Large Format Printer Market Size, Share & Trends Analysis Report By Technology, By Ink Type, By Printing Material, By Connectivity (Wired, Wireless), By Print Width, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Large Format Printer Market Size & Trends

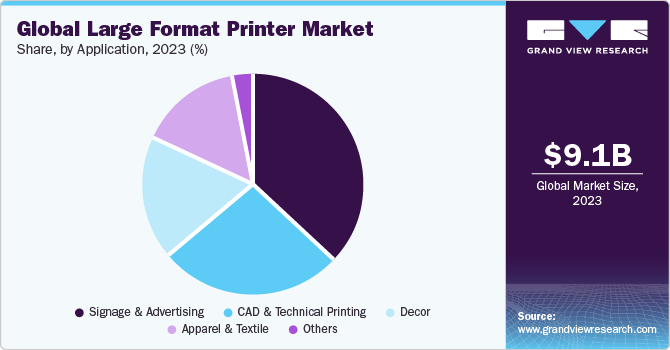

The global large format printer market size was estimated at USD 9.11 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The increasing demand for high-quality graphics and signage across various industries, such as advertising, retail, and construction, fuels the adoption of LFPs for large-scale printing tasks. In addition, advancements in printing technology, including improved ink formulations, faster printing speeds, and enhanced color accuracy, are driving upgrades and replacements of existing equipment.

The increasing popularity of dye-sublimation printing technology contributes to the rising adoption of large format printers. Dye-sublimation printing provides high-quality and long-lasting prints with vivid colors applicable to textiles, soft signage, and promotional materials. The growing demand for personalized and customized products, particularly in the apparel and home decor industries, is driving the adoption of dye-sublimation printers due to their ability to produce intricate designs and photo-realistic images on different substrates.

The rise of e-commerce created a need for visually appealing and customized packaging that enhances brand visibility and customer experience. Large format printers are critical in producing high-quality packaging materials such as corrugated boxes, folding cartons, and labels with vibrant graphics and intricate designs. Moreover, the shift towards sustainable packaging solutions encourages manufacturers to invest in large format printers capable of printing on eco-friendly substrates such as recycled paper and biodegradable materials. Moreover, the trend towards mass customization and shorter print in the packaging industry is driving the adoption of digital printing technologies, including large format printers, to meet the evolving needs of brand owners and consumers. Therefore, the packaging industry's reliance on large format printing solutions drives the market's growth.

The substantial cost of purchasing LFPs and expenses related to ink, media, and maintenance hinder small and medium-sized businesses from investing in these printing solutions. Moreover, the rapid pace of technological advancements in the printing industry necessitates frequent upgrades and updates to stay competitive, further increasing the total cost of ownership, thus restraining the market growth.

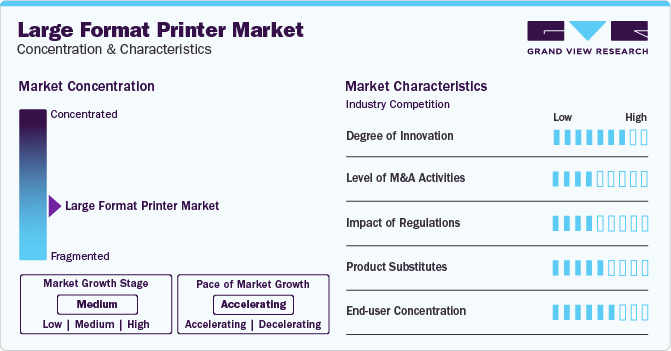

Market Concentration & Characteristics

The large format printer market growth stage is medium and the pace of growth is accelerating. The market is characterized by a constant push for innovation, driven by evolving customer demands for higher print quality, faster production speeds, and increased substrate compatibility. The market indicates a trend toward digitalization as businesses increasingly shift from traditional analog printing methods to digital large-format printing technologies for enhanced flexibility, customization, and efficiency.

The industry is significantly fragmented in nature, featuring several global and regional players. Merger and acquisition activities are rising due to the need for technology integration and innovation as companies seek to enhance capabilities and stay competitive. In addition, strategic partnerships and acquisitions enabled companies to access new markets, distribution channels, and customer segments, facilitating geographic expansion and market penetration. For instance, in April 2022, Canon acquired Edale, a packaging-converting equipment manufacturer. This acquisition is aimed to strengthen Canon's label and packaging products and create development opportunities. The deal is part of Canon's long-term strategy to provide turn-key solutions for the packaging and label sectors and to allow Canon production printing to enhance the LabelStream 4000 product line.

The emergence and integration of 3D printing technology represent a significant innovation reshaping the industry landscape. 3D printing enables the creation of three-dimensional objects layer-by-layer, offering unparalleled versatility and customization capabilities for large-format printing applications. With the ability to produce intricate prototypes, architectural models, signage, and functional parts with various materials ranging from plastics to metals, 3D printing expands the scope of possibilities across diverse industries.

The large-format printer (LFP) market exhibits a notable concentration of end-use industries, showing diverse applications and widespread adoption of large-format printing solutions across various sectors. Industries such as advertising, signage, and retail prominently utilize LFPs to produce banners, posters, and point-of-sale displays to enhance brand visibility and attract customers.

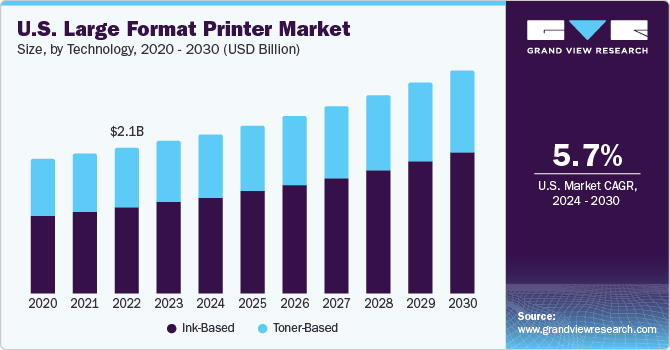

Technology Insights

The ink-based segment accounted for the highest revenue share of 61.3% in 2023 due to advancements in ink technology and expanding application opportunities. The growing demand for customization and personalization in marketing and branding efforts further boosts the adoption of ink-based large-format printing solutions, enabling businesses to create new and engaging visual displays.

The toner-based segment is anticipated to witness significant growth during the forecast period. The increasing trend towards in-house printing and production capabilities among businesses drives demand for adaptable toner-based systems that can efficiently handle a wide range of print jobs. In addition, new market opportunities, such as interior decor printing, including wallpaper, canvas prints, and wall decals, offer a significant growth opportunity for toner-based LFPs due to their ability to deliver durable prints on various substrates.

Ink Type Insights

The solvent ink segment accounted for the largest revenue share in 2023. The growth is driven by its compatibility with environments requiring stringent safety standards, such as hospitals and schools. Unlike other printing technologies, solvent-based inks emit minimal volatile organic compounds (VOCs) during printing, making them safe for indoor environments with sensitive populations. For instance, in January 2023, MUTOH America launched the XpertJet 1682SR Pro, an Eco-Solvent printer with dual-stage AccuFine HD printheads that can print up to 89% faster than the previous model. It uses MUTOH MS41 UL GREENGUARD Gold Certified Eco-Solvent ink, making it safe for use in sensitive areas such as schools and hospitals.

The UV-cured ink segment is expected to grow at the fastest CAGR over the forecast period. It is used for printing on various substrates, including non-traditional materials such as glass, ceramics, and metal, expanding the scope of applications. It enables businesses to offer unique and customized print products to meet the needs of various industries, including interior design, retail displays, and industrial applications.

Printing Material Insights

The porous printing materials segment accounted for the highest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. New printing technologies such as UV-curable inkjet printing, dye-sublimation printing, and latex printing provide high-quality prints on porous materials with improved speed and efficiency. These advancements have made large-format printing more accessible and affordable, increasing demand for porous materials.

The non-porous materials segment is anticipated to witness significant growth during the forecast period due to the increasing demand for digital signage. Digital signage is becoming increasingly popular in various industries, such as retail, hospitality, and transportation. These signs are made using non-porous materials such as vinyl and plastic, which are suitable for businesses requiring eye-catching displays that can withstand the elements.

Connectivity Insights

The wired connectivity segment accounted for the highest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The need for high-speed and reliable data transfer capabilities fuels the demand for wired LFPs, particularly in environments where stability and security are vital, such as enterprise settings and production facilities. Advancements in wired connectivity technologies, such as Gigabit Ethernet and USB 3.0, further enhance the performance and efficiency of wired LFPs.

The wireless segment is anticipated to witness significant growth during the forecast period due to the development of cloud-based printing services and mobile applications, further enhancing the accessibility and usability of wireless LFPs and enabling remote printing and collaboration with an internet connection. For instance, in April 2021, HP Inc. announced a new product called HP+. This cloud-based ecosystem is designed for both consumers and small businesses. HP+ aims to provide a more sustainable, secure, and productive printing model suitable for the hybrid work environment. The company's vision is to enable customers to print from anywhere and anytime with an efficient and flexible printing experience.

Print Width Insights

The 24" - 36” print width segment accounted for the highest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The growing demand for mid-sized printing capabilities for a wide range of applications, including architectural drawings, engineering designs, GIS maps, posters, and signage, is driving the growth of the segment in the market.

Advancements in print head technology, ink formulations, and workflow automation enhance the efficiency and print quality of mid-sized LFPs and drive adoption across diverse industries. For instance, in July 2023, Scrona, a Swiss inkjet manufacturer, announced that it would make its electrostatic print head technology scalable by utilizing MEMS microfabrication. The advancement allows many nozzles to work in a small area, increasing high-volume manufacturing capabilities. Scrona's electrostatic inkjet printing uses electric forces, significantly improving efficiency. The technology prints a broader range of materials, including highly viscous inks, with resolutions as low as 0.5µm.

The 36"- 44” segment is anticipated to grow significantly during the forecast period. The demand for large format printing solutions with 36"- 44” print widths is driven by specific industry requirements, such as detailed architectural plans, engineering drawings, and GIS maps in the architecture, engineering, and construction sectors. These industries rely heavily on accurate and high-quality prints for design reviews, client presentations, and project documentation, thus driving the adoption.

Application Insights

The signage and advertising segment accounted for the largest revenue share in 2023 due to the increasing demand for visually appealing and high-quality prints for advertising purposes. The growing trend towards digitalization and customization in marketing strategies contributes to the expansion of this segment, as businesses seek versatile printing solutions capable of accommodating variable data printing, short print runs, and personalized advertising campaigns.

The CAD & technical printing segment is anticipated to grow significantly during the forecast period. Educational institutions, vocational schools, and training centers rely on large format printers for producing educational materials, technical diagrams, and teaching aids for students pursuing careers in architecture, engineering, and design. The CAD & technical printing cater to specific educational settings by offering printers tailored for producing detailed technical prints and schematics, supporting hands-on learning and skill development.

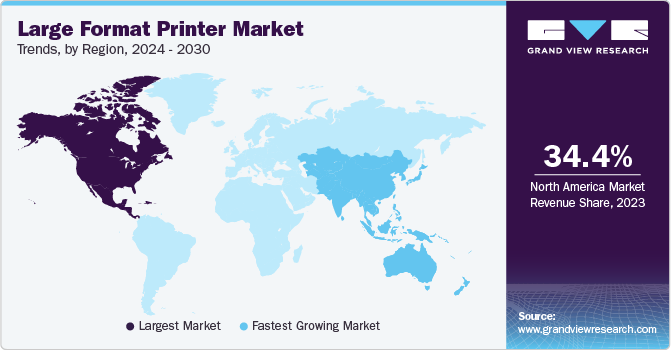

Regional Insights

North America dominated the market with a revenue share of 34.4% in 2023 due to the increasing investments in infrastructure projects, construction, and advertising across various industries. Moreover, the region's growing retail sector and rising trend towards personalized and immersive customer experiences fuel the adoption of LFPs for producing eye-catching signage, displays, and promotional materials.

U.S. Large Format Printer Market Trends

The U.S. accounted for a market share of 24.2% in the global large format printer in 2023. The rapid expansion of the digital out-of-home (DOOH) advertising sector drives demand for large format printing solutions. With advertisers increasingly using large format prints for billboards, transit displays, and building wraps to capture consumer attention, the demand for LFPs in the U.S. is rising. Moreover, the versatility of LFPs in creating dynamic and compelling advertising displays, coupled with advancements in printing technology, plays a crucial role in captivating audiences in high-traffic areas throughout the country. For instance, according to the Outdoor Advertising Association of America (OAAA), 71% of drivers often look at billboards while driving, demonstrating the potential for large format print ads to capture the attention of individuals on the road.

Asia Pacific Large Format Printer Market Trends

The Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period due to the growth of the textile industry, particularly in signage, textile printing, and apparel manufacturing. Countries such as China, India, Bangladesh, and Vietnam are major textile-producing countries in the global textile market, with a significant portion of their production exported worldwide. Textile manufacturers and garment producers are increasingly adopting large format printers equipped with textile printing capabilities to create customized designs, fabric banners, and soft signage. The increasing demand for personalized textile products is driving market growth in the region.

The China large format printer market is expected to grow significantly over the forecast period owing to the country's large and increasing textile production capacity. For instance, according to the World Trade Statistical Review 2023, China dominates the global apparel trade with a 31.7% market share, while Bangladesh comes in second with only 7.9%. It highlights China's significant control and influence in the apparel industry's supply chain.

The large format printer market in India is expected to grow at the fastest CAGR over the forecast period. The government's initiatives promoting digitalization and adopting advanced technologies in various sectors drive the demand for large format printing solutions in India. Initiatives such as Make in India, Digital India, and Smart Cities Mission create opportunities for businesses to invest in modern printing technologies to enhance productivity, efficiency, and innovation. Large format printers equipped with advanced features such as UV-curable inks, eco-friendly printing solutions, and wireless connectivity cater to the evolving needs of industries adopting digital transformation, thus driving market growth.

Latin America Large Format Printer Market Trends

The increasing adoption of wide-format printers in the textile and apparel industry contributes to market growth in Latin America. Textile manufacturers, garment producers, and printing service providers utilize large format printers to print fabrics, textiles, and apparel items, including T-shirts, banners, flags, and promotional merchandise. Large format printers' versatility and customization capabilities enable businesses to meet the growing demand for personalized and on-demand printing solutions in the textile and apparel market.

Key Large Format Printer Company Insights

Some of the key players operating in the market includeCanon Inc.; HP Development Company, L.P.; and Ricoh.

-

Canon Inc. produces imaging and optical products. Its portfolio includes cameras, camcorders, printers, scanners (MFDs), laser beam printers, inkjet printers, steppers, and medical equipment. Canon products include the EOS series of digital cameras, Canon Pixma printers, and image RUNNER ADVANCE multifunction devices.

-

H.P. Development Company, L.P. manufactures large-format printers, including the HP DesignJet series. These printers are designed for architecture, engineering, construction, and GIS professionals who require precise plans, technical drawings, maps, orthophotos, and renders. H.P.'s plotter portfolio offers solutions that deliver seamless plotting for professionals adapting to hybrid workflows.

-

Ricoh offers various products and services, including imaging equipment, office automation solutions, and digital printing technologies. The Ricoh Pro L5160 latex printer uses 2nd generation aqueous resin latex ink and long-life stainless steel printheads to deliver durable, touch-dry prints at high speeds.

Key Large Format Printer Companies:

The following are the leading companies in the large format printer market. These companies collectively hold the largest market share and dictate industry trends.

- ARC Document Solutions, LLC

- Canon Inc.

- Dover Corporation

- Durst Group AG

- Electronics For Imaging, Inc

- HP Development Company, L.P.

- Konica Minolta Holdings, Inc.

- MIMAKI ENGINEERING CO., LTD.

- Mutoh

- Ricoh

Recent Developments

-

In January 2024, Canon launched its new large-format imagePROGRAF printer range, which includes three new inkjet models: the 44-inch PRO-4600, the 60-inch PRO-6600, and the 24-inch PRO-2600. These printers are designed for fine art and photography enthusiasts and equipped with Canon's latest Lucia Pro II pigment ink. The ink is developed to enhance image quality further than previous models and offers improved black density on art paper.

-

In September 2023, H.P. Development Company, L.P., launched the H.P. Latex 630 printer series to complete its Latex range and make white ink technology available to print service providers of all sizes. The Latex 630-series allows users to offer sustainable printing services with water-based latex inks with minimum odors or chemicals and environmental certifications.

-

In April 2023, Dover Corporation announced the launch of the 9750+ continuous inkjet (CIJ) printer, the first to use dye inks and pigment for marking and coding. This innovative product will help Markem-Imaje's customers reduce inventory needs and costs.

Large Format Printer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.48 billion |

|

Revenue forecast in 2030 |

USD 12.70 billion |

|

Growth rate |

CAGR of 5.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, ink type, printing material, connectivity, print width, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; KSA; South Africa |

|

Key companies profiled |

ARC Document Solutions, LLC; Canon Inc.; Dover Corporation; Durst Group AG; Electronics For Imaging, Inc.; HP Development Company, L.P.; Konica Minolta Holdings, Inc.; MIMAKI ENGINEERING CO., LTD.; Mutoh; Ricoh |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Large Format Printer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global large format printer marketreport based on technology, ink type, printing material, connectivity, print width, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Ink-Based

-

Toner-Based

-

-

Ink Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Aqueous Ink

-

Solvent Ink

-

UV Cured Ink

-

Latex Ink

-

Dye Sublimation Ink

-

-

Printing Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Porous Materials

-

Non-porous Materials

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Print Width Outlook (Revenue, USD Million, 2017 - 2030)

-

17”- 24”

-

24”- 36”

-

36”- 44”

-

44”- 60”

-

60”- 72”

-

72” and above

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Apparel & Textile

-

Signage & Advertising

-

Decor

-

CAD & Technical Printing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global large format printer market size was estimated at USD 9.11 billion in 2023 and is expected to reach USD 9.48 billion in 2024

b. The global large format printer market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 12.70 billion by 2030

b. North America dominated the market, with a revenue share of 34.4% in 2023, due to increasing investments in infrastructure projects, construction, and advertising across various industries.

b. Some key players operating in the large format printer market include ARC Document Solutions, LLC, Canon Inc., Dover Corporation, Durst Group AG, Electronics For Imaging, Inc., HP Development Company, L.P., Konica Minolta Holdings, Inc., MIMAKI ENGINEERING CO., LTD., Mutoh, Ricoh, Roland, Seiko Epson Corporation, Xerox Corporation

b. Factors such as increasing demand from packaging, advertising, and textile industries and on-going advancements in printer and ink-related technologies are driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."