Large Molecule Bioanalytical Testing Services Market Size, Share & Trends Analysis Report By Phase (Preclinical, Clinical), By Test (ADME, PD), By Type, By Therapeutic Area, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-979-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

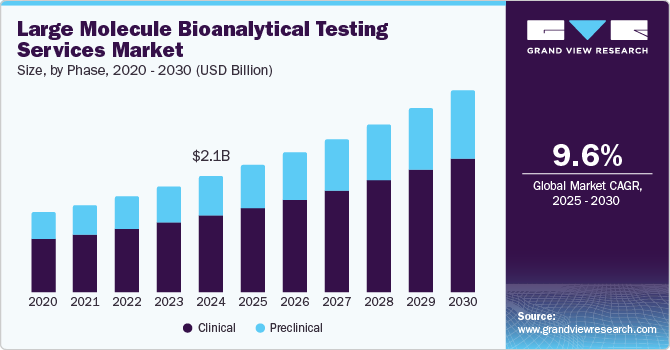

The global large molecule bioanalytical testing services market size was valued at USD 2.13 billion in 2024 and is projected to grow at a CAGR of 9.63% from 2025 to 2030. The market is projected to grow due to several factors, such as increasing demand for high-tech and reliable large molecule bioanalytical testing services and the complexity of product designs and engineeringhas boosted the adoption of analytical testing services. Rapid innovations in healthcare have increased the need for pharmaceutical companies to adopt new technologies in their services to maintain market demand. In addition, the demand for large molecule bioanalytical testing services is rising due to less time to market, evolving regulatory guidelines, and a high risk of product failure.

The demand for quality healthcare is increasing due to increasing healthcare costs. With growing innovations pertaining to new pharmaceutical products, the demand for analytical testing is increasing. Many companies opt for outsourcing services for analytical testing due to increasing competition in the healthcare industry and growing pricing concerns. Technological advancements and focus on customized care shorten a product’s life cycle, which leads to the rapid development of new products. Increasing R&D activities for new drug development, combination products, and other advanced medicines have increased the demand for analytical testing. For instance, the patent for the composition of matter for Eylea (aflibercept), which is a blockbuster drug developed by Regeneron to treat numerous eye disorders, such as age-related macular degeneration, expired in the U.S. in May 2024, creating opportunities for biosimilar developers to enter the market. Several pharmaceutical companies, including Samsung Bioepis and Amgen, are proactively involved in the development and commercialization of biosimilar versions of aflibercept. Further, rising testing costs are another key factor boosting the demand for bioanalytical testing outsourcing for large molecules.

The biopharmaceutical industry has a significant socioeconomic influence on society through R&D investment and manufacturing. R&D supports various drug discovery programs; thereby, biopharmaceutical R&D spending plays an important role in drug discovery and development. Currently, the global pharmaceutical industry has the second highest R&D intensity measures of any sector, which indicates that the spending on R&D is increasing, and the overall R&D spending is likely to grow during the forecast period. Growing R&D on large molecules has increased the demand for bioanalytical testing. Thus, increasing R&D spending is expected to drive market growth during the forecast period.

Major pharmaceutical firms such as Pfizer and Roche are channeling substantial funds into developing advanced bioanalytical methodologies, including HTS and mass spectrometry techniques, to enhance the accuracy & efficiency of drug development processes. Contract research leaders such as LabCorp, WuXi AppTec, and Charles River International are investing in cutting-edge technologies like automation and AI to streamline bioanalytical workflows and reduce turnaround times for clinical trials. For instance, in May 2023, WuXi AppTec launched a new research and development center for large animal PK & non-GLP bioanalytical research services in China. These strategic investments by key sponsors drive overall growth within the outsourcing market.

The rising demand for biologics and biosimilars is a key driver in the market growth. The rising biologics pipelines and clinical trials, along with the cost-effectiveness of biosimilars, require rigorous bioanalytical testing to meet complex regulatory standards. As these advanced therapies gain traction, there is a high demand for CROs and CDMOs specializing in large molecule testing. Moreover, ongoing advancements in analytical testing methodologies like ligand-binding assays and mass spectrometry enhance safety and efficacy, driving the need for advanced bioanalytical services in this growing market segment.

Phase Insights

The clinical phase segment dominated the market in 2024 with the largest revenue share of 66.6%.The growing prevalence of chronic diseases and increasing demand for clinical trials in developing countries are factors expected to drive segment growth. An increase in the number of biologics, high demand for advanced technologies, and the requirement for personalized orphan drugs & medicine are other factors likely to fuel segment growth during the forecast period.

The preclinical segment is expected to rise with the fastest CAGR over the forecast period. Preclinical studies include pharmacokinetic bioanalysis of plasma or serum samples. This study involves dosing patients or animals with the drug product and then taking blood samples at various time points. The plasma or serum is separated and sent to a laboratory for analysis. The laboratory conducts two types of preclinical studies (in vivo and in vitro). Bioanalytical techniques are used to determine the concentration of the drug product in plasma or serum. Large molecules are typically measured using ligand binding assays such as Enzyme-linked Immunosorbent Assay (ELISA) and Meso Scale Discovery (MSD). Numerous factors, such as technological evolution, globalization of clinical trials, and increased demand for CROs to conduct clinical trials, are anticipated to boost the segment’s growth.

Type Insights

The global market is segmented into pharmacokinetics, Antidrug Antibodies (ADA), and others. The ADA segment accounted for the largest revenue share of the global market in 2024. ADA assays support the development of large-molecule drugs. Large molecule drugs, such as an antibody or protein therapeutics, provoke the immune system to produce antibodies against the drug. Hence, ADAs can be detected with the help of ADA assays.

The pharmacokinetics segment is expected to witness the fastest CAGR over the forecast period. Pharmacokinetic services are offered in strict accordance with Good Clinical Practice (GCP) guidelines and international regulatory guidelines such as FDA, EMA, and ICH. Moreover, as part of the pharmacokinetic investigation for biologics and biosimilars in clinical trials, the concentration of a drug is tested in healthy volunteers. The ELISA or MSD platform is used for this service. ELISA is the most commonly used immunoassay with a high sensitivity for major pharmacokinetic studies. Depending on the nature and mechanism of action of drugs, the sensitivity of pharmacokinetic immunoassays should be adjusted.

Test Insights

The bioavailability segment held the largest revenue share in 2024. The segment growth can be attributed to the high demand for these services in generic drug manufacturing. The bioavailability of a drug is determined by the properties of the dosage form, which is dependent partly on its design. In addition, bioavailability studies offer significant advantages in investigating new drugs following administration and aid in establishing equivalence between early and late clinical trial formulations. This technique helps establish an equivalence between formulations used in clinical trials and stability studies. Besides, it helps ensure therapeutic equivalence between a pharmaceutically equivalent test drug and a generic or reference drug. Thus, the demand for bioavailability studies is rising with a strong demand for generic products, thereby boosting the need for bioavailability studies.

The bioequivalence segment is anticipated to register the fastest CAGR over the forecast period. It is a biopharmaceutical parameter used to assess biological equivalence using in vivo methods. This parameter becomes critical when drug manufacturers apply it to generic versions of branded pharmaceuticals.Moreover, bioequivalence studies are anticipated to gain popularity with the emergence of biosimilars during the forecast period.

Furthermore, the segment is anticipated to witness strong demand due to the growing production and consumption of generics & biosimilars. Likewise, technological advancements such as LC-MS/MS allow for detecting lower drug concentrations with greater specificity, improving the data quality. For instance, Eurofins offers a comprehensive range of bioequivalence analyses to sponsors in biopharmaceutical and pharmaceutical companies globally. The company’s bioequivalence analysis supports study design, preclinical & clinical studies, GLP/GCP compliance, in-house method development (LC/MS/MS) & validation, PK parameters calculation (WinNonlin), bioequivalence assessments, CDISC standards, and biosimilars.

Therapeutic Area Insights

Oncology accounted for a majority of revenue share in the global market in 2024. The segment is also anticipated to register the fastest CAGR during the forecast period. An increase in cancer incidence rate, a rapidly rising geriatric population, and sedentary lifestyles are primary factors expected to drive segment growth. For instance, according to the WHO, around 9.6 to 10 million people died from cancer in 2023. As per the estimates of cancer, 35 million people are likely to have cancer by 2050.

The infectious disease segment accounted for the second-highest revenue share of the total market in 2024. Rising prevalence of infectious diseases, growing initiatives to raise awareness about treatments & diagnosis of these conditions, and increasing clinical test studies for the development of the latest drugs are factors likely to propel segment growth. For instance, according to the WHO, infectious diseases are the second leading cause of death globally. It is estimated that the global population will reach 9 billion by 2050.

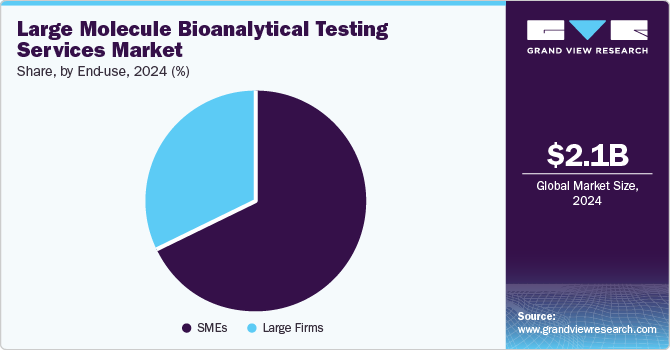

End Use Insights

The SMEs segment dominated the global market in 2024. The segment is also anticipated to grow at the fastest CAGR over the forecast timeline, retaining its market dominance. Small pharmaceutical companies are driving innovation, accounting for about 63% of all new prescription drug approvals in the past five years. A report by HBM Partners highlighted this trend by tracking NMEs or new molecular entities originally developed by small, midsized, and big pharmaceutical companies.

Large firms are anticipated to grow at a considerable CAGR over the forecasting period. Large firms are further divided into CROs & CMOs, sponsor organizations, and others. With increasing changes in the economy, larger companies examine business practices and consider every option & opportunity to manage their workflow. Large enterprises need to control & manage costs and maintain their market position while accelerating their ability to react to changing market and economic conditions.

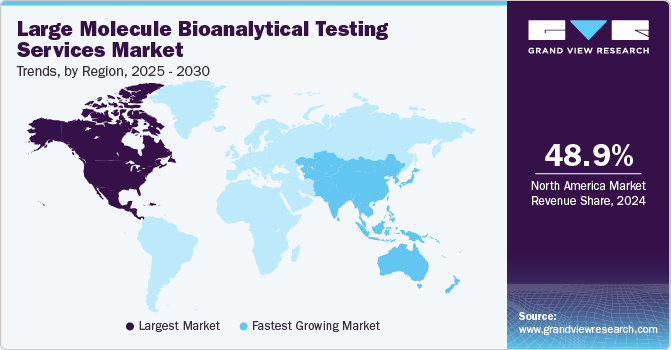

Regional Insights

North America large molecule bioanalytical testing services market dominated globally in 2024 with a revenue share of more than 48.94% as the region is among the top manufacturing hubs for highly reliable, complex, and high-end pharmaceuticals. Increasing investments by bioanalytical testing services organizations, growing R&D spending in the biopharmaceutical industry, and favorable regulatory reforms are factors contributing to market growth.

U.S. Large Molecule Bioanalytical Testing Services Market Trends

The large molecule bioanalytical testing services market in the U.S. dominated the North America market in 2024, owing to the presence of several pharmaceutical and biotechnology companies and outsourcing firms in the country. A company such as Alcami Corporation, a U.S.-based CDMO offering analytical development services, supports various therapeutic modalities varying from small molecules to biologics. Moreover, growing strategic initiatives by several academic institutions, biopharmaceutical companies, and CROs are also contributing to market growth.

The large molecule bioanalytical testing services market in Canada is owing to the high potential for R&D activities. According to the data published by Statistics Canada in September 2024, Canada has witnessed an upward trend in research and development spending in 2022, and the outsourced research and development expenditure reached USD 5.8 billion. Thus, with the increasing R&D expenditure, there is a growing need to develop new and innovative therapies.

Europe Large Molecule Bioanalytical Testing Services Market Trends

The large molecule bioanalytical testing services market in Europe is one of the leading markets globally owing to advancements in technology, an increasing number of clinical trials, and the presence of key players offering advanced analytical testing solutions. Europe has become a hub for clinical research due to its diverse patient populations and well-established regulatory frameworks. The need for proper bioanalytical testing is essential to monitor the pharmacokinetics, pharmacodynamics, and safety profiles of new drugs.

The large molecule bioanalytical testing services market in Germany accounted for the largest share of the European market in 2024, owing to the country's increasing demand for analytical testing services for complex large molecules coupled with an increasing number of biologics in the country. Furthermore, several strategic initiatives, such as expansion and mergers and acquisitions by outsourcing firms, are also driving the demand for bioanalytical testing services in the country. For instance, in May 2024, BioAgilytix partnered with BBI Solutions OEM Limited (BBI) to simplify and accelerate bioanalytical testing. The new partnership aims to offer innovative therapies to patients.

The UK large molecule bioanalytical testing services market is driven by extensive R&D initiatives and clinical trials to address the challenges of various infectious diseases. These companies often require bioanalytical testing services to assess their pharmaceutical products' safety, efficacy, and quality, contributing to market growth. Furthermore, the country's dominance in the European market is primarily attributed to the increased focus on healthcare R&D.

Asia Pacific Large Molecule Bioanalytical Testing Services Market Trends

Asia Pacific large molecule bioanalytical testing services market is projected to witness the fastest CAGR in the coming years owing to increasing pharmaceutical & biotechnology activities, rising healthcare expenditure, and increasing investments by pharmaceutical and biotechnology companies. Furthermore, key companies are opening new facilities and forming collaborations and partnerships to increase the reach of their offerings to various locations in the region. For instance, in July 2023, LabCorp announced the opening of a new kit production facility by expanding its immunotoxicology & immunology lab in China. These expanded operations will further increase China’s drug development capabilities to advance a pipeline of innovative therapies.

The large molecule bioanalytical testing services market growth in Japan is anticipated to be driven by several developments and strategic initiatives by the market players contributing to the country’s market growth. For instance, in March 2024, EPNextS Group, a provider of clinical trial solutions, entered into a collaboration agreement with Frontage Laboratories, Inc. to address the challenge of “Drug Loss” and “Drug Lag” in Japan. This will further drive the demand for bioanalytic testing, as it will help optimize dosing regimens and improve drug formulations, ultimately enhancing therapeutic efficacy.

The large molecule bioanalytical testing services market in China is owing to the strong presence of local players, low operational cost, technological advancement, and growing product development in the field of large molecules, boosting the growth of the China market. In addition, growing R&D expenditures by key players for the new products’ development have led to a rise in outsourcing trends, further fueling market growth.

India's large molecule bioanalytical testing services market is driven by low service costs, availability of industry experts, and the presence of WHO-cGMP-compliant facilities. India has become one of the most preferred sites for clinical trials due to its largest patient pool, developing healthcare sector, educated physicians, and cost competitiveness. Moreover, growing investment from overseas firms for research and development is expected to support market growth over the projected period.

Key Large Molecule Bioanalytical Testing Services Company Insights

The key market players are undertaking several strategic initiatives, such as acquisitions, partnerships, expansion, agreements, collaborations, etc., to increase market presence and gain a competitive edge, driving market growth. For instance, in August 2024, SGS introduced its new specialized bioanalytical testing services in Hudson, New Hampshire, North America. Through these services, the company provides advanced bioanalytical services to both biopharmaceutical and pharmaceutical companies.

Key Large Molecule Bioanalytical Testing Services Companies:

The following are the leading companies in the large molecule bioanalytical testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Laboratory Corporation of America Holdings

- IQVIA

- Syneos Health

- SGS SA

- WuXi AppTec

- Intertek Group plc

- Pace Analytical Services LLC

- ICON Plc

- Charles River Laboratories

- Thermo Fisher Scientific

Recent Developments

-

In July 2024, Charles River Laboratories International, Inc. collaborated with the FOXG1 Research Foundation (FRF) to accelerate drug development through the clinical phase for FOXG1 syndrome.

-

In March 2024, Pace Analytical Services announced the acquisition of Lebanon, a New Jersey laboratory facility from Curia. The acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry.

Large Molecule Bioanalytical Testing Services Market Report Scope

|

Report Attribute |

Details |

|

Market Size value in 2025 |

USD 2.34 billion |

|

Revenue forecast in 2030 |

USD 3.70 billion |

|

Growth Rate |

CAGR 9.63% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Phase, type, test, therapeutic area, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; Japan; China; Thailand; South Korea; Australia; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Key companies profiled |

Laboratory Corporation of America Holdings, IQVIA, Syneos Health, SGS SA, WuXi AppTec, Intertek Group plc, Pace Analytical Services LLC, ICON Plc,Charles River Laboratories, Thermo Fisher Scientific |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of customization. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Large Molecule Bioanalytical Testing Services Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018-2030. For this study, Grand View Research has segmented the global large molecule bioanalytical testing services market based on phase, test, type, therapeutic area, end use, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

With Antibody

-

Without Antibody (ELISA Based Assay)

-

-

Clinical

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacokinetics

-

ADA

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

ADME

-

PD

-

Bioavailability

-

Bioequivalence

-

Other Tests

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Cardiology

-

Neurology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

CROs & CMOs

-

Sponsor Organizations

-

Others

-

-

Large Firms

-

CROs & CMOs

-

Sponsor Organizations

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global large molecule bioanalytical testing services market size was estimated at USD 2.13 billion in 2024 and is expected to reach USD 2.34 billion in 2025.

b. The global large molecule bioanalytical testing services market is expected to grow at a compound annual growth rate of 9.63% from 2025 to 2030 to reach USD 3.70 billion by 2030.

b. North America dominated the global large molecule bioanalytical testing services market with a share of 48.94% in 2024. This is attributable to the increasing focus on bioanalytical testing, growing R&D expenditure, and technological advancements in analytical testing.

b. Some key players operating in the global large molecule bioanalytical testing services market include Laboratory Corporation of America Holdings, IQVIA, Syneos Health, SGS SA, WuXi AppTec, Intertek Group plc, Pace Analytical Services LLC, ICON Plc, Charles River Laboratories, Thermo Fisher Scientific, etc.

b. Key factors that are driving the large molecule bioanalytical testing services market growth include increasing demand for bioanalytical testing services, growing R&D expenditure, and increasing cases of chronic diseases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."