- Home

- »

- Next Generation Technologies

- »

-

Large Language Models Market Size, Industry Report, 2030GVR Report cover

![Large Language Models Market Size, Share & Trends Report]()

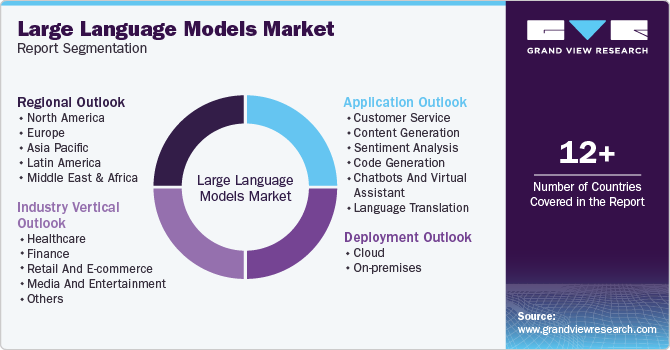

Large Language Models Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Customer Service, Content Generation), By Deployment (Cloud, On premise), By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-186-2

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Large Language Models Market Summary

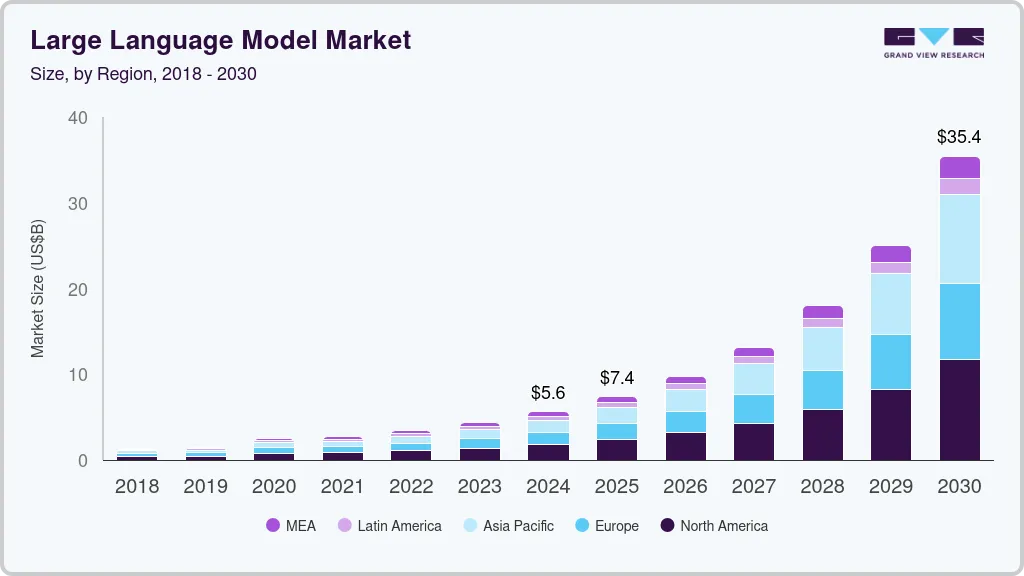

The global large language models market size was estimated at USD 5,617.4 million in 2024 and is projected to reach USD 35,434.4 million by 2030, growing at a CAGR of 36.9% from 2025 to 2030. The integration of a zero human intervention feature in training systems is a driving force behind the acceleration of the large language models industry.

Key Market Trends & Insights

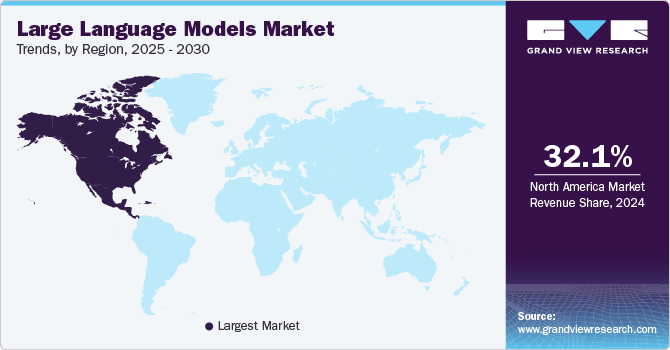

- North America dominated the large language models market with the largest revenue share of 32.1% in 2024.

- The large language models market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on application, the chatbots and virtual assistant segment led the market with the largest revenue share of 26.8% in 2024.

- Based on deployment, the on-premise segment accounted for the largest market revenue share in 2024.

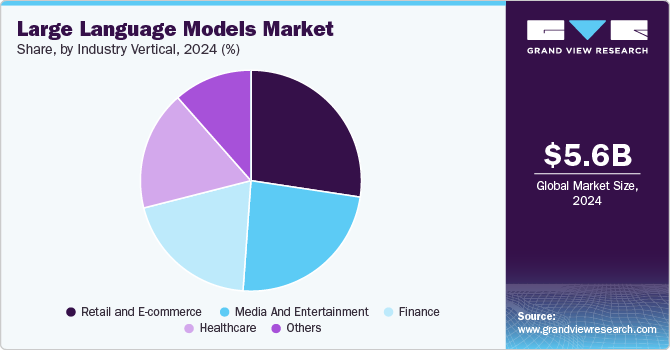

- Based on industry vertical, the retail and e-commerce segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,617.4 Million

- 2030 Projected Market Size: USD 35,434.4 Million

- CAGR (2025-2030): 36.9%

- North America: Largest market in 2024

This capability increases efficiency by enabling models to autonomously learn and adapt without continual manual oversight, significantly reducing time and resource demands. It promotes scalability, enabling LLMs to accommodate expanding data volumes and workloads effortlessly. For instance, in June 2023, Databricks, Inc., a software company headquartered in the U.S., completed a USD 1.3 billion acquisition of MosaicMLL, a U.S.-based provider specializing in large language models and model-training software. This strategic move aims to enhance Databricks' generative AI capabilities. Databricks plans to integrate MosaicMLL's models, training, and inference capabilities into its lakehouse platform, empowering enterprises to create generative AI applications.

The emerging trend in the LLM market is the development of models customized for specific industries or scientific domains, such as Earth science and astrophysics. These specialized models are designed to process complex, domain-specific data more effectively. Consequently, organizations can achieve higher accuracy in tasks such as data analysis, research, and decision-making within their respective fields. For instance, in June 2024, NASA, an independent agency of the US federal government, and IBM Corporation collaborated to develop INDUS, a suite of large language models (LLMs) customized for five key scientific domains, including Earth science and astrophysics. The models, designed for improved performance in scientific tasks such as question-answering and data retrieval, feature a custom vocabulary and domain-specific training, enhancing their ability to process complex scientific data and assist researchers in accessing valuable insights.

Techniques such as transfer learning and self-supervised learning have significantly advanced Large Language Models (LLMs), allowing them to utilize pre-trained knowledge and adapt to new tasks more effectively. Moreover, breakthroughs in hardware, particularly GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units) have accelerated both training and inference processes, enabling the handling of larger, more complex models. These advancements have enhanced LLMs' performance by improving contextual understanding, memory handling, and training efficiency. Consequently, companies such as OpenAI, Google LLC, and Microsoft are increasingly adopting these models to boost operational efficiency, gain a competitive advantage, and ensure long-term financial sustainability in their respective industries.

The vast availability of internet data has significantly driven the growth of the large language models (LLM) industry. This extensive data serves as a key resource, allowing LLMs to learn from a wide variety of sources, resulting in improved performance and adaptability. With access to such rich information, LLMs can develop a better understanding of context, enhance language comprehension, and improve their capabilities in diverse language-related tasks. The abundance of data fuels continuous advancements in LLM technology, expanding their applications across various industries and accelerating their adoption in the market.

Application Insights

Based on application, the chatbots and virtual assistant segment led the market with the largest revenue share of 26.8% in 2024. The ability to easily integrate AI into apps enables the creation of more personalized chatbots and virtual assistants. These AI-powered solutions help businesses automate customer support, sales, and other services, driving efficiency. Consequently, companies can offer seamless and interactive experiences, improving customer engagement and satisfaction. For instance, in July 2023, Google Cloud launched Conversational AI on Gen App Builder, a platform that enables developers, even without ML experience, to create AI-powered chatbots and virtual assistants for tasks such as customer support, automation, and personalized services. The tool streamlines generative AI integration, enabling faster implementation of natural interactions and ensuring security and reliability.

The customer service segment is expected to experience at a significant CAGR over the forecast period, driven by advancements in LLM technology. LLMs offer scalable solutions, allowing businesses to handle multiple customer queries simultaneously without the need for proportional resource expansion. This scalability ensures that businesses can efficiently accommodate fluctuating demands without compromising on service quality. Moreover, LLMs provide consistent and accurate responses, helping maintain brand identity and uniformity in customer interactions. By automating routine tasks, LLMs enable human agents to focus on more complex customer needs, ultimately enhancing the overall quality of service delivery.

Deployment Insights

Based on deployment, the on-premise segment accounted for the largest market revenue share in 2024, driven by businesses' need for greater control over their data and security. With sensitive customer information at stake, many companies prefer on-premise solutions to ensure strict data governance and compliance with regulatory requirements. These solutions also offer more flexibility for customization, enabling organizations to customize the system to their specific needs. Moreover, on-premise deployments provide faster processing speeds, as data does not need to be transmitted over the internet. The on-premise segment is poised to maintain strong growth as organizations continue prioritizing security and performance.

The cloud segment is experiencing rapid growth. Cloud-based LLM solutions offer scalability, enabling businesses to easily adjust resources according to demand. This flexibility, combined with a pay-as-you-go pricing model, makes it cost-effective for companies to optimize expenses. The cloud segment is further driven by its ability to support global collaboration and remote access, allowing businesses to utilize the power of AI across borders. As more companies adopt cloud infrastructure, it is expected to continue dominating the market, offering enhanced performance and security features.

Industry Vertical Insights

Based on industry vertical, the retail and e-commerce segment accounted for the largest market revenue share in 2024. In the LLM market, the retail and e-commerce sectors are using AI to deliver personalized recommendations and improve product search experiences. LLMs enhance customer support through chatbots and virtual assistants that manage inquiries, process orders, and provide real-time help, reducing costs. AI-driven content generation also aids in creating product descriptions, reviews, and marketing materials more efficiently. As consumer demand for seamless shopping and automation increases, LLMs are becoming integral in optimizing retail and e-commerce processes.

In the media and entertainment sector, LLMs are transforming content creation by generating scripts, articles, and social media posts, speeding up production processes. They enhance customer engagement by providing personalized content recommendations, improving user experience on platforms such as streaming services. LLMs also assist in automating content moderation, ensuring compliance with community guidelines, and filtering harmful content. As demand for diverse and high-quality content grows, LLMs are becoming an essential tool for innovation and efficiency in media and entertainment.

Regional Insights

North America dominated the large language models market with the largest revenue share of 32.1% in 2024, driven by its advanced technology infrastructure and the presence of major AI-focused companies. The region’s continuous investments in AI innovation and research fuel widespread adoption across industries, including finance, healthcare, and retail. Governments and private organizations are also heavily backing AI research and development, further accelerating the growth of LLMs.

U.S. Large Language Models Market Trends

The large language models market in the U.S. accounted for the largest market revenue share in North America in 2024. The U.S. is a central hub for large language model innovation, with tech giants such as Google LLC, Microsoft, and OpenAI pushing the boundaries of AI research. Its vast and varied industries, from finance to healthcare, are increasingly adopting LLMs to improve efficiency, automate processes, and enhance customer experiences. The government’s regulatory framework and investments in AI infrastructure ensure a conducive environment for LLM growth.

Europe Large Language Models Market Trends

The large language models market in Europe is emerging as a strong player, with countries such as the UK, Germany, and France focusing on integrating AI into various sectors. The European Union's focus on data privacy and AI ethics also shapes the market’s development and adoption. European businesses are utilizing LLMs to streamline operations and improve customer experiences across industries such as manufacturing, retail, and healthcare. The region’s growing emphasis on digital transformation is expected to drive further LLM advancements in the coming years.

Asia Pacific Large Language Models Market Trends

The large language models market in Asia Pacific is rapidly advancing in the LLM industry, with countries such as China, Japan, and India investing heavily in AI technologies. China, in particular, is focusing on becoming a global AI leader, with significant resources directed towards AI research and LLM integration. Japan is utilizing LLMs to improve automation in industries such as robotics and manufacturing. Meanwhile, India’s expanding tech sector and increasing adoption of LLMs for customer service and education are also contributing to the region’s strong growth trajectory.

Key Large Language Models Company Insights

Some of the key companies in the large language models industry include Alibaba Group Holding Limited, Amazon.com, Inc., Baidu, Inc. and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Alibaba Group Holding Limited is heavily investing in LLMs to enhance its e-commerce, cloud computing, and AI capabilities. The company has developed its own AI models, such as AliMe, which improve customer service and shopping experiences on its platforms. Alibaba's LLMs are also being integrated into its cloud services to offer scalable AI solutions to businesses. The company's focus is on creating more intelligent, efficient tools for both consumer-facing and enterprise applications.

-

Amazon.com, Inc. has integrated LLMs into its retail, cloud services, and virtual assistant technologies, such as Alexa. Its AWS cloud division offers tools for businesses to build and deploy LLM-based applications, enabling innovation across various sectors. Amazon's focus is on using LLMs to improve product recommendations, customer service, and logistics. The company is continually evolving its AI capabilities to create smarter, more personalized shopping experiences for consumers.

Key Large Language Models Companies:

The following are the leading companies in the large language models market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Baidu, Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- Meta Platforms, Inc.

- Microsoft

- OpenAI LP

- Tencent Holdings Limited

- Yandex NV

Recent Developments

-

In April 2024, Microsoft collaborated with G42, an artificial intelligence company in UAE, focusing on accelerating AI innovation, expanding digital access, and supporting AI workforce development in the UAE and surrounding regions. As part of this collaboration, G42’s Arabic LLM, Jais, will be available in the Azure AI Model Catalog, providing generative AI access to over 400 million Arabic speakers.

-

In December 2023, Google LLC launched VideoPoet, a versatile multimodal LLM that generates videos from text, images, and audio, showcasing unprecedented video generation capabilities. This model employs a decoder-only architecture and a two-step training process, enabling it to produce content for tasks beyond its specific training.

-

In September 2022, Meta Platforms, Inc., a U.S.-based technology company, collaborated with Microsoft to introduce Llama 2, a Large Language Models, marking an extension of their artificial intelligence partnership. The objective behind Llama 2 is to present a high-performing Large Language Models (LLM) that excels across diverse domains, serving both research and commercial needs while establishing competition with established LLMs.

Large Language Models Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,357.8 million

Revenue forecast in 2030

USD 35,434.4 million

Growth rate

CAGR of 36.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Application, deployment, industry vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Alibaba Group Holding Limited; Amazon. com Inc; Baidu Inc; Google LLC; Huawei Technologies Co Ltd; Meta Platforms Inc; Microsoft; OpenAI LP; Tencent Holdings Limited; Yandex NV

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Large Language Models Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global large language models market report based on the application, deployment, industry vertical and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Customer Service

-

Content Generation

-

Sentiment Analysis

-

Code Generation

-

Chatbots And Virtual Assistant

-

Language Translation

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Finance

-

Retail And E-commerce

-

Media And Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global large language model market size was estimated at USD 5,617.4 million in 2024 and is expected to reach USD 7,357.8 million in 2025.

b. The global large language model market is expected to grow at a compound annual growth rate of 36.9% from 2025 to 2030 to reach USD 35,434.4 million by 2030.

b. North America dominated the large language model market with a share of 32% in 2024. The drive to enhance customer experiences through AI-driven language models significantly fuels the ongoing development and adoption of these technologies across various consumer-focused industries in North America.

b. Some key players operating in the Large Language Models (LLM) market include Alibaba Group Holding Limited; Amazon.com Inc; Baidu Inc; Google LLC; Huawei Technologies Co Ltd; Meta Platforms Inc; Microsoft Corporation; OpenAI LP; Tencent Holdings Limited; Yandex NV.

b. Key factors that are driving the market growth include ongoing advancements in AI, particularly in deep learning architectures and natural language processing (NLP) algorithms, and increasing requirements in various industries for AI applications centered around language.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.