- Home

- »

- Medical Devices

- »

-

Large Molecule Drug Substance CDMO Market Report, 2033GVR Report cover

![Large Molecule Drug Substance CDMO Market Size, Share & Trends Report]()

Large Molecule Drug Substance CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Service (Contract Manufacturing, Contract Development), By Source, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-946-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Large Molecule Drug Substance CDMO Market Summary

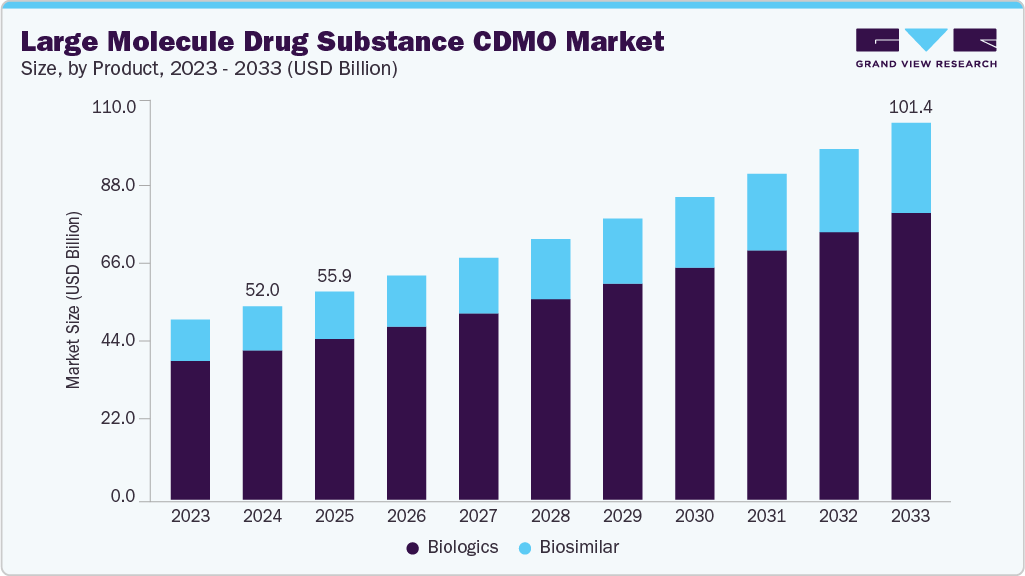

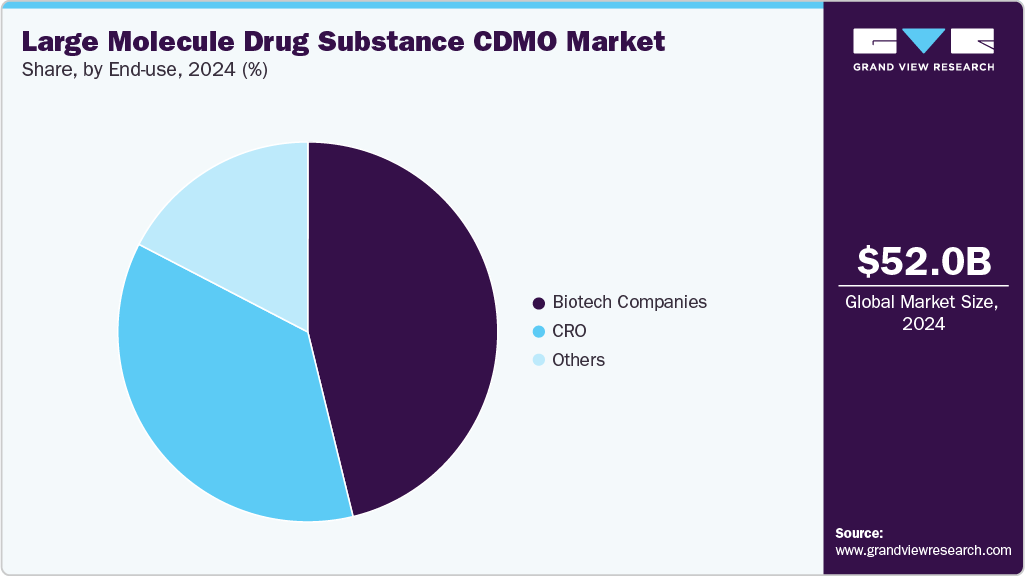

The global large molecule drug substance CDMO market size was estimated at USD 52.02 billion in 2024 and is projected to reach USD 101.41 billion by 2033, growing at a CAGR of 7.71% from 2025 to 2033. This market is experiencing significant growth driven by rising biologics demand, growing bioprocessing technological advancements, emerging cost efficiency & risk mitigation, and increasing capital investments by pharma and biotech companies.

Key Market Trends & Insights

- Asia Pacific dominated the large molecule drug substance CDMO market with the largest revenue share of 37.90% in 2024.

- The large molecule drug substance CDMO industry in the U.S. is expected to grow at a significant CAGR over the forecast period.

- Based on product, the biologics segment led the market with the largest revenue share of 77.25% in 2024.

- Based on service, the contract manufacturing segment accounted for the largest market revenue share in 2024.

- Based on source, the microbial segment accounted for the largest market revenue share in 2024.

- Based on end-use, the biotech companies segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 52.02 Billion

- 2033 Projected Market Size: USD 101.41 Billion

- CAGR (2025-2033): 7.71%

- Asia Pacific: Largest market in 2024

Besides, the increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and rare genetic conditions is expected to drive the demand for new treatments and therapies. For instance, according to National Cancer Institute NIH, 2.04 billion new cancer cases are estimated in 2025 in U.S. and approximately 6 million people will die from it. Thus, rising burden of cancer cases has fueled the demand for biologics, including monoclonal antibodies, recombinant proteins, and gene therapies. Besides, these therapies require complex manufacturing capabilities, which makes CDMOs crucial partners for biopharma companies seeking speed, scalability, and regulatory compliance.In addition, biologics’ rising share in global drug pipelines has created sustained outsourcing opportunities, as pharmaceutical companies increasingly rely on CDMOs for advanced bioprocessing expertise, flexible capacity, and specialized technologies. The global shift toward personalized medicine further strengthens the market growth, driving reliance on CDMOs to deliver efficient, cost-effective solutions in large molecule development and manufacturing.

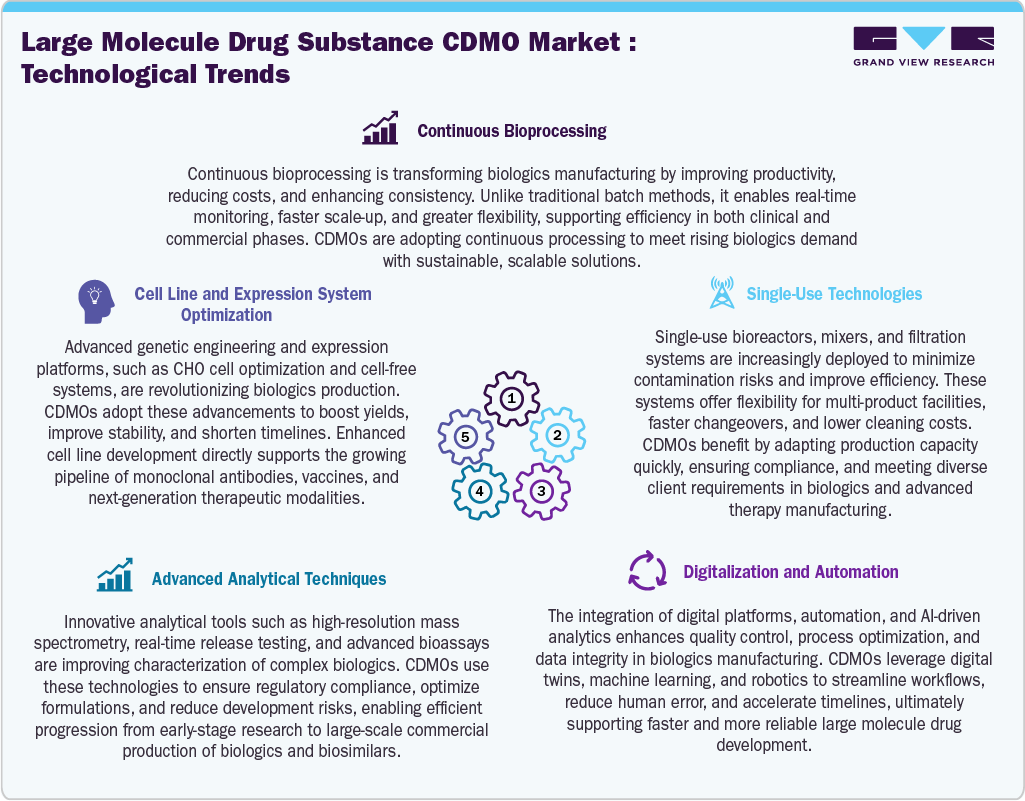

Moreover, rapid advancements in single-use bioreactors, continuous manufacturing, process intensification, and high-throughput screening are transforming the large molecule manufacturing landscape. These innovations enable faster scale-up, higher yields, and greater flexibility, empowering CDMOs to support diverse client needs across biologics, biosimilars, and next-generation modalities like cell and gene therapies. Besides, digitalization, AI-driven process optimization, and advanced analytics are enhancing the quality, reproducibility, and regulatory compliance. CDMOs investing in cutting-edge technologies gain a competitive edge, attracting pharma and biotech partners looking to reduce development timelines and costs.

Furthermore, pharmaceutical companies can lower infrastructure investments, operational risks, and regulatory obligations by contracting with CDMOs to handle large molecule development and manufacture. Many start-up biotech companies lack the time, money, and experience necessary to develop in-house biologics capabilities. In order to free up resources for research and development and commercialization, CDMOs provide continuous services that expedite drug development, reduce expenses, and shorten deadlines. In a competitive industry where flexibility and speed-to-market are essential, this cost-effective solution has become essential. CDMOs are crucial in helping both big pharmaceutical companies and small innovators who are pursuing biologics pipelines by reducing risks and providing scalable solutions.

Developing a large molecule drug substance that is both safe and effective while controlling costs and timelines is highly challenging. The complexity and fragility of large molecule active compounds create significant hurdles in formulation development. To address these challenges, CDMOs play a vital role in the early stages by ensuring efficiency, overcoming technical barriers, and adhering to tight deadlines. Innovative technologies, such as advanced encapsulation methods and the strategic use of stabilizing buffers, are increasingly leveraged to enhance stability and protect drug substances, supporting successful development and faster progress toward clinical and commercial milestones.

Opportunity Analysis

The large molecule drug substance CDMO industry is expected to witness new growth opportunities driven by growing demand for biologics, monoclonal antibodies, and advanced therapeutics. Besides, most pharmaceutical companies increasingly use CDMOs to acquire specialist knowledge, innovative manufacturing platforms, and economical solutions. In addition, expanding pipelines in vaccines, antibody-drug conjugates, and cell and gene treatments support the market.

Moreover, with the advantageous regulations and growing healthcare expenditures, the emerging markets are creating new opportunities for market growth. In addition, manufacturing efficiency is increased by technical advancements, including automation, digitization, and continuous bioprocessing. Thus, growing partnership with CDMOs is expected to drive the market growth by allowing market players to develop complex biologics and commercialize quickly and reliably in the market.

Impact of U.S. Tariffs on the Global Large Molecule Drug Substance CDMO Market

U.S. tariffs on raw materials, intermediates, and biomanufacturing equipment have significantly impacted the global market. The increased operating costs due to higher import component costs put pressure on CDMOs to modify their pricing and profit margins. Moreover, these tariffs cause supply chain disruptions by delaying access to vital technology and materials required for the manufacturing of biologics. Some CDMOs are reducing risks by diversifying their regions and sourcing locally where international cooperation is difficult. Long-term tariffs may encourage smart investments in domestic manufacturing capacity, but they may also put pressure on smaller CDMOs that rely on foreign trade for scalability and competitiveness.

Technological Advancements

The large molecule drug substance CDMO industry is driven by major technological developments that improve effectiveness, adaptability, and quality. Besides, single-use solutions speed up transitions and lower contamination hazards, while continuous bioprocessing promotes scalable, economical production. AI, automation, and digitization enhance timeliness, data integrity, and process control. Complex biologics are better characterized and more compliant due to advanced analytical techniques. Similarly, advancements in cell line and expression system optimization boost yields and stability, bolstering next-generation treatments, vaccines, and monoclonal antibodies. Thus, these developments allow CDMOs to provide quicker, more dependable, and sustainable solutions, satisfying the changing demands of international biopharmaceutical producers and developers.

Pricing Model Analysis

The large molecule drug substance CDMO industry employs diverse pricing models to align with client needs. Milestone-based pricing ensures accountability and lowers risk by linking payments to project accomplishments. Value-based pricing rewards creativity and performance by emphasizing quantifiable results like yields or timeframes. Fixed-fee arrangements are most appropriate for standardized procedures because they provide cost certainty and transparency. Subscription or retainer arrangements, on the other hand, offer continuous access to knowledge, promoting enduring collaborations and resource stability. Thus, these models strike a balance between adaptability, effectiveness, and teamwork, allowing CDMOs to enable the efficient, high-quality development and production of complex biologics for both large pharmaceutical companies and up-and-coming biotechs.

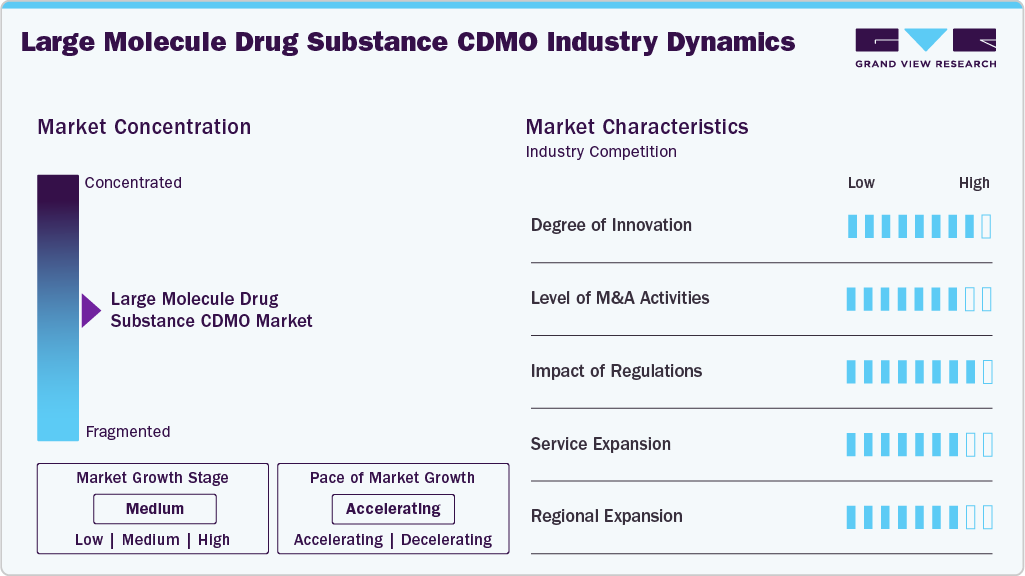

Market Concentration & Characteristics

The large molecule drug substance CDMO industry growth stage is moderate, and pace is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation is central to the large molecule drug substance CDMO industry, with continuous advances in bioprocessing, automation, AI-driven analytics, and single-use technologies. CDMOs are adopting novel expression systems, continuous manufacturing, and advanced analytical tools to enhance yields, quality, and timelines. This innovation-driven approach strengthens competitiveness, attracts partnerships, and supports evolving biologics pipelines globally.

The large molecule drug substance CDMO industry is witnessing high M&A activities as CDMOs pursue scale, capabilities, and global presence. Acquisitions expand service portfolios in biologics, gene therapies, and advanced modalities. For instance, in January 2025, BioCina and NovaCina merged under the BioCina name, creating an integrated CDMO offering end-to-end biologics services, combining expertise, sterile fill-finish, global reach, and regulatory strength to meet rising biopharma demand.

CDMO activities are greatly impacted by regulatory frameworks, particularly in the creation of large molecules due to adherence to strict FDA, EMA, and regional requirements is essential. Regulations influence product safety, quality control, and process validation. Despite their demands, they push CDMOs to implement innovative technologies and systems, which sets them apart.

CDMOs are broadening service offerings to meet complex client needs, adding capabilities in cell and gene therapies, ADCs, vaccines, and novel biologics. Service expansion spans early discovery support, process optimization, commercial-scale manufacturing, and fill-finish solutions. By offering integrated, end-to-end services, CDMOs attract long-term partnerships, improve efficiency, and accelerate time-to-market for biologics and advanced therapies.

Global demand is fueling regional expansion, with CDMOs investing in North America, Europe, and rapidly growing Asia-Pacific and Middle East markets. Expanding local presence strengthens supply chain resilience, regulatory alignment, and client access. For instance, in April 2025, Sumitomo Chemical launched SC-AMSA in U.S., to support its oligonucleotide CDMO business, focusing on advanced gRNA production. This strategic move enhances customer access, collaboration, and responsiveness in genome editing therapies.

Product Insights

The biologics segment led the market with the largest revenue share of 77.25% in 2024. The segment growth is attributed to the increasing adoption of biologics in treating complex diseases such as cancer, autoimmune disorders, and rare conditions. The high therapeutic efficacy of biologics, combined with rising demand for monoclonal antibodies, recombinant proteins, and cell and gene therapies, is expected to drive the segment growth. Besides, CDMOs play a significant role in biologics product development by providing advanced biomanufacturing, process development, and regulatory expertise, further supporting pharma companies to accelerate commercialization. Moreover, the large molecule drug substance CDMO industry is also experiencing significant investments in bioprocessing technologies, single-use systems, and capacity expansion, boosting the demand for biologics globally. Such factors are expected to drive the market over the estimated time period.

The biosimilars segment is anticipated to grow at the fastest CAGR over the forecast period, driven by patent expirations of blockbuster biologics and increasing demand for cost-effective therapies. Governments and healthcare providers encourage biosimilar adoption to reduce treatment costs and improve patient access. CDMOs leverage expertise in process development, analytical characterization, and large-scale manufacturing to support faster biosimilar development and regulatory compliance. Furthermore, the market is advancing due to rising approvals for biosimilars, creating opportunities in markets such as the U.S., Europe, and Asia Pacific.

Service Insights

The contract manufacturing segment accounted for the largest market revenue share in 2024, driven by growing demand for cost efficiency, scalability, and regulatory compliance. Biopharmaceutical companies increasingly outsource manufacturing to CDMOs to reduce capital expenditure and accelerate timelines. Besides, contract manufacturing ideally offers advanced infrastructure, specialized expertise, and global quality standards, enabling seamless production of complex biologics, biosimilars, and advanced therapies. In addition, strong investments in single-use systems, continuous bioprocessing, and digitalized operations, ensuring higher productivity and flexibility, are supporting the market growth.

The contract development segment is anticipated to grow at the fastest CAGR during the forecast period, fueled by the growing complexity of biologics, biosimilars, and advanced medicines that require specific knowledge of process and analytical development. In order to accelerate the drug pipelines, biopharma companies are increasingly depending on CDMOs for early-stage services like formulation, tech transfer, and cell line development. Moreover, contract development is witnessing new growth opportunities due to rising demand for shorter time-to-market, lower R&D costs, and access to advanced technologies like high-throughput screening and AI-driven process optimization. Such factors are expected to drive the market growth.

Source Insights

The microbial segment accounted for the largest market revenue share in 2024. The segment growth is attributed to the growing requirement for biologics such as enzymes, hormones, vaccines, plasmid DNA, and biosimilars. Microbial expression systems like E. coli and yeast are widely used due to cost-effectiveness, scalability, and shorter production timelines compared to mammalian systems. Besides, the market is experiencing growth due to the rising need for biologics generated from microorganisms in oncology, infectious illnesses, and uncommon disorders. To increase yields and ensure regulatory compliance, CDMOs are investing in continuous bioprocessing, quality control systems, and advanced fermentation technologies, establishing microbial platforms as the foundation of the production of large molecule medicinal substances.

The mammalian segment is anticipated to grow at the fastest CAGR during the forecast period, driven by its critical role in producing complex biologics such as monoclonal antibodies, fusion proteins, and advanced cell and gene therapies. The ability of mammalian expression systems, specifically Chinese Hamster Ovary (CHO) cells, to guarantee appropriate protein folding, post-translational changes, and high-quality therapeutic output makes them the preferred choice. The market is driven by rising demand for immunotherapies, cancer biologics, and precision medications. Mammalian systems are essential for future biologics. CDMOs are increasing capacity with high-density bioreactors, single-use technologies, and sophisticated cell culture platforms, enabling scalability, regulatory compliance, and quicker timelines.

End-use Insights

The biotech companies segment accounted for the largest market revenue share in 2024. The segment is driven by the growing requirement for creating novel biologics, biosimilars, and innovative treatments. These companies increasingly prefer CDMOs due to they lack the internal infrastructure, size, or regulatory knowledge necessary to produce sophisticated big compounds. Thus, CDMOs support biotech companies to access advanced technologies, flexible capacity, and international compliance requirements by outsourcing to specialist partners.

The contract research organizations (CROs) segment is anticipated to grow at the second-fastest CAGR during the forecast period, driven by rising outsourcing of early-stage research, process development, and analytical services. CROs enable quicker turnaround times and risk reduction by offering specialized knowledge in cell line creation, bioassays, formulation, and regulatory support. Biologics, gene therapy, and biosimilars pipeline expansions boost the need for CROs to provide scalable, adaptable solutions. CRO partnerships are becoming more and more important in the global CDMO environment because of their capacity to combine research and manufacturing, which speeds up drug development.

Regional Insights

The North America large molecule drug substance CDMO market is anticipated to grow at a significant CAGR during the forecast period, driven by strong biologics and biosimilars demand and increasing outsourcing by pharma and biotech firms. Advancements in single-use bioprocessing, cell-line development, and automation enhance efficiency and scalability. Furthermore, regulatory support, coupled with strategic collaborations and facility expansions, strengthens the North America market in innovative biologics manufacturing solutions.

U.S. Large Molecule Drug Substance CDMO Market Trends

The large molecule drug substance CDMO market in the U.S. is expected to grow at a significant CAGR over the forecast period, owing to increasing chronic disease burden and strong outsourcing trends among pharmaceutical and biotech companies. According to the U.S. Centers for Disease Control and Prevention, five of the top 10 leading causes of death are due to chronic diseases in the U.S. The market is witnessing growth, with key players such as Lonza, Catalent, WuXi Biologics, Samsung Biologics, and Thermo Fisher Scientific leading innovation, strategic collaborations, and facility expansions to meet growing domestic and global demand.

The Canada large molecule drug substance CDMO marketis expected to grow at a significant CAGR during the forecast period, driven by rising demand for advanced therapies and alongside supportive government initiatives for biomanufacturing expansion. Besides, increasing collaborations between domestic biotech firms and global CDMOs are boosting capacity and innovation. Advancements in automation and integrating artificial intelligence are improving efficiency and reducing costs. Moreover, a strong R&D ecosystem, skilled workforce, and focus on localized production to strengthen supply chain resilience position Canada as a growing hub for biologics manufacturing.

Europe Large Molecule Drug Substance CDMO Market Trends

The large molecule drug substance CDMO market in Europe is advancing, propelled by the harmonized regulatory frameworks and demand for flexible, scalable manufacturing capacity. The market is witnessing growth due to continuous bioprocessing, single-use technologies, and enhanced analytics that accelerate development timelines and reduce costs. In addition, cell and gene therapy investments are expanding service offerings. For instance, in March 2025, CordenPharma launched a USD 541 million peptide manufacturing facility in Switzerland, expanding capacity with advanced automation and digitalization. This expansion is expected to create new growth opportunities to boost regional growth.

The Germany large molecule drug substance CDMO marketheld the largest share in 2024. fueled by the growing cell and gene therapy sector and access to central European logistics hubs. The country benefits from a strong regulatory framework, world-class GMP compliance, and a deep talent pool. Advances such as continuous manufacturing and technological innovations are enhancing efficiency and scalability. The robust infrastructure and innovation-driven ecosystem have built Germany as an emerging key hub for high-quality, flexible large molecule development and manufacturing solutions. For instance, in April 2025, Sartorius partnered with Mabion S.A. to integrate lab-to-large-scale biologics development and manufacturing, streamlining timelines and reducing complexity. This collaboration strengthened both firms’ CDMO capabilities, offering comprehensive solutions to accelerate biologics delivery.

The large molecule drug substance CDMO market in the UKis expected to grow at a significant CAGR over the forecast period, propelled by strong R&D investment and growing regulatory rigor via agencies like MHRA and EMA. There’s rising pressure from smaller biotech firms and virtual companies to outsource cell line development, process optimization, and scale‐up. With expanding infrastructure and talent clusters, the UK is rapidly scaling its CDMO capabilities. For instance, in March 2023, Pharmaron’s Liverpool Gene Therapy CDMO secured UK government support for a USD 205m expansion, quadrupling development and analytical capacity across viral vectors, DNA, and RNA. This investment strengthens Pharmaron’s role in advancing cell and gene therapies.

Asia Pacific Large Molecule Drug Substance CDMO Market Trends

Asia Pacific dominated the large molecule drug substance CDMO market with the largest revenue share of 37.90% in 2024, boosted by rapidly rising biologics pipelines, the appeal of lower cost, high-quality manufacturing. Governments are facilitating support through stringent regulations, incentives, and infrastructure improvements. Key players such as WuXi Biologics, Samsung Biologics, Lonza, Fujifilm Diosynth, and Boehringer Ingelheim are strengthening their market presence through continuous innovations, thereby fostering market growth.

The large molecule drug substance CDMO market in Chinais accelerating, driven by growing domestic demand and global collaborations and partnerships. In order to bring the regulatory environment closer to international standards, agencies are increasing quality standards and expediting approvals. To increase competency and competitiveness, local CDMOs are modernizing facilities, building new infrastructure, and partnering with international firms. To enable simultaneous IND submissions in China and the United States, Porton Pharma Solutions teamed up with Aojin Life Sciences in December 2024 to offer CDMO services for XDC conjugate pharmaceuticals. Global XDC medication development was strengthened by this partnership

The Japan large molecule drug substance CDMO marketis advancing steadily due to the rising aging population and growing demand for precision medicines. According to Japan’s Ministry of Internal Affairs and Communications, elderly people make up the highest proportion of the population in Japan, estimated at 29.3%, the highest of any country. Regulatory reforms and alignment with global GMP standards are helping shorten approval timelines and ease outsourcing. Regions like Kanto, with its strong academic, R&D, and manufacturing ecosystem, are becoming key hubs.

The large molecule drug substance CDMO market in India isexperiencing rapid growth, driven by factors such as a robust pharmaceutical infrastructure, government or private funding, and cost-effective manufacturing capabilities. The government's initiatives, including the Production-Linked Incentive (PLI) scheme and the establishment of bulk drug parks, are further bolstering the sector. For instance, in January 2025, Aragen secured a USD 100 million private equity (PE) investment from Quadria Capital to expand CDMO capacity in India, enhancing niche capabilities, adopting driven technologies, and strengthening its position in multi-modality biologics manufacturing.

Latin America Large Molecule Drug Substance CDMO Market Trends

The large molecule drug substance CDMO market in Latin America is expected to grow at a significant CAGR during the forecast period, due to advancements in biotechnology and supportive government initiatives. The region's expanding healthcare infrastructure and skilled workforce further bolster its position in the global market. Furthermore, the regulatory framework is evolving, with Brazil and Mexico leading in biosimilar guidelines, while regional fragmentation and inconsistent approvals present challenges for harmonized biologics manufacturing.

The Brazil large molecule drug substance CDMO market is experiencing robust growth, driven by increasing collaborations and partnerships, advancements in biotechnology, and supportive government initiatives. The regulatory agency ANVISA has aligned its standards with international norms, facilitating smoother market entry for global players and enhancing the country's competitiveness in biologics manufacturing.

Middle East & Africa Large Molecule Drug Substance CDMO Market Trends

The large molecule drug substance CDMO market in the Middle East & Africa is growing steadily due to strategic geopolitical positioning and strategic investments in biotechnology infrastructure. Countries like Saudi Arabia and the UAE are emerging as regional hubs, attracting global CDMOs through incentives, infrastructure, and government visionary initiatives. Major players such as Lonza, WuXi AppTec, Catalent, Thermo Fisher Scientific, and Piramal Pharma Solutions are actively expanding operations in the region. For instance, in June 2023, Saudi Arabia’s Public Investment Fund launched Lifera, a commercial-scale CDMO, to strengthen local biomanufacturing, enhance skills, enable technology transfer, and boost national pharmaceutical capabilities and resilience.

The UAE large molecule drug substance CDMO marketis rapidly growing, driven by government support for pharmaceutical manufacturing and strategic investments in healthcare infrastructure. Regulatory frameworks are evolving to facilitate global collaborations and streamline approvals. For instance, in January 2025, European CDMOs like Gaelic Laboratories are entering the UAE, establishing subsidiaries in Dubai to navigate regulations, support marketing, and provide full-service development, reflecting the region’s expanding biopharma ecosystem.

Key Large Molecule Drug Substance CDMO Company Insights

The global large molecule drug substance CDMO industry is experiencing significant growth, with the major market players including Lonza Group, Thermo Fisher Scientific, WuXi Biologics, Samsung Biologics, and Catalent. These firms offer comprehensive services from cell line development to commercial manufacturing, driving innovation and efficiency in biologic drug production.

For instance, in July 2025, 35Pharma partnered with Samsung Biologics to accelerate the development and manufacturing of two recombinant protein therapeutics, leveraging quality-by-design, risk assessment, and synchronized processes, resulting in faster approvals and scalable production. Such collaborations have streamlined timelines, enhanced product quality, reduced development risk, scalable manufacturing, and strengthened partnerships for future biologics projects.

Key Large Molecule Drug Substance CDMO Companies:

The following are the leading companies in the large molecule drug substance CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- WuXi Biologics

- Samsung Biologics

- Catalent, Inc.

- Rentschler Biopharma SE

- AGC Biologics

- Recipharm AB

- Siegfried Holding AG

- Boehringer Ingelheim

- FUJIFILM Diosynth Biotechnologies

Recent Developments

-

In July 2025, Samsung Biologics partnered with Canadian biopharma 35Pharma, enabling the launch of two recombinant protein therapies. Their collaboration accelerated development, ensured scalability, and secured clinical approvals, showcasing partnership-driven success in complex biologics manufacturing.

-

In April 2025, Meribel Pharma Solutions launched as a mid-sized UK-based CDMO following acquisitions of Synerlab Group and Recipharm sites. With 13 European facilities, it expanded capabilities, emphasizing agility, innovation, and customer-focused solutions.

-

In October 2024, Thermo Fisher Scientific launched Accelerator Drug Development at CPHI Milan, integrating CDMO and CRO services. The platform streamlined manufacturing, clinical research, and supply chain, supporting global biotech and pharma companies with end-to-end solutions.

Large Molecule Drug Substance CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 55.99 billion

Revenue forecast in 2033

USD 101.41 billion

Growth rate

CAGR of 7.71% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Eurofins Scientific; WuXi Biologics; Samsung Biologics; Catalent, Inc.; Rentschler Biopharma SE; AGC Biologics; Recipharm AB; Siegfried Holding AG; Boehringer Ingelheim; FUJIFILM Diosynth Biotechnologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Large Molecule Drug Substance CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global large molecule drug substance CDMO market report based on product, service, source, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Biosimilar

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Manufacturing

-

Clinical

-

Commercial

-

-

Contract Development

-

Cell Line Development

-

Process Development

-

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Mammalian

-

Microbial

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biotech Companies

-

CRO

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global large molecule drug substance CDMO market size was estimated at USD 52.02 billion in 2024 and is expected to reach USD 55.99 billion in 2025.

b. The global large molecule drug substance CDMO market is expected to grow at a compound annual growth rate of 7.71% from 2025 to 2033 to reach USD 101.41 billion by 2033.

b. Asia Pacific dominated the large molecule drug substance CDMO market with a share of 37.90% in 2024. The market growth is attributed to rapidly rising biologics pipelines and the appeal of lower-cost, high-quality manufacturing. Governments facilitate support through stringent regulations, incentives, and infrastructure improvements, further contributing to market growth.

b. Some key players operating in the large molecule drug substance CDMO market include Eurofins Scientific, WuXi Biologics., Samsung Biologics, Catalent, Inc, Rentschler Biopharma SE, AGC Biologics, Recipharm AB, Siegfried Holding AG, Boehringer Ingelheim, and FUJIFILM Diosynth Biotechnologies among others.

b. The market growth is driven by rising demand for biologics, growing bioprocessing technological advancements, emerging cost efficiency & risk mitigation and increasing capital investments by pharma and biotech companies. Besides, increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and rare genetic conditions is expected to drive the demand for new treatment and therapies, further contributes to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.