

-

In February 2024, Omron Corporation introduced the HLS-S series of laser displacement sensors. These sensors feature high-speed capabilities and high-resolution output. The HLS-S series can achieve micron-level accuracy and offers measurement speeds of up to 40 kHz. This product launch is a part of Omron's efforts to address market demands for faster and more precise measurement solutions in industrial applications.

-

In February 2024, Rockwell Automation announced the launch of the Allen-Bradley Bulletin 5000 LDX laser distance sensor series. These sensors are intended for long-range measurement applications requiring high precision. The new series offers a measurement range of up to 10 meters and claims an accuracy of ±2 mm.

-

In April 2023, Keyence introduced a new line of ultra-compact laser sensors designed for applications with limited space. The product release is aimed at strengthening Keyence's presence in the electronics and semiconductor industries, where miniaturization and precise measurements are often required. The launch of these sensors reflects the ongoing trend in industrial automation towards smaller, more accurate sensing devices for use in compact manufacturing environments.

Laser Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 900.4 million |

|

Revenue forecast in 2030 |

USD 1,847.4 million |

|

Growth rate |

CAGR of 12.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Keyence Corporation; Banner Engineering; SICK AG; Rockwell Automation; OMRON Corporation; Baumer Group; Panasonic Corporation; Leuze electronic GmbH; Schneider Electric; Schmitt Industries Inc; SmartRay GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laser Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laser sensor market report based on component, type, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser Displacement Sensors

-

Laser Photoelectric Sensors

-

Laser Scanners

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Surveillance

-

Motion & Guidance

-

Process Monitoring & Quality Control

-

Distance Measurement

-

Manufacturing Plant Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Food & Beverages

-

Consumer Electronics

-

Chemical

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global laser sensor market size was estimated at USD 828.3 million in 2023 and is expected to reach USD 900.4 million in 2024.

b. The global laser sensor market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030 to reach USD 1,847.4 million by 2030.

b. North America dominated the laser sensor market, with a share of 30.1% in 2023. This is attributable to the growing trend towards integrating laser sensors with IoT and AI technologies, especially in smart manufacturing and Industry 4.0 applications.

b. Some key players operating in the laser sensor market include Broadcom Inc., Crowdstrike Holdings, Inc., McAfee, LLC, Cisco Systems Inc., Trend Micro Inc., GTB Technologies, Palo Alto Networks, Fortinet Inc., Zscaler Inc., Check Point Software Technologies, Juniper Networks, and Forcepoint.

b. Key factors driving market growth include the increasing adoption of automation and Industry 4.0 principles, the rising demand for non-contact sensing technologies, and stringent safety regulations in industrial environments.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."