- Home

- »

- Biotechnology

- »

-

Large And Small-scale Bioprocessing Market Report, 2030GVR Report cover

![Large And Small-scale Bioprocessing Market Size, Share & Trends Report]()

Large And Small-scale Bioprocessing Market Size, Share & Trends Analysis Report By Workflow (Downstream, Upstream), By Product, By Use type (Multi-use), By Mode (In-house, Outsourced), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-277-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global large and small-scale bioprocessing market size was valued at USD 58.85 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.5% from 2023 to 2030. Bioprocess engineering has been effectively explored for the development of biopharmaceuticals, and it has provided bio manufacturers and contract manufacturing organizations (CMOs) with lucrative avenues of growth. This, in turn, is expected to attract focused efforts to bolster the market adoption of various bioprocess engineering solutions.

Biopharmaceutical manufacturing is expected to serve as a lucrative source of revenue within the pharmaceutical industry in the coming years. Hence, with the gradual shift of the pharmaceutical industry towards biopharmaceuticals, the bioprocessing market is also expected to grow significantly throughout the forecast period. The need for global healthcare development and the commitment of governmental bodies and private players to facilitate and accelerate the process will ultimately benefit the global large and small-scale bioproducts market.

Rapid advancements in bioprocess engineering, including the evolution of contract services and single-use technology, have contributed huge success to biopharmaceutical manufacturing. Emerging innovations, such as nano-biocatalysts, aimed to improve the turnaround times by enhancing enzyme activity and stability to enhance bioproduction, thus driving revenue generation. Nano biocatalysts have been designed to have desired characteristics for their applications in biotechnology, synthesis, diagnostic, therapeutic, environmental, agricultural, medicinal, food processing, and more. Altogether, the application of nanotechnology in biotechnology has demonstrated its true potential.

Previously, only a handful of firms could handle the entire value chain of large-molecule bio-production. However, in the current scenario, many companies in the space are involved in developing biologics and biosimilars owing to the technological advances in bioprocessing technology.

Driven by the high demand for biopharmaceuticals, suppliers' product portfolio for bio-manufacturing has become more robust. Suppliers of bioreactors and other ancillary bioprocessing equipment are undertaking endeavors to fulfill the growing expectations of bio manufacturers concerning cost, space requirement, and portability. MERCK Mobius single-use manufacturing is both cost-effective and efficient.

Budgets for bio-manufacturing operations are expanding in all aspects. Companies are observed making significant investments in bio manufacturing-related R&D. This also includes hiring expert professionals and expanding manufacturing capacity. These factors are expected to play a pivotal role in reshaping the bioprocessing of various products shortly. In September 2022, the U.S. Department of Defense announced a USD 1.2 billion investment in bio-industrial, domestic manufacturing infrastructure, intending to create a home-based bio-industrial manufacturing platform for American innovators.

Moreover, introducing high throughput process development and data analysis services enables entities to gain insight into the production process for product development and consequently optimizes the whole process. The evolution of bioremediation as a promising solution for the cost-effective treatment of contaminants like heavy metals has also contributed to the enhanced adoption of bioprocessing equipment.

However, even though this market is expected to witness significant growth in the coming years, purification and stability issues regarding protein production and environmental concerns about the use of single-use bioprocessing equipment are expected to hamper the market growth to a certain extent.

Workflow Insights

Based on workflow, the market is segmented into upstream processing, fermentation, and downstream processing based on activities for converting crude raw material to the final finished product.

Downstream processing dominated the market with a significant revenue share in 2022. Product purification, the key step in downstream processing, is considered the most challenging & crucial step and thus demands more attention. Moreover, any advancement in bioprocessing engineering directly affects the production yield, which positions the downstream processing segment as the center of significant attraction of several major big pharma stakeholders.

Upstream processing is expected to grow at the fastest CAGR over the forecast period, owing to the advent of single-use technology and growth in mammalian production titer. Also, technological modifications in bioreactors and fermenters are projected to accelerate revenue growth for the fermentation segment in the coming years. For instance, advanced products, such as the Ambr 15 micro-bioreactor system by Sartorius AG, offer high-throughput upstream process development, efficient cell culture processing, and media & feed optimization with automated experimental setup and sampling.

Product Insights

Based on product, the market for large and small-scale bioprocessing is segmented into bioreactors/fermenters, cell culture products, filtration assemblies, bioreactors accessories, bags & containers, and others.

Bioreactors accounted for a significant revenue share in 2022 due to the extensive use of the product in the pharmaceutical sector and the portfolio expansion of major players. Automated cell culturing using specialized bioreactor designs is significant for developing value-added products, influencing growth in this segment.

The availability of a wide range of bioreactors based on the operation mode, phase type, capacity, fluid flow type, use type, and applications is expected to boost revenue generation in this segment soon. Other products offered in this market include bags & containers, filtration assemblies, cell culture products, and bioreactors accessories.

Cell culture product is expected to be the fastest-growing segment. This is mainly attributed to the ongoing advancements in cell line development, including the development of the recombinant cell line. One of the most significant applications of cell culture in cell and molecular biology is to provide a platform for studying the biological, biochemical, physiological, and metabolic systems of wild-type and sick cells. Production of biopharmaceutical-derived cell lines from mammalian cell lines supports this segment's projected growth.

Application Insights

The market is segmented based on application into biopharmaceuticals, specialty industrial chemicals, and environmental aids.

Biopharmaceuticals held the largest share owing to the commercial success of biologics & biosimilars for clinical use in the current scenario. Pharmacists are leveraging the wide spectrum application of bioprocess engineering to develop organism-derived therapeutics, which in turn are expected to drive the growth of this segment.

Biopharmaceuticals can be anything from cytokines and plasminogens to growth factors and vaccines. They can treat various conditions, like cancer, diabetes, and other conditions.

Moreover, companies are involved in enhancing their manufacturing capacity for biopharmaceutical development, which is expected to provide avenues of lucrative growth. Other market applications include microbial biomass, enzymes, metabolites, biofuels, bioremediation, and bio-refineries.

Scale Insights

Based on the scale, the market is segmented into the industrial scale (over 50,000 liters) and small scale (less than 50,000 liters).

Small-scale bioreactor systems provide parallel processing and allow the evaluation of a series of experiments for bioprocess optimization by being part of upstream processing. This factor is expected to support the projected growth of small-scale bioprocessing.

Bioprocessing for pharmaceutical development at the industrial scale has held the largest share in 2022. The continuous introduction of techniques and tools to support industrial-scale bioprocessing in the market has accelerated industrial-scale bioprocessing applications.

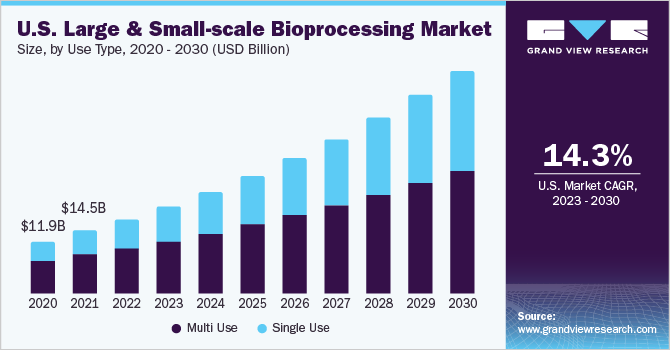

Use Type Insights

Concerning use type, this market offers multiple-use type and single-use type products. Due to increased investment in biologic research and development, including developing anti-infectives, vaccines, and recombinant proteins, single-use product-based bioprocessing is expected to witness the fastest growth during the forecast period. It is observed that substantial demand for innovation in single-use instruments is anticipated to drive growth in this segment soon.

The number of advantages associated with single-use products is expected to boost the adoption in this segment. The major advantage of the single-use type includes reducing the additional expenses associated with assembly, cleaning, process validation, operation, and equipment qualification of multiple-use bioprocess equipment.

Multiple-use products for bioprocessing dominated the 2022 market in terms of revenue generation. The low environmental impact associated with implementing multiple-use instruments and one-time investment is the major factor attributed to its large share in the current market.

Mode Insights

The large and small-scale bioprocessing market is segmented into in-house and outsourced based on the mode. The in-house segment dominated the market with a revenue share of 59.6% in 2022, owing to well-established international players capable of performing in-house biopharmaceutical production. The complexity of biologics is one of the major factors for keeping the manufacturing process in-house. Furthermore, companies use their in-house capabilities to maintain the secrecy of their product development processes.

However, the outsourced manufacturing model is expected to grow at the fastest CAGR of 14.8% over the forecast period from 2023 to 2030. This is due to the substantial growth in the budgets for outsourcing biomanufacturing. In the last decade, more and more biopharma companies have started to use contract manufacturers, which is now the fastest-growing segment.

Besides, factors such as lack of sufficient expertise, limited capacity to perform industrial-scale bioprocess applications, and cost-saving advantages associated with contract services are expected to provide potential opportunities in the outsourcing sector.

Regional Insights

North America dominated the market with a revenue share of 33.5% in 2022. The dominance of this region concerning revenue generation is due to focused, cutting-edge R&D in biomanufacturing. Other key factors that influence the market's progress in this region are developed infrastructure and rising funds for bioprocessing technology. Moreover, the presence of a substantial number of bio-manufacturing facilities in this region has also attributed to the large share of this segment.

Asia Pacific is anticipated to grow at the fastest CAGR of 15.5% over the forecast period. Several companies are outsourcing biologics manufacturing and clinical trials in the region, which is the key factor to drive progress. The region's economic development has led to increased investment in the healthcare sector. The growth of the population has necessitated the development of effective healthcare facilities.

Key Companies & Market Share Insights

The players in the market are undertaking strategic initiatives to retain their significant share as well as to enhance industrial share. Strategic initiatives undertaken by the companies include product line enhancement, regional expansion, distribution network reinforcement, collaborations, and merger & acquisition.

In March 2023, Sartorius Stedim Biotech, one of the leading biopharmaceutical companies in the world, signed an agreement to acquire Polyplus for over USD 2.6 billion. Polyplus develops and manufactures transfection & other DNA/RNA delivery reagents and plasmid DNA in GMP grade and high quality. These are crucial constituents for producing viral vectors utilized in gene & cell therapies and other innovative therapeutic solutions.

In addition, in April 2022, Merck KGaA announced an approximately USD 105 million investment to accelerate its single-use manufacturing in China. The following are some of the major participants in the global large and small-scale bioprocessing market:

-

Merck KGaA

-

Thermo Fisher Scientific, Inc.

-

GE healthcare

-

Corning, Inc.

-

Sartorius AG

-

CESCO BIOENGINEERING CO., LTD

-

Bio-Process Group

-

Bioprocess Control AB

-

Eppendorf AG

-

Applikon Biotechnology

-

Lonza

-

PBS Biotech, Inc

-

Finesse

-

Meissner Filtration Products, Inc.

-

CellGenix GmbH

-

Boehringer Ingelheim

-

Samsung BioLogics

-

Patheon

-

CMC Biologics

-

Binex Co., Ltd

-

Rentschler Biotechnology GmbH

-

TOYOBA CO., LTD.

-

Inno Biologics Sdn Bhd

-

F. Hoffmann-La Roche Ltd

Large And Small-Scale Bioprocessing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 69.0 billion

Revenue forecast in 2030

USD 177.8 billion

Growth Rate

CAGR of 14.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Scale, workflow, product, application, use type, mode, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck KGaA; Thermo Fisher Scientific, Inc.; GE healthcare; Corning, Inc.; Sartorius AG; CESCO BIOENGINEERING CO., LTD; Bio-Process Group; Bioprocess Control AB; Eppendorf AG; Applikon Biotechnology; Lonza; PBS Biotech, Inc; Finesse; Meissner Filtration Products, Inc.; CellGenix GmbH; Boehringer Ingelheim; Samsung BioLogics; Patheon; CMC Biologics; Binex Co., Ltd; Rentschler Biotechnology GmbH; TOYOBA CO., LTD.; Inno Biologics Sdn Bhd; F. Hoffmann-La Roche Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Large And Small-scale Bioprocessing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Large-and Small-Scale bioprocessingmarket on the basis of scale, workflow, product, application, use type, mode, and region:

-

Scale Outlook (Revenue in USD Billion, 2018 - 2030)

-

Industrial Scale (Over 50,000 Litre)

-

Small Scale (Less Than 50,000 Litre)

-

-

Workflow Outlook (Revenue in USD Billion, 2018 - 2030)

-

Downstream Processing

-

Fermentation

-

Upstream Processing

-

-

Product Outlook (Revenue in USD Billion, 2018 - 2030)

-

Bioreactors/Fermenters

-

Cell Culture Products

-

Filtration Assemblies

-

Bioreactors Accessories

-

Bags & Containers

-

Others

-

-

Application Outlook (Revenue in USD Billion, 2018 - 2030)

-

Biopharmaceuticals

-

Speciality Industrial Chemicals

-

Environmental Aids

-

-

Use Type Outlook (Revenue in USD Billion, 2018 - 2030)

-

Multi Use

-

Single Use

-

-

Mode Outlook (Revenue in USD Billion, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Regional Outlook (Revenue in USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global large and small scale bioprocessing market size was estimated at USD 58.85 billion in 2022 and is expected to reach USD 69.0 billion in 2023

b. The global large and small scale bioprocessing market is expected to grow at a compound annual growth rate of 14.47% from 2023 to 2030 to reach USD 177.8 billion by 2030

b. By mode, in-house segment dominated the large and small scale bioprocessing market with a share of 59.58% in 2022. The complexity of biologics is one of the major factors for keeping the manufacturing process in-house. Furthermore, companies are using their in-house capabilities as a strategy to maintain the secrecy of their product development processes.

b. Some prominent players operating in the market include Merck KGaA (Sigma-Aldrich Co. LLC), Thermo Fisher Scientific, Inc.; Corning, Inc.; Sartorius AG; CESCO BIOENGINEERING Co., Ltd.; Bioprocess Control AB; Eppendorf AG; Applikon Biotechnology; Lonza; and Meissner Filtration Products, Inc.

b. Key driving factors of the market include huge success of biologics, technological advancements in single-use bioprocessing, advent of single-use technology, and facility expansion by contract manufacturing organizations

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."