Laparoscopic Devices Market Size, Share & Trends Analysis Report By Product (Laparoscopes, Energy Systems, Trocars), By Application (Bariatric Surgery, Urological Surgery), By End-use (Hospital, Clinic), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-306-5

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Laparoscopic Devices Market Size & Trends

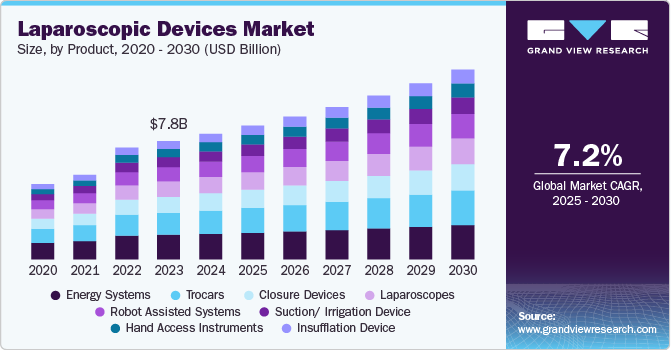

The global laparoscopic devices market size was valued at USD 8.3 billion in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The laparoscopic devices market is experiencing significant growth, driven by several key factors. Increasing demand for minimally invasive surgical procedures, which offer reduced recovery times and lower postoperative pain, is a primary driver. Advancements in technology, such as improved imaging systems and enhanced surgical instruments, are further propelling market expansion. The growing prevalence of conditions requiring laparoscopic interventions, such as obesity and gastrointestinal disorders, contributes to rising procedure volumes.

In recent times, laparoscopic surgery is preferred more than conventional ones owing to its numerous benefits, such as shorter hospital stay, decreased blood loss, and lower patient morbidity of laparoscopy, as well as offering quick recovery time, rapid and successful outcomes, low risk of infection, small or no incision and less pain. Since the demand for laparoscopic surgery is significantly increasing, the demand for laparoscopic devices is likely to also grow during the forecast period. The factors driving the growth of the market are the increasing number of patients suffering from health issues such as uterine fibroids, and endometriosis, the rising number of hysterectomy and myomectomy procedures, and growing awareness about the improving healthcare infrastructure in emerging economies.

Key players are looking to expand their operations regionally by establishing new warehouses in various locations and utilizing multiple channels in the hardest-hit areas. Companies are implementing different strategies to address supply chain disruptions, such as rerouting logistics, sourcing from additional partners, and utilizing air freight. In July 2024, Amber Therapeutics, a start-up associated with the University of Oxford, raised USD100 million in Series A funding to develop Amber-UI, an innovative implantable therapy for mixed urinary incontinence (MUI). This device targets the pudendal nerve through a minimally invasive procedure, representing a significant advancement in treatment. The funding will aid its development and clinical trials as it seeks U.S. regulatory approval.

The rising prevalence of obesity as a chronic disease is critical for the laparoscopic device market. With obesity linked to serious health issues like type 2 diabetes, heart disease, and certain cancers, there's an increasing demand for surgical interventions, particularly laparoscopic bariatric surgery. For instance, in May 2024, Advanced Laparoscopic Surgeons of Morris partnered with the New York Bariatric Group (NYBG), a top provider of bariatric services. This collaboration aims to enhance access to advanced surgical techniques and patient care, with new offices in Edison and Florham Park, NJ, increasing NYBG's presence to 30 locations in the tri-state area. As healthcare providers seek effective solutions to manage obesity and its associated risks, laparoscopic procedures are favored due to their minimally invasive nature, shorter recovery times, and improved patient outcomes. The need for effective weight management solutions is driving innovations and investments in laparoscopic technologies, contributing to market growth. Enhanced diagnostic measures like BMI and waist circumference assessments further facilitate early interventions, emphasizing the importance of laparoscopic devices in obesity treatment.

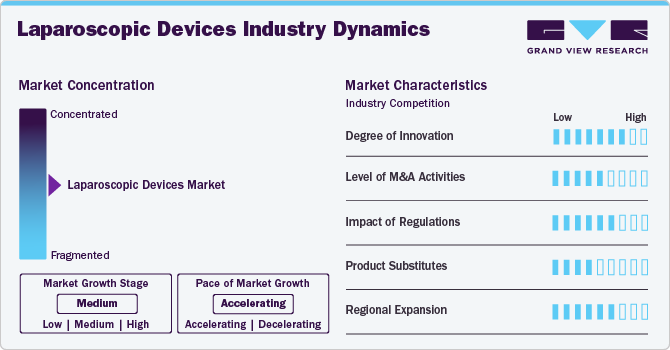

Market Concentration & Characteristics

The laparoscopic devices industry is characterized by moderate to high concentration, with several key players such as Karl Storz SE & CO. Kg, Medtronic, Olympus Corporation, and others dominating the market. Established manufacturers often lead in innovation, quality, and market share, while new entrants focus on niche products and technological advancements. The industry encompasses various devices, including cameras, instruments, and access systems, catering to minimally invasive procedures. Regulatory compliance is crucial, impacting product development and market entry. Additionally, increasing demand for minimally invasive surgeries and advancements in surgical technologies drive competitive dynamics, prompting continuous innovation and collaboration among industry stakeholders to enhance patient outcomes and operational efficiency.

The laparoscopic devices industry witnessed a notable innovation when UC Davis Health adopted ConMed's AirSeal System in November 2022, establishing low-pressure insufflation as the standard for all laparoscopic surgeries. This initiative makes UC Davis the first multi-site health system in the U.S. to implement this method, which enhances patient comfort and improves surgical outcomes. Such advancements highlight the industry's commitment to adopting cutting-edge technologies that prioritize patient well-being while optimizing surgical procedures.

Regulations play a crucial role in the laparoscopic devices industry, ensuring the safety, efficacy, and quality of surgical instruments. Regulatory bodies, such as the FDA and EMA, impose stringent requirements for device approval, necessitating comprehensive clinical trials and thorough documentation. Compliance with these regulations can increase development costs and timelines but ultimately fosters consumer trust and drives innovation. Additionally, evolving regulatory standards encourage manufacturers to invest in advanced technologies and improve product designs. This regulatory landscape shapes market dynamics, influencing competition and market entry, while ensuring that laparoscopic devices meet the highest safety and performance standards.

Mergers and acquisitions in the laparoscopic devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in June 2024, Karl Storz SE & CO. entered into a merger agreement with Asensus Surgical to expand its surgical robotics division. Asensus will become a subsidiary of KARL STORZ Endoscopy-America after the deal is finalized in the third quarter of 2024. This move strengthens KARL STORZ's presence in the robotics space, enhancing its innovation capabilities.

In the laparoscopic devices industry, product substitutes can significantly influence market dynamics. Alternatives such as traditional open surgery may be considered for certain procedures, particularly when laparoscopic techniques are not feasible or when surgeons prefer conventional methods. Additionally, advancements in non-invasive technologies, such as endoscopic and robotic-assisted surgeries, present viable substitutes that can enhance surgical precision and reduce recovery times. Furthermore, emerging innovations in imaging and diagnostic tools may also compete with traditional laparoscopic devices. As these alternatives gain traction, they prompt manufacturers to continually innovate and improve their laparoscopic offerings to maintain a competitive edge in the market.

The laparoscopic devices industry is witnessing significant regional expansion, driven by increasing healthcare demands and advancements in surgical techniques. Emerging markets in Asia-Pacific and Latin America are experiencing rapid growth due to rising investments in healthcare infrastructure and a growing number of surgical procedures. For instance, in May 2024, B. Braun Melsungen AG has opened a new factory in Switzerland, expanding its production capabilities for advanced medical devices. The facility is designed to enhance efficiency and quality in manufacturing, aligning with the company’s commitment to innovation in the healthcare sector. This expansion reflects B. Braun’s growth strategy in the MedTech industry.

Product Insights

Based on type, the energy systems segment held the largest market share accounting around 20.3% in 2024. Increasing incidence of obesity and urological diseases is expected to contribute to market growth. These systems have wide applications in bariatric surgeries, such as gastric bypass, sleeve gastrectomy, adjustable gastric band, and biliopancreatic diversion with duodenal switch. According to the IFSO Global Registry Report 2019, 833,687 bariatric surgeries were performed in 61 countries globally in 2019. Thus, the abovementioned factors are expected to fuel market growth during the forecast period.

The insufflation device segment held significant market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. This growth is driven by the increasing adoption of minimally invasive surgical procedures, where insufflation devices play a critical role in creating a working space within the abdomen. Advances in technology, such as low-pressure insufflation systems, enhance patient safety and comfort, further fueling demand. As more healthcare providers recognize the benefits of these devices in improving surgical outcomes, the insufflation segment is positioned for robust growth, reflecting broader trends in the minimally invasive surgery landscape.

Application Insights

Based on application, bariatric surgery is among the leading segments, holding around 26.8% of the market share in 2024. With obesity rates rising globally, the demand for bariatric procedures has surged, increasing the need for specialized instruments and consumables. According to the World Obesity Federation, in 2024, the NCD Risk Factor Collaboration (NCD-RisC) reported that over one billion people worldwide now live with obesity, including nearly 880 million adults and 159 million children and adolescents aged 5-19. Their analysis showed that almost 3 billion people are affected by overweight or obesity, making these conditions a greater health risk globally than underweight. This trend drives demand for laparoscopic tools and energy-based devices tailored for bariatric procedures.

The general surgery segment in the laparoscopic devices market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. General surgery, which encompasses a wide range of procedures, including abdominal surgeries, hernia repairs, and appendectomies, is a key segment within the laparoscopic devices market. This field requires a diverse array of specialized instruments and consumables, such as scalpels, forceps, cannulas, retractors, and dilators, tailored to various surgical needs. Technological advancements in devices such as energy systems, closure devices, and hand access instruments have significantly improved surgical precision and outcomes.

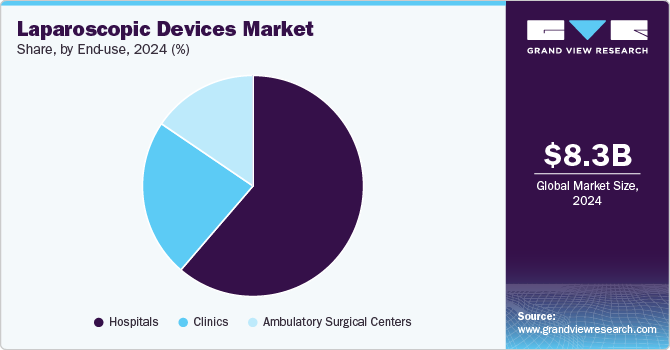

End-use Insights

The hospitals segment accounted for the largest revenue share of 61.3% in 2024. driven by an increase in cases requiring surgical intervention and preventive procedures. In the U.S., the CDC reported approximately 125.7 million outpatient department visits, reflecting a growing need for surgical equipment. Surgical procedures such as angioplasties, kidney and liver transplants, and trauma care have contributed to this demand. Moreover, the aging population and rising unhealthy lifestyle choices, including smoking and alcohol consumption, have led to a surge in noncommunicable diseases, such as cancer, diabetes, and cardiovascular disorders.

The ambulatory surgical centers segment is projected to witness the fastest CAGR over the forecast period due to increasing preference for same-day surgeries, cost savings, and reduced waiting times. These centers facilitate minimally invasive procedures, and better reimbursement policies compared to hospitals are driving segment expansion. The rising number of ASCs is also boosting market growth, with approximately 9,600 active centers in the U.S. as of 2024, according to Definitive Healthcare. The ability to perform large volumes of surgeries efficiently is expected to sustain this trend during the forecast period.

Regional Insights

North America laparoscopic devices market dominated the overall global market and accounted for the 34.3% revenue share in 2024. The growing preference for laparoscopic surgeries over open surgeries is significantly driving the market. Surgeons increasingly recommend laparoscopy for its faster recovery and better outcomes. Moreover, competition among key players in terms of product innovation will impact market dynamics. The rising incidence of cardiovascular diseases also fuels demand for laparoscopic devices. The CDC reports that heart disease accounted for 702,880 deaths in the U.S. in 2022. As minimally invasive procedures gain popularity for their advantages, the laparoscopic devices market is expected to see substantial growth in the coming years.

U.S. Laparoscopic Devices Market Trends

The laparoscopic devices market in the U.S. held a significant share of North America's laparoscopic devices market in 2024. Technological innovations like robotic-assisted surgeries and miniaturized devices are crucial in the laparoscopic field. In February 2024, the FDA authorized Virtual Incision Corporation’s MIRA Surgical System, a groundbreaking miniaturized robotic-assisted device for colectomy procedures. This approval, under the FDA's De Novo Classification process for novel devices, was partly based on U.S. clinical trials conducted under the Investigational Device Exemption (IDE). The MIRA system marks a significant advancement in surgical technology, improving precision in minimally invasive procedures.

Europe Laparoscopic Devices Market Trends

The European laparoscopic devices market is witnessing growth. The UK, France, Germany, Italy, and Spain are some of the major markets in this region. Growth in the region can be attributed to the increasing prevalence of chronic diseases such as diabetes, which often necessitates surgeries due to complications associated with the condition. According to the International Diabetes Federation report published in May 2023, around 61 million Europeans were living with type 2 diabetes, which is further expected to reach 67 million by 2030.

In the UK, the laparoscopic devices market is experiencing significant growth due to several key factors. High per capita income, an established healthcare system, a substantial number of healthcare professionals, good access to healthcare services, the availability of advanced devices, and favorable reimbursement policies are all expected to drive market expansion in the UK.

The laparoscopic devices market in France is witnessing growth, benefits from a comprehensive healthcare system and advanced medical technology adoption. France has high healthcare spending that ensures access to high-quality, people-centered treatment and health services in the country. According to World Bank data, France’s healthcare expenditure was around 12.31% of its GDP in 2021. France has a strong healthcare infrastructure, which meets the healthcare needs of its citizens. This favors the usage of minimally invasive surgical instruments & devices.

The laparoscopic devices market in Germany is undergoing significant growth, driven by the growing prevalence of chronic diseases in the country. As per data from International Diabetes Federation for 2021, in Germany, out of the total adult population of 62,027,700, the prevalence of diabetes in adults was 10%, resulting in a total of 6,199,900 diabetes cases in adults.

Asia Pacific Laparoscopic Devices Market Trends

The Asia Pacific laparoscopic devices market is witnessing significant growth driven by rising healthcare investments, expanding elderly population, and increasing prevalence of chronic respiratory diseases. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The APAC laparoscopic devices market is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

The Japan laparoscopic devices market is set for significant growth, primarily driven by the country's aging population. As of 2023, approximately 30% of the population is aged 65 and older, making them more susceptible to diseases like cancer, blood disorders, and autoimmune conditions. This demographic shift is anticipated to boost demand for laparoscopic devices in the coming years.

The laparoscopic devices market in China is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the laparoscopic devices market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The India laparoscopic devices market is rapidly growing, driven by the integration of VR and telesurgery technologies, highlighting the country’s commitment to advanced medical practices. This innovation is expected to boost confidence in minimally invasive techniques, leading to increased adoption of laparoscopic devices and attracting investments in equipment and education. As hospitals adopt these technologies, demand for cutting-edge laparoscopic tools will rise, further fueling market expansion.

Latin America Laparoscopic Devices Trends

The Latin American laparoscopic devices market is experiencing growth driven by increasing surgical procedures and rising healthcare investments. The market is propelled by the rise in the prevalence of chronic diseases and a rapidly aging population, which is increasing the number of surgical procedures. Surgical equipment such as forceps, dilators, scissors, and retractors are widely used in several surgeries related to orthopedic, cardiac, and gynecological conditions in the region.

The laparoscopic devices market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Laparoscopic Devices Company Insights

The competitive scenario in the laparoscopic devices market is highly competitive, with key players such as B. Braun Melsungen AG, BD; and Medtronic holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Laparoscopic Devices Companies:

The following are the leading companies in the laparoscopic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Karl Storz SE & CO. Kg

- Medtronic

- Johnson and Johnson

- Olympus Corporation

- CONMED Corporation

- B. Braun Melsungen AG

- The Cooper Companies Inc.

- Richard Wolf GmbH

- Microline Surgical

- BD

- Welfare Medical Ltd

- DEAM

- Intuitive Surgical

- Shenzen Mindray Bio Medical Electronics Co., Ltd

View a comprehensive list of companies in the Laparoscopic Devices Market

Recent Developments

-

In April 2024,Medtronic introduced AI capabilities with its new Touch Surgery Live Stream, featuring 14 AI algorithms. These enhance post-operative analysis and provide AI-driven surgical insights across both laparoscopic and robotic-assisted surgeries.

-

In August 2024, Olympus Corporation introduced the new 5mm POWERSEAL Sealer/Divider devices, enhancing its advanced bipolar surgical energy lineup. These POWERSEAL devices offer surgeons dependable sealing, dissection, and grasping functions in both laparoscopic and open surgeries, while minimizing the force needed to close the jaws.

-

In June 2024, Intuitive Surgical announced that the U.S. Food and Drug Administration (FDA) has cleared a labeling update for the da Vinci X and Xi systems, specifically related to radical prostatectomy procedures.

Laparoscopic Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.8 billion |

|

Revenue forecast in 2030 |

USD 12.5 billion |

|

Growth rate |

CAGR of 7.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end -use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Karl Storz SE & CO. Kg; Medtronic; Johnson and Johnson; Olympus Corporation; CONMED Corporation; B. Braun Melsungen AG; The Cooper Companies Inc.; Richard Wolf GmbH; Microline Surgical; BD; Welfare Medical Ltd; DEAM; Intuitive Surgical; Shenzen Mindray Bio Medical Electronics Co., Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laparoscopic Devices Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laparoscopic devices market report on the basis of product, application, end-use and region:

-

Laparoscopic Devices Market by Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Energy Systems

-

Trocars

-

Closure Devices

-

Laparoscopes

-

Robot Assisted Systems

-

Suction/ Irrigation Device

-

Hand Access Instruments

-

Insufflation Device

-

-

Laparoscopic Devices Market by Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Bariatric Surgery

-

Urological Surgery

-

Gynecological Surgery

-

General Surgery

-

Colorectal Surgery

-

Others

-

-

Laparoscopic Devices Market by End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Laparoscopic Devices Market by Region Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laparoscopic devices market size was valued at USD 8.3 billion in 2024 and is expected to reach USD 8.82 billion in 2025.

b. The global laparoscopic devices market is expected to grow at a compound annual growth rate of 7.25% from 2025 to 2030 to reach USD 12.5 billion by 2030.

b. North America dominated the laparoscopic devices market with a share of 34.3% in 2024. This is attributable to the increasing incidence of colorectal cancer, Crohn’s disease, technological advancements, and the presence of key players in the region.

b. Key companies operating in the laparoscopic devices market are Medtronic PLC; Karl Storz GmbH; Stryker Corp.; Cooper Surgical; Intuitive Surgical; Richard Wolf; Johnson and Johnson Services, Inc.; CONMED Corp.; and Olympus Corp.

b. Key factors that are driving the laparoscopic devices market growth include the increasing number of patients suffering from gallstones, obesity, rectal prolapse, and severe gastroesophageal reflux disease syndrome.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."